Corporation Tax Percentage UK: Current Rates Explained

28 November, 2025

Introduction to UK Corporation Tax Framework

The United Kingdom’s corporation tax system stands as a cornerstone of the nation’s fiscal architecture, playing a pivotal role in public finance generation while influencing business investment decisions across the economy. This tax, levied on the profits of companies operating within the UK jurisdiction, has undergone significant transformations in recent decades, reflecting broader economic policy objectives and international competitive pressures. The corporation tax percentage in the UK represents more than a mere numeric value; it embodies the government’s approach to business taxation and serves as a barometer for the country’s investment climate. For businesses contemplating company incorporation in the UK, understanding the nuances of this tax regime is essential for effective financial planning and corporate structuring.

Historical Evolution of UK Corporation Tax Rates

The journey of UK corporation tax rates illustrates a remarkable fiscal transformation over the past few decades. In the early 1980s, the main rate stood at a substantial 52%, reflecting the higher-tax environment prevalent during that period. The subsequent years witnessed a gradual but consistent downward trajectory as successive governments embraced more business-friendly tax policies. The 1990s saw rates hovering around 33%, while the early 2000s brought further reductions to 30%. The financial crisis of 2008 catalyzed additional rate cuts, with the main rate declining to 28% in 2010. This downward momentum continued with particular vigor during the 2010s, as the UK government pursued an explicit strategy of creating one of Europe’s most competitive corporate tax environments. By 2017, the main rate had reached a historic low of 19%, positioning the UK favorably among developed economies and enhancing its appeal for businesses considering UK company formation for non-residents.

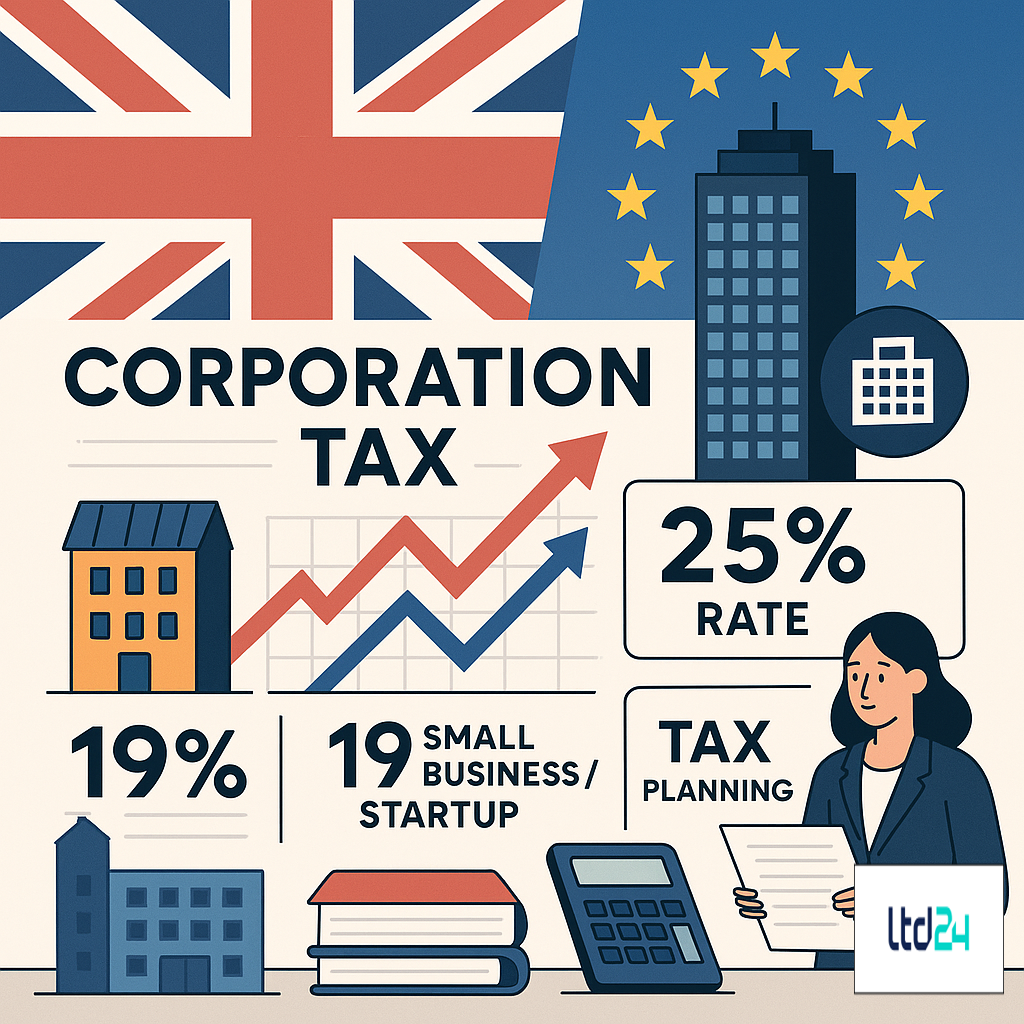

Current UK Corporation Tax Rate Structure

As of the current tax year, the standard UK corporation tax rate stands at 25% for companies with profits exceeding £250,000. However, a more nuanced system applies to businesses with lower profit margins. Companies with profits below £50,000 benefit from the small profits rate of 19%, creating a significant advantage for smaller enterprises. Between these thresholds lies a marginal relief zone, where businesses face gradually increasing effective rates as their profits rise from £50,000 to £250,000. This tiered approach reflects the government’s policy of maintaining relative tax advantages for smaller businesses while increasing the fiscal contribution from larger, more profitable entities. The current structure represents a departure from the previous uniform 19% rate that prevailed until March 2023, marking a notable policy shift in the UK’s corporate taxation landscape. Businesses engaged in setting up a limited company in the UK must carefully consider these rate differentials when projecting their tax liabilities.

Calculating Corporation Tax Liabilities

The determination of corporation tax liability involves a methodical assessment of taxable profits derived from various business activities. Companies must first calculate their total income, encompassing trading profits, investment returns, chargeable gains from asset disposals, and any other revenue streams. From this aggregate, allowable expenses—including staff costs, premises expenses, financing charges, and depreciation (in the form of capital allowances)—are deducted to arrive at the taxable profit figure. This net amount is then subjected to the applicable corporation tax rate based on the tiered structure. For companies falling within the marginal relief band (£50,000-£250,000 profits), a specific formula determines the precise effective rate. The resulting tax liability is typically payable nine months and one day after the end of the accounting period, though larger companies must adhere to quarterly instalment payment schedules. Professional assistance from accountancy firms, particularly those specializing in UK company taxation, often proves invaluable in navigating these calculations accurately.

Capital Allowances and Tax Relief Opportunities

The UK tax system offers substantial relief opportunities through capital allowances, which effectively provide tax deductions for capital expenditure on qualifying business assets. The Annual Investment Allowance (AIA) permits businesses to deduct the full value of qualifying plant and machinery up to £1 million in the year of purchase, offering significant cash flow benefits. Super-deduction allowances, introduced temporarily to stimulate post-pandemic investment, provide enhanced relief at 130% for qualifying plant and machinery investments. Additionally, structures and buildings allowances (SBAs) offer relief for construction costs at 3% annually over 33.33 years. Research and Development (R&D) expenditure qualifies for enhanced tax relief, with SMEs potentially claiming up to 230% of qualifying costs and larger companies benefiting from the Research and Development Expenditure Credit (RDEC) at 20% of qualifying expenditure. The Patent Box regime further reduces corporation tax on profits derived from patented inventions to 10%, incentivizing innovation. Businesses establishing operations through UK company incorporation and bookkeeping services should thoroughly assess these allowances to maximize tax efficiency.

Corporation Tax Payment Deadlines and Compliance

Adhering to HMRC’s corporation tax payment schedules is essential for avoiding penalties and maintaining good standing. Most companies must settle their corporation tax liability nine months and one day after the end of their accounting period. However, large companies—defined as those with annual profits exceeding £1.5 million—must make quarterly instalment payments, with the first instalment due in the sixth month of the accounting period. The Corporation Tax Return (Form CT600) must be filed electronically within 12 months of the accounting period end, irrespective of the payment deadline. Late payment triggers interest charges at rates significantly above commercial borrowing costs, while delayed filing incurs automatic penalties starting at £100 and escalating substantially for extended delays. Persistent non-compliance may result in HMRC enforcement action, potentially including director penalties. To ensure seamless compliance, many businesses engage professional services for company incorporation in UK online that include ongoing tax filing support.

International Aspects of UK Corporation Tax

The international dimensions of UK corporation tax have gained increasing prominence amid global initiatives to reform corporate taxation. The UK implements extensive transfer pricing regulations requiring transactions between connected entities to adhere to arm’s length principles, with documentation requirements proportionate to business size. Double taxation agreements with over 130 countries mitigate the risk of profits being taxed twice, providing relief through credit or exemption mechanisms. The Diverted Profits Tax (DPT) at 31% targets arrangements designed to artificially shift profits from the UK, while the Digital Services Tax (DST) imposes a 2% levy on revenues from search engines, social media platforms, and online marketplaces. Recent global developments, notably the OECD’s international tax reform framework establishing a 15% global minimum tax rate, have profound implications for multinational enterprises operating in the UK. These complexities underscore the value of specialized advice for foreign businesses considering UK company incorporation services to navigate the intricate international tax landscape effectively.

Corporation Tax for Small Businesses and Startups

The UK tax framework contains several provisions specifically beneficial for small businesses and startups. The small profits rate of 19% offers a direct tax advantage for companies with annual profits below £50,000, creating a 6% differential compared to the main rate. Beyond this base rate benefit, smaller enterprises can access enhanced capital allowances, with the Annual Investment Allowance effectively providing 100% immediate relief on qualifying capital expenditure up to £1 million. The R&D tax relief scheme is particularly generous for SMEs, potentially allowing deductions of up to 230% of qualifying expenditure. Startups can also benefit from the Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS), which offer tax incentives to investors, indirectly improving capital access for early-stage companies. Additionally, the VAT registration threshold of £85,000 provides administrative relief for the smallest businesses. For entrepreneurs exploring options to set up an online business in UK, these targeted tax provisions can significantly enhance the viability of new ventures.

Comparing UK Corporation Tax Internationally

In the global tax landscape, the UK’s 25% main corporation tax rate positions it near the median among developed economies. This represents a notable increase from its previous 19% rate, which had ranked among the lowest in the G20. Within Europe, the UK now sits above countries like Ireland (12.5%), Hungary (9%), and Bulgaria (10%), which maintain deliberately competitive rates to attract foreign investment. However, it remains below several major economies including Germany (approximately 30% including local taxes), France (25%), and Italy (24%). The United States federal corporate tax rate stands at 21%, though state taxes can push the combined rate higher. Japan imposes around 30%, while Canada’s combined federal-provincial rates typically range from 23% to 31%. Beyond headline rates, comparative analyses must consider the breadth of the tax base, availability of reliefs, and complexity of compliance. For businesses contemplating international structures, jurisdictions like Bulgaria offer company formation services with potentially advantageous tax implications, though these must be balanced against substance requirements and anti-avoidance measures.

Recent and Upcoming Changes to UK Corporation Tax

The UK corporation tax landscape has undergone significant recent changes, with further developments on the horizon. The most substantial recent reform was the April 2023 increase in the main rate from 19% to 25%, accompanied by the reintroduction of the small profits rate at 19%. This marked the first major corporation tax increase in decades, reversing the long-term trend of rate reductions. Alongside this headline change, the government enhanced certain reliefs, including a temporary "super-deduction" providing 130% relief for qualifying plant and machinery investments through March 2023. Looking forward, the implementation of the OECD’s global tax reform framework—featuring a 15% global minimum tax for multinational enterprises—will reshape international aspects of UK taxation. Digital taxation continues to evolve, with the Digital Services Tax potentially transitioning to a new international framework. Environmental tax measures are gaining prominence, with carbon pricing mechanisms expanding. These ongoing changes underscore the importance of remaining vigilant to tax developments for businesses utilizing UK company registration and formation services.

Corporation Tax and Business Structures

The interaction between corporation tax and business structure represents a critical consideration for enterprises operating in the UK. Limited companies face corporation tax on their profits, with directors typically receiving remuneration through a combination of salary and dividends—the latter benefiting from lower personal tax rates despite being paid from post-corporation tax profits. Sole traders, in contrast, pay income tax and National Insurance contributions on business profits directly, avoiding corporation tax but potentially facing higher marginal rates on substantial earnings. Partnerships, whether traditional or limited liability (LLPs), operate as tax-transparent entities with profits taxed in the partners’ hands rather than at the business level. For multinational operations, permanent establishment considerations determine UK tax exposure, while branch versus subsidiary decisions carry significant tax implications. The choice between these structures should balance tax efficiency with commercial objectives, legal protections, and administrative requirements. Entrepreneurs seeking to how to register a business name UK should carefully evaluate these structural options within the context of their specific circumstances and long-term business goals.

Tax Planning Strategies for UK Companies

Prudent tax planning within the boundaries of legislation can significantly enhance a company’s after-tax position. Strategic timing of capital expenditure to maximize annual investment allowance benefits represents a fundamental planning approach. Careful structuring of director remuneration packages—balancing salary, dividends, pension contributions, and benefits—can optimize the overall tax position for both the company and its leadership. Research and development activities should be structured to qualify for enhanced tax relief, potentially transforming necessary business expenditure into substantial tax advantages. For groups, loss utilization strategies can minimize the overall tax burden by offsetting profits in one entity against losses in another. Intellectual property management, including potential utilization of the Patent Box regime, offers opportunities for reduced taxation on innovation-derived income. International businesses may consider supply chain restructuring to align commercial objectives with tax efficiency, though always mindful of substance requirements and transfer pricing regulations. For businesses seeking specialized guidance on these matters, consulting with professionals who provide formation agent services in the UK can provide valuable insights tailored to specific circumstances.

Common Corporation Tax Compliance Mistakes

Despite best intentions, businesses frequently encounter compliance pitfalls that can result in penalties and administrative burdens. Late filing of returns represents one of the most common errors, triggering automatic penalties regardless of whether tax is due. Inadequate record-keeping practices create significant risks, as inability to substantiate expense claims or capital allowances can lead to disallowances during HMRC inquiries. Transfer pricing documentation deficiencies pose particular dangers for businesses with international connections, potentially resulting in substantial adjustments. Misclassification of expenses—particularly regarding the capital versus revenue distinction—frequently leads to incorrect tax calculations. For companies with research and development activities, incorrectly identifying qualifying expenditure can result in missed relief opportunities or unsustainable claims. VAT registration threshold breaches often go unnoticed until significant liabilities have accumulated. These common pitfalls underscore the importance of professional guidance, particularly for businesses utilizing online company formation in the UK services that may lack in-house tax expertise.

HMRC Investigations and Risk Mitigation

HMRC’s compliance activities range from routine checks to comprehensive investigations, with significant implications for affected businesses. Risk-based selection criteria include unusual fluctuations in reported figures, industry benchmarking outliers, and third-party information discrepancies. Investigations typically commence with formal information notices and may involve detailed examination of accounting records, director loan accounts, and private expenditure. The scope ranges from aspect inquiries focused on specific issues to full-scale investigations examining all tax affairs. Penalties for inaccuracies vary based on behavior, from 30% for carelessness to 100% for deliberate and concealed errors. To mitigate these risks, businesses should maintain comprehensive, contemporaneous documentation supporting tax positions, implement robust internal review procedures for tax filings, and consider disclosure of uncertain positions. Professional fee protection insurance provides valuable coverage for representation costs during investigations. Companies utilizing UK business address services should ensure these arrangements don’t inadvertently create compliance vulnerabilities regarding permanent establishment or substance requirements.

Corporation Tax Implications for Directors

Directors bear significant responsibilities regarding corporation tax compliance, with personal implications extending beyond their corporate roles. Director’s loan accounts require careful management, as overdrawn balances may trigger additional tax charges for the company (currently 33.75% on loans outstanding more than nine months after the accounting period). Directors receiving substantial dividends must navigate the dividend tax rates (8.75%, 33.75%, or 39.35% depending on income levels) and ensure distributions are properly documented with appropriate reserves. Personal expenses incorrectly processed through the company create risks of benefit-in-kind taxation and potential HMRC challenges. Directors of companies facing financial difficulties should be particularly vigilant, as continuing to trade while insolvent could result in personal liability for unpaid taxes. The Senior Accounting Officer regime imposes additional certification requirements on directors of larger companies. Understanding these personal implications is especially important for individuals who be appointed director of a UK limited company without extensive prior experience in UK corporate governance.

Brexit Impact on UK Corporation Tax

The United Kingdom’s departure from the European Union has introduced significant tax considerations, though corporation tax itself—being a predominantly domestic matter—has seen more limited direct impact than other tax areas. Nevertheless, several important implications have emerged. EU directives that previously eliminated withholding taxes on cross-border dividend, interest, and royalty payments no longer automatically apply, potentially increasing tax friction in transactions with EU entities. While the UK has retained many provisions in domestic law, and the EU-UK Trade and Cooperation Agreement provides some continuity, businesses must navigate a more complex landscape of bilateral treaties. The Northern Ireland Protocol creates specific tax considerations for businesses operating across the Irish border. Brexit has also enabled greater flexibility in future UK tax policy, potentially allowing more targeted incentives or divergence from EU state aid rules. Companies previously structured for EU single market operations may need to reconsider their arrangements, particularly regarding intellectual property holdings and supply chains. These evolving considerations underscore the value of specialized guidance for businesses setting up a limited company UK with European connections.

Specialized Corporation Tax Regimes

Beyond the standard framework, the UK offers several specialized tax regimes catering to particular sectors and activities. The Creative Industry Tax Reliefs provide enhanced deductions for qualifying expenditure in film, television, animation, video games, theater, orchestra, and museum exhibitions, offering effective tax rates as low as 13%. Real Estate Investment Trusts (REITs) enjoy exemption from corporation tax on property rental business profits, provided they distribute 90% of exempt profits as dividends. The Substantial Shareholdings Exemption eliminates corporation tax on qualifying disposals of business subsidiaries, facilitating corporate restructuring. Oil and Gas companies face the Ring Fence Corporation Tax at 30% plus a Supplementary Charge of 10% on "upstream" activities, though various allowances mitigate this higher rate. The banking sector contends with the Bank Levy on balance sheet liabilities and the Banking Companies Surcharge of 3% on profits above £100 million. These specialized provisions highlight the importance of sector-specific expertise when how to register a company in the UK for activities falling within these specialized domains.

Expert Support for Corporation Tax Compliance

Navigating the complexities of UK corporation tax often necessitates professional guidance, particularly for businesses without dedicated in-house tax functions. Chartered accountants provide comprehensive compliance services, including preparation of computations, filing of returns, and management of HMRC correspondence. Tax consultants offer strategic planning advice, identifying relief opportunities and structuring options to enhance tax efficiency while maintaining robust compliance. For businesses with international dimensions, international tax specialists provide crucial guidance on cross-border implications, transfer pricing, and treaty applications. Tax technology solutions increasingly support compliance processes, offering automated data collection, calculation verification, and digital filing capabilities. The investment in professional support typically delivers value beyond mere compliance, identifying optimization opportunities that can substantially reduce overall tax liabilities. For companies utilizing how to issue new shares in a UK limited company or other specialized corporate transactions, targeted professional advice regarding the tax implications is particularly valuable to avoid unintended consequences.

Expert Tax Guidance for International Businesses

For businesses navigating the complexities of UK corporation tax, professional expertise can make the difference between mere compliance and strategic tax optimization. At LTD24, we specialize in providing comprehensive tax guidance for international businesses operating in or through the UK tax environment. Our team possesses deep understanding of both domestic UK tax provisions and their interaction with international tax frameworks, enabling holistic solutions that address both immediate compliance needs and long-term strategic objectives.

If you’re seeking to optimize your corporate structure, identify applicable tax reliefs, navigate cross-border transactions, or ensure robust compliance with UK requirements, we invite you to book a personalized consultation with our international tax specialists. As a boutique international tax consulting firm, we deliver tailored solutions for entrepreneurs, professionals, and corporate groups operating globally. Our services encompass corporate law, tax risk management, asset protection, and international audits, providing comprehensive support for your international business activities.

Schedule your expert session today at $199 USD/hour and receive concrete answers to your tax and corporate questions that can drive meaningful improvements in your tax position while maintaining full compliance with applicable regulations.

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.