Landlord Tax Advice UK: Essential Tips for Property Owners

12 August, 2025

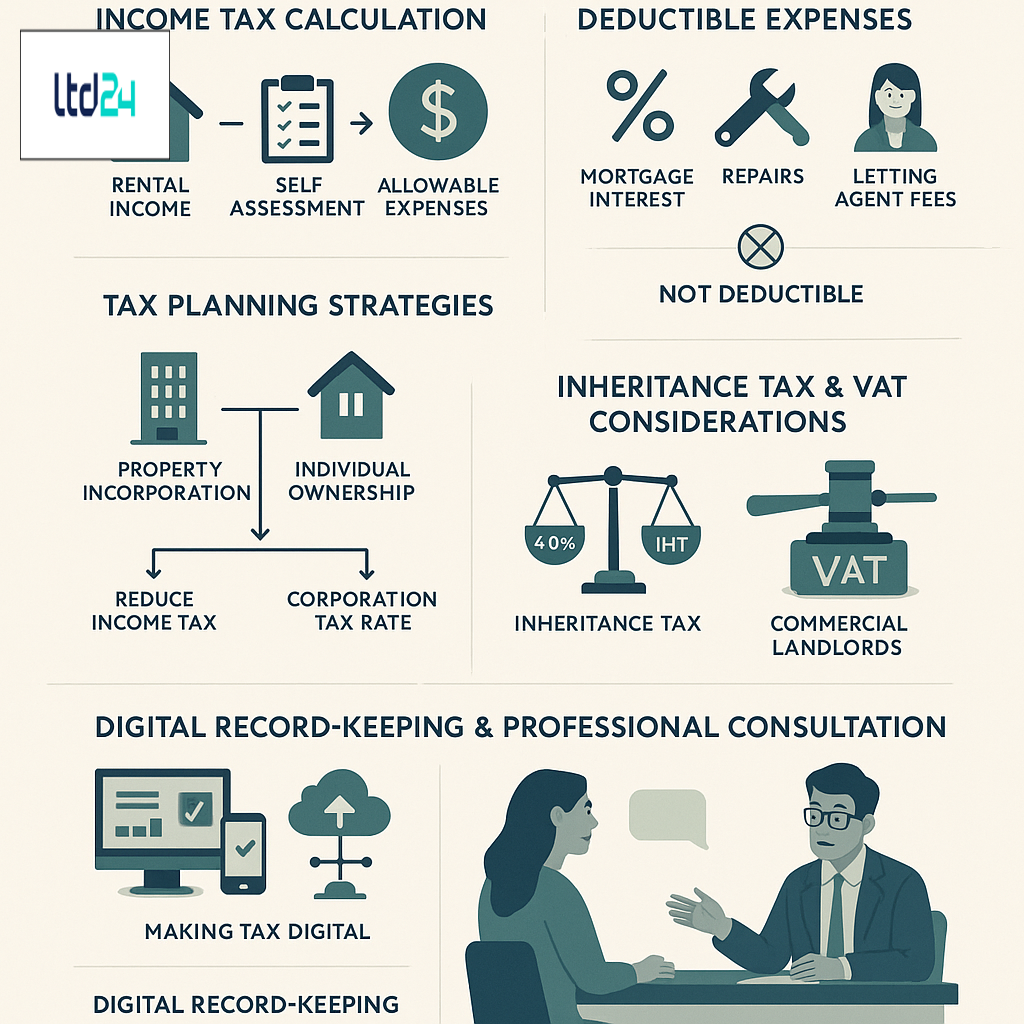

Understanding the UK Landlord Tax Framework

The taxation system applicable to landlords in the United Kingdom represents a complex web of obligations that requires meticulous attention to ensure compliance while maximizing potential deductions. Property owners who derive income from letting residential or commercial properties are subject to Income Tax on rental profits, which necessitates careful record-keeping and timely reporting to HM Revenue & Customs (HMRC). The basic structure encompasses various tax liabilities including income tax on rental profits, capital gains tax on property disposals, and in some circumstances, stamp duty land tax upon acquisition of investment properties. Landlords must navigate these obligations judiciously to avoid penalties while optimizing their tax position through legitimate means. The foundation of effective landlord tax management begins with understanding the distinction between revenue expenditure (deductible against rental income) and capital expenditure (generally added to the property’s cost base for capital gains tax calculations). This fundamental dichotomy forms the cornerstone of strategic tax planning for property investors operating within the UK tax framework.

Income Tax on Rental Profits: Calculation and Reporting

Rental income becomes taxable after deducting allowable expenses, with the resulting profit added to the landlord’s other income sources to determine their overall tax liability. The applicable tax rates follow the standard income tax bands: 20% for basic rate taxpayers, 40% for higher rate taxpayers, and 45% for additional rate taxpayers. Proper calculation requires meticulous tracking of all rental income, including rent, service charges paid by tenants, and fees for additional services. Landlords must submit a Self Assessment tax return annually, with the deadline for online submissions falling on January 31st following the tax year end (April 5th). Those who fail to meet this reporting obligation face automatic penalties starting at £100, with escalating charges for prolonged non-compliance. It’s imperative to maintain comprehensive records of all rental transactions, including income receipts and expense documentation, for a minimum of six years as HMRC reserves the right to investigate your tax affairs retrospectively. Property investors should consider implementing dedicated accounting software or engaging professional services to ensure accurate calculation and timely submission of their UK tax return.

Deductible Expenses: Maximizing Legitimate Claims

One of the most significant areas where landlords can optimize their tax position is through the strategic claiming of allowable expenses. The tax legislation permits deductions for costs wholly and exclusively incurred for the purpose of the rental business. These typically include mortgage interest (subject to restrictions introduced in 2017-2020), letting agent fees, property maintenance and repairs, insurance premiums, utility bills (if paid by the landlord), council tax during void periods, and professional service fees. It’s crucial to distinguish between repairs (deductible) and improvements (capital expenditure), as this differentiation has substantial tax implications. For instance, replacing a broken window with a similar product constitutes a repair, while upgrading to energy-efficient double glazing may be classified as an improvement. Landlords should maintain meticulous documentation supporting all expense claims, including invoices, receipts, and bank statements. Additionally, landlords operating multiple properties should consider structuring their affairs as a formal property business to potentially access additional deductions available to businesses rather than individual investors. The HMRC guidelines provide comprehensive information on allowable deductions, and consulting with a UK tax advisor can help identify all legitimate opportunities to reduce your taxable rental profits.

The Mortgage Interest Relief Changes: Impact and Adaptation

The phased implementation of mortgage interest relief restrictions between 2017 and 2020 represents one of the most significant tax policy changes affecting UK landlords in recent years. Prior to these reforms, landlords could deduct 100% of mortgage interest payments as an expense against rental income. Now, this has been replaced with a basic rate tax credit (20%), substantially increasing the tax burden for higher and additional rate taxpayers. The financial impact has been considerable, with many landlords experiencing reduced profitability and cash flow challenges. To adapt to this new landscape, property investors have explored various strategies, including transferring properties to limited company structures to benefit from corporation tax rates, restructuring existing debt arrangements, or diversifying investment portfolios. Each approach carries its own advantages and potential drawbacks, necessitating careful analysis of individual circumstances. For instance, incorporating a property business may offer tax advantages but involves transfer costs including potential capital gains tax and stamp duty liabilities. Landlords should conduct comprehensive tax planning with qualified professionals to assess whether restructuring would deliver net benefits in their specific situation, considering both immediate tax implications and long-term investment objectives.

Capital Gains Tax for Landlords: Essential Considerations

When disposing of investment properties, landlords face potential Capital Gains Tax (CGT) liabilities on the profit realized between acquisition and disposal values, after accounting for eligible reliefs and allowable costs. The current CGT rates for residential property stand at 18% for basic rate taxpayers and 28% for higher or additional rate taxpayers, representing a premium over the rates applicable to other asset classes. Strategic planning can legitimately mitigate CGT exposure through several mechanisms. Landlords should ensure they claim all qualifying enhancement expenditure that increases the property’s base cost, such as major renovations, extensions, or planning permission costs. Additionally, the annual CGT exemption (£12,300 for 2023/24, though reduced to £6,000 from April 2023 and £3,000 from April 2024) can be utilized effectively through carefully timed disposals. In certain circumstances, reliefs such as Private Residence Relief (for properties previously occupied as main residences) and Lettings Relief (though significantly restricted since April 2020) may reduce the taxable gain. Property investors should maintain comprehensive records of all capital expenditure throughout their ownership period to substantiate claims for base cost additions. The UK capital gains tax calculator can provide preliminary estimates of potential liabilities, but personalized professional advice remains essential for optimizing CGT positions, particularly for substantial property portfolios or high-value disposals.

Property Incorporation: Tax Implications and Benefits

The transition from individual ownership to a limited company structure represents a significant strategic decision for landlords with substantial portfolios or high marginal tax rates. This approach can offer several potential advantages, including access to the corporation tax rate (currently 25% for profits over £250,000, with a small profits rate of 19% for profits under £50,000), unrestricted mortgage interest deductibility, and greater flexibility for reinvestment and succession planning. However, the incorporation process itself triggers potential tax charges, including capital gains tax on the deemed disposal of properties and stamp duty land tax (SDLT) on their acquisition by the company. While certain reliefs may mitigate these costs—such as incorporation relief for CGT and potential SDLT group relief in specific circumstances—these are subject to strict qualifying conditions. The ongoing operational considerations also include additional administrative requirements, potential "benefit in kind" implications for company directors using the properties personally, and double taxation concerns when extracting profits from the company. Landlords contemplating incorporation should conduct a thorough cost-benefit analysis with tax planning specialists to evaluate whether the long-term advantages outweigh the immediate conversion costs and increased compliance burden, particularly considering their specific portfolio characteristics, income profile, and future investment intentions.

Furnished Holiday Lettings: Special Tax Treatment

Furnished Holiday Lettings (FHLs) occupy a distinctive position within the UK tax system, potentially offering landlords substantial advantages compared to standard residential lettings. To qualify for this privileged status, properties must meet specific criteria: they must be located in the UK or European Economic Area, furnished sufficiently for normal occupation, commercially let with the intention of profit, available for letting to the public for at least 210 days annually, and actually let commercially for at least 105 days (excluding longer-term occupancies exceeding 31 days). The tax benefits for qualifying FHLs include full mortgage interest relief as a business expense, capital allowances for furniture and equipment, potential qualification for Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) reducing CGT to 10% on disposal, and the ability to generate pension contributions through property income. Additionally, FHL losses can be offset against future FHL profits, though generally not against other income sources. The administrative requirements include maintaining separate records for FHL properties distinct from other rental activities and careful documentation of occupancy patterns to demonstrate compliance with the availability and actual letting conditions. For landlords with suitable properties in tourist destinations, structuring operations to meet FHL criteria can deliver significant tax efficiencies, though this requires meticulous planning and record-keeping to withstand potential HMRC scrutiny. Consulting with specialists in tourism property taxation can help optimize the tax position for these specialized rental operations.

Stamp Duty Land Tax for Investment Properties

Stamp Duty Land Tax (SDLT) represents a significant acquisition cost for landlords purchasing investment properties in England and Northern Ireland, with analogous taxes applying in Scotland (Land and Buildings Transaction Tax) and Wales (Land Transaction Tax). Since April 2016, residential property investments attract a 3% SDLT surcharge above the standard rates, substantially increasing the initial capital outlay. Current thresholds include a nil rate band up to £250,000, with graduated rates thereafter culminating in 12% for portions above £1.5 million, plus the 3% surcharge throughout. Strategic approaches to managing SDLT include careful consideration of property values near threshold boundaries, exploring mixed-use properties that may qualify for the lower non-residential rates, and structured acquisitions where appropriate. Special rules apply to bulk purchases of multiple dwellings, potentially allowing for a recalculation based on the average property value rather than the aggregate purchase price. Additionally, certain corporate acquisitions of residential properties valued above £500,000 may trigger the 15% higher rate, though reliefs exist for genuine property rental businesses meeting specific conditions. Landlords should incorporate SDLT costs into their investment analysis to accurately assess overall returns, while seeking professional guidance to identify legitimate planning opportunities that align with their acquisition strategy and portfolio objectives. The property tax UK landscape continues to evolve, making specialist advice invaluable when structuring significant property investments.

VAT Considerations for Commercial Property Landlords

Value Added Tax (VAT) presents complex challenges primarily for commercial property landlords, as residential lettings are generally exempt from VAT, with limited exceptions. Commercial property transactions can be either VAT-exempt or standard-rated (currently 20%), depending on several factors including the property’s nature, the landlord’s VAT registration status, and whether an option to tax has been exercised. Opting to tax commercial properties allows landlords to recover input VAT on expenses related to the property but requires charging VAT on rents, potentially disadvantaging tenants who cannot fully recover this additional cost. Strategic considerations include the profile of prospective tenants (VAT-registered businesses can typically recover the VAT charged, while those making exempt supplies cannot), the anticipated capital expenditure requiring VAT recovery, and the long-term investment horizon. The decision to opt for taxation remains effective for a minimum of 20 years and applies to subsequent property owners, making this a significant long-term commitment. Certain properties, including residential or charitable buildings, remain exempt even after an option to tax. Commercial landlords should engage VAT specialists early in their investment planning to structure arrangements optimally, particularly for mixed-use developments or conversion projects where partial exemption calculations may apply. Proper VAT registration and compliance is essential for commercial property investors to avoid potential penalties while maximizing legitimate input tax recovery.

Tax Planning for Property Disposals

Strategic planning for property disposals can significantly reduce tax liabilities through legitimate timing and structuring mechanisms. Landlords contemplating property sales should consider several key factors, including the optimal timing to utilize annual CGT allowances, potential eligibility for reliefs such as Business Asset Disposal Relief for qualifying furnished holiday lettings, and whether phased disposals might provide tax advantages over a single transaction. Principal Private Residence Relief remains available for properties that have served as the owner’s main residence during the ownership period, with precise calculations based on qualifying occupation periods. For properties transferred between spouses or civil partners, special rules allow for tax-neutral transfers that might facilitate more efficient use of combined allowances and lower tax bands. Additionally, reinvestment of proceeds into qualifying business assets might allow for deferral of gains through Business Asset Rollover Relief in specific circumstances. Landlords facing substantial gains should also explore whether legitimate hold-over relief might be available for certain business assets or gifts. Prior to disposal, investors should review their entire tax position to determine whether accelerating or deferring the sale into a different tax year might produce more favorable outcomes. Professional advice from tax attorneys specializing in property transactions is invaluable for navigating these complex decisions, particularly given the frequent legislative changes affecting property taxation.

Inheritance Tax Planning for Property Portfolios

Property investments frequently constitute a substantial portion of landlords’ estates, potentially creating significant Inheritance Tax (IHT) exposure without appropriate planning. Current IHT legislation imposes a 40% tax rate on estate values exceeding the nil-rate band (£325,000) and residence nil-rate band (up to £175,000 for direct descendants inheriting the main residence), subject to tapering for estates valued above £2 million. Effective planning strategies include lifetime gifting of properties (potentially subject to CGT considerations and the seven-year survival rule), establishing appropriate trust structures for asset protection and tax efficiency, and exploring Business Property Relief for qualifying furnished holiday lettings or commercial property investments. For married couples and civil partners, the transferable nil-rate band offers opportunities to maximize tax-free thresholds through careful will planning. Insurance policies written in trust can provide liquidity for IHT liabilities without increasing the taxable estate. Landlords should consider the balance between retaining control during their lifetime and achieving tax efficiency, potentially through mechanisms such as discounted gift trusts or loan trusts that offer partial immediate inheritance tax benefits while maintaining some access to capital or income. Regular reviews of estate planning arrangements remain essential as property portfolios evolve and legislative frameworks change. Specialist advice from inheritance tax planning experts should form an integral component of comprehensive wealth management for property investors with substantial portfolios, particularly those with multi-generational succession objectives.

Navigating HMRC Investigations and Record-Keeping Requirements

Property income attracts heightened scrutiny from HMRC, making robust record-keeping practices essential for landlords to defend their tax positions effectively. HMRC possesses extensive powers to examine financial records, including the ability to request information from third parties such as letting agents, mortgage providers, and online platforms. Compliance risk factors that may trigger investigations include significant discrepancies between reported income and lifestyle indicators, substantial expense claims relative to income, persistent late filing or payment, and inconsistent reporting patterns across tax years. To mitigate these risks, landlords should implement systematic record-keeping protocols, maintaining comprehensive documentation of all income streams (including cash payments and non-monetary considerations), expense receipts, bank statements, property improvement costs, and correspondence with tenants and suppliers. Digital record-keeping solutions compliant with Making Tax Digital requirements can streamline this process while ensuring data integrity. The statutory retention period for tax records extends to six years after the relevant tax year, though longer retention is advisable for information affecting multiple tax years, such as property acquisition details. In the event of an HMRC inquiry, professional representation from tax compliance specialists can significantly improve outcomes by managing communication appropriately, ensuring proportionate information disclosure, and negotiating reasonable settlement terms where discrepancies are identified, particularly in cases involving technical interpretations rather than deliberate non-compliance.

Making Tax Digital: Implications for Landlords

The progressive rollout of Making Tax Digital (MTD) represents a fundamental transformation in tax administration that will substantially impact landlords’ compliance obligations. This HMRC initiative aims to digitize the tax system, requiring taxpayers to maintain digital records and submit information through compatible software. For landlords with property income exceeding £10,000 annually, MTD for Income Tax Self Assessment (ITSA) is scheduled for implementation from April 2026, necessitating significant preparatory adjustments to record-keeping systems and reporting processes. The new regime will mandate quarterly digital updates rather than the current annual self-assessment cycle, with a final declaration after the tax year end to incorporate any adjustments and reliefs. While potentially increasing administrative frequency, this approach offers benefits including more regular visibility of tax positions, reduced year-end compliance pressure, and potentially earlier identification of tax-saving opportunities. Landlords should evaluate their current accounting systems and consider transitioning to MTD-compatible software well before the mandatory implementation date to ensure seamless compliance. Those with multiple properties or complex arrangements may benefit from early professional consultation to establish efficient digital processes aligned with their specific portfolio characteristics. Staying informed about implementation timelines through reliable sources such as the HMRC MTD updates is essential, as is securing appropriate training or support to navigate the technological transition successfully.

International Taxation for Non-Resident Landlords

Non-resident landlords owning UK property face distinct tax obligations requiring specialized knowledge to ensure compliance while optimizing tax efficiency. The Non-Resident Landlord Scheme (NRLS) requires either letting agents or tenants (where rent exceeds £100 weekly and no agent is involved) to withhold basic rate tax (currently 20%) from rental payments unless the landlord has secured HMRC approval to receive gross rents. Regardless of this withholding mechanism, non-resident landlords must file an annual Self Assessment tax return declaring UK rental income and claiming appropriate deductions. Since April 2019, non-UK residents have also become liable for UK Capital Gains Tax on disposals of both residential and commercial UK property, with specific reporting and payment requirements including a 60-day post-completion filing deadline. International landlords must additionally consider their tax obligations in their country of residence, navigating potential double taxation issues through available treaty relief mechanisms. The interaction between different tax jurisdictions creates complexity requiring expert guidance, particularly regarding permanent establishment considerations, corporate structures, and repatriation strategies. Non-resident corporate landlords previously benefited from income tax treatment but now fall under corporation tax rules, introducing group relief possibilities alongside interest restriction and loss relief modifications. International investors should conduct comprehensive tax planning with international specialists before acquiring UK property assets to establish optimal ownership structures aligned with their global tax position and investment objectives.

Tax Implications of Property Development vs. Investment

The distinction between property investment and development activities carries profound tax implications that can significantly impact overall returns. Traditional landlords holding properties primarily for long-term rental income typically face income tax on rental profits and capital gains tax on eventual disposals. Conversely, those engaged in property development or substantial renovation for immediate resale may be classified as trading, resulting in income tax (potentially at higher rates than CGT) and National Insurance contributions on profits. The determination hinges on various factors including the frequency and scale of transactions, financing arrangements, modification extent, and holding periods—collectively known as the "badges of trade." This classification affects not only the applicable tax rates but also the deductibility of certain expenses, loss relief options, and potential VAT implications. Strategic considerations include whether to establish separate corporate entities for development versus investment activities to maintain clear operational boundaries and optimize the respective tax treatments. Properties initially acquired for investment that later become development opportunities present particularly complex scenarios requiring careful analysis of the point at which their character may have changed for tax purposes. Landlords contemplating development projects should seek specialized tax planning advice to structure arrangements advantageously from inception, as retrospective planning offers limited opportunities once transactions have commenced.

Advanced Tax Planning Strategies for Established Landlords

Sophisticated landlords with substantial portfolios can benefit from advanced tax planning techniques that optimize overall returns while maintaining full compliance. These strategies require comprehensive understanding of tax legislation and typically involve coordinated approaches across multiple tax regimes. Portfolio segmentation between personally held and corporate properties can maximize the utility of available allowances and lower rate bands while accessing corporate tax advantages for higher-value or higher-yielding assets. Strategic use of pension schemes presents another avenue, with Self-Invested Personal Pensions (SIPPs) or Small Self-Administered Schemes (SSAS) potentially holding commercial property investments with significant tax advantages including income and gains sheltering within the pension environment. Family tax planning through carefully structured joint ownership arrangements or family investment companies can legitimately distribute income across family members while facilitating efficient succession planning. Refinancing strategies can optimize interest deductibility by allocating debt appropriately between investment and non-investment purposes. Property investors should also regularly review the cost-efficiency of their operating structures, potentially incorporating technological solutions for enhanced record-keeping and tax position monitoring. These advanced approaches require expert implementation with appropriate commercial substance to withstand HMRC scrutiny, necessitating collaboration with specialized tax advisors who maintain current knowledge of evolving legislation and case law developments affecting property taxation.

Expert Support: Securing Professional Tax Advice

The complexity of property taxation necessitates professional guidance to navigate effectively, particularly as legislative frameworks continue to evolve with increasing frequency. Selecting appropriate tax advisory support represents a critical business decision for landlords seeking to optimize their tax position while ensuring compliance. When evaluating potential advisors, landlords should consider several key factors: relevant property taxation expertise, professional qualifications (such as chartered tax adviser status), experience with similar portfolio sizes and structures, and familiarity with any specialized areas applicable to their circumstances (such as furnished holiday lettings or non-resident considerations). The advisory relationship should encompass both compliance support for accurate reporting and strategic planning to identify tax-efficient structures and operational approaches. Effective advisors provide proactive guidance rather than merely reactive processing, highlighting emerging opportunities and risks as regulations change. While professional fees represent an additional cost, the potential tax savings and risk mitigation typically deliver substantial return on investment, particularly for portfolios of scale or complexity. Landlords should establish clear service expectations and communication protocols, ensuring they receive timely advice that balances legitimate tax efficiency with commercial practicality and compliance requirements. Regular portfolio reviews with qualified tax professionals allow for continuous optimization as both property holdings and personal circumstances evolve throughout the investment lifecycle.

Staying Informed: Navigating Tax Legislative Changes

The property tax landscape undergoes frequent modifications, requiring landlords to maintain vigilance regarding legislative developments that may impact their investment strategies and compliance obligations. Recent years have witnessed significant changes affecting landlords, including the phased restriction of mortgage interest relief, the 3% stamp duty surcharge on additional properties, modifications to private residence relief, the extension of capital gains tax to non-residents, and forthcoming Making Tax Digital requirements. Proactive approaches to staying informed include establishing relationships with professional advisors who provide regular updates, subscribing to reputable tax publications or newsletters focusing on property investment, and participating in landlord associations that monitor policy developments. While legislative changes often introduce additional compliance burdens or costs, they may simultaneously create planning opportunities for well-informed investors. For instance, rate differentials between various tax regimes might suggest advantageous restructuring, while new reliefs or allowances could be incorporated into existing arrangements. Landlords should approach tax changes with a balanced perspective, considering both immediate implications and longer-term strategic adjustments that might optimize their position within the revised framework. Regular portfolio reviews following significant tax announcements, such as Budget statements or Finance Acts, enable timely adaptation to evolving requirements. Those with substantial property investments might consider periodic comprehensive tax health checks to ensure their structures remain optimal as both personal circumstances and legislative parameters change.

Expert Property Tax Guidance for Your Investment Journey

Navigating the intricate landscape of landlord taxation demands specialized knowledge and strategic planning to ensure compliance while maximizing legitimate tax efficiencies. The dynamic nature of property tax legislation makes professional guidance an essential component of successful portfolio management. Whether you’re a novice landlord with a single property or an established investor with extensive holdings, personalized tax advice can significantly enhance your after-tax returns and provide valuable peace of mind.

If you’re seeking expert guidance on optimizing your property investment tax position, we invite you to book a personalized consultation with our team of specialists. As an international tax consulting firm, Ltd24 offers comprehensive solutions for landlords facing complex tax challenges across multiple jurisdictions. Our advisors combine deep technical knowledge with practical experience to deliver actionable strategies tailored to your specific portfolio characteristics and investment objectives.

We are a boutique international tax consultancy with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We provide customized solutions for entrepreneurs, professionals, and corporate groups operating globally.

Book a session with one of our experts now at $199 USD/hour and receive concrete answers to your tax and corporate questions (https://ltd24.co.uk/consulting).

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.