How to Become a Director of a Company

26 March, 2025

Understanding the Role of a Company Director

Becoming a director of a company represents a significant career milestone that carries substantial legal responsibilities and fiduciary duties. At its core, the directorship position involves strategic governance, corporate decision-making, and legal accountability for company actions. Directors are appointed to act in the best interests of the company while navigating complex regulatory frameworks that differ across jurisdictions. The fundamental nature of directorship transcends mere titular status; it encompasses a legal relationship between the individual and the corporate entity that imposes specific statutory obligations. Directors are bound by various legislative provisions that regulate corporate conduct, including the Companies Act 2006 in the United Kingdom, which codifies directors’ duties comprehensively. Before pursuing directorship, prospective candidates must thoroughly understand these intrinsic responsibilities that define the position’s parameters.

Legal Qualifications for Directorship

The legal prerequisites for company directorship vary significantly across jurisdictions, though certain common requirements exist in most corporate governance frameworks. In the United Kingdom, the Companies Act 2006 establishes that directors must be at least 16 years of age and must not be disqualified from serving as a director by court order or due to bankruptcy. Similarly, other jurisdictions impose comparable age restrictions and disqualification criteria. Additional eligibility considerations include mental capacity requirements and restrictions regarding previous corporate malfeasance. Notably, certain regulated sectors impose supplementary qualification criteria; financial services firms, for instance, may require directors to satisfy regulatory "fit and proper person" tests administered by the Financial Conduct Authority (FCA) or Prudential Regulation Authority (PRA). Prospective directors should consult relevant regulatory guidance to ensure compliance with sector-specific requirements.

Professional Qualifications and Experience

While no universal formal qualifications are legally mandated for directorship, the practical requirements for securing directorial positions frequently encompass substantial professional expertise and industry-specific knowledge. Companies typically seek directors with demonstrable executive leadership experience, strategic vision, and specialized sectoral understanding. Educational credentials such as Master of Business Administration (MBA) degrees, professional accounting qualifications (ACCA, CPA, ACA), or legal qualifications often strengthen candidacy. Professional director certification programs like those offered by the Institute of Directors provide structured pathways to develop governance competencies. Industry associations frequently offer specialized directorship courses that address sector-specific governance challenges. The accumulation of relevant board committee experience, particularly in audit, risk, or remuneration committees, creates a progressive pathway toward full directorship appointment. This professional development trajectory requires methodical cultivation of both technical expertise and leadership capabilities.

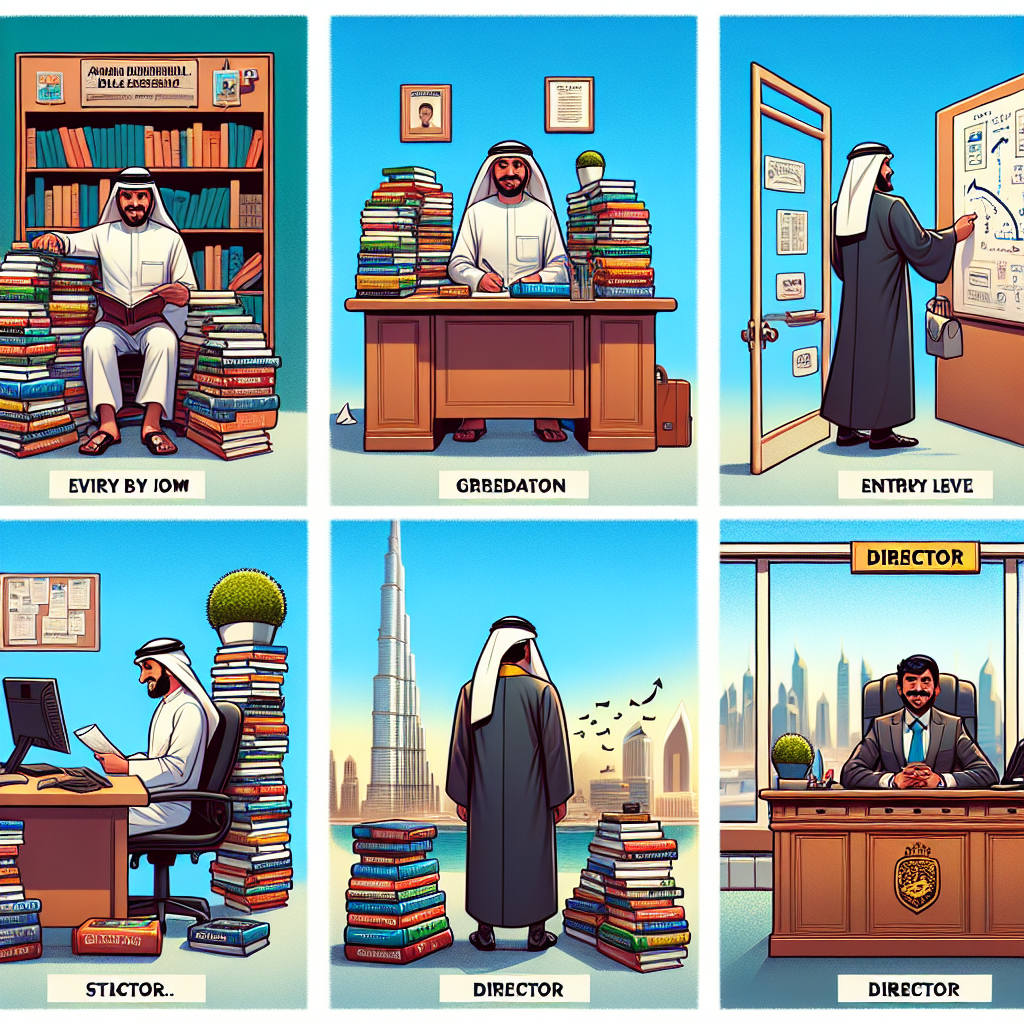

Pathways to Directorship Appointment

Several distinct routes exist for attaining company directorship. The traditional corporate advancement pathway involves progressive promotion through executive ranks, culminating in senior management positions that may lead to executive directorship consideration. Alternatively, professionals with specialized expertise may be recruited as non-executive directors to contribute specific knowledge in areas such as finance, law, or industry dynamics. Entrepreneurial individuals frequently become directors through company formation, where founding and incorporating a business automatically establishes directorship. Our specialized UK company incorporation service provides comprehensive support for this pathway. Networking strategically within industry circles, engaging with professional director organizations, and establishing visibility through thought leadership can significantly enhance directorship opportunities. Additionally, participation in formal director search processes conducted by executive recruitment firms represents an increasingly common appointment mechanism for professionally-managed companies.

The Appointment Process

The formal process for director appointment typically involves several procedural steps governed by company constitutional documents and applicable corporate law. For established companies, the appointment generally requires board resolution, potentially followed by shareholder approval depending on constitutional requirements. The appointment must be registered with the relevant corporate registry—Companies House in the UK—within specified timeframes, typically 14 days. Appointees must provide consent to serve and disclose certain personal information for regulatory filing purposes. The appointment process customarily includes due diligence procedures to verify the candidate’s credentials, confirm eligibility, and assess potential conflicts of interest. For newly formed companies, directors are appointed during the company formation process, with initial appointments documented in incorporation documents. Many jurisdictions additionally require directors to sign formal acceptance declarations and acknowledgments of statutory responsibilities prior to appointment finalization.

Statutory Duties of Company Directors

Directors are bound by stringent statutory duties that form the legal framework for their actions and decisions. In the UK, these duties are primarily codified in Sections 171-177 of the Companies Act 2006. The duty to act within powers requires directors to operate within the company’s constitutional framework. The duty to promote the success of the company mandates decisions that benefit the corporate entity while considering various stakeholder interests. The duty of independent judgment prohibits delegation of decision-making responsibility. The duty of reasonable care, skill, and diligence establishes a performance standard based on reasonably expected knowledge and capabilities. The duty to avoid conflicts of interest prohibits situations where personal interests might conflict with company interests. The duty not to accept benefits from third parties prevents improper influence. The duty to declare interest in proposed transactions ensures transparency in corporate dealings. These comprehensive obligations create a robust accountability framework that shapes directorial conduct and decision-making processes.

International Considerations for Directorship

Directorship requirements manifest considerable variation across international jurisdictions, necessitating careful consideration when pursuing multinational board positions. Corporate governance frameworks differ substantially between common law jurisdictions (like the UK and US) and civil law jurisdictions (such as those in continental Europe). Certain jurisdictions impose nationality or residency requirements; for instance, some countries mandate that a percentage of directors be resident nationals. Cross-border directorship entails complex tax implications that may trigger dual taxation concerns without appropriate planning. Our specialists can assist with international directorship arrangements through services like our nominee director service. Tax treaty considerations become particularly significant when directors receive remuneration from multiple jurisdictions. Additionally, cultural variations in governance practices—such as board composition, meeting frequency, and decision-making processes—require adaptability from directors operating across multiple countries. For specific jurisdictional guidance, our services for company formation in Bulgaria or establishing an Irish company provide tailored support.

Director Remuneration Structures

Director compensation arrangements vary substantially based on company size, sector, and the specific nature of directorship (executive versus non-executive). Executive directors typically receive comprehensive remuneration packages incorporating base salary, performance-based bonuses, equity incentives (stock options or share awards), pension contributions, and benefits packages. Non-executive directors more commonly receive fixed annual fees, potentially supplemented by additional compensation for committee chairmanship or specialized board responsibilities. Director remuneration determinations must adhere to governance best practices, with remuneration committees typically overseeing compensation policies to ensure alignment with shareholder interests and corporate performance. Comprehensive guidance regarding directors’ remuneration elucidates taxation implications and optimization strategies. Regulatory requirements increasingly mandate transparent disclosure of director compensation arrangements through annual reports and governance statements. Remuneration structures must be meticulously documented and approved in accordance with corporate constitutional provisions and applicable regulatory frameworks to ensure legal compliance and tax efficiency.

The Director’s Role in Corporate Governance

Directors function as the central architects and guardians of corporate governance frameworks. The board collectively establishes governance policies, including committee structures, delegation frameworks, and risk management protocols that define organizational control mechanisms. Directors must ensure compliance with relevant governance codes—such as the UK Corporate Governance Code for listed companies—which typically operate on a "comply or explain" basis. The implementation of robust internal control systems represents a critical directorial responsibility, encompassing financial reporting controls, operational risk safeguards, and compliance monitoring mechanisms. Board composition considerations, including diversity parameters, independence requirements, and skills matrices, fall within governance oversight. Directors additionally bear responsibility for establishing ethical frameworks through codes of conduct, whistleblowing procedures, and corporate social responsibility policies. Effective governance necessitates periodic governance reviews to assess framework efficacy and alignment with evolving regulatory expectations and business requirements.

Risk Management Responsibilities

Directors bear primary responsibility for enterprise risk oversight and management framework implementation. This encompasses establishing risk appetite parameters, approving risk management policies, and ensuring appropriate risk assessment methodologies across operational areas. Directors must ensure the development of comprehensive risk registers that identify, assess, and document mitigation strategies for key organizational risks. Regular risk reporting mechanisms, escalation protocols, and monitoring processes require directorial approval and oversight. In regulated sectors, directors face heightened expectations regarding regulatory compliance and specialized risk management protocols. The board audit committee typically assumes particular responsibility for financial reporting risk supervision, while sector-specific risks may necessitate dedicated oversight mechanisms. Directors must demonstrate due diligence through documented risk governance processes, including board-level risk discussions evidenced through meeting minutes. Directorial liability exposure can be partially mitigated through appropriate directors’ and officers’ liability insurance coverage, though such protection does not eliminate fundamental statutory responsibilities.

Strategic Planning and Business Development

Directors serve as organizational stewards responsible for defining corporate strategic direction and facilitating business development initiatives. The board establishes the company’s vision, mission, and strategic objectives through structured strategic planning processes that typically encompass market assessment, competitive analysis, and opportunity identification. Directors must critically evaluate management-proposed strategies, challenging assumptions and ensuring alignment with organizational capabilities and risk appetite. The approval of strategic business plans, capital allocation decisions, and significant investment proposals falls within directorial purview. Directors additionally oversee strategic implementation, monitoring performance against established metrics and adjusting direction as necessary. This responsibility extends to major corporate transactions—acquisitions, disposals, joint ventures, and significant contractual arrangements—which require board approval following appropriate due diligence. For entrepreneurs establishing new ventures, our guidance on setting up a UK limited company provides foundational strategic insights.

Financial Accountability and Reporting

Directors bear significant financial stewardship responsibilities, including fiduciary obligations regarding organizational assets. The board must establish robust financial control frameworks, approve financial strategies, and oversee capital structure decisions. Directors approve annual budgets, monitor performance against financial targets, and implement corrective measures when necessary. A fundamental directorial responsibility involves ensuring the preparation of accurate financial statements that present a "true and fair view" of company affairs in compliance with applicable accounting standards. Directors must personally attest to financial statement accuracy through formal approval processes documented in board minutes. Additionally, directors oversee dividend policy formulation and distribution decisions within legal constraints regarding distributable reserves. Tax compliance oversight represents another crucial directorial responsibility, encompassing tax strategy approval and ensuring appropriate company taxation compliance. For listed entities, directors face enhanced financial reporting obligations, including market-sensitive information disclosure requirements under applicable securities regulations.

Stakeholder Management

Effective directorship necessitates balanced consideration of diverse stakeholder interests. While shareholder value remains paramount in most governance frameworks, contemporary directorial responsibilities encompass broader stakeholder engagement. Directors must establish mechanisms for meaningful shareholder communication, including annual general meetings, investor relations programs, and transparency regarding corporate performance and governance. Employee interests require consideration through human capital policies, organizational culture initiatives, and appropriate remuneration structures. Customer relationship management, supplier engagement protocols, and community impact considerations similarly fall within the modern director’s purview. Environmental, Social, and Governance (ESG) factors increasingly influence directorial decision-making, with sustainability considerations integrated into strategic planning processes. Directors must navigate potential conflicts between stakeholder interests, balancing short-term pressures against long-term value creation imperatives. For entrepreneurs establishing new ventures, our business name registration service represents an initial step in stakeholder identity development.

Board Dynamics and Effective Meeting Management

Productive directorship requires mastery of board dynamics and meeting management skills. Directors must contribute constructively to boardroom discussions, demonstrating both assertiveness in presenting perspectives and receptiveness to colleagues’ viewpoints. Effective boards establish clear meeting governance protocols, including agenda structuring, information distribution timeframes, and decision-making procedures. Directors must prepare thoroughly for board deliberations, reviewing board papers comprehensively and seeking clarification regarding complex matters prior to meetings when possible. During discussions, directors should focus on strategic rather than operational matters, maintaining appropriate governance boundaries. The cultivation of productive working relationships with fellow directors and senior executives, characterized by respectful challenge and collaborative problem-solving, proves essential. Directors typically participate in regular board evaluation processes, including individual performance assessment and collective effectiveness reviews. For newly appointed directors, induction programs facilitate rapid integration into existing board structures and familiarization with organizational specifics.

Legal Liability and Insurance Considerations

Directors assume personal legal liability for certain corporate actions, necessitating comprehensive understanding of liability parameters and protection mechanisms. Directors may face claims from shareholders (derivative actions), regulatory authorities, employees, customers, or other stakeholders arising from alleged negligence, breach of duty, or statutory violations. Financial liabilities potentially extend to personal assets in cases of fraud, wrongful trading, or specific regulatory breaches. To mitigate these risks, companies typically provide Directors’ and Officers’ (D&O) liability insurance covering defense costs and potential damages arising from claims. Directors should verify insurance coverage scope, exclusions, and indemnification provisions before accepting appointments. Additional protection derives from company indemnification provisions in constitutional documents, though these typically exclude fraudulent behavior. The maintenance of comprehensive board records documenting decision-making processes, consideration of relevant factors, and professional advice utilization provides essential evidence of due diligence. Directors should periodically review liability protection mechanisms to ensure alignment with evolving regulatory requirements and litigation trends.

Continuing Professional Development for Directors

Directorship effectiveness requires ongoing knowledge enhancement and skill development through structured continuing professional development (CPD). Numerous governance institutions offer specialized director education programs covering evolving governance practices, regulatory changes, and emerging business challenges. For example, the Institute of Directors provides a comprehensive Chartered Director qualification pathway. Directors should establish personal development plans addressing specific knowledge gaps related to their directorial responsibilities. Participation in industry conferences, governance forums, and professional networking events facilitates knowledge exchange with governance peers. Many boards implement formal director development policies, allocating resources for continuing education and sometimes mandating minimum annual development requirements. Technology-facilitated learning platforms increasingly provide flexible director education options. Regular board education sessions addressing specific governance topics or organizational challenges represent common practice. Directors should maintain developmental activity records demonstrating commitment to professional growth. For specialized sectors, targeted education addressing sector-specific governance challenges proves particularly valuable in enhancing directorial effectiveness.

Directorship in Different Corporate Structures

Directorial responsibilities manifest differently across various corporate structures, requiring tailored governance approaches. In private limited companies, directors typically maintain close alignment with shareholder interests, often managing companies where they hold significant ownership stakes. Our services for UK company formation for non-residents support international entrepreneurs pursuing this structure. Public limited companies impose enhanced governance requirements, including additional regulatory compliance obligations, market disclosure requirements, and typically more formalized governance structures. Subsidiary company directors face dual considerations, balancing standalone entity governance with parent company strategic alignment. Joint venture directorships require careful navigation of potentially divergent venture partner interests while maintaining entity-level fiduciary duties. Not-for-profit organization directorships emphasize mission fulfillment rather than financial returns, necessitating different performance metrics. Family business governance presents unique challenges regarding succession planning, family dynamics, and professionalization tensions. Directors must adapt governance approaches to organizational specifics while maintaining fundamental fiduciary principles regardless of corporate structure.

Directorship in Digital and Online Businesses

The digital economy presents distinctive directorial challenges requiring specialized governance approaches. Directors of technology-focused enterprises must develop sufficient technical literacy to effectively oversee technology strategy, digital transformation initiatives, and cybersecurity risk management. For entrepreneurs establishing digital ventures, our service for setting up an online business in the UK provides comprehensive support. Data governance represents a critical directorial responsibility, encompassing oversight of data protection compliance, information security frameworks, and data ethics considerations. Directors must ensure robust digital risk management, including technology dependency risks, digital disruption threats, and intellectual property protection strategies. E-commerce operations introduce specific legal compliance considerations regarding consumer protection legislation, online contracting requirements, and cross-border transaction regulations. Directors of digital businesses should establish appropriate governance mechanisms for rapid innovation cycles, potentially including specialized technology committees or advisory boards. Digital business directors must additionally navigate regulatory uncertainty as governance frameworks evolve to address emerging technologies and business models.

Resignation and Removal Processes

Understanding directorship termination processes proves essential for both appointment consideration and eventual transition planning. Directors may resign voluntarily by providing formal written notice in accordance with constitutional requirements, typically specifying an effective date that allows orderly transition planning. Resignation does not automatically terminate liability for actions taken during the directorship period. Involuntary removal may occur through shareholder resolution, requiring specified notice periods and sometimes special majority thresholds depending on constitutional provisions. Some governance frameworks permit board-initiated removal under specified circumstances, such as mental incapacity or prolonged non-attendance. Regulatory disqualification may arise from court orders, bankruptcy proceedings, or specific regulatory sanctions. Regardless of termination mechanism, the company must file appropriate notifications with the corporate registry (Companies House in the UK) within statutory timeframes. Directors should ensure comprehensive handover processes, including knowledge transfer to successors and return of company property. Post-directorship confidentiality obligations and potential non-compete restrictions may apply depending on agreement terms.

Common Challenges and Pitfalls in Directorship

Navigating directorship successfully requires awareness of common governance challenges. Role confusion frequently arises between board and management responsibilities, necessitating clear governance boundaries that distinguish strategic oversight from operational management. Information asymmetry between executive and non-executive directors requires structured information protocols ensuring comprehensive board visibility into organizational realities. Groupthink tendencies potentially undermine robust decision-making, necessitating deliberate cultivation of constructive challenge within boardroom dynamics. Conflicts of interest require systematic identification and management through disclosure mechanisms, recusal protocols, and sometimes independent assessment. Stakeholder pressure balancing demands careful prioritization when facing conflicting stakeholder demands. Regulatory compliance complexity necessitates ongoing vigilance regarding evolving governance requirements. Crisis management readiness requires advance preparation through scenario planning and response protocol development. Succession planning deficiencies frequently undermine long-term organizational stability. Directors can mitigate these challenges through governance education, mentorship relationships with experienced directors, and implementation of structured governance frameworks addressing common vulnerability points.

Directorship in International Expansion Contexts

Directors overseeing international business expansion face heightened complexity requiring specialized governance approaches. Cross-border operations necessitate governance structures incorporating appropriate subsidiary boards, regional governance mechanisms, and clear delegation frameworks. Directors must develop sufficient understanding of material foreign legal systems affecting corporate operations, including statutory compliance requirements and directorship obligations in relevant jurisdictions. For businesses expanding internationally, our services for company registration with VAT and EORI numbers facilitate cross-border trade compliance. International tax structuring considerations require directorial oversight ensuring compliance with transfer pricing regulations, permanent establishment provisions, and withholding tax requirements. Our guide for cross-border royalties addresses specific international tax complexities. Currency risk management, geopolitical risk assessment, and cross-cultural governance adaptation represent additional international directorship challenges. Directors should establish robust compliance monitoring mechanisms incorporating local legal requirements while maintaining consistent governance principles across organizational boundaries. International directorship frequently benefits from specialized advisory support regarding jurisdiction-specific compliance requirements.

Seek Expert Guidance for Your Director Journey

Navigating the complex responsibilities of company directorship requires specialized knowledge and strategic planning. At Ltd24.co.uk, our international tax consulting team provides comprehensive support for current and aspiring directors facing complex governance challenges. From initial company formation through our online company formation service to ongoing directorship support, our expertise encompasses both technical compliance and strategic governance optimization. We offer tailored advisory services addressing specific directorial challenges, including international expansion governance, director remuneration structuring, and risk management protocols. Our expertise extends to specialized arrangements such as issuing new shares and establishing effective governance frameworks for multinational operations.

If you’re seeking expert guidance for addressing international fiscal challenges, we invite you to schedule a personalized consultation with our specialized team. As an international tax consulting boutique with advanced expertise in corporate law, fiscal risk management, asset protection, and international auditing, we deliver customized solutions for entrepreneurs, professionals, and corporate groups operating globally. Book a session with one of our experts now at the rate of 199 USD/hour to receive concrete answers to your corporate and tax inquiries (link: https://ltd24.co.uk/consulting).

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.