Funds Transfer Pricing Explained: Clear Breakdown

22 March, 2025

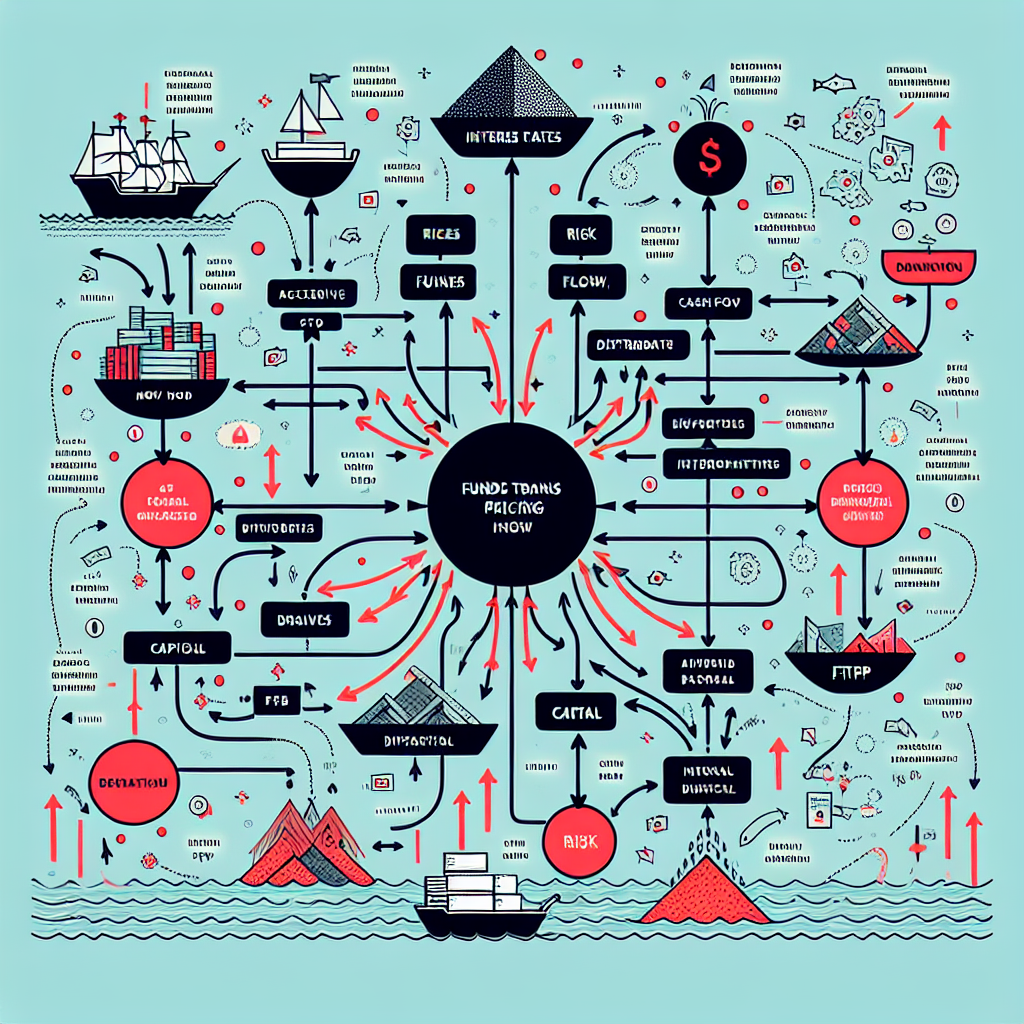

Introduction to Funds Transfer Pricing: The Cornerstone of Financial Management

Funds Transfer Pricing (FTP) represents a critical internal accounting methodology employed by financial institutions to allocate costs, benefits, risks, and opportunities associated with funding activities across different business units. This sophisticated mechanism serves as the foundational framework for evaluating the profitability of various banking segments, products, and customer relationships while facilitating strategic decision-making processes. In the current regulatory environment, characterized by stringent capital requirements under Basel III standards, FTP has transcended its traditional role to become an indispensable component of bank governance structures and risk management systems. The implementation of a robust FTP framework enables banks to accurately attribute funding costs to their originating sources, thereby enhancing transparency in performance measurement and promoting accountability across organizational hierarchies. As financial institutions navigate increasingly complex market conditions, FTP methodologies continue to evolve, incorporating more nuanced approaches to risk quantification and capital allocation.

The Fundamental Principles of Funds Transfer Pricing

The core principle underlying Funds Transfer Pricing rests on the establishment of internal transfer rates that mirror external market conditions while reflecting the institution’s specific funding structure. These rates function as the cornerstone for calculating the net interest margin of various banking operations, essentially determining the economic value generated by each business unit. The FTP mechanism operates through a central treasury function that acts as an intermediary, purchasing funds from deposit-gathering departments at predetermined transfer rates while simultaneously selling these resources to lending units at rates that incorporate appropriate risk premiums. This internal marketplace for funds creates a financially consistent framework where business units can be evaluated independently of actual funding activities. Fundamentally, FTP aims to isolate interest rate risk management from the primary business functions, centralizing this responsibility within the treasury department while establishing clear accountability measures for business line performance. By adhering to these principles, financial institutions can implement decision-making processes that align with their strategic objectives and risk management policies.

Historical Development and Modern Applications of FTP

The evolution of Funds Transfer Pricing methodologies traces back to the 1970s when financial deregulation introduced unprecedented volatility into interest rate markets, compelling banks to develop more sophisticated asset-liability management techniques. Initially implemented as simplistic single-rate models, FTP frameworks have progressively incorporated multi-dimensional approaches that capture various risk factors with increasing precision. The 2008 global financial crisis marked a pivotal turning point, highlighting critical deficiencies in prevailing FTP practices and catalyzing substantial reforms in regulatory requirements for liquidity management. Contemporary FTP systems now integrate liquidity premiums, term funding costs, and contingent liquidity provisions—reflecting the true economic cost of maintaining adequate funding buffers under stress scenarios. The application of FTP has expanded beyond traditional banking institutions to encompass insurance companies, asset management firms, and various financial service providers seeking to optimize capital allocation across diverse business lines. This historical progression demonstrates how FTP methodologies have adapted to changing market conditions while maintaining their fundamental purpose of enhancing financial institution governance.

Key Components of an Effective FTP Framework

An effective Funds Transfer Pricing framework encompasses several critical components that collectively establish a comprehensive system for internal financial attribution. The base interest rate curve forms the foundation of this structure, typically derived from risk-free market rates or the institution’s actual borrowing costs in wholesale funding markets. Layered upon this foundation are various risk premium adjustments that quantify and allocate specific risk factors—including liquidity premiums, credit spreads, optionality costs, and regulatory compliance expenses. The operational infrastructure supporting FTP implementation requires sophisticated modeling capabilities, advanced data management systems, and precise calculation methodologies to ensure accurate rate determination across varying maturities and product categories. Additionally, a well-designed governance structure must establish clear responsibilities for rate-setting processes, dispute resolution mechanisms, and periodic review procedures. The incorporation of behavioral adjustments for non-maturing deposits and prepayable loans represents another crucial component, capturing the economic impact of embedded options within banking products. Financial institutions seeking to establish effective FTP frameworks often engage specialized consulting services to navigate the complexities of implementation, particularly when adapting international standards to jurisdiction-specific regulatory environments. For organizations with cross-border operations, integrating FTP systems with international corporate structures becomes essential for comprehensive financial management.

Methodological Approaches to Funds Transfer Pricing

Various methodological approaches exist within the Funds Transfer Pricing domain, each presenting distinct advantages and limitations depending on the institution’s size, complexity, and strategic objectives. The matched-maturity approach represents the most sophisticated methodology, assigning transfer rates based on the specific maturity characterisitics of individual assets and liabilities, thereby creating precise alignment between funding sources and applications. Conversely, the pooled-funds approach applies uniform transfer rates across broad categories of transactions, sacrificing granularity for operational simplicity. Between these extremes lies the multiple-pool method, which strikes a balance by establishing separate funding pools for major product categories while maintaining reasonable implementation complexity. Advanced institutions increasingly adopt option-adjusted spread (OAS) methodologies that explicitly price embedded optionality within banking products, capturing the economic value of prepayment rights, withdrawal options, and interest rate caps or floors. The selection of an appropriate methodology must consider the institution’s data availability, system capabilities, and organizational readiness to implement and maintain sophisticated modeling frameworks. Regardless of the chosen approach, methodological consistency remains paramount to ensure fair performance comparisons across business units and time periods. Financial institutions operating international corporate structures must additionally consider how these methodologies interact with varying regulatory frameworks across jurisdictions.

Risk-Adjusted Performance Measurement and FTP

The integration of Funds Transfer Pricing with risk-adjusted performance measurement frameworks establishes a comprehensive system for evaluating business unit contributions to overall profitability while accounting for varying risk profiles. By incorporating appropriate risk premiums into transfer rates, FTP creates direct linkages between assumed risks and allocated capital costs, enabling the calculation of risk-adjusted return on capital (RAROC) metrics that facilitate meaningful performance comparisons. This integrated approach transforms conventional profit metrics into risk-calibrated indicators that reveal whether business activities generate returns commensurate with their risk exposure. The risk-adjusted net interest margin emerges as a fundamental performance metric, measuring the spread between customer rates and fully loaded transfer prices that incorporate all relevant risk components. Furthermore, FTP-derived performance indicators inform strategic decision-making processes regarding resource allocation, product pricing, customer relationship management, and incentive compensation structures. The implementation of these sophisticated measurement systems requires cross-functional collaboration between finance, treasury, risk management, and business units to establish consensus regarding measurement methodologies and performance standards. Organizations with international operations particularly benefit from risk-adjusted metrics when evaluating performance across different regulatory regimes and market conditions, especially when coordinating activities between foreign holding structures and subsidiary operations.

Liquidity Risk Premium: A Critical Component of Modern FTP

In the post-financial crisis regulatory environment, the incorporation of liquidity risk premiums has emerged as one of the most significant developments in Funds Transfer Pricing methodologies. These premiums quantify the economic cost of maintaining sufficient liquidity buffers to withstand stressed market conditions, reflecting both the direct expense of holding low-yielding liquid assets and the opportunity cost of restricted investment flexibility. The calibration of liquidity premiums typically involves analyzing the spread between secured and unsecured funding rates, the cost of standby liquidity facilities, and the yield differential between high-quality liquid assets and alternative investments. Regulatory requirements under the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) have fundamentally altered the economics of banking operations, necessitating explicit allocation of liquidity costs to their originating sources through the FTP mechanism. This allocation process creates appropriate incentives for business units to consider liquidity implications when designing products, establishing pricing structures, and pursuing growth strategies. Furthermore, the dynamic nature of liquidity premiums requires regular recalibration to reflect changing market conditions, regulatory expectations, and institutional funding profiles. For multinational financial groups, implementing consistent liquidity premium methodologies across different international corporate structures presents additional complexity due to varying regulatory interpretations and market characteristics.

FTP in the Context of Interest Rate Risk Management

Funds Transfer Pricing serves as an instrumental mechanism for centralizing interest rate risk management within the treasury function while establishing clear accountability for business units’ performance independent of market rate fluctuations. By transferring all interest rate risk to a specialized asset-liability management (ALM) desk, FTP creates a structural separation between customer relationship management and complex market risk hedging activities. The treasury’s centralized risk management function can then employ sophisticated hedging strategies—utilizing interest rate swaps, futures, options, and other derivative instruments—to manage aggregate exposure based on the institution’s risk appetite and market outlook. This centralization generates significant benefits through economies of scale in trading operations, specialized expertise concentration, and comprehensive portfolio-level risk assessment capabilities. Furthermore, the FTP system provides critical data inputs for interest rate risk modeling, supporting both regulatory compliance requirements and internal risk management objectives. The calibration of transfer rates across the yield curve directly influences business unit incentives regarding product design and maturity transformation activities, with inappropriate rate structures potentially encouraging excessive risk-taking or overly conservative positioning. Institutions with international tax planning considerations must additionally evaluate how interest rate risk management practices interact with cross-border funding arrangements and regulatory arbitrage opportunities.

Transfer Pricing vs. Funds Transfer Pricing: Important Distinctions

While sharing terminological similarities, Transfer Pricing in the international tax context and Funds Transfer Pricing in banking represent distinct concepts with fundamentally different purposes, regulatory frameworks, and implementation methodologies. International Transfer Pricing addresses the valuation of cross-border transactions between related entities for tax purposes, aiming to ensure transactions occur at arm’s length prices to prevent artificial profit shifting between tax jurisdictions. In contrast, Funds Transfer Pricing in banking focuses on internal allocation of funding costs and benefits to support performance measurement and risk management objectives. Nevertheless, important interactions exist between these domains, particularly for multinational financial institutions that must navigate both sets of requirements simultaneously. The establishment of cross-border funding arrangements between parent companies and subsidiaries triggers transfer pricing considerations under OECD guidelines and local tax regulations, potentially affecting the implementation of consistent FTP methodologies across international operations. Sophisticated financial groups implement integrated approaches that satisfy both internal management requirements and external tax compliance obligations, often necessitating careful documentation of the economic substance underlying intercompany funding arrangements. Organizations establishing international corporate structures must consider these intersecting regulatory domains when designing global treasury operations and internal financial attribution systems.

Regulatory Considerations in FTP Implementation

The regulatory landscape significantly influences Funds Transfer Pricing practices, with supervisory expectations increasingly prescribing specific methodological approaches and governance requirements. Regulatory authorities—including the Basel Committee on Banking Supervision, the European Banking Authority, and various national regulators—have published guidance documents establishing principles for sound FTP practices as components of broader risk management frameworks. These regulatory expectations emphasize the integration of FTP with liquidity management systems, stress testing programs, recovery planning processes, and capital adequacy assessments. The supervisory focus extends beyond technical methodologies to encompass governance structures, documentation standards, independent validation requirements, and board-level oversight mechanisms. Regulatory examinations frequently scrutinize the alignment between stated FTP policies and actual implementation practices, with particular attention to whether transfer rates appropriately incorporate all relevant risk factors. Furthermore, regulatory reporting requirements often necessitate detailed disclosures regarding internal pricing methodologies and their impact on business line performance metrics. Financial institutions operating across multiple jurisdictions face additional complexity when reconciling potentially conflicting regulatory expectations, particularly when establishing consistent approaches across international corporate structures. Proactive engagement with regulatory authorities regarding FTP methodologies contributes to more effective supervision while potentially influencing the evolution of regulatory standards.

Implementation Challenges and Success Factors

The implementation of a robust Funds Transfer Pricing framework presents substantial challenges that extend beyond technical modeling considerations to encompass organizational dynamics, data management requirements, and change management processes. Among the most significant obstacles, data availability and quality concerns frequently impede accurate rate determination, particularly regarding behavioral assumptions for non-contractual cash flows and historic performance metrics. Moreover, the technological infrastructure supporting FTP calculations must accommodate complex modeling requirements while maintaining sufficient processing efficiency for timely rate publication and performance reporting. Organizational resistance often emerges as stakeholders question methodology assumptions, dispute performance implications, or resist changes to existing incentive structures. Successful implementations address these challenges through comprehensive project management approaches that emphasize cross-functional collaboration, transparent methodology development, extensive stakeholder engagement, and phased implementation strategies. Critical success factors include securing executive sponsorship, establishing clear governance structures, investing in specialized expertise development, and maintaining consistent communication throughout the implementation process. Additionally, organizations benefit from adopting flexible framework designs that accommodate incremental refinements as business models evolve and regulatory expectations change. Companies with international operations face additional implementation complexities when harmonizing FTP practices across entities operating under different regulatory regimes and market conditions.

FTP Application to Non-Interest Income and Expense Allocation

While traditionally focused on interest-bearing products, contemporary Funds Transfer Pricing frameworks increasingly extend to non-interest income sources and expense allocation methodologies. This expanded scope enables comprehensive performance measurement across all banking activities while creating integrated attribution systems for total economic value generation. The application of FTP concepts to fee-based services—such as payment processing, wealth management, and treasury management products—typically involves establishing internal transfer prices for associated deposit balances and liquidity consumption. Similarly, expense allocation methodologies increasingly incorporate FTP principles to assign infrastructure costs, technology investments, and shared service expenses to appropriate business units based on consumption patterns and value-driven metrics. This holistic approach creates consistent evaluation standards across diverse banking activities while supporting strategic decision-making regarding resource allocation and product development priorities. Advanced implementations establish clear relationships between customer-level profitability metrics and aggregate business unit performance, enabling granular analysis of value creation throughout the organization. Organizations with international corporate structures particularly benefit from integrated performance measurement frameworks that facilitate meaningful comparisons across different legal entities, regulatory environments, and market segments.

The Impact of FTP on Product Pricing and Competitive Strategy

Funds Transfer Pricing fundamentally influences product pricing strategies by establishing internal cost benchmarks that define minimum profitability thresholds for customer offerings. When properly implemented, FTP provides a consistent analytical framework for calculating risk-adjusted break-even rates across diverse product categories, enabling targeted pricing strategies that reflect both market competitive conditions and institutional risk-return objectives. This structured approach supports differentiated pricing based on customer segment characteristics, relationship value considerations, and strategic market positioning priorities. Furthermore, the incorporation of all relevant risk premiums into transfer rates ensures pricing decisions reflect comprehensive economic costs rather than partial accounting expenses, thereby preventing inadvertent risk subsidization across business lines. Financial institutions with sophisticated FTP frameworks gain significant competitive advantages through enhanced pricing precision, enabling selective competition based on identified market opportunities while maintaining appropriate risk-adjusted returns. These capabilities prove particularly valuable during periods of interest rate volatility, where institutions with advanced FTP systems can rapidly adjust pricing strategies in response to changing market conditions while maintaining profitability targets. Companies establishing new business operations should consider incorporating FTP principles into their initial pricing strategies to ensure sustainable profitability while supporting competitive market entry.

FTP in Mergers and Acquisitions: Due Diligence and Integration Considerations

During merger and acquisition transactions involving financial institutions, Funds Transfer Pricing methodologies represent critical elements of both due diligence processes and post-acquisition integration planning. Acquirers conducting due diligence must thoroughly evaluate target institutions’ FTP frameworks to identify potential economic distortions that might affect valuation assumptions or reveal hidden risks within seemingly profitable business lines. Disparities between the acquirer’s and target’s FTP methodologies often explain significant variations in reported business unit profitability, necessitating careful normalization of performance metrics to support accurate valuation. Furthermore, the sophistication of a target’s FTP framework provides valuable insights regarding its risk management capabilities, governance structures, and management information systems. Post-acquisition integration frequently involves harmonizing FTP methodologies across the combined entity, with decisions regarding methodology standardization carrying substantial implications for reported business unit performance and organizational incentives. Successful integration strategies typically implement phased convergence approaches that balance methodological consistency with organizational stability objectives. Companies engaged in cross-border acquisitions face additional complexity when reconciling different regulatory expectations and market practices regarding FTP implementation, particularly when integrating entities operating under different accounting standards or supervisory frameworks. Organizations considering international expansion should incorporate FTP considerations into their strategic planning processes.

Technology Solutions and System Architecture for FTP

The technological infrastructure supporting Funds Transfer Pricing has evolved substantially, with contemporary implementations leveraging specialized software solutions, advanced database architectures, and integrated analytics platforms. Modern FTP systems require sophisticated capabilities for curve construction, cash flow modeling, behavioral analysis, scenario simulation, and performance reporting—functionalities typically exceeding the capacity of general-purpose accounting systems or spreadsheet applications. Leading financial institutions implement dedicated FTP engines that interface with multiple source systems to gather transaction data, apply appropriate methodologies, calculate transfer rates, and distribute results to downstream applications. These specialized systems often incorporate workflow management capabilities that support rate approval processes, exception handling procedures, and audit documentation requirements. The system architecture typically establishes clear separation between methodology configuration components and calculation execution modules, enabling governance controls over parameter changes while maintaining efficient processing capabilities. Integration with enterprise data warehouse environments facilitates comprehensive analysis combining FTP results with other financial and risk metrics, supporting both management reporting needs and regulatory compliance requirements. Organizations implementing new FTP systems increasingly adopt cloud-based solutions that provide scalability advantages and processing flexibility, particularly valuable for institutions with international operations requiring consistent methodology application across multiple legal entities and geographic locations.

Governance Framework and Policy Development for FTP

Effective governance represents a foundational element of successful Funds Transfer Pricing implementation, encompassing policy formulation, oversight mechanisms, dispute resolution processes, and control activities. A comprehensive governance framework typically establishes an FTP committee with cross-functional representation from treasury, finance, risk management, business units, and the executive leadership team. This committee assumes responsibility for methodology approval, parameter calibration, exception management, and policy compliance monitoring. Formal documentation requirements ensure transparency regarding methodology assumptions, data sources, calculation procedures, and approval workflows. The governance structure typically implements segregation of duties between methodology development, rate calculation, validation, and application functions to maintain appropriate control standards. Regular independent validation processes verify methodology implementation accuracy, assumption reasonableness, and consistent application across different business units and product categories. Furthermore, the governance framework establishes clear escalation procedures for methodology disputes or implementation challenges, ensuring timely resolution while maintaining methodological integrity. Leading practices incorporate formal periodic methodology reviews to evaluate ongoing appropriateness in light of changing market conditions, business strategies, and regulatory expectations. Organizations with complex corporate structures should implement governance mechanisms that accommodate entity-specific requirements while maintaining enterprise-wide methodological consistency.

FTP Best Practices for International Banking Groups

International banking groups face unique challenges when implementing Funds Transfer Pricing across multiple jurisdictions, legal entities, and regulatory environments. Leading institutions address these complexities through frameworks that establish consistent methodological principles while accommodating jurisdiction-specific requirements regarding liquidity regulations, capital adequacy standards, and supervisory expectations. Best practices emphasize centralized methodology development combined with localized implementation oversight, creating appropriate balance between global consistency and local relevance. The harmonization of transfer rate determination across currencies requires sophisticated approaches to cross-currency basis adjustments, especially for institutions operating in markets with limited liquidity or convertibility restrictions. Furthermore, effective governance structures establish clear responsibilities between global treasury functions and local entity management regarding methodology application, exception handling, and performance reporting. Advanced institutions implement integrated systems that capture intragroup funding arrangements while maintaining appropriate separation between internal funding attribution and external transfer pricing requirements for tax purposes. The complexities of implementing consistent methodologies across international operations often necessitate specialized expertise in both technical modeling approaches and regulatory interpretation across multiple jurisdictions. Organizations establishing international corporate structures should proactively incorporate FTP considerations into their operational design to ensure effective performance measurement capabilities from inception.

Future Trends in Funds Transfer Pricing Methodologies

The evolution of Funds Transfer Pricing continues to accelerate, driven by regulatory developments, technological innovations, and emerging financial risks. Several significant trends are reshaping FTP methodologies and implementation approaches across the financial services industry. The integration of climate risk factors into FTP frameworks represents an emerging practice, with institutions developing approaches to incorporate transition risks, physical risks, and carbon pricing into funding cost allocations. Additionally, advancements in artificial intelligence and machine learning technologies enable more sophisticated behavioral modeling for non-maturing deposits and prepayable loans, improving the predictive accuracy of embedded option valuations. Regulatory emphasis on operational resilience and recovery planning drives increasing incorporation of contingent liquidity costs into transfer pricing methodologies, capturing the economic impact of maintaining robust business continuity capabilities. Furthermore, the potential introduction of central bank digital currencies and evolving payment technologies may fundamentally alter funding structures and liquidity characteristics, necessitating methodological adaptations to capture emerging risks and opportunities. Financial institutions pursuing sustainable competitive advantages increasingly view FTP as a strategic capability rather than merely a compliance requirement, investing in advanced analytics to derive actionable insights from transfer pricing data. Organizations planning long-term international expansion should monitor these emerging trends to ensure their FTP frameworks remain aligned with evolving best practices.

Case Study: FTP Implementation at a Multinational Bank

The transformation of Funds Transfer Pricing practices at Global Financial Group (GFG), a multinational banking institution with operations across 27 countries, illustrates both the challenges and benefits associated with implementing sophisticated FTP frameworks. Prior to its transformation initiative, GFG operated disparate FTP methodologies across regional operations, creating inconsistent performance measurements and misaligned incentives between local entities and global business lines. The implementation project commenced with a comprehensive assessment of existing practices, identifying substantial methodological variations ranging from simplistic pooled-fund approaches in emerging markets to advanced matched-maturity systems in developed regions. The transformation strategy established a global Center of Excellence responsible for methodology development while maintaining regional implementation teams to address local regulatory requirements and market characteristics. A phased implementation approach prioritized core lending and deposit products before expanding to more complex structured transactions and off-balance-sheet exposures. The initiative encountered significant challenges regarding data availability, system integration, and organizational resistance—particularly from business units anticipating adverse performance impacts under revised methodologies. Despite these obstacles, the implementation delivered substantial benefits including enhanced risk-adjusted performance measurement, improved strategic decision-making, and more effective liquidity management across the global organization. Companies considering international corporate structures can derive valuable insights from this case study regarding implementation approaches and change management strategies.

Conclusion: Strategic Implications of Effective FTP Implementation

The strategic importance of Funds Transfer Pricing transcends its technical complexity, establishing fundamental connections between financial institution governance, risk management practices, performance measurement systems, and competitive positioning. Effectively implemented FTP frameworks transform abstract risk concepts into tangible economic metrics that influence daily decision-making processes throughout banking organizations. By creating direct linkages between risk assumption and economic returns, FTP systems enable financial institutions to optimize capital allocation, enhance pricing precision, improve product design, and align incentive structures with long-term shareholder value creation. Furthermore, the integration of FTP with strategic planning processes supports more informed decisions regarding business model evolution, acquisition opportunities, market entry strategies, and resource prioritization. Financial institutions that treat FTP merely as a compliance exercise forfeit substantial benefits associated with enhanced performance measurement and strategic decision support capabilities. The competitive landscape increasingly favors institutions that leverage sophisticated FTP frameworks to identify granular profit opportunities while maintaning disciplined risk management practices. In an environment characterized by margin pressure, regulatory complexity, and technological disruption, FTP implementation represents a critical capability differentiating high-performing financial institutions from their less sophisticated competitors. Organizations seeking international growth opportunities should recognize FTP as an essential component of their governance infrastructure and strategic toolkit.

Expert Guidance for International Financial Optimization

Navigating the complexities of Funds Transfer Pricing implementation within international corporate structures requires specialized expertise that balances technical methodology knowledge with practical implementation experience. The interplay between FTP practices, international tax considerations, regulatory compliance requirements, and management information systems necessitates comprehensive approaches that address multiple dimensions simultaneously. If your organization faces challenges regarding FTP methodology development, system implementation, governance structure establishment, or integration with broader financial management frameworks, specialized guidance can significantly enhance your probability of success while reducing implementation risks.

If you’re seeking expert guidance to navigate international financial challenges, we invite you to book a personalized consultation with our team.

We are a boutique international tax consultancy with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating on a global scale.

Book a session with one of our experts now at $199 USD/hour and get concrete answers to your tax and corporate questions https://ltd24.co.uk/consulting.

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Comments are closed.