Isle Of Man UK Resident: What It Means For Tax Purposes

3 December, 2025

Understanding Isle of Man’s Special Status

The Isle of Man occupies a unique jurisdictional position that creates distinctive tax implications for its residents. Situated in the Irish Sea between Great Britain and Ireland, the Isle of Man is neither part of the United Kingdom nor the European Union, but rather a self-governing Crown Dependency with its own parliament (Tynwald), legal system, and fiscal autonomy. This special constitutional status enables the island to establish its own taxation framework independent of UK tax legislation, making it a jurisdiction of significant interest for individuals seeking advantageous tax arrangements. While maintaining close ties with the UK through a customs and currency union, the Isle of Man’s tax sovereignty allows it to offer a compelling alternative residency option for those who understand the nuanced interplay between Manx residence and UK tax liabilities. For businesses considering international expansion, the UK company taxation framework differs substantially from the Isle of Man regime.

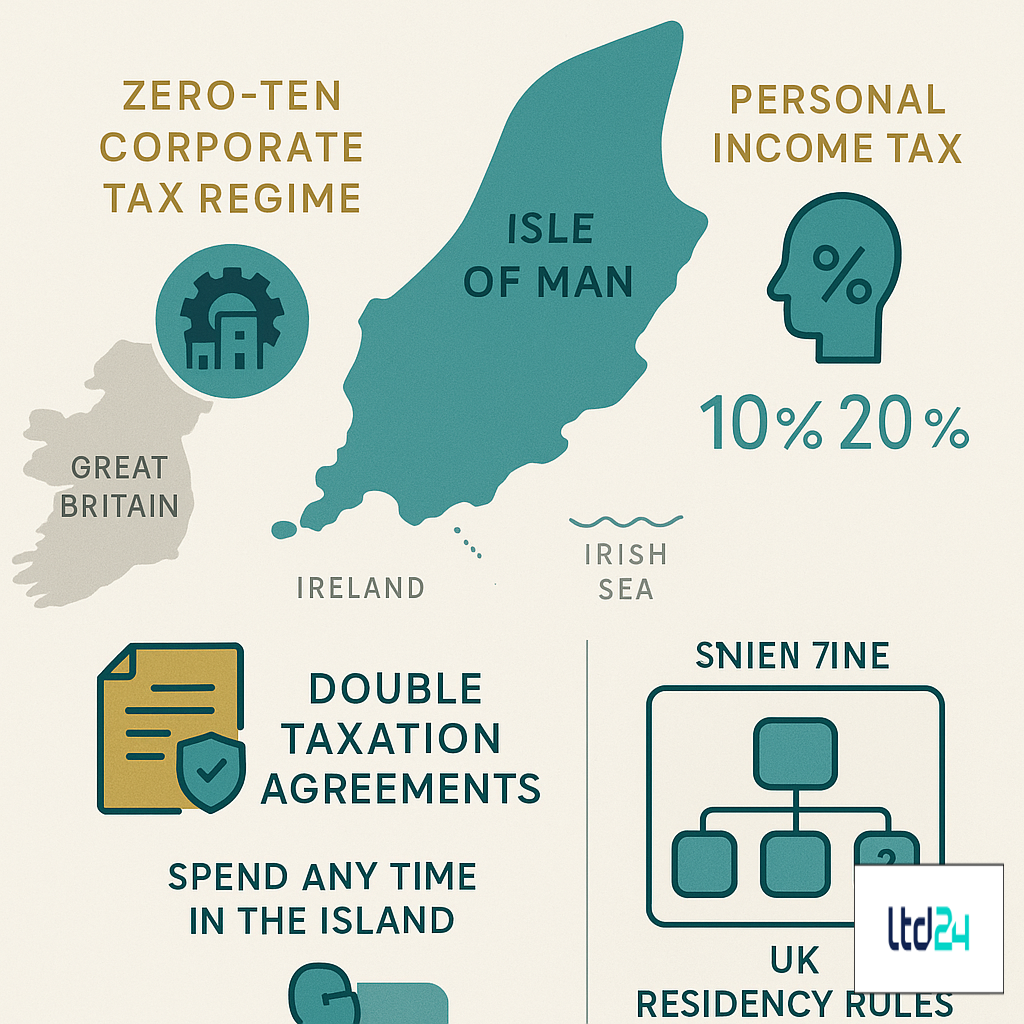

Defining Residency Status: Isle of Man vs. UK Criteria

Determining whether an individual qualifies as an Isle of Man resident for tax purposes follows specific statutory tests that differ from UK residency criteria. Under Isle of Man tax law, residency is primarily established through the “183-day rule,” whereby an individual spending 183 days or more in any tax year on the island is automatically considered resident. Additionally, someone who maintains a pattern of regular visits averaging 90+ days annually over four consecutive years may acquire resident status. Unlike the UK’s Statutory Residence Test with its complex arrangement of “sufficient ties” and “connection factors,” the Isle of Man applies a more straightforward assessment centered on physical presence. This distinction creates important planning opportunities, particularly for those who can structure their affairs to maintain Isle of Man residency while avoiding UK tax residence. Careful documentation of travel patterns, accommodation arrangements, and business activities becomes crucial in substantiating residency claims under potential scrutiny from either tax authority. For UK-oriented business structures, understanding UK company incorporation and bookkeeping services remains essential for compliance.

Zero-Ten Corporate Tax Regime: Implications for Business Owners

The Isle of Man’s Zero-Ten corporate tax regime presents compelling advantages for business owners with Isle of Man residency. Implemented in 2006, this system applies a standard 0% rate of corporate income tax to most companies, with certain regulated financial services businesses and Isle of Man property income subject to a 10% rate, and retail businesses with annual taxable profits exceeding £500,000 facing a 10% rate on those profits. This framework enables Isle of Man resident entrepreneurs to operate companies with minimal corporate taxation, particularly when business activities occur outside the island. However, the interaction with UK tax rules requires careful navigation; UK resident directors or shareholders may still face UK tax liabilities on Isle of Man company profits depending on management and control factors, beneficial ownership arrangements, and the nature of income generated. The regime has withstood international scrutiny, being deemed compliant with EU Code of Conduct and OECD standards for business taxation. For comparison with other jurisdictions, offshore company registration in the UK follows different rules and taxation principles.

Personal Income Tax: The Key Attraction

The Isle of Man’s personal income tax structure represents perhaps the most compelling feature of its fiscal system for UK expats considering relocation. The island applies a standard rate of 10% on the first £6,500 of taxable income (2023/24 figures) and 20% thereafter, with a tax cap option allowing high-net-worth individuals to elect to pay a fixed maximum amount of income tax annually (currently £200,000). This contrasts sharply with the UK’s progressive rates reaching 45% on income over £150,000. Furthermore, the Isle of Man tax system provides generous personal allowances (£14,500 for individuals in 2023/24) and offers no capital gains tax, inheritance tax, or stamp duty. The absence of these taxes, coupled with the ability to apply for the tax cap, creates substantial savings opportunities for affluent individuals. However, maintaining genuine Isle of Man residency while severing UK tax ties remains essential, as UK tax authorities may challenge arrangements appearing contrived or artificial. For businesses operating across borders, understanding transfer pricing concepts becomes crucial for proper tax compliance.

National Insurance Contributions on the Isle of Man

The National Insurance contribution system in the Isle of Man parallels the UK structure but with notable differences that can yield financial advantages. Isle of Man residents make National Insurance contributions at rates that broadly mirror UK percentages, but with lower overall liability due to the island’s differing thresholds and maximum contribution limits. Employed individuals currently contribute 11% on earnings between the primary threshold and the upper earnings limit, with a 1% charge on earnings above this limit. Self-employed contributors pay Class 2 and Class 4 contributions, though typically at lower effective rates than their UK counterparts. Crucially, Isle of Man National Insurance contributions still count toward UK state pension entitlements due to reciprocal agreements between the jurisdictions, allowing residents to maintain benefit eligibility while potentially reducing their overall contribution burden. This arrangement creates a compelling proposition for those seeking to optimize their social security position while residing on the island. For entrepreneurs structuring international operations, nominee director services in the UK may provide additional flexibility.

Double Taxation Agreements: Preventing Fiscal Duplication

The Isle of Man maintains an extensive network of tax agreements that prevent the double taxation of income across jurisdictions, most crucially with the United Kingdom. The UK-Isle of Man Double Taxation Agreement ensures that residents do not pay tax twice on the same income stream across both territories. This comprehensive agreement covers income tax, capital gains tax, and corporation tax, providing relief through either exemption or credit methods depending on income type. Additionally, the Isle of Man has signed numerous Tax Information Exchange Agreements (TIEAs) and implemented the Common Reporting Standard (CRS), demonstrating its commitment to international fiscal transparency while protecting legitimate taxpayer interests. The practical implication for Isle of Man residents with UK connections is that income properly taxed in one jurisdiction generally receives appropriate relief in the other, though the precise mechanisms vary by income category and require careful planning to optimize tax efficiency. For international business operations, understanding permanent establishment taxation becomes essential.

Asset Protection: Strategic Wealth Management

The Isle of Man offers sophisticated wealth protection mechanisms that complement its favorable tax environment, creating a comprehensive proposition for high-net-worth individuals. The island’s mature trust law, influenced by English legal principles but with distinctive Manx features, enables the establishment of asset protection structures with strong statutory protections against foreign claims. Isle of Man trusts can be particularly effective for inheritance planning given the absence of inheritance tax on the island, allowing for multi-generational wealth transfer without the erosive effect of death duties. Additionally, the island’s robust insurance sector provides access to specialized insurance wrappers that can offer both asset protection and tax efficiency. The established banking system, regulated by the Financial Services Authority, maintains confidentiality while adhering to international transparency standards. These wealth protection tools, when properly implemented with professional guidance, create legitimate barriers against creditor claims, matrimonial disputes, and political instability, enhancing overall financial security. For UK-connected entrepreneurs, understanding how to register a company in the UK remains important for diversified business operations.

Pension Planning: Maximizing Retirement Benefits

Pension planning presents significant opportunities for Isle of Man UK residents through the island’s Qualifying Recognised Overseas Pension Scheme (QROPS) provisions and domestic pension arrangements. The Isle of Man offers approved pension schemes that can receive transfers from UK pension funds, potentially reducing exposure to UK lifetime allowance charges and providing greater flexibility in retirement income options. These schemes must satisfy stringent regulatory requirements but can offer tax-efficient growth and withdrawal strategies tailored to an individual’s residency position. For those maintaining UK pension arrangements, the double taxation agreement ensures appropriate tax credits for pension income taxed in either jurisdiction. Importantly, Isle of Man residents can benefit from the island’s absence of inheritance tax on pension assets, creating substantial estate planning advantages compared to UK pension holdings. The interplay between UK and Isle of Man pension regulations requires careful navigation, particularly regarding reporting obligations and potential UK tax charges on certain pension transfers or withdrawals. For business owners, considering director remuneration strategies alongside pension planning creates a comprehensive approach to compensation.

Banking and Financial Services: Confidentiality with Compliance

The Isle of Man’s banking sector offers residents a balanced approach to financial privacy and regulatory compliance that distinguishes it from both mainstream onshore jurisdictions and traditional offshore havens. Licensed under the island’s robust Financial Services Act and regulated by the Financial Services Authority, Isle of Man banks provide sophisticated services with a degree of confidentiality that respects legitimate privacy concerns while adhering to international transparency standards. Account holders benefit from the island’s Depositors’ Compensation Scheme, covering deposits up to £50,000 per depositor per licensed bank, and the absence of withholding taxes on most interest payments. While banking information remains protected under Manx law, the island has implemented automatic exchange of information regimes including FATCA and the Common Reporting Standard, ensuring that financial data is shared with relevant tax authorities when required. This contemporary approach to financial services allows residents to maintain privacy from commercial parties while meeting their international tax obligations. Business owners may also benefit from understanding virtual business address services for maintaining corporate presence across jurisdictions.

Residency by Investment: Pathways to Manx Status

The Isle of Man offers specific immigration routes for wealthy individuals seeking residency status, though these pathways differ significantly from formal “golden visa” programs seen in other jurisdictions. High-net-worth individuals can apply under the Investor Visa category, which typically requires a substantial investment in Isle of Man businesses or government bonds (currently at least £2 million). Alternatively, the Entrepreneur route demands active participation in Isle of Man business operations with a minimum investment threshold. Once established on the island, maintaining residency status requires physical presence that satisfies the previously discussed residency tests, with careful documentation of time spent on the island. The immigration process involves detailed application procedures, background checks, and proof of financial resources, typically requiring specialized legal assistance. Successfully obtaining and maintaining Isle of Man residency through investment pathways creates legitimate access to the island’s tax advantages while establishing a genuine connection that withstands scrutiny from tax authorities in original home jurisdictions. For businesses establishing physical presence, business address services in the UK may complement Isle of Man operations.

Anti-Avoidance Provisions: Navigating Compliance Challenges

The modern tax environment necessitates careful navigation of anti-avoidance measures that can impact Isle of Man residents with UK connections. UK tax authorities have implemented increasingly sophisticated anti-avoidance provisions that may affect Isle of Man arrangements, including the General Anti-Abuse Rule (GAAR), Diverted Profits Tax, Transfer of Assets Abroad legislation, and substance requirements. These provisions aim to counteract artificial arrangements lacking commercial substance or undertaken primarily for tax advantages. Isle of Man residents must ensure their structures demonstrate genuine economic purpose, appropriate substance, and commercial rationale beyond tax benefits. Particular attention must be paid to management and control factors for corporate structures, beneficial ownership considerations for income streams, and sufficient connection to the Isle of Man for claimed residency status. The emphasis on international information exchange through Common Reporting Standard and similar mechanisms means transparency has largely replaced secrecy as the operating principle for compliant structures. For those with UK business interests, understanding UK company formation for non-residents remains crucial for proper compliance.

Case Studies: Successful Planning Strategies

Several real-world implementations of Isle of Man residency planning illustrate the potential benefits when properly structured. Consider the case of a retired entrepreneur who relocated to the Isle of Man after selling his UK business, establishing clear Isle of Man residency by purchasing a primary home and spending over 200 days annually on the island. By carefully timing his departure from the UK and liquidating certain investments before establishing new tax residency, he legally avoided UK capital gains tax on post-residency asset appreciation. Similarly, a financial services professional relocated her consultancy business to the Isle of Man, establishing a local company structure with proper substance (office, staff, local directors) that qualified for the 0% corporate tax rate on international consultancy income, while she personally benefited from the income tax cap. Another case involved a family utilizing Isle of Man trust structures to hold international investments, creating appropriate asset protection and succession planning advantages without exposure to UK inheritance tax. Each case demonstrates the importance of comprehensive planning, proper implementation, and ongoing compliance monitoring rather than isolated tactical measures. For entrepreneurs in specific industries, understanding how to set up an online business in the UK provides complementary knowledge.

Exit Planning: Managing Departure from the Isle of Man

Thoughtful exit planning becomes essential when Isle of Man residents contemplate returning to the UK or relocating elsewhere. The tax implications of departing Isle of Man residency status require careful management to avoid unnecessary tax liabilities. When returning to the UK specifically, individuals must consider potential exposure to UK taxes on gains that accrued during Isle of Man residency but are realized after UK residency resumes. Strategic timing of asset disposals, restructuring of investment holdings, and review of pension arrangements before departure can significantly mitigate tax impacts. Additionally, trust structures established during Isle of Man residency may require reassessment to ensure they remain compatible with the tax regime of the new residence jurisdiction. Practical considerations include formal notification to Isle of Man tax authorities of departure, settlement of any outstanding tax liabilities, and proper documentation of residency changes to prevent disputes. Proper exit planning should ideally begin at least 12-18 months before intended departure to allow sufficient time for implementing appropriate restructuring steps. For those maintaining UK business interests, understanding how to be appointed director of a UK limited company remains important for corporate governance.

Reporting Requirements: Maintaining Compliance

Isle of Man residents face specific reporting obligations to both Isle of Man and potentially UK tax authorities, necessitating meticulous record-keeping and timely submissions. On the Isle of Man, residents must file annual tax returns by October 6th following the tax year ending April 5th, declaring worldwide income unless qualifying for certain exemptions. Additionally, residents with UK income sources must typically file UK non-resident tax returns for those specific income streams, even while claiming treaty benefits. Importantly, individuals maintaining certain connections with the UK while claiming Isle of Man residency may face expanded UK reporting requirements under various anti-avoidance provisions. Compliance extends beyond tax filings to include appropriate disclosure of offshore accounts, investments, and structures under relevant international reporting frameworks such as FATCA and CRS. Professional guidance becomes particularly valuable in navigating these overlapping obligations, as penalties for non-compliance have increased substantially in recent years, potentially including criminal sanctions for deliberate failures. The complexity of these requirements underscores the importance of comprehensive compliance strategies rather than isolated planning tactics. For businesses with international operations, understanding company search capabilities in the UK helps with due diligence and partnership research.

Professional Advice: Essential Guidance for Compliance

Securing specialized professional advice represents perhaps the most critical element in successfully navigating the tax implications of Isle of Man UK residency. The intersection of Isle of Man and UK tax laws creates a complex landscape requiring expertise in both jurisdictions. Qualified tax advisors with specific experience in Isle of Man residency planning can provide tailored guidance on residency determination, income characterization, treaty application, and compliance obligations. Legal counsel specializing in Isle of Man corporate and trust law becomes essential when implementing structures, while wealth managers familiar with the island’s investment environment can guide appropriate asset allocation. Given the potential consequences of improper planning—including unexpected tax liabilities, penalties, and reputational damage—the cost of professional guidance represents a prudent investment rather than an avoidable expense. Individuals should seek advisors who take a conservative approach emphasizing substance and compliance rather than aggressive schemes that may prove unsustainable. Ongoing advisory relationships, rather than one-time consultations, typically deliver greater long-term value as personal circumstances and regulatory environments evolve. For business owners, understanding accounting and bookkeeping services for startups provides complementary knowledge for financial compliance.

Future Outlook: Evolving Tax Environment

The tax landscape affecting Isle of Man UK residents continues to develop in response to global transparency initiatives, international pressure on preferential tax regimes, and the changing relationship between the UK and Crown Dependencies. Ongoing OECD initiatives, including the Global Minimum Tax under Pillar Two, may introduce new compliance considerations for corporate structures, though the Isle of Man government has demonstrated its commitment to maintaining competitiveness within internationally accepted standards. Brexit has altered certain aspects of the Isle of Man’s relationship with the EU, potentially affecting customs arrangements and market access, though core tax advantages remain largely unaffected. The trend toward expanded information exchange between tax authorities seems likely to continue, reinforcing the importance of genuine substance in offshore arrangements rather than paper constructs. Isle of Man authorities have signaled continued commitment to a transparent but competitive tax framework, suggesting that well-structured arrangements with legitimate purpose and substance will remain viable despite increasing scrutiny. Those contemplating Isle of Man residency should approach planning with a long-term perspective, building flexibility into structures to accommodate evolving regulatory requirements. For international business operations, understanding UK VAT and EORI registration provides essential knowledge for cross-border trade.

Expert Support for Your International Tax Planning

Navigating the complex interplay between Isle of Man and UK tax systems requires specialized expertise and tailored solutions. At LTD24, we’ve helped numerous clients successfully establish legitimate Isle of Man residency arrangements that withstand scrutiny while maximizing available tax benefits. Our team combines deep technical knowledge with practical implementation experience, ensuring your residency planning aligns with your broader financial objectives.

If you’re considering Isle of Man residency or seeking to optimize existing arrangements, we invite you to book a personalized consultation with our international tax specialists. We are a boutique international tax consultancy firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating globally.

Schedule a session with one of our experts now at $199 USD/hour and get concrete answers to your tax and corporate questions. Book your consultation today.

Bruno is a sales specialist at Ltd24 and a key collaborator in lead generation. He focuses on identifying potential clients, initiating first contact, and providing the initial support needed to help them move forward with their business projects. With a degree in Economics and Commercial Sales, Bruno stands out for his analytical mindset, customer-oriented approach, and strong communication skills. His proactive attitude and commercial awareness allow him to build solid relationships from the very first interaction. Outside of work, he enjoys competing in padel tournaments.

Comments are closed.