British Corporate Tax Rate: What You Should Know

28 November, 2025

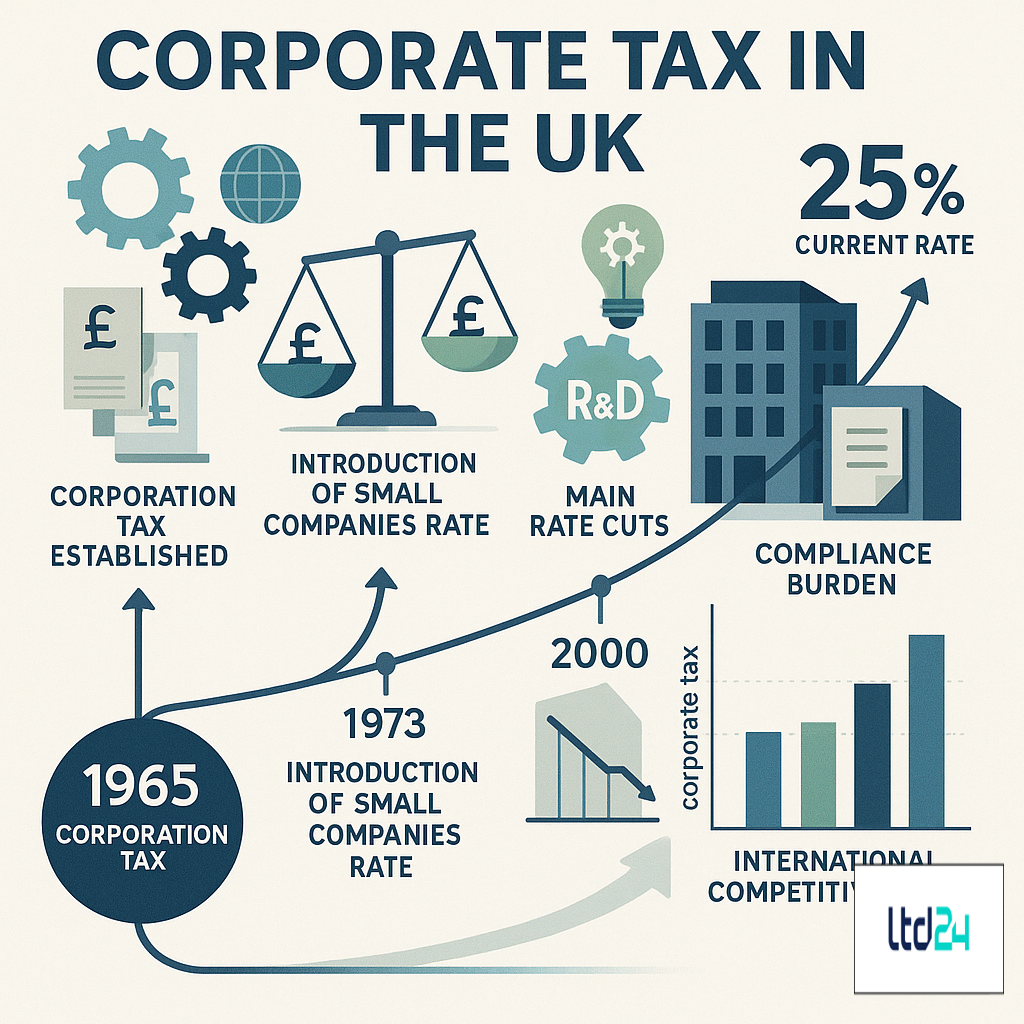

Historical Context of UK Corporate Taxation

The British corporate tax system has undergone significant transformations since its inception, reflecting the economic and political priorities of successive governments. Initially established in 1965, corporation tax replaced the previous system of income tax and profits tax that applied to companies. In the early 1980s, the main rate stood at a substantial 52%, before experiencing a gradual reduction under the Thatcher administration. This downward trajectory has largely continued over subsequent decades, with the UK tax system evolving to balance revenue generation with international competitiveness. The legislative framework governing corporate taxation has been codified primarily through Finance Acts and the Corporation Tax Acts, establishing a comprehensive system that differs significantly from other jurisdictions. These historical developments have shaped the contemporary corporate tax landscape in Britain, creating a framework that businesses must navigate when establishing their operations through UK company formation.

Current Corporate Tax Rate Structure

The present British corporate tax rate stands at 25% for companies with profits exceeding £250,000, effective from April 1, 2023. This represents a significant increase from the previous 19% rate that had been maintained for several years. For smaller businesses with profits below £50,000, a reduced rate of 19% continues to apply, creating what’s known as the Small Profits Rate. Between these thresholds, marginal relief provisions create a tapered rate, incrementally increasing the effective tax burden as profits rise toward the £250,000 threshold. This graduated approach aims to mitigate the impact on smaller enterprises while ensuring larger corporations contribute more substantially to the fiscal system. The rate structure differs from many international jurisdictions, including the United States where federal corporate tax rates were reduced to a flat 21% under the Tax Cuts and Jobs Act of 2017. For entrepreneurs considering setting up a limited company in the UK, understanding this tiered structure is essential for effective tax planning.

Comparative Analysis with Other Jurisdictions

When positioned in the global tax landscape, the UK’s 25% headline corporate tax rate places it near the median among developed economies. This rate exceeds the OECD average of approximately 23.5% but remains significantly below historical UK levels. Notable comparisons include Ireland’s highly competitive 12.5% rate for trading income, which has attracted substantial foreign direct investment, and Germany’s combined federal and municipal rate approaching 30%. The United States maintains a 21% federal rate, though state taxes often push the combined burden higher. Within the European context, France has progressively reduced its rate to 25% from previous levels exceeding 33%, creating competitive alignment with the UK. Singapore offers a 17% rate with various incentives, while British Virgin Islands companies benefit from a zero corporate tax regime, though such jurisdictions face increasing scrutiny under international tax transparency initiatives. This comparative positioning influences corporate structuring decisions, particularly for businesses contemplating offshore company registration or international expansion.

Small Profits Rate and Marginal Relief

The Small Profits Rate represents a significant concession within the British corporate tax framework, maintaining a 19% rate for companies with annual profits below £50,000. This preferential treatment acknowledges the disproportionate compliance burden that taxation can impose on smaller enterprises and supports entrepreneurial growth. The marginal relief mechanism operates between the £50,000 and £250,000 thresholds, creating a gradual transition between the Small Profits Rate and the main rate. This relief is calculated through a formula-based approach that effectively creates a sliding scale of taxation. For instance, a company with profits of £150,000 would face an effective rate of approximately 22%, rather than the full 25% main rate. Associated company rules prevent artificial fragmentation of businesses to exploit this tiered structure, as connected entities are considered collectively when determining the applicable threshold. This system offers substantial benefits for entrepreneurs engaged in UK company incorporation at the smaller end of the business spectrum.

Tax Deductions and Allowances

British tax legislation provides numerous deductions that can significantly reduce a company’s effective tax burden below the headline rate. Capital allowances permit businesses to offset the cost of qualifying capital expenditure against taxable profits, with the Annual Investment Allowance currently offering immediate 100% relief on the first £1 million of qualifying expenditure. Research and Development (R&D) tax credits provide enhanced deductions of up to 230% for qualifying expenditure, substantially benefiting innovation-focused enterprises. The Patent Box regime allows a reduced 10% rate on profits derived from patented inventions, incentivizing intellectual property development within the UK. Loss relief provisions permit the carry-forward of trading losses indefinitely against future profits of the same trade, with certain restrictions for larger companies. Additionally, specific industry reliefs exist for sectors including creative industries, shipping, and real estate investment trusts. These allowances create opportunities for effective tax planning, particularly for businesses focused on capital-intensive or innovation-driven activities when setting up an online business in UK.

Impact of Recent Legislative Changes

The most consequential recent shift in British corporate taxation was the April 2023 increase in the main rate from 19% to 25%, reversing the long-term downward trend observed over previous decades. This adjustment followed pandemic-related fiscal pressures and aligned with global movements toward establishing minimum corporate tax rates. Simultaneously, the government introduced enhanced capital allowances through the "super-deduction" scheme, providing 130% relief on qualifying plant and machinery investments until March 2023. The Finance Act 2022 implemented significant reforms to loss relief utilization, restricting the offset of carried-forward losses to 50% of profits above a £5 million allowance for larger businesses. Additionally, anti-avoidance measures have been strengthened, with updated Diverted Profits Tax provisions targeting artificial arrangements that shift profits away from the UK. The notification requirement for uncertain tax treatments has created new compliance obligations for larger businesses. These legislative developments have created a more complex landscape for corporate taxpayers, necessitating careful consideration during UK company formation.

Corporate Tax Payment and Administration

British companies must adhere to specific timelines and procedural requirements when fulfilling their corporate tax obligations. The tax payment deadline typically falls nine months and one day after the end of the accounting period, although larger companies must pay in quarterly installments. Tax returns must be filed electronically within 12 months of the accounting period end, using the prescribed CT600 form and accompanying computations. HMRC’s Making Tax Digital initiative is progressively digitizing tax administration, requiring compatible software for tax compliance. Penalties for late payment begin at 5% of unpaid tax after 30 days, with additional 5% charges accruing at six and twelve months. Interest charges apply to late payments at rates that fluctuate with the Bank of England base rate. Tax administration represents a significant compliance burden, particularly for smaller enterprises, with HMRC’s business tax account serving as the primary interface for managing obligations. For businesses utilizing UK company incorporation services, understanding these administrative requirements is essential for maintaining good standing.

Tax Planning Strategies for UK Companies

Effective corporate tax planning within the British context involves legitimate strategies to optimize tax positions while maintaining full compliance. Timing capital expenditure to maximize capital allowances represents a fundamental approach, particularly in light of temporary enhanced allowances. Structuring operations to qualify for R&D tax credits can generate substantial relief for innovative activities, while appropriate intellectual property management may allow access to the beneficial Patent Box regime. Group relief provisions permit the transfer of losses between qualifying group companies, enabling more efficient utilization of tax attributes. Remuneration strategy optimization between salary, dividends, and pension contributions can enhance tax efficiency for owner-managers, though anti-avoidance provisions must be navigated carefully. International businesses may consider transfer pricing arrangements that properly align profit attribution with economic substance. For non-resident companies, understanding the permanent establishment concept is crucial to avoid inadvertently creating UK tax liabilities. Responsible tax planning requires maintaining documentation that demonstrates commercial rationale beyond tax advantages, particularly in light of strengthened anti-avoidance measures.

Digital Services Tax and Future Developments

The UK Digital Services Tax (DST) represents a significant development in British corporate taxation, imposing a 2% levy on revenues derived from UK users of search engines, social media platforms, and online marketplaces. This targeted measure addresses challenges in taxing digital business models that can generate substantial economic value within a jurisdiction without physical presence. The DST applies only to large businesses with global digital revenues exceeding £500 million and UK digital revenues exceeding £25 million. While initially positioned as a temporary measure, it signals a broader shift toward taxing economic activity where value is created rather than where businesses are physically established. Looking forward, the OECD’s international tax reform proposals, including the global minimum tax rate of 15% under Pillar Two, will significantly impact multinational enterprises operating in the UK. These reforms aim to curtail profit shifting and tax base erosion through coordinated international standards. For businesses involved in e-commerce and digital services, these evolving frameworks represent critical considerations when establishing UK operations through online company formation.

Corporate Tax Audits and Investigations

HMRC’s approach to corporate tax enforcement encompasses risk-based audits, targeted investigations, and specialized programs for specific sectors or issues. The department employs sophisticated data analytics to identify discrepancies and potential areas of non-compliance, with large businesses assigned dedicated Customer Compliance Managers who maintain ongoing relationships. Business Risk Reviews categorize taxpayers according to their compliance history and control frameworks, with higher-risk entities facing more intensive scrutiny. Common triggers for investigation include inconsistencies between tax returns and financial statements, unusual fluctuations in profitability, and cross-border transactions with low-tax jurisdictions. During an inquiry, HMRC possesses substantial information-gathering powers, including the ability to request documents, access premises, and interview relevant personnel. The Corporate Criminal Offence of Failure to Prevent Tax Evasion has enhanced enforcement capabilities, placing responsibility on businesses to implement reasonable prevention procedures. For companies utilizing formation agent services, ensuring proper compliance frameworks from inception helps mitigate audit risks.

Brexit Impact on Corporate Taxation

Britain’s departure from the European Union has produced multifaceted effects on the corporate tax landscape, removing constraints previously imposed by EU Directives while creating new compliance considerations. The UK is no longer bound by the Parent-Subsidiary and Interest and Royalties Directives, potentially leading to increased withholding taxes on cross-border payments within corporate groups. Post-Brexit, the UK has greater autonomy in designing tax incentives and special regimes without adhering to EU State Aid rules, though this freedom is somewhat constrained by commitments under the Trade and Cooperation Agreement. Customs duties and import VAT now apply to movements of goods between the UK and EU, creating additional administrative and financial burdens. Tax treaty access remains largely unchanged, as these agreements operate independently of EU membership. For multinational groups, these shifts necessitate reconsideration of supply chains and corporate structures. Businesses involved in cross-border transactions should review cross-border royalties arrangements and potentially restructure operations to mitigate adverse tax consequences. Companies engaged in UK company formation must now navigate this changed landscape when structuring their European operations.

Transfer Pricing and International Considerations

British transfer pricing regulations require transactions between connected parties to adhere to the arm’s length principle, reflecting terms that would prevail between independent entities. These provisions apply to both cross-border and domestic transactions, though small and medium-sized enterprises benefit from certain exemptions unless directed otherwise by HMRC. Documentation requirements mandate maintenance of primary documentation demonstrating compliance, with country-by-country reporting obligations for larger multinational groups. Advance Pricing Agreements offer a mechanism to secure pre-approval of transfer pricing methodologies, reducing uncertainty for complex arrangements. The Diverted Profits Tax serves as a complementary regime, applying a punitive 31% rate to profits artificially diverted from the UK. Permanent establishment considerations determine when a foreign company creates a taxable presence in Britain, with careful structuring required to manage exposure. For businesses with international operations, the interaction between UK transfer pricing rules and foreign tax systems creates complex compliance challenges. Understanding these international dimensions is particularly important for companies utilizing offshore company registration services, as proper structuring can significantly impact global tax efficiency.

VAT and Other Indirect Taxes

Value Added Tax represents a crucial component of the British fiscal system, currently levied at a standard rate of 20% on most goods and services. Businesses with annual taxable supplies exceeding £85,000 must register for VAT, though voluntary registration may benefit companies below this threshold who supply primarily to VAT-registered customers. Certain categories, including essential foods, children’s clothing, and books, benefit from zero-rating, while reduced rates apply to specific items such as domestic fuel and sanitary products. VAT-registered businesses must file quarterly returns, with Making Tax Digital requirements mandating compatible software for record-keeping and submission. Besides VAT, companies may encounter various indirect taxes including Insurance Premium Tax, Stamp Duty Land Tax on property acquisitions, and environmental levies. Customs duties now apply to goods imported from the European Union following Brexit, creating additional administrative and financial considerations. For businesses engaged in cross-border trade, obtaining an EORI number has become essential for customs clearance. Understanding these indirect tax obligations forms a crucial element of tax planning for companies establishing operations through UK company formation.

Corporate Tax Relief for Research and Development

The British R&D tax relief system offers substantial incentives for companies engaged in qualifying innovative activities, operating through two primary schemes. The SME scheme provides enhanced deductions of 230% of qualifying expenditure for eligible small and medium-sized enterprises, potentially generating a tax credit of up to 33% of R&D spending. The Research and Development Expenditure Credit (RDEC) scheme applies to larger companies and certain subcontracted R&D, offering a taxable credit currently set at 20% of qualifying expenditure. Qualifying activities must seek to achieve an advance in science or technology through the resolution of scientific or technological uncertainty, with eligible costs including staff expenses, subcontractor fees, consumables, and certain software. Recent reforms have refocused the regime on UK-based innovation, restricting relief for overseas R&D while enhancing support for domestic activities in data-intensive and cloud computing projects. To access these benefits, companies must maintain contemporaneous documentation demonstrating the technical uncertainties addressed and the systematic approach to resolution. For innovative businesses considering UK company formation, these incentives can substantially reduce effective tax rates and improve cash flow during development phases.

Corporate Restructuring and Tax Implications

Corporate restructuring operations, including mergers, acquisitions, demergers, and group reorganizations, trigger various tax considerations under British legislation. The Substantial Shareholding Exemption potentially provides relief from corporation tax on capital gains arising from qualifying disposals of shareholdings, subject to specific ownership and trading conditions. Group relief provisions facilitate tax-neutral transfers of assets between qualifying group companies, preventing crystallization of latent gains. Stamp duty considerations arise on share transfers (0.5%) and property transactions (progressive rates up to 5%), though various reliefs may apply to corporate reorganizations. Debt restructuring carries potential tax implications regarding loan relationship rules, with corporate rescue provisions potentially providing relief in insolvency contexts. The tax treatment of acquisition costs varies between revenue and capital expenditure, with specific rules governing the deductibility of transaction fees. When companies issue new shares, stamp taxes may apply, though various exemptions exist for group reorganizations. For businesses contemplating structural changes, early tax planning is essential to identify opportunities for relief and mitigate potential liabilities that might otherwise erode transaction value.

Compliance and Reporting Requirements

British corporate tax compliance encompasses a range of filing obligations beyond the annual tax return, creating a substantial administrative burden for businesses. Companies must submit their annual accounts to both Companies House and HMRC, with differing content requirements and deadlines. The Senior Accounting Officer regime requires designated individuals in larger businesses to certify that appropriate tax accounting arrangements exist, with penalties for non-compliance. Country-by-Country reporting obligations apply to multinational groups with consolidated revenues exceeding €750 million, requiring detailed disclosure of global activities. Quarterly instalment payments accelerate tax collection for larger companies, while the Uncertain Tax Treatment notification regime requires disclosure of positions where HMRC might take a contrary view. Mandatory Disclosure Rules require reporting of certain cross-border arrangements with hallmarks of potential tax avoidance. These compliance requirements necessitate robust systems and processes, particularly for company directors who bear ultimate responsibility for tax governance. For businesses utilizing UK company incorporation services, establishing appropriate compliance frameworks from inception helps prevent costly penalties and reputational damage.

Expert Tax Support for International Businesses

Navigating the complexities of British corporate taxation requires specialized expertise, particularly for international businesses establishing UK operations. Professional advisors can provide critical guidance on structuring decisions, compliance obligations, and tax planning opportunities within the legislative framework. For non-resident businesses, understanding permanent establishment thresholds and transfer pricing requirements proves especially challenging without expert support. Tax advisors can assist with determining residency status, application of tax treaties, and management of withholding tax obligations on cross-border payments. They can also facilitate engagement with HMRC through clearance applications and advance ruling requests for uncertain positions. When selecting advisors, businesses should consider sector-specific expertise, international capabilities, and understanding of relevant foreign tax systems. Effective advisor relationships involve clear communication about risk appetite and commercial priorities, enabling tailored recommendations that align with broader business objectives. For companies utilizing formation agent services, integrating tax advice from inception helps establish optimal structures and prevent costly restructuring later.

Your Partner in International Tax Navigation

If you’re seeking to navigate the complexities of British corporate taxation and international tax considerations, comprehensive professional guidance can make a critical difference to your business outcomes. The ever-changing landscape of tax legislation, coupled with increased scrutiny from tax authorities worldwide, creates significant risks for businesses operating across borders.

We are a boutique international tax consulting firm specializing in corporate law, tax risk management, wealth protection, and international audits. Our team delivers tailored solutions for entrepreneurs, professionals, and corporate groups operating globally, with particular expertise in UK corporate taxation.

Book a personalized consultation with one of our tax experts at $199 USD/hour and receive actionable insights on your specific tax and corporate challenges. Our advisors can help you optimize your tax position while ensuring full compliance with UK and international regulations. Schedule your consultation today and transform tax complexities into strategic advantages for your business.

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.