Can I Claim Travel To My Rental Property UK?

2 December, 2025

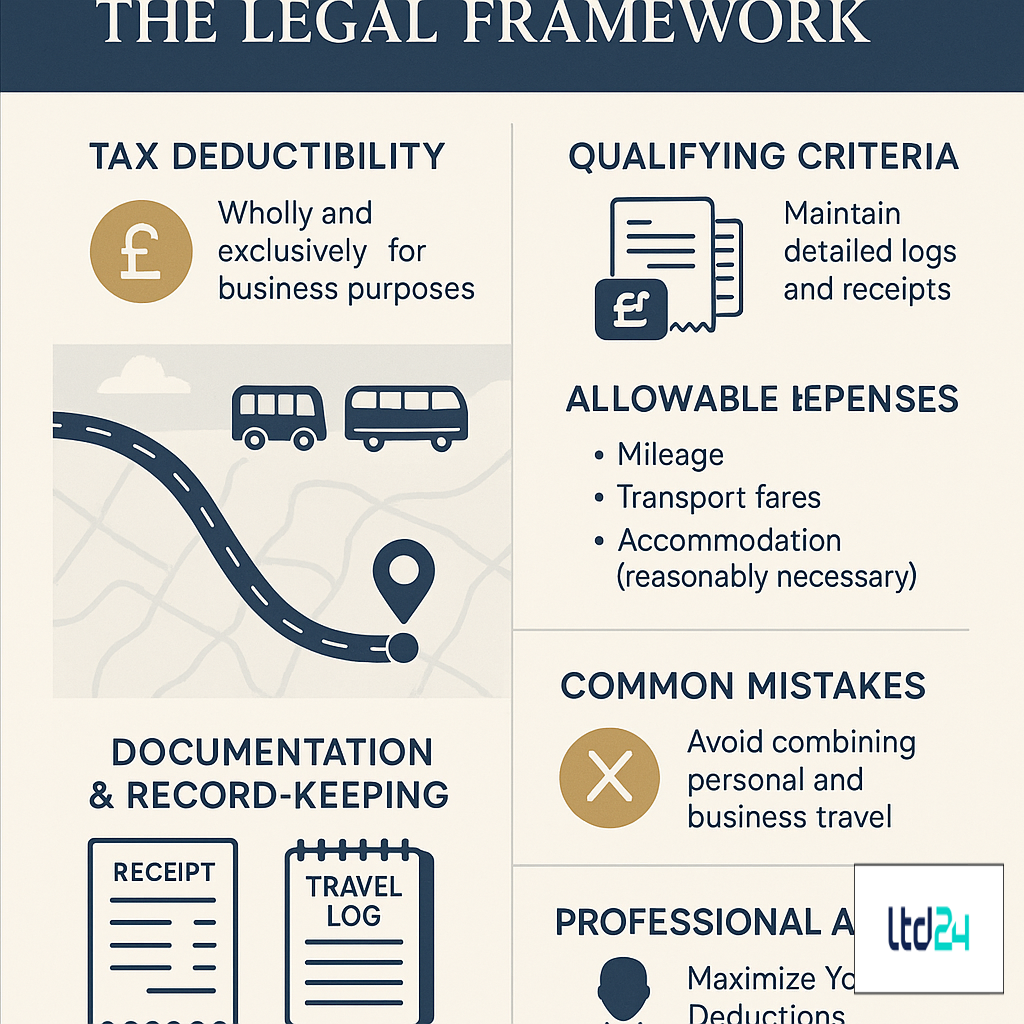

Understanding Travel Expenses for Landlords: The Legal Framework

For UK property investors and landlords, understanding the tax implications of owning and managing rental properties is crucial for optimizing returns and ensuring compliance with HM Revenue & Customs (HMRC) regulations. One common question that arises is whether travel expenses to rental properties are tax-deductible. Under current UK tax legislation, specifically Section 272 of the Income Tax (Trading and Other Income) Act 2005, landlords may be entitled to claim travel expenses incurred wholly and exclusively for business purposes related to their rental activities. This provision allows property owners to potentially reduce their taxable rental income by deducting legitimate travel costs associated with property management, maintenance visits, inspections, and tenant-related matters. However, the application of these rules requires careful consideration of various factors, including the purpose of travel, documentation, frequency, and the specific circumstances surrounding each journey to the rental property. The UK tax system establishes clear parameters for what constitutes allowable travel expenses, and landlords must navigate these regulations judiciously to ensure compliance while maximizing legitimate tax relief opportunities.

Qualifying Criteria for Travel Expense Claims

To successfully claim travel expenses to your rental property, you must satisfy several essential qualifying criteria established by HMRC. First and foremost, the travel must be undertaken wholly and exclusively for rental business purposes. This means the primary purpose of your journey must be directly connected to the management or maintenance of your rental property. For instance, traveling to conduct property inspections, meet with tenants, address maintenance issues, or arrange for repairs would generally qualify. Conversely, trips that combine personal activities with property management duties may face scrutiny regarding the apportionment of expenses. The second critical criterion involves maintaining comprehensive documentation to substantiate your claims, including dated receipts, mileage logs, and records detailing the business purpose of each journey. Additionally, the frequency and pattern of your visits should align with reasonable property management practices; unusually frequent trips may trigger questions about their necessity. Landlords operating multiple properties may find it easier to demonstrate that travel constitutes a legitimate business expense compared to those with a single rental investment. It’s worth noting that HMRC’s property tax guidance emphasizes that travel between your home and the rental property is potentially allowable, provided the home genuinely serves as your business base and the journey is necessary for business purposes rather than personal convenience.

Allowable Travel Expenses: What Can You Claim?

When claiming travel expenses for your rental property activities, it’s essential to understand precisely which costs are allowable under HMRC guidelines. Landlords can typically claim for various modes of transportation, including mileage costs for using personal vehicles (currently at 45p per mile for the first 10,000 miles and 25p thereafter), public transportation fares (trains, buses, taxis), parking fees, and toll charges incurred during business-related journeys. For landlords traveling longer distances, accommodation expenses and subsistence costs may be allowable if the stay is necessary for property management purposes and not excessive in duration or cost. The expenses must be reasonable and proportionate to the rental income generated. When using your own vehicle, you have two options: claim the actual costs (fuel, insurance, repairs, depreciation) with appropriate business/private use apportionment, or utilize the simplified mileage allowance. Most landlords find the latter more straightforward, as it eliminates the need to calculate complex vehicle expense allocations. It’s important to note that travel expenses for initial property viewings before purchase, or journeys to improve rather than maintain the property (capital improvement visits) are generally not deductible against rental income, as they relate to capital expenditure rather than ongoing business expenses. As highlighted in HMRC’s guidance on rental income, these distinctions require careful consideration when preparing your tax return.

Documenting Your Travel Claims: Essential Record-Keeping

Maintaining meticulous records is paramount when claiming travel expenses for rental property activities, as HMRC may request evidence to support your claims during an inquiry or audit. Comprehensive record-keeping should include a travel log documenting each journey’s date, destination, mileage (if using your own vehicle), purpose of the visit, and specific rental property business activities conducted. This documentation creates a clear audit trail demonstrating the business necessity of each trip. Additionally, preserve all receipts for fuel, public transportation, parking, tolls, and any other travel-related expenses in chronological order, either physically or digitally. For regular property visits, consider implementing a standardized reporting template that records property conditions, maintenance issues addressed, tenant interactions, and other relevant business activities conducted during each visit. Landlords should also maintain appointment records with contractors, tenants, or property professionals that necessitated travel. Banking records showing payment for travel expenses should be preserved, particularly where these clearly identify the business nature of the expenditure. As noted in HMRC’s tax compliance guidance, contemporaneous record-keeping significantly strengthens your position if your claims are ever scrutinized, as retroactively created documentation carries less evidential weight during tax investigations.

Common Mistakes to Avoid When Claiming Travel Expenses

Landlords frequently make several critical errors when claiming travel expenses that can trigger HMRC inquiries or result in disallowed deductions. A prevalent mistake is failing to differentiate between personal and business travel, particularly when trips serve dual purposes. For example, visiting a rental property while also meeting friends or family in the area requires careful apportionment of expenses. Another common pitfall involves claiming for prohibited journeys, such as travel related to the initial purchase of the property, property improvements (as opposed to repairs), or unnecessary frequent visits that HMRC might deem excessive or unreasonable. Many landlords also err by inadequately documenting their travel claims, providing insufficient detail about the business purpose of journeys, or failing to retain receipts and evidence of expenditure. Over-claiming mileage by using inaccurate distances or inappropriate rates can also attract unwanted scrutiny. Additionally, some property owners mistakenly claim for commuting costs between their home and rental property when their home doesn’t qualify as a genuine business base. As detailed in UK property taxation guidelines, HMRC increasingly focuses on rental business expense claims, making it essential to avoid these common errors and ensure all travel claims are legitimate, proportionate, and well-documented to withstand potential examination.

The Home Office Consideration: Impact on Travel Claims

Establishing a legitimate home office for your rental property business can significantly influence your ability to claim travel expenses. When your home genuinely functions as your business headquarters—where you maintain records, communicate with tenants, arrange repairs, and manage property-related administration—journeys from this base to your rental properties may qualify as business travel rather than non-deductible commuting. To substantiate a home office claim, allocate a specific area of your home exclusively or predominantly for rental business activities, maintain proper business records there, and demonstrate regular use for property management functions. The home office should contain appropriate business equipment and resources necessary for property administration. It’s advisable to document the time spent working from this space through activity logs or calendars. However, landlords should be aware that claiming home office expenses might have capital gains tax implications when eventually selling their residence, potentially reducing private residence relief. The home office must represent a genuine business arrangement rather than a contrived attempt to justify travel claims. As noted in HMRC’s guidance on property management, the tax authority increasingly scrutinizes such arrangements, applying a substance-over-form approach to determine whether claimed business travel from home offices reflects economic reality or tax avoidance strategies. Landlords considering this approach should seek professional advice to ensure proper implementation and compliance with current regulations.

Multiple Properties: How Travel Claims Differ

Landlords managing a portfolio of multiple rental properties face more complex considerations regarding travel expense claims compared to those with single property investments. When you own several properties, travel arrangements can be structured more efficiently to maximize tax deductions. For instance, planning strategic property inspection routes that cover multiple properties in a single journey demonstrates cost-effective business management and strengthens the wholly and exclusively business purpose argument. HMRC generally views travel expenses more favorably for landlords with multiple properties, as this activity more closely resembles an established business operation rather than a passive investment. When claiming expenses across a property portfolio, maintain detailed records that identify which properties were visited during each journey and the specific business activities conducted at each location. This documentation helps justify the necessity and business nature of your travel. For landlords with properties in different regions or countries, overnight accommodation and subsistence costs may be allowable when necessary for property management, provided they are reasonable and proportionate. As highlighted in our guide on tax planning for property investors, those with multiple properties should consider implementing dedicated property management software that tracks visits, maintenance schedules, and related travel, creating contemporaneous evidence that strengthens expense claims while demonstrating professional business administration practices that support the commercial intent behind property-related journeys.

Digital Property Management: Reducing Travel Necessity

The evolution of digital property management technologies has transformed how landlords interact with their rental investments, potentially reducing the frequency of physical visits while raising questions about travel expense deductibility. Modern property management platforms, virtual inspection tools, and remote monitoring systems enable landlords to conduct many traditional on-site activities from a distance, including virtual property viewings, remote check-ins/check-outs, and digital maintenance inspections. This technological shift may impact HMRC’s assessment of whether physical travel is “wholly and exclusively” necessary for business purposes when digital alternatives exist. Landlords should consider how the adoption of these technologies affects their travel claims, potentially documenting why certain situations required in-person attendance despite digital options. When implementing remote management solutions, maintain records showing how these technologies complement rather than replace necessary site visits, creating a balanced approach that demonstrates cost-effective property management. While digital tools may reduce travel frequency, they can strengthen the business case for remaining physical visits by showing they were essential and couldn’t be conducted virtually. As noted in our guidance on modern property management practices, landlords should consider the tax implications of this digital evolution, including potential new deductions for technology expenses that may offset reduced travel claims. This technological transformation represents both a challenge and opportunity for property investors seeking to optimize their tax position while maintaining effective property management.

HMRC’s Approach to Travel Expense Scrutiny

HMRC has increasingly focused on rental property expense claims, particularly travel costs, as part of its broader compliance efforts within the property sector. Understanding the tax authority’s approach to scrutinizing these expenses can help landlords prepare appropriate documentation and justification. HMRC applies several key tests when examining travel claims, including whether the expense was incurred wholly and exclusively for business purposes, whether the level of travel claimed appears reasonable for the properties’ income generation, and whether proper records support the claims. The tax authority often compares claimed expenses against industry benchmarks and may question travel costs that seem disproportionate to rental income. HMRC inspectors typically look for patterns of visits that align with genuine property management needs rather than personal convenience or lifestyle choices. Recent tax tribunal cases have emphasized that the burden of proof rests with the landlord to demonstrate that claimed journeys were necessary for business purposes rather than personal reasons. HMRC has been particularly attentive to claims involving properties in desirable locations or holiday areas where personal motives might be suspected. As detailed in our UK tax investigation guidance, random and targeted compliance checks often include rental income reviews, with travel expenses frequently subject to detailed examination. Landlords should therefore maintain comprehensive contemporaneous documentation that clearly establishes the business necessity of each journey and be prepared to explain how claimed travel directly relates to the generation or maintenance of rental income.

Tax Relief Calculation: Practical Examples

To illustrate how travel expense claims work in practice, let’s examine several scenarios that demonstrate the calculation methodology and tax implications for different property ownership situations. Consider a landlord with a single rental property located 50 miles from their home office, who makes 12 annual visits for inspections, maintenance, and tenant meetings. Using the mileage allowance method, they would calculate: 50 miles × 2 (round trip) × 12 visits × £0.45 = £540 in deductible travel expenses. For a landlord with multiple properties who conducts efficient “rounds” of visits, the calculation becomes more favorable. If they visit three properties in a single 100-mile journey conducted quarterly, their claim would be: 100 miles × 4 quarterly visits × £0.45 = £180, which is significantly more cost-effective per property than individual trips. For landlords using public transportation, the actual costs of train tickets, bus fares, or taxi receipts would be directly deductible, provided they exclusively relate to property business. When considering the tax relief value, a higher-rate taxpayer (40%) claiming £600 in travel expenses would reduce their tax liability by £240 (£600 × 40%). As explained in our UK tax calculator guidance, these deductions directly reduce the rental profit subject to income tax, making accurate travel expense tracking financially beneficial. Landlords should remember that these calculations must be supported by comprehensive documentation and satisfy the “wholly and exclusively” test to withstand potential HMRC scrutiny during tax investigations or random compliance checks.

Special Considerations for Overseas Landlords

Non-UK resident landlords face distinct considerations when claiming travel expenses for visiting their UK rental properties. For overseas landlords, international travel costs to the UK may be allowable if the primary purpose of the visit is to manage rental properties rather than for personal reasons. However, HMRC applies particularly rigorous scrutiny to such claims, requiring clear evidence that the journey was necessary and proportionate to the rental business needs. When claiming international travel, documentation becomes even more crucial—maintain detailed itineraries showing business activities conducted during the visit, correspondence arranging property-related meetings, and evidence demonstrating the business necessity of physical presence rather than remote management. If the visit combines business and personal activities, expenses must be apportioned accordingly, with only the business element being tax-deductible. Overseas landlords should consider the Non-Resident Landlord Scheme requirements and ensure compliance with these obligations before claiming expenses. For those with properties in multiple countries, be aware that different tax jurisdictions may have varying rules regarding expense deductibility, potentially creating complex cross-border tax considerations. As outlined in our guide on UK taxation for overseas investors, non-resident landlords should maintain particularly robust documentation systems that clearly demonstrate the commercial rationale for international travel and how these journeys directly contribute to maintaining or generating UK rental income. Professional tax advice is especially valuable in these scenarios to navigate the intersection of multiple tax regimes and ensure compliant expense claims.

Mileage Rates vs. Actual Costs: Which Method to Choose?

Landlords face an important decision when claiming vehicle-related expenses: using the simplified mileage allowance method or calculating actual vehicle costs with a business use percentage. The mileage rate method offers simplicity, allowing landlords to claim 45p per mile for the first 10,000 business miles in the tax year and 25p for subsequent miles, without needing to track individual vehicle expenses. This approach requires only a log of business journeys, distances traveled, and their purposes. Conversely, the actual cost method involves calculating total vehicle expenses (fuel, insurance, repairs, servicing, depreciation, road tax, MOT, breakdown cover) and applying a business use percentage based on business versus total mileage. This more complex approach might yield higher deductions for vehicles with significant running costs or high business usage percentages. When deciding between methods, consider factors such as your vehicle’s fuel efficiency, age, maintenance costs, and the proportion of business use. Generally, newer, more expensive vehicles with higher running costs might benefit from the actual cost method, while older, more economical vehicles often fare better under the mileage allowance. Once you’ve selected a method for a particular vehicle, consistency is important—HMRC typically expects you to maintain the same approach throughout the vehicle’s use in the business. As detailed in our tax planning guide for landlords, calculating potential deductions under both methods for your specific circumstances before making a decision can identify the most tax-advantageous approach for your rental property business.

Recent Tax Changes Affecting Travel Claims

The landscape for rental property travel expense claims has evolved significantly in recent years due to legislative changes and updated HMRC guidance. One of the most impactful developments was the Finance Act 2017, which introduced restrictions on interest relief for residential property businesses, indirectly affecting the relative importance of maximizing other deductible expenses, including travel costs. More recently, HMRC has enhanced its scrutiny of property expense claims through advanced data analytics and information sharing with property platforms, making robust documentation of travel claims increasingly important. The 2018 amendment to HMRC’s Property Income Manual provided clearer guidance on the “wholly and exclusively” test for travel expenses, emphasizing that journeys with dual purposes require careful apportionment. Additionally, recent tax tribunal cases have refined the interpretation of allowable travel expenses, generally taking a stricter approach to claims involving properties with potential personal use elements. The Making Tax Digital initiative has also influenced how rental income and expenses should be reported, with digital record-keeping requirements affecting travel expense documentation. Looking forward, as highlighted in our tax updates for landlords, proposed changes to basis period rules and potential future reforms to property taxation may further affect how travel expenses are claimed and calculated. Landlords should stay informed about these evolving regulations and consider seeking professional advice to ensure their expense claims remain compliant with current requirements while maximizing legitimate tax relief opportunities within the increasingly complex regulatory framework.

Travel Expenses for Furnished Holiday Lettings

Furnished Holiday Lettings (FHLs) operate under distinct tax rules compared to standard residential lettings, creating different considerations for travel expense claims. Properties qualifying as FHLs benefit from more favorable tax treatment, similar to trading businesses rather than investment properties. This classification often enables broader travel expense deductibility, as HMRC generally recognizes that holiday lettings require more frequent visits for changeovers, maintenance, and guest management. FHL owners can typically claim travel expenses for property inspections, meeting service providers, conducting changeovers, addressing maintenance issues, and managing guest requirements. The higher frequency of these activities compared to long-term rentals usually results in more substantial travel claims, which HMRC tends to view as a necessary part of the holiday letting business operation. However, landlords must still satisfy the “wholly and exclusively” test, maintaining clear records that distinguish business trips from personal visits to the holiday property. For properties in scenic or vacation locations, this distinction becomes particularly important to demonstrate that claimed travel served genuine business purposes. As with standard rentals, choosing between mileage allowance and actual cost methods remains relevant, though FHL operators typically generate more business mileage due to the nature of their operations. As detailed in our guide to holiday letting taxation, FHL owners should implement robust tracking systems that document each journey’s business purpose, particularly when properties are located in areas that might suggest personal enjoyment, helping to substantiate legitimate business travel in case of HMRC inquiries.

Professional Advice: When to Consult a Tax Specialist

While many landlords manage their own tax affairs, certain scenarios warrant consulting a tax professional regarding travel expense claims. Consider seeking expert guidance if you operate a substantial property portfolio with complex travel patterns, maintain properties in multiple countries with cross-border travel implications, or use properties that might have both business and personal elements. Professional advice is particularly valuable if you’ve received an HMRC inquiry or compliance check notice focused on rental expenses, as specialists can help formulate appropriate responses and gather supporting documentation. Landlords transitioning between different property business structures (such as from individual ownership to limited company operation) should seek advice on how this affects travel claim methodology. Similarly, those with unusually high travel costs relative to rental income may benefit from professional validation of their claims before submission. Tax specialists can provide tailored strategies for optimizing legitimate travel claims while ensuring compliance with evolving tax regulations. They can also review your record-keeping systems to strengthen documentation against potential challenges. When selecting an advisor, look for professionals with specific expertise in property taxation rather than general practitioners. As recommended in our guide to selecting tax advisors, verify their credentials, professional memberships, and experience with rental property clients. While professional advice involves costs, the potential tax savings, risk reduction, and peace of mind often justify the investment, particularly for landlords with substantial property interests or complex arrangements where travel claims represent significant deductions.

Digital Tools for Tracking Rental Property Travel

Modern technology offers landlords efficient solutions for documenting travel expenses and strengthening tax claims. Specialized mileage tracking applications like MileIQ, Triplog, and Hurdlr automatically record journey details using GPS technology, categorizing trips as business or personal and calculating deductible expenses based on current rates. These apps often include features for adding notes about visit purposes and attaching relevant photos or documents, creating comprehensive digital evidence of business necessity. Cloud-based property management platforms such as Landlord Studio and Goodlord incorporate expense tracking features specifically designed for rental businesses, allowing integration of travel expenses with other property management functions. Receipt scanning apps like Expensify and Receipt Bank enable immediate digitization and categorization of travel receipts, reducing the risk of lost documentation. For landlords managing multiple properties, route optimization software can demonstrate efficient journey planning, supporting the business rationale for travel claims. Digital calendar systems integrated with property management software can create automatic audit trails linking property visits to scheduled inspections, maintenance, or tenant meetings. As discussed in our guide to digital tools for landlords, these technologies not only simplify record-keeping but also create more robust documentation that can withstand HMRC scrutiny. When implementing these solutions, ensure they comply with UK data protection requirements, particularly when capturing information about tenants or properties. The initial investment in appropriate digital tools often yields significant benefits through time savings, improved accuracy, and stronger substantiation of travel expense claims.

Conclusion: Balancing Compliance and Tax Efficiency

Navigating travel expense claims for rental properties requires striking a careful balance between maximizing legitimate tax deductions and ensuring full compliance with HMRC regulations. Successful management of travel expenses hinges on understanding the fundamental “wholly and exclusively” principle that governs all business expense claims. Landlords should adopt a strategic approach to property visits, planning journeys efficiently, documenting them comprehensively, and ensuring each trip serves clear business purposes that contribute directly to rental income generation or property maintenance. The evolving digital landscape offers both challenges and opportunities—while remote management technologies may reduce the necessity for some physical visits, they also provide powerful tools for documenting and substantiating legitimate travel claims. Remember that HMRC’s approach to expense verification continues to become more sophisticated through data analytics and information sharing with other agencies, making proper documentation increasingly important. When in doubt about specific claims, particularly for unusual or substantial expenses, seeking professional advice can provide clarity and risk mitigation. As demonstrated throughout this article, travel expense claims represent just one element of comprehensive tax planning for property investors. By implementing robust record-keeping practices, staying informed about regulatory changes, and taking a principled approach to expense claims, landlords can achieve tax efficiency while maintaining compliance with their legal obligations. This balanced strategy not only optimizes current tax positions but also builds a foundation for sustainable property investment that withstands potential future scrutiny.

Expert Tax Support for Property Investors

Managing the tax implications of your rental property portfolio requires specialized knowledge and strategic planning. At LTD24, our international tax experts specialize in helping property investors navigate the complexities of UK property taxation, including travel expense claims. Our team has extensive experience assisting both UK and overseas landlords with optimizing legitimate deductions while ensuring full compliance with HMRC regulations. We understand the nuances of property tax legislation and stay current with the latest regulatory developments affecting landlords’ tax positions. Whether you’re managing a single property or an extensive portfolio, our personalized approach focuses on your specific circumstances to develop tax-efficient strategies that withstand scrutiny. Our services include comprehensive property tax reviews, implementation of robust expense tracking systems, preparation of rental accounts, and representation during HMRC inquiries. With property taxation becoming increasingly complex, professional guidance can provide both peace of mind and significant financial benefits through properly structured arrangements. We invite you to explore how our expertise can support your property investment journey through a personalized consultation.

Seeking expert guidance for your international tax challenges? Book a personalized consultation with our specialized team. As a boutique international tax consultancy, we offer advanced expertise in corporate law, tax risk management, asset protection, and international audits. We deliver tailored solutions for entrepreneurs, professionals, and corporate groups operating globally. Schedule a session with one of our experts for just 199 USD/hour and receive concrete answers to your tax and corporate questions (https://ltd24.co.uk/consulting).

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.