Below Market Value Properties: What Investors Should Know

28 November, 2025

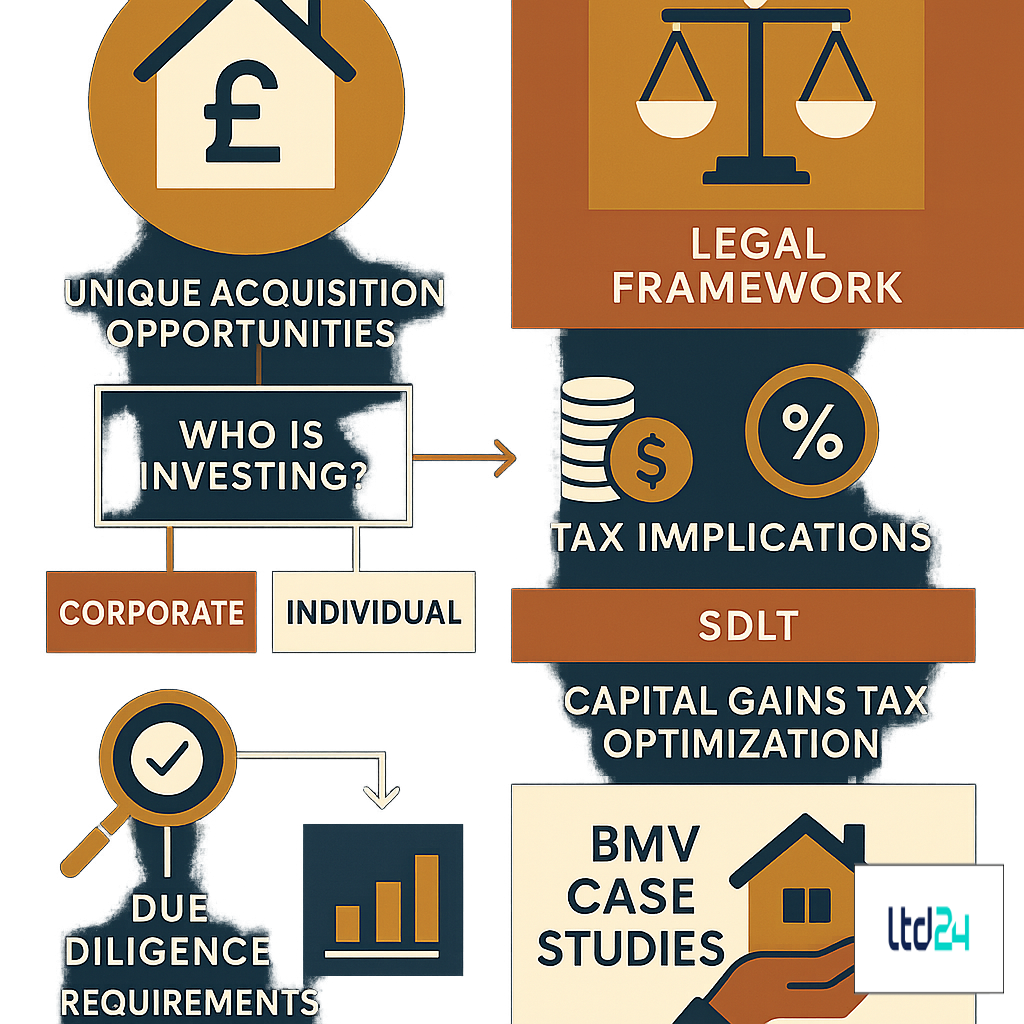

Understanding Below Market Value Properties: A Fiscal Perspective

In the realm of real estate investment, below market value (BMV) properties represent a unique opportunity for astute investors seeking to optimize their portfolios while navigating complex tax implications. These properties, valued at less than their intrinsic market worth, often emerge from distressed situations such as foreclosures, probate sales, or motivated sellers facing financial constraints. From a tax and legal standpoint, BMV acquisitions require meticulous consideration of various fiscal elements including capital gains implications, stamp duty assessments, and potential tax relief schemes. The discrepancy between purchase price and genuine market value creates significant tax planning opportunities that, when properly structured, can enhance overall investment returns through legitimate tax efficiency measures. Investors engaged in UK company taxation must be particularly attentive to how these acquisitions are documented and reported to maintain compliance while optimizing fiscal outcomes.

The Legal Framework Governing BMV Property Transactions

The regulatory environment surrounding below market value property transactions encompasses multiple jurisdictions and statutory frameworks. In the United Kingdom, such transactions fall under the purview of the Finance Act, Money Laundering Regulations, and property law statutes that govern conveyancing procedures. The legal doctrine of "consideration" becomes particularly relevant, as tax authorities may scrutinize transactions where the declared consideration appears significantly below observable market values. Anti-avoidance legislation, including the General Anti-Abuse Rule (GAAR) and Targeted Anti-Avoidance Rules (TAARs), specifically addresses arrangements where artificially depressed values might be employed to circumvent tax liabilities. Connected party transactions face heightened scrutiny, with specific provisions in tax codes addressing transfers between related entities or individuals. Investors considering offshore company registration UK structures must navigate additional complexities regarding cross-border property acquisitions and the associated reporting obligations under international tax information exchange agreements.

Tax Implications for Corporate Entities Acquiring BMV Properties

Corporate entities acquiring below market value properties must navigate distinctive tax considerations that differ significantly from individual investors. When a UK limited company purchases property below market value, the differential between acquisition cost and fair market value may trigger taxable events under corporate tax provisions. The Annual Tax on Enveloped Dwellings (ATED) regime may apply to properties valued above certain thresholds held within corporate structures. Corporation tax computations must account for the correct base cost of the asset, which impacts future capital allowances claims and eventual disposal calculations. Transfer pricing regulations may become relevant when properties transfer between connected entities at non-arm’s length values. Corporate entities must also consider the VAT implications of BMV property acquisitions, particularly regarding the option to tax commercial properties. Establishing a proper UK company formation for non-resident investors requires careful consideration of these corporate tax elements to ensure compliance while maximizing legitimate tax efficiencies.

Stamp Duty Land Tax Considerations for BMV Transactions

Stamp Duty Land Tax (SDLT) presents significant considerations in below market value property transactions, as the tax is calculated on the "chargeable consideration" rather than simply the cash price. HMRC maintains the right to substitute market value for the stated consideration where it believes a transaction occurs below genuine market rates. This creates potential additional tax liability that investors must factor into acquisition calculations. SDLT anti-avoidance provisions specifically target arrangements designed to artificially reduce property valuations. The connected persons rules within SDLT legislation presume that transactions between related parties occur at market value regardless of the stated price. Various SDLT reliefs may apply to certain BMV transactions, including those involving property transfers within corporate group reorganizations or transfers under court orders in divorce proceedings. Investors utilizing UK ready made companies should be particularly attentive to SDLT compliance requirements when structuring BMV property acquisitions to avoid unexpected tax liabilities and potential penalties for incorrect submissions.

Capital Gains Tax Optimization Strategies with BMV Properties

Below market value properties present distinctive opportunities for capital gains tax optimization when approached with proper planning and fiscal discipline. The acquisition cost forms the base value for future capital gains calculations, making accurate documentation of the property’s genuine market value at acquisition crucial for establishing a defensible tax position. For corporate investors, indexation allowance calculations (where still applicable) depend on establishing the correct base cost. Private investors may utilize principal private residence relief, entrepreneurs’ relief, or business asset disposal relief when applicable to BMV properties used in qualifying circumstances. Timing considerations become critical, as the holding period impacts available reliefs and applicable tax rates. Reinvestment of proceeds into qualifying investments may trigger rollover or holdover relief in certain scenarios. Investors considering nominee director service UK arrangements must ensure these structures do not compromise available capital gains reliefs through inadvertent breaches of qualifying conditions. Strategic phasing of property disposals across multiple tax years can also mitigate overall capital gains liability through effective utilization of annual exemption allowances.

Due Diligence Requirements for BMV Property Investments

Thorough due diligence represents an essential component of below market value property investment strategy, addressing both commercial and tax compliance aspects. Legal title verification must confirm the seller’s authority to dispose of the property at the stated price, particularly in distressed sales scenarios. Valuation evidence becomes crucial documentation for tax purposes, with independent professional valuations strongly recommended to substantiate the market value differential. Environmental assessments, structural surveys, and planning permission verification contribute to establishing the property’s genuine value and identifying potential liabilities that might justify the below-market price. Anti-money laundering compliance requirements demand enhanced scrutiny of the source of funds in BMV transactions to ensure regulatory adherence. Investors utilizing UK companies registration and formation services should implement robust due diligence protocols that address these specific requirements of BMV property acquisitions, including comprehensive documentation of factors justifying the price differential to establish a defensible position in case of future tax authority inquiries.

BMV Property Sourcing Methods: Legal and Compliance Aspects

Sourcing below market value properties necessitates navigating various legal frameworks while maintaining regulatory compliance throughout the acquisition process. Distressed property markets, including pre-foreclosure and bank repossession inventories, provide legitimate opportunities for BMV acquisitions but require adherence to specific procedural requirements. Probate sales often yield BMV opportunities but demand sensitivity to inheritance tax considerations and executor responsibilities. Off-market acquisition strategies, including direct-to-seller approaches, must comply with consumer protection regulations and avoid prohibited marketing practices. Property auctions represent a transparent mechanism for BMV acquisitions but necessitate thorough pre-auction due diligence. Corporate disposals, particularly from companies in administration or liquidation, may yield BMV opportunities while requiring compliance with insolvency regulations. Investors establishing a company incorporation in UK online presence should develop ethical and compliant sourcing methodologies that address these legal aspects while building sustainable acquisition channels that withstand regulatory scrutiny.

Risk Management in BMV Property Investments

Effective risk management in below market value property investments encompasses financial, legal, and tax-related exposures that require structured mitigation approaches. Title insurance becomes particularly important in BMV transactions to protect against undisclosed encumbrances that might explain the price differential. Robust legal documentation of the transaction’s commercial rationale provides protection against retrospective tax challenges. Insurance provisions should address specific risks associated with distressed properties, including environmental liabilities, structural defects, and potential claims from previous owners or creditors. Financing structures for BMV acquisitions require careful design to avoid lender issues regarding loan-to-value calculations based on purchase price versus market value discrepancies. Corporate investors should implement governance protocols that clearly document decision-making processes for BMV acquisitions, including board-level approval of the commercial justification. Entities utilizing directorship services must ensure directors understand their fiduciary responsibilities regarding property valuations and associated tax reporting obligations to mitigate personal liability risks alongside corporate exposures.

Financing BMV Properties: Structural and Tax Considerations

Financing structures for below market value properties involve unique considerations at the intersection of lending requirements and tax optimization. Mortgage lenders typically advance funds based on purchase price rather than market value, creating equity leverage opportunities through appropriately documented BMV acquisitions. Interest deductibility rules, particularly for corporate borrowers, impact the tax efficiency of various financing structures. Sale and leaseback arrangements involving BMV properties require careful structuring to avoid adverse tax characterizations while achieving financing objectives. Mezzanine financing and other subordinated lending structures may facilitate BMV acquisitions while creating specific tax implications regarding deductibility and security arrangements. Joint venture structures can optimize both financing capacity and tax outcomes when properly established. For international investors utilizing UK company incorporation and bookkeeping service providers, the interaction between foreign financing arrangements and UK tax provisions requires specialized attention to prevent unintended tax consequences while maximizing legitimate financing efficiencies in BMV property acquisitions.

Holding Structures for BMV Property Portfolios

Strategic selection of holding structures for below market value property portfolios significantly impacts tax efficiency, asset protection, and eventual disposal outcomes. Direct personal ownership provides simplicity but may limit tax planning opportunities compared to corporate or trust structures. Limited companies offer potential corporation tax advantages and inheritance tax planning benefits but introduce additional compliance requirements. Limited Liability Partnerships (LLPs) provide tax transparency while maintaining liability protection. Real Estate Investment Trusts (REITs) offer specific tax advantages for qualifying BMV property portfolios of sufficient scale. Offshore structures, while increasingly regulated, may provide advantages for non-UK resident investors in certain circumstances. Family investment companies represent an increasingly popular structure for intergenerational property portfolio management. Property traders versus property investors face fundamentally different tax treatments, with the distinction particularly significant for BMV portfolios where substantial value appreciation occurs shortly after acquisition. Investors utilizing UK corporate search services to identify existing property holding structures should conduct thorough comparative analysis of alternative holding vehicles before committing to specific arrangements for their BMV property portfolios.

International Taxation Aspects of Cross-Border BMV Investments

Cross-border below market value property investments introduce multiple layers of tax complexity requiring coordinated international planning. Double taxation treaties significantly impact the overall tax burden on rental income and capital gains from UK properties held by non-resident entities or individuals. Permanent establishment considerations become relevant when overseas entities actively manage UK BMV property portfolios. Transfer pricing regulations apply to cross-border property transactions between connected entities, with particular scrutiny on below market valuations. The UK’s Non-Resident Landlord Scheme imposes specific tax compliance obligations on overseas investors. Corporate residence determinations impact whether UK or foreign tax regimes primarily apply to property-holding structures. Diverted profits tax and other anti-avoidance measures specifically target artificial arrangements involving overseas structures. Investors utilizing opening a company USA services should incorporate these international tax considerations into their BMV property investment strategies from the outset to establish compliant and efficient cross-border structures that withstand increasing scrutiny from multiple tax authorities.

BMV Property Portfolio Management: Tax Efficiency Strategies

Effective tax management of below market value property portfolios requires ongoing implementation of strategic efficiency measures throughout the investment lifecycle. Capital expenditure planning should maximize available capital allowances through proper categorization of improvement costs. Regular portfolio revaluations establish updated market values to support refinancing strategies and tax planning. Expense allocation methodologies significantly impact taxable profit calculations, requiring consistent application of defensible approaches. Family tax planning opportunities, including income splitting and intergenerational transfers, may optimize overall family tax positions while maintaining commercial property management arrangements. Loss utilization strategies become particularly relevant in diversified BMV portfolios. Annual tax compliance planning should address timing of transactions and expense recognition to smooth tax liabilities across multiple periods. Strategic VAT registration and planning optimizes tax outcomes for mixed residential and commercial BMV portfolios. Property investors working with formation agent in the UK should implement comprehensive portfolio management systems that facilitate these ongoing tax efficiency strategies while maintaining robust compliance documentation.

BMV Properties in Pension Fund Structures

Self-Invested Personal Pensions (SIPPs) and Small Self-Administered Schemes (SSAS) offer distinctive advantages for holding below market value properties with significant tax benefits. Contribution tax relief effectively subsidizes property acquisitions, while rental income and capital gains within the pension wrapper grow tax-free. Strict connected party transaction rules apply, prohibiting BMV acquisitions from related parties into pension structures. The lifetime allowance impacts maximum portfolio value before tax penalties apply. Pension-held properties must be commercially let, restricting personal use of residential BMV investments. Administrative requirements include independent valuations and arm’s length documentation for all transactions. Commercial property investments in pensions may elect for VAT registration with specific implications for tenant relationships. Pension borrowing limitations restrict leverage to 50% of pension assets, impacting BMV acquisition financing strategies. Investors considering incorporation advantages should compare these pension-specific benefits against corporate holding structures when determining optimal vehicles for their BMV property portfolios, particularly regarding the tax-free growth environment that pension structures uniquely provide.

Exit Strategies and Tax Planning for BMV Property Investments

Strategic exit planning for below market value property investments should integrate commercial objectives with tax optimization throughout the investment lifecycle. Timing considerations significantly impact tax outcomes, with property disposals strategically phased across tax years to utilize annual allowances. Entity restructuring prior to disposal may optimize available reliefs and exemptions. Installment sales can spread capital gains liability while potentially utilizing multiple years’ tax allowances. Tax-deferred exchanges under specific reinvestment relief provisions allow portfolio repositioning without triggering immediate tax liabilities. Gifting strategies to family members or charitable entities may provide inheritance tax and capital gains advantages when properly structured. Investors approaching retirement may benefit from specific reliefs available upon business cessation. Foreign investors must consider both UK and home country tax implications of disposal strategies. Property developers utilizing how to register a company in the UK services should incorporate exit tax planning into their initial acquisition and development strategies for BMV properties to establish structures that facilitate tax-efficient disposals when market conditions or investment objectives dictate.

Case Studies: Successful Tax-Efficient BMV Property Strategies

Examining real-world applications of tax-efficient below market value property strategies provides valuable insights for investors developing their own approaches. In a notable 2019 case, a property investor acquired a distressed commercial building for £450,000 against a market value of £700,000, documenting the valuation differential through comprehensive condition surveys that justified the discount. By establishing a clear audit trail of the property’s defects, the investor successfully defended the BMV acquisition against HMRC scrutiny while later claiming capital allowances on substantial improvements that transformed the property’s value. Another successful strategy involved a family property business restructuring into a company structure before acquiring multiple BMV residential properties, utilizing the corporate envelope to manage rental profits at corporation tax rates while establishing a shareholders’ agreement that facilitated efficient profit extraction and eventual succession planning. Pension fund strategies have proven particularly effective, with one investor acquiring a BMV commercial property through a SIPP at £320,000 against a £450,000 market value, then leasing it to an unconnected business tenant, generating tax-free rental returns while the property appreciated without capital gains liability. For investors working with offshore company registration providers, these case studies demonstrate the importance of comprehensive documentation and commercial substance in establishing defensible tax positions for BMV property strategies.

Compliance Documentation Requirements for BMV Property Investments

Maintaining robust compliance documentation represents an essential practice for below market value property investors to withstand tax authority scrutiny and demonstrate regulatory adherence. Transaction memoranda should comprehensively document the commercial rationale behind BMV acquisitions, including distressed nature, defects, or market conditions justifying the price differential. Independent professional valuations from qualified surveyors provide critical evidence of the property’s genuine market value at acquisition. Photographic and condition survey evidence substantiates physical defects impacting valuation. Financial distress documentation regarding the seller’s circumstances may support the commercial basis for below-market pricing. Evidence of proper marketing efforts by the seller demonstrates arm’s length transaction conditions. Bank valuations and lending documentation provide third-party validation of transaction parameters. Board minutes for corporate acquisitions should clearly articulate the investment rationale and approval process. For investors utilizing business service provider assistance, implementing systematic documentation protocols specific to BMV acquisitions creates an essential audit defense file that significantly mitigates compliance risk while establishing a clear evidential basis for the tax treatment of these specialized property investments.

Expert Support: Navigating the Complexities of BMV Property Investment

If you’re exploring the intricacies of below market value property investment and seeking to optimize your tax position while maintaining full compliance, specialized expertise is essential. The multifaceted nature of BMV property transactions demands integrated knowledge across real estate valuation, taxation, corporate structuring, and regulatory compliance.

We are an international tax consulting boutique with advanced expertise in corporate law, tax risk management, asset protection, and international auditing. We provide tailored solutions for entrepreneurs, professionals, and corporate groups operating globally in the property investment sector.

Schedule a session with one of our specialists at $199 USD/hour to receive concrete answers to your property investment, tax and corporate questions. Our team will help you develop a robust strategy for your BMV property investments that maximizes returns while ensuring full regulatory compliance. Book your consultation today.

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.