Rate Of Capital Gains Tax In UK: Complete Breakdown

28 November, 2025

The Fundamental Framework of Capital Gains Tax in the UK

Capital Gains Tax (CGT) represents a significant element within the UK’s taxation landscape, applying to profits realized from the disposal of assets that have appreciated in value. The regime operates on a principle of taxing the ‘gain’ rather than the entire proceeds from a disposal. For individuals seeking to navigate the complexities of CGT in the UK, understanding the rate structure is paramount. The tax applies to a wide spectrum of assets, including but not limited to property not designated as a principal private residence, shares not held within tax-efficient vehicles such as ISAs, business assets, and certain personal possessions valued above £6,000. The calculation methodology involves determining the difference between the acquisition cost (plus allowable expenses) and the disposal proceeds, with the resultant figure representing the taxable gain. HM Revenue & Customs (HMRC) administers this tax, which forms a cornerstone of the UK’s capital taxation framework. For international investors considering UK company formation for non-residents, understanding CGT obligations is essential for effective tax planning.

Current Capital Gains Tax Rates for Individuals

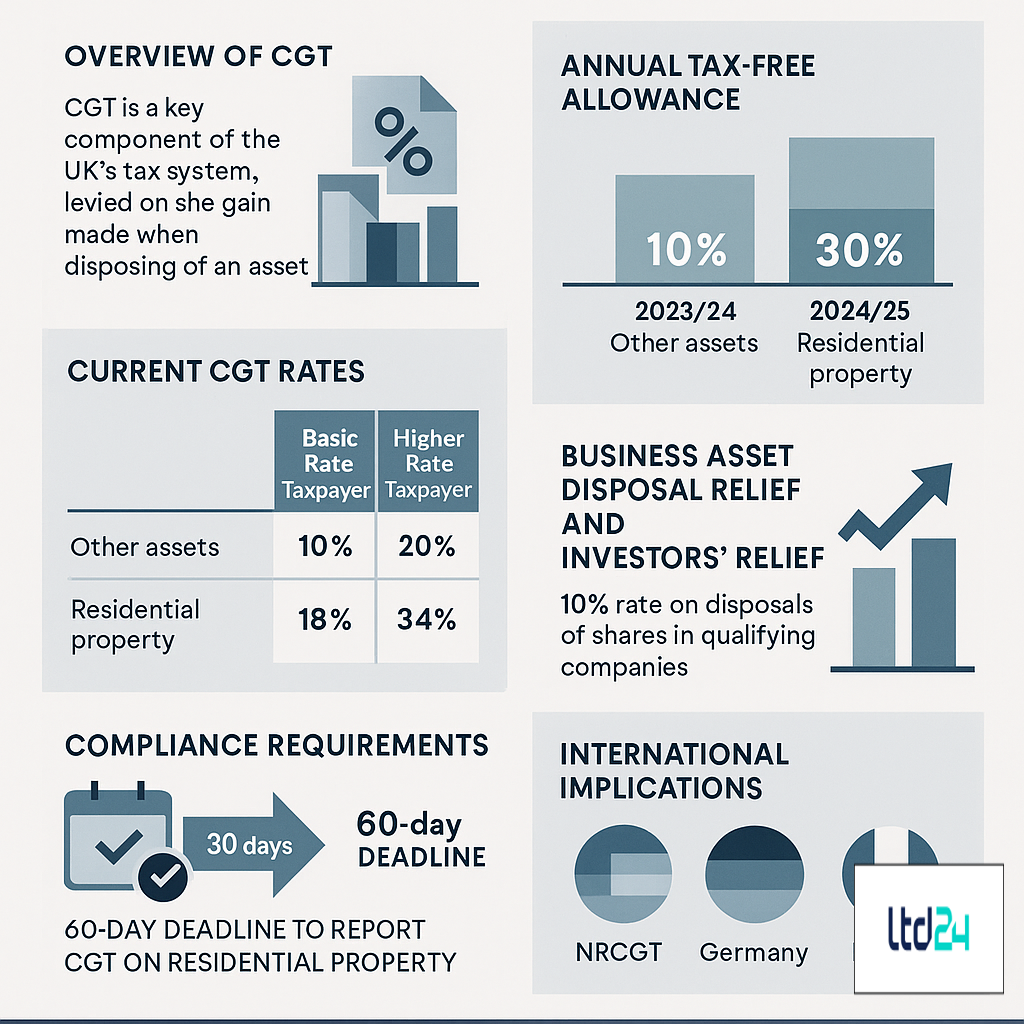

The current rate structure for Capital Gains Tax in the UK follows a two-tier system that varies according to both the nature of the asset disposed of and the individual’s income tax band. For the tax year 2023/24, basic rate taxpayers face a CGT rate of 10% on most assets and 18% specifically on residential property that doesn’t qualify for Private Residence Relief. Higher and additional rate taxpayers encounter elevated rates of 20% for standard assets and 28% for residential property disposals. This bifurcated approach reflects the government’s policy objectives regarding property investment. The applicable rate determination process requires individuals to add their taxable gain (after deducting the annual exempt amount) to their taxable income. If this combined figure remains within the basic rate band (£37,700 for 2023/24), the lower CGT rates apply; if it extends beyond this threshold, the higher rates become operative. This creates a nuanced tax planning landscape for those with substantial capital gains, particularly those with UK company taxation concerns or considering setting up a limited company in the UK as part of their investment strategy.

The Annual Tax-Free Allowance and Recent Changes

A pivotal component of the UK’s Capital Gains Tax framework is the Annual Exempt Amount (AEA), which has undergone significant modifications in recent fiscal periods. For the 2023/24 tax year, the AEA stands at £6,000, representing a substantial reduction from the previous year’s £12,300. This 51% diminution illustrates the government’s policy trajectory of broadening the CGT tax base. Further contraction is scheduled for the 2024/25 tax year, when the allowance will decrease to a mere £3,000, representing a 75% reduction from its 2022/23 level. This progressive constriction of the tax-free threshold magnifies the effective tax burden on capital disposals, particularly for regular traders or investors with diverse portfolios. The rationale behind these adjustments aligns with broader fiscal consolidation efforts and the objective of increasing revenue from capital taxation. For those engaged in UK company incorporation, these allowance reductions necessitate more strategic planning regarding the timing of asset disposals and the utilization of available reliefs. Taxpayers should scrutinize the interaction between these allowance reductions and their overall tax position, potentially considering corporate structures to optimize their capital gains position.

Business Asset Disposal Relief (Formerly Entrepreneurs’ Relief)

Business Asset Disposal Relief (BADR), the successor to Entrepreneurs’ Relief, represents a significant concession within the UK’s Capital Gains Tax framework for business owners. This relief enables qualifying individuals to apply a reduced CGT rate of 10% to disposals of business assets, irrespective of their income tax band, subject to a lifetime limit of £1 million of gains. To access this preferential treatment, stringent eligibility criteria must be satisfied: the individual must hold at least 5% of the shares and voting rights in a trading company, be an officer or employee of the company, and have maintained these conditions for at least two years preceding the disposal. For sole traders or partnerships, similar tenure requirements apply to business assets being disposed of. The lifetime allowance has been progressively reduced from £10 million (pre-2020) to its current level, reflecting policy shifts toward limiting tax advantages for higher-value disposals. For entrepreneurs considering UK company taxation implications when setting up a limited company in the UK, BADR remains a critical consideration in exit planning, potentially affecting decisions about how to issue new shares in a UK limited company and ownership structures.

Investors’ Relief: An Alternative Path for External Investors

Investors’ Relief constitutes a specialized Capital Gains Tax concession targeted at external investors in unlisted trading companies. Introduced in 2016, this relief offers a reduced 10% CGT rate on qualifying disposals, with a separate lifetime limit of £10 million of gains. Unlike Business Asset Disposal Relief, Investors’ Relief is specifically designed for individuals who are not employees or officers of the company, positioning it as a complementary measure to encourage equity investment in private businesses. To qualify, shares must be newly issued, held continuously for a minimum of three years, and acquired on or after 17 March 2016. The shares must be in an unlisted trading company or holding company of a trading group. This relief represents a significant opportunity for angel investors, venture capitalists, and other external stakeholders in private businesses. For those involved in UK company incorporation and bookkeeping services, understanding this relief can inform client advice regarding capital raising and investor relations. Similarly, for entrepreneurs setting up an online business in UK who seek external investment, awareness of Investors’ Relief can enhance funding proposals and negotiation positions with potential investors by highlighting the tax advantages available to them.

Capital Gains Tax on Residential Property

The taxation of capital gains arising from residential property disposals in the UK represents one of the most stringent aspects of the CGT regime. Higher rate bands of 18% for basic rate taxpayers and 28% for higher/additional rate taxpayers apply specifically to residential property not qualifying for Private Residence Relief (PRR). This contrasts markedly with the standard CGT rates of 10% and 20% respectively. Furthermore, the administrative framework for property disposals has been significantly tightened since April 2020, with the introduction of the 60-day reporting and payment window for UK residential property disposals. This accelerated compliance timeline requires taxpayers to calculate, report, and pay any CGT liability within 60 days of completion, representing a substantial contraction from the previous system where reporting occurred through the annual Self Assessment process. Failure to meet these expedited deadlines triggers automatic penalties starting at £100. For international investors utilizing UK company formation for non-residents for property investment purposes, these heightened rates and compressed compliance windows create additional administrative burdens. Similarly, those considering offshore company registration UK as a vehicle for property investment must evaluate the CGT implications against any potential benefits of such structures, especially in light of the Annual Tax on Enveloped Dwellings (ATED) that may also apply.

The Non-Resident Capital Gains Tax Regime

The Non-Resident Capital Gains Tax (NRCGT) regime represents a specialized framework within the UK’s taxation system, applicable to non-UK residents disposing of UK property interests. Introduced in stages—initially for residential property from April 2015 and subsequently extended to all UK land and property (including commercial property) from April 2019—this regime eliminated the historical CGT exemption for non-residents. The current framework imposes CGT on non-residents at rates identical to those applicable to UK residents: 18%/28% for residential property and 10%/20% for commercial property, depending on the individual’s UK income levels. A distinctive feature of NRCGT is the accelerated reporting requirement, mandating notification to HMRC within 60 days of disposal completion, even when no tax liability arises. This reporting obligation exists independently of any Self Assessment requirements. For those engaging formation agents in the UK to establish corporate structures, understanding NRCGT implications is essential, particularly when considering online company formation in the UK for property investment purposes. The regime also interacts with other international tax considerations, potentially including the UK’s extensive treaty network, which may modify the default NRCGT position depending on the non-resident’s jurisdiction of residence.

Capital Gains Tax and Cryptocurrency

The taxation of cryptocurrency transactions under the UK’s Capital Gains Tax framework has emerged as a significant area requiring specialist knowledge. HMRC’s position classifies cryptocurrencies as ‘chargeable assets’ for CGT purposes, meaning disposals (including coin-to-coin exchanges, conversion to fiat currency, and using cryptocurrency to purchase goods or services) potentially trigger CGT liabilities. The standard CGT rates of 10% for basic rate taxpayers and 20% for higher/additional rate taxpayers apply, with gains calculated by reference to Sterling value at the dates of acquisition and disposal. Particular complexities arise regarding ‘pooling’ rules for assets acquired at different times, token identification for disposal purposes, and the treatment of forks and airdrops. The highly volatile nature of cryptocurrency values creates additional computational challenges for determining accurate gains. For individuals engaged in regular cryptocurrency trading who might be considering UK company taxation implications, the potential classification as ‘trading’ rather than ‘investment’ activity could shift the tax treatment from CGT to Income Tax, potentially increasing the effective tax rate substantially. Those setting up a limited company in the UK specifically for cryptocurrency activities should evaluate whether a corporate structure offers tax advantages compared to personal ownership, particularly given the inability to apply certain CGT reliefs to cryptocurrency assets.

Interaction Between CGT and Other UK Taxes

The interrelationship between Capital Gains Tax and other elements of the UK tax system creates a complex matrix requiring holistic analysis for optimal tax planning. The interaction with Income Tax is particularly significant, as an individual’s income tax band determines their applicable CGT rate. This creates planning opportunities around the timing of income recognition and capital disposals to maximize utilization of the basic rate band. The interface with Inheritance Tax (IHT) presents further considerations, as assets transferred upon death receive a ‘tax-free uplift’ to market value for CGT purposes, effectively wiping out any latent gain for the beneficiary. However, certain lifetime gifts can trigger both immediate CGT liability for the donor and potential future IHT implications if the donor fails to survive seven years. For business owners who have registered a company in the UK, the interaction between CGT, Corporation Tax on chargeable gains, and potential double taxation upon extraction of proceeds requires careful navigation. Additionally, the Annual Tax on Enveloped Dwellings (ATED) regime intersects with CGT for high-value UK residential property held within corporate structures, potentially influencing decisions about setting up a limited company UK for property investment purposes. This multidimensional tax environment necessitates integrated planning approaches that consider the cumulative impact across different tax heads.

International Aspects of UK Capital Gains Tax

The international dimensions of the UK’s Capital Gains Tax regime present both challenges and opportunities for cross-border investors and expatriates. UK residents are subject to CGT on their worldwide disposals, creating potential double taxation issues where assets are located overseas. While the UK maintains an extensive network of Double Taxation Agreements (DTAs) that typically allocate taxing rights for immovable property to the jurisdiction where the property is situated, relief mechanisms such as foreign tax credit relief may apply to mitigate double taxation on other assets. For temporary non-UK residents (those abroad for fewer than five complete tax years), the ‘temporary non-residence rules’ can retroactively impose CGT on certain disposals made during the period of non-residence. This anti-avoidance provision significantly impacts exit planning for those considering temporary relocation. For international entrepreneurs considering UK company formation for non-residents, the distinction between personal and corporate ownership of assets becomes crucial, as does understanding the interaction with overseas tax regimes. Similarly, those exploring company registration with VAT and EORI numbers for cross-border trading activities should incorporate CGT considerations into their structural planning, particularly regarding the potential future disposal of the business or its assets.

Tax Planning Strategies for Capital Gains

Effective Capital Gains Tax planning encompasses a repertoire of legitimate strategies to optimize an individual’s CGT position while remaining compliant with tax legislation. Annual exemption utilization represents a foundational strategy, with the current £6,000 allowance (2023/24) creating opportunities for ‘bed and breakfast’ transactions across spouses or civil partners to reset acquisition values. Deferral relief mechanisms, including the Enterprise Investment Scheme (EIS), offer opportunities to postpone CGT liabilities by reinvesting proceeds into qualifying investments. Loss harvesting—deliberately crystallizing paper losses to offset against gains in the same or future tax years—provides another tactical approach, particularly in volatile markets. For business owners, evaluating the application of Business Asset Disposal Relief against broader succession planning objectives becomes critical, potentially informing decisions about how to register a business name UK and ownership structures. Pension contributions represent another strategic lever, as they extend the basic rate band, potentially reducing the applicable CGT rate on disposals. For international individuals, timing relocations to capture the tax-free uplift on departure from certain jurisdictions can yield substantial benefits. Those seeking to set up a limited company in the UK should evaluate whether corporate ownership of investment assets offers tax advantages compared to personal ownership, particularly regarding the applicable tax rates and available reliefs.

Record-Keeping Requirements and Compliance

The administrative framework surrounding Capital Gains Tax in the UK imposes rigorous record-keeping obligations that underpin accurate calculation and reporting of liabilities. Taxpayers must maintain comprehensive documentation evidencing acquisition dates, costs (including allowable enhancement expenditure), disposal proceeds, and relevant dates for a minimum of 22 months after the end of the tax year in which the disposal occurred (or 6 years for business assets). For assets acquired before March 1982, evidence supporting the March 1982 valuation becomes particularly important given the rebasing of acquisition costs to that date. The reporting mechanism typically operates through the Self Assessment system, with CGT liabilities declared on the tax return for the relevant tax year. However, UK residential property disposals face accelerated reporting requirements, with the 60-day submission window creating additional compliance pressures. Penalties for non-compliance escalate based on both the duration of the delay and the behavior underlying the failure (careless, deliberate but not concealed, or deliberate and concealed). For those utilizing UK company incorporation and bookkeeping service, integrating CGT record-keeping into broader financial administration systems becomes essential. Similarly, international investors employing nominee director service UK structures must ensure their record-keeping protocols accommodate CGT compliance requirements, particularly regarding property disposals.

CGT on Business Assets and Shares

The treatment of business assets and shares under the UK’s Capital Gains Tax regime encompasses a nuanced framework of rates, reliefs, and computational rules. For unincorporated businesses, the disposal of business assets (including goodwill, premises, and equipment) attracts CGT at standard rates of 10%/20% depending on the taxpayer’s income level, subject to potential relief under Business Asset Disposal Relief where the 10% rate applies irrespective of income. For shareholdings, the position varies according to the nature of the company and the shareholder’s relationship with it. Quoted shares benefit from established market values, while unquoted shares require formal valuation, typically applying earnings-based or asset-based methodologies. Share-for-share exchanges generally qualify for rollover relief, deferring any gain until the disposal of the replacement shares. For controlling shareholdings in trading companies, substantial shareholding exemption may apply to corporate shareholders, potentially creating advantages for those considering UK company formation as an investment vehicle. Entrepreneurs contemplating how to issue new shares in a UK limited company should evaluate the CGT implications for both the company and potential investors, particularly regarding the availability of Business Asset Disposal Relief or Investors’ Relief upon eventual disposal. For international business structures, understanding the interaction between the UK CGT regime and overseas tax systems becomes critical for effective exit planning.

The Chattels Exemption and Wasting Assets

Within the UK’s Capital Gains Tax framework, specific provisions apply to chattels (tangible movable property) and wasting assets, creating distinctive treatment compared to standard investment assets. The ‘chattels exemption’ provides that disposals of individual items with a value not exceeding £6,000 are entirely exempt from CGT, creating planning opportunities for collections of valuable items. For chattels with values exceeding this threshold, a complex computational rule applies that effectively caps the maximum CGT liability at 5/3 of the amount by which the proceeds exceed £6,000. This creates a ‘ceiling effect’ particularly beneficial for higher-value items selling for close to the threshold. Wasting assets—those with a predictable useful life not exceeding 50 years—generally receive CGT exemption, although this doesn’t extend to business assets where capital allowances have been claimed. Notably, certain assets automatically qualify as wasting assets regardless of their actual durability, including racehorses and greyhounds. For international investors utilizing UK company formation for non-residents structures for art or collectible investment, the interaction between the chattels rules and corporate ownership creates additional considerations. Those setting up an online business in UK dealing in collectibles or luxury goods should incorporate these specialized CGT rules into their business modeling and inventory management strategies.

Gift Hold-Over Relief and Transfers Between Spouses

Gift Hold-Over Relief and interspousal transfers represent significant concessions within the UK’s Capital Gains Tax framework that facilitate tax-efficient asset transfers in specific contexts. Gift Hold-Over Relief enables the donor to defer CGT on gifts of business assets or shares in unlisted trading companies, effectively transferring the latent gain to the recipient who assumes the donor’s original acquisition cost. This creates substantial planning opportunities for business succession, allowing family businesses to transition between generations without triggering immediate tax liabilities. The administrative procedure requires joint election by both parties within specific time limits. Transfers between spouses or civil partners benefit from an even more generous provision—automatic CGT-free treatment regardless of asset type or value. These transfers occur at ‘no gain, no loss’ for tax purposes, with the recipient adopting the transferor’s acquisition cost and date. This creates opportunities for equalizing asset ownership between spouses to maximize utilization of dual annual exemptions and basic rate bands. For those who be appointed director of a UK limited company alongside their spouse, these provisions facilitate tax-efficient ownership structuring of the business. Similarly, international couples where one partner is setting up a limited company UK can utilize these rules to optimize their overall tax position, potentially shifting assets between personal and corporate ownership as appropriate.

Recent and Anticipated Changes to UK CGT

The evolutionary trajectory of the UK’s Capital Gains Tax regime has featured significant recent modifications and continues to generate speculation regarding potential future reforms. The most substantial recent change involved the progressive reduction of the Annual Exempt Amount from £12,300 in 2022/23 to £6,000 in 2023/24, with a further decrease to £3,000 scheduled for 2024/25. This 75% cumulative reduction over two years materially increases the effective tax burden on capital disposals. The introduction of the 60-day reporting window for UK residential property disposals in April 2020 represented another significant administrative tightening. Looking forward, various reform proposals have emerged from authoritative sources including the Office of Tax Simplification, which has advocated for potential alignment of CGT rates with Income Tax rates (potentially doubling CGT rates to 40% for higher rate taxpayers), the abolition of the tax-free uplift on death, and further restrictions to Business Asset Disposal Relief. While these recommendations have not yet been implemented, they signal potential reform directions that could significantly impact investment and succession planning. For those considering UK company taxation structures or setting up a limited company in the UK, these potential changes create planning challenges, particularly for long-term investments or business succession strategies. International investors should particularly monitor potential reforms to the non-resident CGT regime, which has been progressively expanded in recent years.

Cross-Jurisdictional Comparative Analysis of CGT Rates

The UK’s Capital Gains Tax regime occupies a distinctive position when benchmarked against comparable advanced economies, presenting both advantages and disadvantages depending on the asset class and taxpayer profile. Compared to the United States’ long-term capital gains rates (0%/15%/20% based on income thresholds, plus potential 3.8% Net Investment Income Tax), the UK’s standard rates (10%/20%) appear broadly competitive, although the absence of preferential treatment for long-term holdings contrasts with the US approach. Germany’s 25% flat rate (plus solidarity surcharge) exceeds the UK’s basic rate but potentially offers advantages for higher-rate taxpayers. France’s complex regime featuring a flat 30% rate (including social charges) on financial assets but progressive rates on real estate with coefficient reductions for holding periods creates a mixed comparative position. Some jurisdictions—notably Singapore and Switzerland (at federal level)—impose no capital gains tax on most investment assets, creating significant disparities with the UK system. These international variations inform decisions for mobile investors considering UK company formation for non-residents versus alternative jurisdictions. For international business owners contemplating exit strategies, understanding these cross-border differentials becomes crucial when structuring disposals, particularly regarding online company formation in the UK versus alternative locations. The UK’s relative position is further influenced by its extensive treaty network, which may modify the default position for cross-border transactions.

Navigating Complex Tax Challenges with Expert Support

The intricate nature of the UK Capital Gains Tax regime, with its varying rates, numerous reliefs, and complex computation rules, often necessitates professional guidance to achieve optimal outcomes. For high-value disposals, business sales, or cross-border transactions, the financial implications of suboptimal tax planning can be substantial. Specialized CGT advisors bring technical expertise across multiple dimensions: quantitative analysis to model alternative disposal strategies; qualitative judgment regarding the application of anti-avoidance provisions; and procedural knowledge to ensure compliance with reporting requirements and deadlines. The cost-benefit equation typically favors professional consultation where significant values are at stake, particularly given the potential for reliefs to reduce tax rates by 50% or more in qualifying circumstances. For those involved in international structures combining UK company incorporation with entities in other jurisdictions, expert guidance becomes essential to navigate the interaction between different tax systems and identify potential treaty benefits. Similarly, business owners contemplating exit strategies who have established their enterprise through setting up a limited company UK processes should engage specialist advisors early in the planning cycle to maximize available reliefs and structure the disposal in the most tax-efficient manner.

Expert Guidance for Your International Tax Needs

Understanding and navigating the complexities of Capital Gains Tax in the UK requires specialized knowledge and strategic planning, particularly for international investors and business owners. The nuanced rate structure, interaction with other tax regimes, and frequent legislative changes create a challenging landscape that demands expert guidance.

If you’re facing decisions about asset disposals, business exits, or international investment structures, don’t leave your tax position to chance. We are an international tax consulting boutique specializing in corporate law, tax risk management, wealth protection, and international audits. Our tailored solutions serve entrepreneurs, professionals, and corporate groups operating globally.

Schedule a personalized consultation with one of our tax specialists at $199 USD/hour and receive concrete answers to your specific tax and corporate questions. Our team can help you develop strategies to optimize your CGT position while ensuring full compliance with UK tax legislation.

Book your expert consultation today and take control of your tax future with confidence.

Marcello is a Certified Accountant at Ltd24, specialising in e-commerce businesses and small to medium-sized enterprises. He is dedicated to transforming complex financial data into actionable strategies that drive growth and efficiency. With a degree in Economics and hands-on expertise in accounting and bookkeeping, Marcello brings clarity and structure to every financial challenge. Outside of work, he enjoys playing football and padel.

Comments are closed.