UK Corporate Tax Rates: Updated Overview

2 December, 2025

Introduction to UK Corporate Taxation

The United Kingdom’s corporate tax framework represents a critical consideration for both domestic enterprises and international investors seeking to establish business operations within British territories. Corporate taxation in the UK is governed primarily by the Corporation Tax Act 2010 and subsequent Finance Acts, creating a dynamic system that continues to undergo refinement in response to economic circumstances and global tax initiatives. Businesses operating in the UK are subject to Corporation Tax on their profits, with varying implications depending on company size, industry sector, and operational structure. For businesses contemplating UK company formation for non-residents, understanding the current corporate tax landscape is essential for effective financial planning and compliance with statutory obligations.

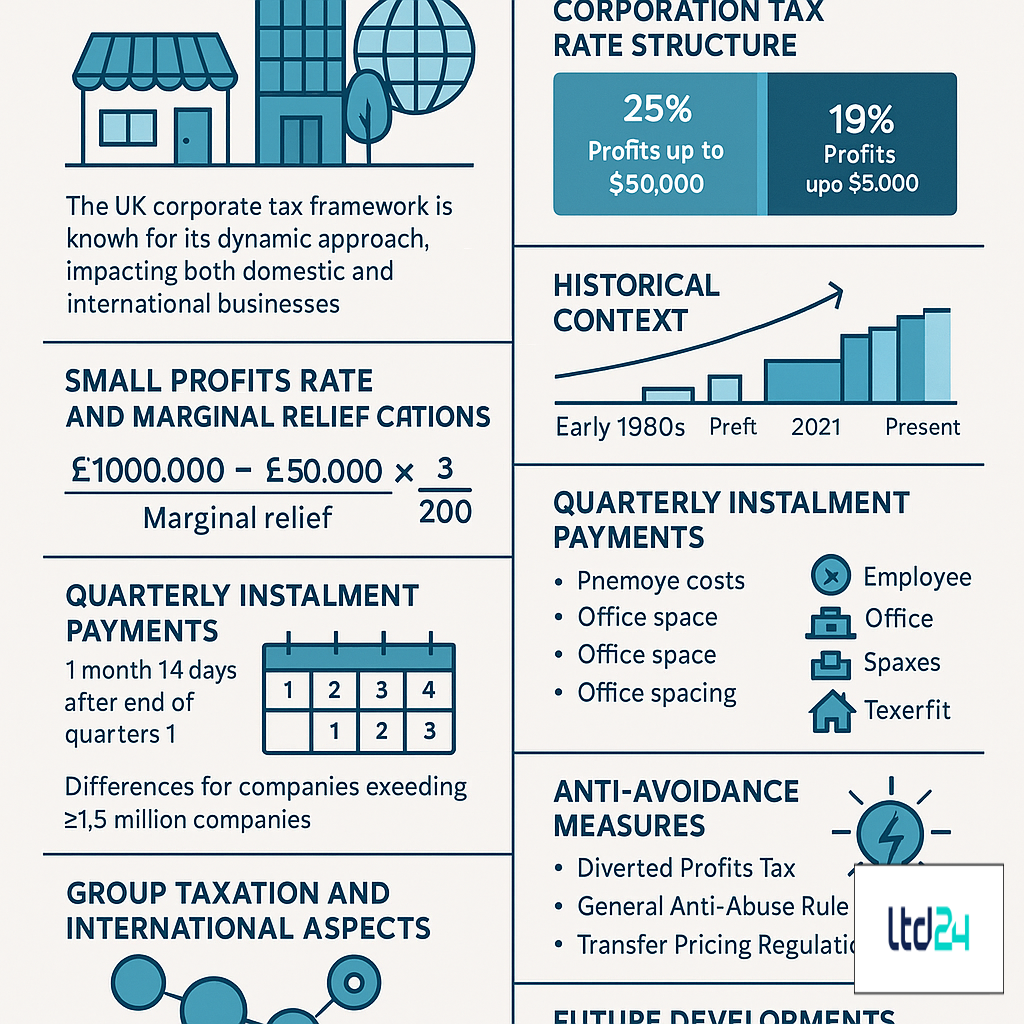

Current UK Corporation Tax Rate Structure

As of the 2023/24 tax year, the UK maintains a main Corporation Tax rate of 25% for companies with profits exceeding £250,000. This represents a significant shift from the previous flat rate of 19% that had been in place for several years. Companies with profits not exceeding £50,000 benefit from what is known as the “small profits rate” of 19%. For businesses with profits falling between £50,000 and £250,000, a system of marginal relief applies, creating a tapered increase in the effective tax rate as profits rise. These thresholds are proportionally reduced for shorter accounting periods and for companies with associated entities. The current rate structure follows the government’s stated intention to maintain a competitive tax regime while ensuring larger businesses contribute more substantially to public finances. Companies considering UK company incorporation and bookkeeping services must factor these rates into their financial projections.

Historical Context of UK Corporate Tax Changes

The trajectory of UK corporate taxation has witnessed notable fluctuations over recent decades. In the early 1980s, the main rate stood at a substantial 52%, before embarking on a gradual downward trajectory that saw it reduced to 30% by the early 2000s. A significant policy shift occurred between 2010 and 2016, when the rate was progressively reduced from 28% to 19% as part of a deliberate strategy to enhance the UK’s global competitiveness and stimulate business investment. This historically low rate of 19% remained stable until April 2023, when the increase to 25% for larger businesses was implemented. This recent upward adjustment represents a partial reversal of the previous long-term downward trend, reflecting changing fiscal priorities in the wake of extraordinary public expenditure during the COVID-19 pandemic. For businesses exploring company incorporation in the UK online, understanding this historical context provides valuable perspective on potential future developments.

Small Profits Rate and Marginal Relief Calculations

The reintroduction of the small profits rate creates a dual-rate system that requires careful calculation for businesses with profits in the transitional range. Companies with taxable profits between £50,000 and £250,000 must apply marginal relief to determine their effective tax rate. The formula for this calculation is defined in the Finance Act 2021 and involves multiplying the difference between the upper limit (£250,000) and the company’s profits by a fraction of the difference between the main rate and small profits rate, then dividing by the difference between the upper and lower limits. This can be expressed as: Marginal Relief = (Upper Limit – Profit) × (Main Rate – Small Profits Rate)/5. For practical purposes, HMRC provides online calculators and software integration to assist with these calculations. The marginal relief system creates an effective tax rate that gradually increases from 19% to 25% across the transitional range, avoiding cliff-edge increases. Businesses setting up a limited company in the UK need to account for these nuances in their financial planning.

Quarterly Instalment Payments for Large Companies

Companies with annual taxable profits exceeding £1.5 million are subject to the Quarterly Instalment Payments (QIPs) regime, requiring them to pay Corporation Tax in quarterly instalments rather than in a single payment nine months after the end of the accounting period. For very large companies with profits exceeding £20 million, an accelerated payment schedule applies. Under the standard QIPs regime, payments are due in the 7th and 10th months of the current accounting period, followed by the 1st and 4th months of the subsequent accounting period. The accelerated schedule for very large companies requires payments in the 3rd, 6th, 9th, and 12th months of the current accounting period. These payment schedules significantly impact cash flow management and financial planning for substantial enterprises. Failure to make accurate and timely instalment payments can result in interest charges, making precise profit forecasting increasingly important. Companies establishing operations through UK companies registration and formation services should incorporate these payment requirements into their financial processes.

Tax Deductions and Allowable Expenses

The UK corporate tax system permits various deductions when calculating taxable profits. Allowable business expenses must meet the criterion of being “wholly and exclusively” incurred for business purposes. These typically include employee costs, premises expenses, administrative overheads, finance costs (subject to certain restrictions), and research and development expenditure. Capital allowances represent another significant area for potential tax efficiency, permitting businesses to deduct qualifying capital expenditure against taxable profits. The Annual Investment Allowance (AIA) provides 100% first-year relief for qualifying plant and machinery expenditure up to specified annual limits (currently £1 million until 31 March 2026). Additionally, the super-deduction scheme (applicable until 31 March 2023) allowed enhanced relief for qualifying plant and machinery investments. For structures and buildings, the Structures and Buildings Allowance provides relief at 3% per annum on a straight-line basis. Businesses engaged in UK company taxation planning should thoroughly evaluate these deduction opportunities.

Research and Development Tax Incentives

The UK offers substantial tax incentives to stimulate business innovation through Research and Development (R&D) activities. SMEs can claim enhanced tax relief of 186% on qualifying R&D expenditure (from April 2023, reduced from the previous 230%). This means for every £100 of qualifying expenditure, an additional £86 can be deducted from taxable profits. Loss-making SMEs can surrender their losses for a payable tax credit at a rate of 14.5% (from April 2023, reduced from 33.35%). For larger companies and SMEs contracted to perform R&D for larger entities, the Research and Development Expenditure Credit (RDEC) scheme applies, offering a credit of 20% (from April 2023, increased from 13%) of qualifying R&D expenditure. Qualifying activities must seek to achieve an advance in science or technology through the resolution of scientific or technological uncertainties. Detailed documentation of the R&D process and expenditure is essential for substantiating claims. Companies engaged in innovative activities should consider these incentives when setting up a business in the UK.

Patent Box Regime and Intellectual Property

The UK Patent Box regime offers a reduced effective Corporation Tax rate of 10% on profits derived from qualifying patented innovations and certain other intellectual property rights. This represents a significant tax advantage for companies commercializing patented technologies or products. To qualify, a company must own or exclusively license-in patents granted by the UK Intellectual Property Office, European Patent Office, or certain other specified patent offices. The company must also have undertaken qualifying development activities related to the patented innovation. The Patent Box calculation involves a complex formula to identify the proportion of profits attributable to the patented innovation. Following OECD Base Erosion and Profit Shifting (BEPS) recommendations, a “modified nexus approach” was implemented, linking tax benefits more closely to R&D activities conducted within the UK. For international businesses, this regime can significantly enhance the attractiveness of locating intellectual property development and exploitation activities in the UK. Companies considering offshore company registration UK should evaluate potential Patent Box benefits as part of their structural planning.

Capital Gains for Companies

Corporate entities in the UK are subject to Corporation Tax on chargeable gains arising from the disposal of capital assets, effectively integrating capital gains taxation into the general Corporation Tax framework. Unlike individuals, companies do not benefit from a separate annual exemption for capital gains. However, indexation allowance was available until December 2017, providing relief for the effects of inflation on asset values up to that date. Significant exemptions exist within this framework, notably the Substantial Shareholding Exemption (SSE), which can exempt gains arising from the disposal of qualifying shareholdings in other companies. To qualify for the SSE, the investing company must generally hold at least 10% of the ordinary share capital for a continuous 12-month period within the six years before disposal, and both companies must meet trading activity requirements. Additionally, assets used in trading that are replaced may qualify for rollover relief, deferring the tax liability. Companies engaged in corporate restructuring or considering asset disposals should seek specialist advice to optimize their position within this framework. Those looking to issue new shares in a UK limited company should consider potential future capital gains implications.

Loss Relief Provisions

The UK corporate tax system provides various mechanisms for utilizing trading losses. Companies can offset current-year trading losses against total profits of the same accounting period or carry them back against profits of the preceding 12 months (temporarily extended to 36 months for losses arising between 1 April 2020 and 31 March 2022 due to COVID-19). For losses carried forward, companies can offset them against future profits from the same trade or, since April 2017, against total profits of the company and its group members. However, for companies with profits exceeding £5 million, there’s a 50% restriction on the amount of brought-forward losses that can be utilized in any one year. Non-trading losses, such as property business losses and non-trading loan relationship deficits, have their own relief rules. Capital losses can only be offset against capital gains and can be carried forward indefinitely but not carried back. These provisions offer significant flexibility for businesses experiencing fluctuating profitability or restructuring operations. Companies establishing operations through online company formation in the UK should consider how these provisions might apply to their business model.

Group Taxation and Relief

UK tax legislation recognizes corporate groups through provisions enabling the transfer of certain tax attributes between qualifying group companies. Group Relief allows for the surrender of current-year trading losses and certain other deficits from one group company to another, effectively enabling profitable companies within the group to reduce their taxable profits by utilizing losses from less profitable group members. For capital gains purposes, assets can typically be transferred between UK group companies on a tax-neutral basis, with the recipient company assuming the transferor’s original acquisition cost. Group payment arrangements permit a nominated company to discharge the Corporation Tax liabilities of all participating group members. To qualify for most group relief provisions, companies must generally be at least 75% owned by the same parent company directly or indirectly. These provisions can offer substantial tax efficiency opportunities for corporate groups and should be carefully considered when structuring UK operations. Businesses undertaking UK company incorporation as part of a wider group structure should evaluate these provisions.

International Aspects: Double Taxation Relief

Companies resident in the UK but earning income from foreign sources face potential double taxation – taxation in both the foreign jurisdiction and the UK. To mitigate this burden, the UK offers double taxation relief through two primary mechanisms. Unilateral relief allows companies to claim credit for foreign taxes paid against their UK tax liability on the same income. Treaty relief operates through the UK’s extensive network of Double Taxation Agreements (DTAs) with over 130 territories, potentially offering more favorable terms than unilateral relief. The UK typically employs the credit method rather than the exemption method in its treaties, meaning foreign income remains taxable in the UK but with credit given for foreign taxes paid. The Foreign Tax Credit is limited to the lower of the foreign tax paid and the UK tax due on the same income. For dividend income, the UK’s participation exemption often eliminates the need for double taxation relief on qualifying dividends from foreign subsidiaries. Companies with international operations should conduct careful analysis of applicable treaties and relief provisions. Businesses seeking nominee director service UK for international structures should consider these international taxation aspects.

Diverted Profits Tax and Anti-Avoidance Measures

The UK has implemented robust anti-avoidance measures to counter artificial profit shifting and tax base erosion. The Diverted Profits Tax (DPT), often referred to as the “Google Tax,” applies at a punitive rate of 31% (increased from 25% from April 2023) to profits artificially diverted from the UK through contrived arrangements. DPT targets arrangements designed to avoid creating a UK permanent establishment or those involving entities or transactions lacking economic substance. The General Anti-Abuse Rule (GAAR) provides HMRC with powers to counteract tax advantages arising from abusive arrangements that cannot reasonably be regarded as a reasonable course of action. Transfer pricing regulations require transactions between connected parties to be conducted at arm’s length, with comprehensive documentation requirements for larger businesses. The Corporate Criminal Offence of Failure to Prevent the Facilitation of Tax Evasion places responsibility on businesses to implement reasonable procedures to prevent associated persons from facilitating tax evasion. Interest deductibility restrictions, including the Corporate Interest Restriction and anti-hybrid rules, further limit potential avoidance strategies. Companies considering how to register a company in the UK should ensure compliance with these anti-avoidance provisions.

Digital Services Tax and Industry-Specific Considerations

The UK’s Digital Services Tax (DST) represents a targeted intervention in the taxation of digital business models, applying a 2% tax on revenues derived from UK users of search engines, social media platforms, and online marketplaces. This applies to groups with global revenues exceeding £500 million from these digital activities, with the first £25 million of UK revenues exempt. DST operates as a separate tax from Corporation Tax and will remain in place until a comprehensive international solution is implemented. Beyond digital services, various sectors face specific tax considerations. Banks and insurance companies are subject to the Bank Levy and Insurance Premium Tax respectively. Oil and gas companies operating in the UK Continental Shelf face Petroleum Revenue Tax and the Ring Fence Corporation Tax regime. Real estate investment trusts (REITs) enjoy special tax treatment, with exemption from Corporation Tax on property rental business income when meeting certain conditions. Understanding these industry-specific provisions is crucial for affected businesses. Companies in specialized sectors should seek tailored advice when registering a business name UK.

Corporate Tax Compliance and Filing Requirements

UK corporate tax compliance follows a self-assessment system, requiring companies to calculate their own tax liability and submit returns accordingly. Companies must file a Corporation Tax Return (Form CT600) annually, typically within 12 months after the end of the accounting period. Supporting computations and financial statements must accompany the return, with online filing mandatory for most companies. Payment deadlines vary based on company size: smaller companies must pay their Corporation Tax liability nine months and one day after the end of the accounting period, while larger companies (with profits exceeding £1.5 million) must pay in quarterly instalments. Companies must maintain adequate records to substantiate their tax position for at least six years from the end of the accounting period. Senior Accounting Officers (SAOs) of large companies must certify that appropriate tax accounting arrangements are in place. Failure to meet filing and payment obligations can result in penalties and interest charges, with penalty rates depending on the nature and severity of the non-compliance. Companies using formation agent services in the UK should ensure ongoing compliance support.

Future Developments and International Tax Initiatives

The UK corporate tax landscape continues to evolve in response to domestic fiscal priorities and international tax reform initiatives. The OECD’s Two-Pillar solution represents perhaps the most significant forthcoming change, with Pillar One reallocating taxing rights for the largest multinational enterprises and Pillar Two implementing a global minimum effective tax rate of 15%. The UK has committed to implementing these reforms and has already legislated for a Domestic Minimum Top-up Tax to ensure UK-headquartered multinational groups pay at least the 15% minimum effective rate from December 2023. Additionally, the UK has expressed intentions to reform the capital allowances regime, potentially making the temporary enhanced allowances more permanent to stimulate business investment. Climate-related tax measures are likely to expand, with potential new incentives for green technology and possible carbon pricing mechanisms. Post-Brexit, the UK retains flexibility to diverge from EU tax directives, potentially creating both opportunities and complexities for businesses operating across the UK-EU border. Companies with international operations should monitor these developments closely. Businesses seeking business address services in the UK should consider how these future developments might impact their long-term tax position.

Tax Planning Strategies for UK Companies

Effective corporate tax planning in the UK involves legitimate structuring of business affairs to optimize tax positions while remaining compliant with legislation and anti-avoidance provisions. Strategic timing of expenditure can maximize available allowances and relief, particularly regarding capital expenditures eligible for enhanced capital allowances. Choosing optimal business structures – whether operating as a standalone company, partnership, LLP, or group structure – can significantly impact overall tax efficiency. For groups, careful planning around loss utilization, asset transfers, and financing arrangements can yield substantial benefits. Employee remuneration strategies, balancing salary, bonuses, pension contributions, and share schemes, offer opportunities for tax efficiency for both the company and its employees. For international businesses, considering permanent establishment implications, transfer pricing arrangements, and the location of intellectual property and financing activities can optimize the global tax position. However, all planning must be conducted with careful consideration of economic substance requirements and anti-avoidance provisions. Businesses should seek qualified professional advice when implementing any tax planning strategies. Companies using UK ready-made companies should review existing structures to ensure optimal tax efficiency.

Expert Corporate Tax Support for Your Business

Navigating the complexities of UK corporate taxation requires specialized knowledge and proactive management. At LTD24, we understand that optimizing your tax position while maintaining full compliance is crucial for business success in the competitive UK market. Our team of corporate tax specialists offers comprehensive support for businesses at every stage of development – from initial company formation through to complex international tax planning. We provide tailored advice on structuring operations, claiming available reliefs and incentives, managing cross-border transactions, and implementing effective compliance processes. Our services encompass both routine compliance matters and strategic tax optimization, ensuring you meet all statutory obligations while identifying opportunities to enhance your tax efficiency. Whether you’re a UK startup, an established enterprise, or an international business expanding into the UK, our expertise can help you navigate the corporate tax landscape with confidence.

If you’re seeking expert guidance on UK corporate tax matters, we invite you to book a personalized consultation with our team. We are a boutique international tax consulting firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating on a global scale. Schedule a session with one of our experts now at $199 USD/hour and get concrete answers to your tax and corporate queries at https://ltd24.co.uk/consulting.

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.