Isle Of Man UK Tax: Key Rules and Rates

12 August, 2025

Introduction to the Isle of Man Tax Regime

The Isle of Man, a self-governing British Crown dependency situated in the Irish Sea between Great Britain and Ireland, has established itself as a noteworthy jurisdiction in the international tax landscape. While maintaining close ties with the United Kingdom, the Isle of Man operates its own distinct tax system, which has attracted considerable attention from businesses and high-net-worth individuals seeking efficient tax planning solutions. The jurisdiction’s tax framework is characterized by simplicity, stability, and transparency, making it an attractive option for various financial activities. This Crown dependency has developed a comprehensive regulatory framework that aligns with international standards while offering certain fiscal advantages that distinguish it from mainland UK taxation. As international tax planning becomes increasingly scrutinized, understanding the nuances of the Isle of Man’s tax system is essential for those considering this jurisdiction for their financial affairs or company incorporation.

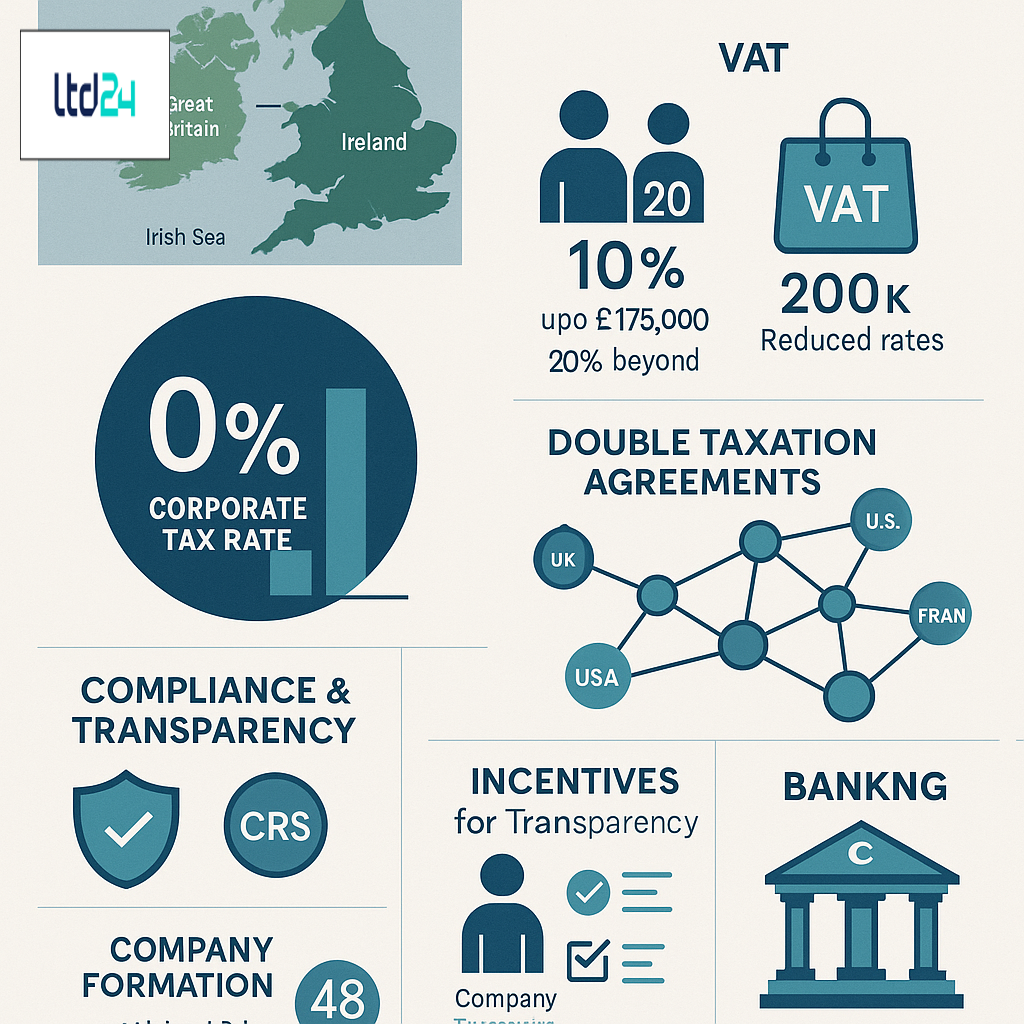

The 0% Corporate Tax Rate: Benefits and Applications

Perhaps the most significant feature of the Isle of Man tax system is its 0% standard rate of corporate tax, which applies to most companies operating within the jurisdiction. This rate represents a substantial deviation from the UK’s mainstream corporate tax regime where rates are considerably higher. The zero-rate policy applies to most trading activities conducted by Isle of Man companies, creating an exceptionally favorable environment for businesses across various sectors. However, it’s crucial to note that certain regulated activities, particularly in banking and retail sectors with significant local presence, are subject to a higher 10% rate. This tiered approach allows the Isle of Man to maintain essential revenue streams while offering competitive advantages to international businesses. Companies engaged in property development and land ownership within the Isle of Man may face a 20% tax rate on profits derived from these activities. The application of these rates must be carefully considered when structuring operations to ensure compliance with both local and international tax obligations. For businesses considering various jurisdictions for UK company formation for non-residents, the Isle of Man’s corporate tax structure presents compelling advantages worth exploring.

Individual Taxation in the Isle of Man

The Isle of Man implements a straightforward individual taxation system characterized by competitive rates and a notable tax cap mechanism. Residents are subject to income tax at a rate of 10% on the first £175,000 of taxable income, followed by 20% on any income exceeding this threshold. This progressive yet simplified structure contrasts favorably with the UK’s more complex banding system. A distinctive feature of the Isle of Man’s personal tax regime is the tax cap policy, which limits the maximum amount of income tax payable by an individual in any tax year to £200,000, regardless of total income. This cap creates a particularly attractive environment for high-net-worth individuals. The Isle of Man also maintains a generous personal allowance of £14,500 (for the 2023/2024 tax year), providing tax-free income up to this threshold. The jurisdiction doesn’t impose capital gains tax, inheritance tax, or wealth tax, further enhancing its appeal for wealth preservation and succession planning. Residency is primarily determined based on physical presence, with individuals spending 183 days or more in the Isle of Man during a tax year generally considered resident. These provisions make the jurisdiction particularly appealing when compared to other European tax systems. For international entrepreneurs exploring offshore company registration options, the personal tax benefits of the Isle of Man merit serious consideration.

Value Added Tax (VAT) in the Isle of Man

While the Isle of Man maintains its own tax authority, it operates within the UK’s VAT system under a revenue-sharing agreement established in 1979. This arrangement means that VAT rates in the Isle of Man mirror those in the UK, currently standing at a standard rate of 20%, with reduced rates of 5% and 0% applying to specific categories of goods and services. The Isle of Man VAT registration threshold is identical to the UK’s threshold, currently set at £85,000 of taxable turnover in a 12-month period. Companies registered for VAT in the Isle of Man are allocated a UK VAT number prefixed with "GB" and can trade within the UK VAT territory without additional VAT registrations. This integration provides significant administrative simplicity for businesses operating across both jurisdictions. The Isle of Man’s participation in this unified VAT framework facilitates seamless commercial transactions between the island and the UK, eliminating potential barriers that might otherwise exist between separate VAT jurisdictions. Businesses considering UK company taxation structures should note that while corporate income tax differs substantially between the jurisdictions, VAT obligations remain largely aligned, requiring careful integration into overall tax planning strategies.

The Double Taxation Agreement Network

The Isle of Man has developed an extensive network of international tax agreements that significantly enhance its attractiveness as a tax planning jurisdiction. Central to this network is a comprehensive double taxation agreement with the United Kingdom, ensuring that income flows between the two jurisdictions occur without punitive tax consequences. Beyond this cornerstone agreement, the Isle of Man has concluded numerous Tax Information Exchange Agreements (TIEAs) with major economies worldwide, including the United States, Australia, France, Germany, and many others. These agreements demonstrate the jurisdiction’s commitment to international tax transparency while providing clarity for businesses and individuals with cross-border activities. The Isle of Man has also been an early adopter of automatic exchange of information standards, including the US Foreign Account Tax Compliance Act (FATCA) and the OECD’s Common Reporting Standard (CRS). This proactive approach to international tax cooperation has helped the jurisdiction maintain its reputation as a responsible financial center while continuing to offer competitive tax advantages. The breadth and depth of these international tax arrangements make the Isle of Man particularly valuable within sophisticated international tax planning structures, especially for businesses with multinational operations seeking legitimate tax efficiency.

Tax Transparency and Compliance

In response to global initiatives promoting tax transparency, the Isle of Man has positioned itself as a cooperative and compliant jurisdiction rather than a secretive tax haven. The government has actively participated in international efforts to combat tax evasion and has implemented robust regulatory frameworks to ensure proper tax compliance. The jurisdiction has fully implemented the Common Reporting Standard (CRS), which facilitates automatic exchange of financial account information with over 100 participating jurisdictions. Similarly, it complies with the EU’s Anti-Money Laundering Directives and has established a publicly accessible beneficial ownership register for companies. These measures demonstrate the Isle of Man’s commitment to international standards while maintaining its tax-competitive environment. The island’s financial services regulator, the Financial Services Authority (FSA), enforces strict compliance requirements, ensuring that businesses operating in the jurisdiction adhere to both local and international standards. For businesses seeking a jurisdiction that balances tax efficiency with proper governance, the Isle of Man represents a pragmatic choice that avoids the reputational risks associated with more controversial offshore locations. Companies considering online company formation in the UK or adjacent jurisdictions should factor these compliance considerations into their planning process.

The ‘Key Employee’ Concession

The Isle of Man offers a distinctive tax incentive known as the ‘Key Employee’ concession, designed to attract specialized talent to the island. Under this provision, certain employees recruited from outside the Isle of Man to fill positions that cannot be adequately filled by local residents may receive a significant tax advantage. Qualifying individuals can apply for a tax concession that limits their income tax liability to Manx-source income only, effectively excluding foreign income and gains from Isle of Man taxation for a specified period (typically up to three years). This concession proves particularly valuable for mobile professionals with international income streams. To qualify, individuals must demonstrate that they possess specific skills unavailable locally and that their role contributes meaningfully to the island’s economy. The application process requires approval from the Isle of Man Treasury and is discretionary rather than automatic. This incentive represents part of the Isle of Man’s broader strategy to attract high-value businesses and individuals to the jurisdiction, complementing its overall tax advantages. For international businesses planning to set up a limited company in the UK or nearby territories, this concession offers additional planning opportunities when structuring executive compensation packages.

Company Formation and Administration

Establishing a company in the Isle of Man involves a straightforward process that can typically be completed within 48 hours, making it an efficient jurisdiction for business formation. The Companies Registry maintains high standards of governance while offering an expeditious registration procedure. Isle of Man companies are generally incorporated as private companies limited by shares under the Companies Act 2006, providing a familiar structure for those accustomed to UK company law. The incorporation requirements include submitting the company’s memorandum and articles of association, details of directors and shareholders, and the registered office address, which must be located on the island. Companies must have at least one director (who can be of any nationality) and a registered agent with a physical presence in the Isle of Man. Annual filing obligations include submitting an annual return and paying the annual company registration fee, currently set at £380 for standard companies. Isle of Man companies benefit from minimal public disclosure requirements compared to UK companies, with no obligation to file accounts publicly. However, proper accounting records must be maintained in accordance with international standards. For businesses exploring UK company incorporation and bookkeeping services, comparing these administrative requirements with Isle of Man procedures provides valuable context for jurisdictional selection.

Banking and Financial Services in the Isle of Man

The Isle of Man has established itself as a reputable international financial center with a robust banking sector that complements its advantageous tax regime. The jurisdiction hosts branches and subsidiaries of major international banking groups, offering comprehensive services to both corporate and private clients. Isle of Man bank accounts provide access to sterling, euro, and dollar facilities, facilitating international trade and investment. A key advantage of Isle of Man banking is the island’s depositor protection scheme, which covers eligible deposits up to £50,000 per depositor per licensed bank. Additionally, the banking sector operates under rigorous regulatory oversight from the Isle of Man Financial Services Authority, ensuring high standards of compliance and customer protection. The island’s banks offer specialized services for corporate clients, including merchant accounts, trade finance, and foreign exchange services tailored to international business needs. For high-net-worth individuals, private banking facilities provide wealth management services, investment advice, and structuring solutions that align with the jurisdiction’s tax advantages. The combination of tax efficiency, regulatory quality, and comprehensive banking services makes the Isle of Man particularly attractive for businesses seeking an integrated approach to their financial affairs. Companies interested in nominee director services in the UK may find complementary banking solutions within the Isle of Man’s financial ecosystem.

The Relationship Between the Isle of Man and UK Tax Systems

While the Isle of Man maintains its fiscal autonomy, its tax system exists within a complex relationship with the UK’s tax framework. Understanding this interplay is essential for effective cross-border planning. The Isle of Man is not part of the United Kingdom for tax purposes, nor is it subject to EU tax directives following Brexit. However, various agreements between the two jurisdictions create important connections. The Customs and Excise Agreement of 1979 established a shared indirect tax territory, meaning that customs duties, excise duties, and VAT are aligned. Companies registered in the Isle of Man can trade with UK businesses without customs barriers, facilitating seamless commercial relationships. For UK tax residents, income arising from Isle of Man sources generally remains taxable in the UK, though the UK-Isle of Man Double Taxation Agreement prevents double taxation. Anti-avoidance provisions in UK tax legislation, including controlled foreign company rules and the general anti-abuse rule, may apply to certain arrangements involving Isle of Man entities. These considerations necessitate careful planning to ensure compliance with both jurisdictions’ requirements. For businesses contemplating UK company registration and formation, understanding these jurisdictional interactions can reveal opportunities for legitimate tax optimization within a compliant framework.

The Isle of Man for International Holding Structures

The Isle of Man presents compelling advantages as a jurisdiction for international holding company structures due to its tax-efficient framework and robust legal system. With its 0% standard rate of corporate tax, absence of withholding taxes on dividends, and exemption from capital gains tax, the Isle of Man

Bruno is a sales specialist at Ltd24 and a key collaborator in lead generation. He focuses on identifying potential clients, initiating first contact, and providing the initial support needed to help them move forward with their business projects. With a degree in Economics and Commercial Sales, Bruno stands out for his analytical mindset, customer-oriented approach, and strong communication skills. His proactive attitude and commercial awareness allow him to build solid relationships from the very first interaction. Outside of work, he enjoys competing in padel tournaments.

Comments are closed.