Capital Gains Tax On Foreign Property: Essential Guide

28 November, 2025

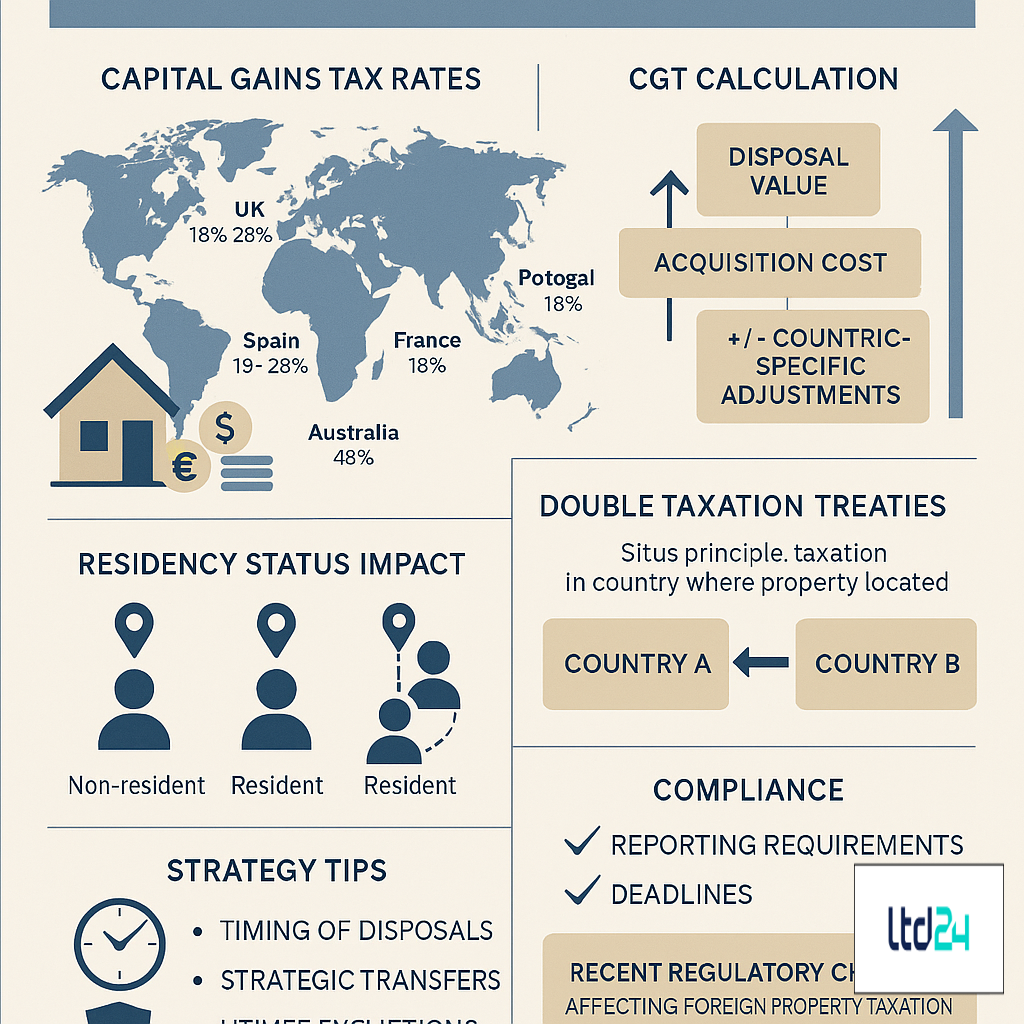

Understanding the Fundamentals of Capital Gains Tax on Foreign Property

Capital gains tax (CGT) on foreign property represents a significant fiscal consideration for international investors and property owners. This tax is levied on the profit realized from the disposal of real estate assets situated outside one’s country of residence. The fundamental principle underpinning this taxation mechanism involves calculating the difference between the acquisition cost and the disposal value, with various adjustments permitted depending on the relevant tax jurisdiction. Tax authorities worldwide have intensified their focus on cross-border property transactions, implementing robust information exchange frameworks to ensure compliance. For instance, the UK’s HM Revenue & Customs (HMRC) maintains stringent reporting requirements for British residents disposing of overseas property, regardless of whether the proceeds are repatriated to the UK or retained abroad. Understanding these basic principles is essential for effective international tax planning and compliance with statutory obligations.

Residency Status and Its Impact on Foreign Property Taxation

Your residency status significantly influences how capital gains from foreign property are taxed. Tax residency rules vary substantially across jurisdictions but generally rely on factors such as physical presence, permanent home availability, economic interests, and personal ties. In the UK, for example, the Statutory Residence Test determines whether an individual is resident for tax purposes, potentially subjecting them to taxation on worldwide capital gains. Non-residents might face different tax treatment, often limited to properties within specific territories. The concept of "deemed domicile" adds another layer of complexity for long-term UK residents. Similarly, under US tax law, citizens and permanent residents face taxation on global income regardless of their physical location, creating potential dual taxation scenarios for American expatriates owning foreign real estate. Understanding these residency-based tax implications is critical for developing appropriate tax strategies and avoiding unexpected tax liabilities when engaging in international property investments.

Jurisdiction-Specific CGT Rates and Thresholds for Foreign Property

CGT rates on foreign property vary significantly across tax jurisdictions, creating a complex landscape for international investors. In the United Kingdom, residential property gains are currently taxed at 18% for basic rate taxpayers and 28% for higher and additional rate taxpayers, with an annual exempt amount of £6,000 (reduced from £12,300 in 2023/24). Contrastingly, Spain imposes a progressive rate system ranging from 19% to 26% for non-residents. Portugal applies a flat 28% rate on property gains for non-residents, while France implements a sliding scale from 19% to 42.2% (including social charges) depending on the holding period. Australia taxes non-residents at a flat 32.5% on property gains with no tax-free threshold. These varying rates highlight the importance of jurisdiction-specific knowledge when calculating potential tax liabilities on foreign property disposals. Many countries also offer rate reductions based on ownership duration, creating opportunities for strategic timing of property disposals to minimize tax exposure through proper tax planning.

Double Taxation Treaties: Protection Mechanisms for Foreign Property Owners

Double Taxation Treaties (DTTs) serve as crucial protection mechanisms for individuals and entities owning foreign property. These bilateral agreements aim to prevent the same income being taxed twice in different jurisdictions, providing relief through tax credits, exemptions, or reduced withholding tax rates. The OECD Model Tax Convention forms the basis for most modern treaties, establishing clear rules for determining taxing rights between contracting states. For property investors, DTTs typically grant primary taxing rights to the country where the real estate is located (situs principle), with the resident country providing relief through tax credits or exemption methods. For instance, under the UK-Spain treaty, a British resident selling Spanish property would pay tax in Spain first, then claim relief in the UK for taxes paid. However, the effectiveness of treaty benefits depends on proper documentation and timely claims. Navigating these complex provisions often requires specialized knowledge of international tax compliance, especially when dealing with multiple property holdings across different jurisdictions.

Calculation Methodology: Determining Capital Gains on Foreign Property

The calculation of capital gains on foreign property involves several technical components that vary by jurisdiction. The basic formula involves subtracting the acquisition cost (plus eligible improvements and transaction expenses) from the disposal proceeds. However, adjustments for currency fluctuations often complicate these calculations, as the gain must typically be computed in the local currency of the property jurisdiction before conversion to the taxpayer’s home currency. Many tax systems permit enhancement expenditure to be added to the base cost, including substantial improvements, extension costs, and certain professional fees—but not regular maintenance expenses. Some jurisdictions offer inflation indexation to adjust the original purchase price for the effects of inflation, though this benefit has been restricted in many countries. Time apportionment relief may apply for properties that served as a primary residence for part of the ownership period. Specialized situations such as compulsory purchases, property exchanges, or inheritances often trigger specific calculation rules. For accurate assessment, comprehensive property transaction documentation must be maintained, ideally from the date of acquisition through to disposal.

Reporting Requirements and Deadlines for Foreign Property Disposals

Compliance with reporting requirements for foreign property disposals is non-negotiable in today’s heightened tax transparency environment. Different jurisdictions impose varying deadlines and documentation standards, creating a complex compliance landscape. In the UK, residents must report foreign property gains within the Self Assessment tax return, due by January 31st following the tax year of disposal. For non-UK properties, supplementary pages SA106 (Foreign) must be completed with comprehensive details of the transaction. Many European countries have implemented more immediate reporting obligations—Spain requires a declaration within four months of transfer, while France mandates reporting within 30 days for certain high-value transactions. The United States requires reporting on Form 8949 and Schedule D of Form 1040, with additional disclosure on Form 8938 (Foreign Asset Reporting) if applicable. Failure to meet these reporting obligations can result in substantial penalties, interest charges, and potential criminal prosecution for deliberate non-compliance. Given the complexity of cross-border reporting requirements, professional guidance from international tax advisors is strongly recommended to ensure comprehensive compliance across all relevant jurisdictions.

Exemptions and Reliefs Available for Foreign Property Capital Gains

Various exemptions and reliefs can significantly reduce CGT liability on foreign property disposals, though availability varies by jurisdiction. Primary residence relief (known as Private Residence Relief in the UK) typically provides full or partial exemption for properties that served as the taxpayer’s main home, with specific conditions regarding occupancy periods and permissible absence. Entrepreneurs’ relief or business asset disposal relief may apply to commercial properties used in qualifying business activities, potentially reducing the applicable tax rate. Certain jurisdictions offer age-related exemptions for elderly taxpayers or those disposing of property to fund retirement care. Reinvestment relief (similar to the US 1031 exchange) allows for tax deferral when proceeds are reinvested in similar qualifying assets within specified timeframes. Inheritance or gift-related transfers may benefit from holdover relief, postponing CGT until subsequent disposal by the recipient. Strategic property gifting between spouses or civil partners can optimize annual exemptions and lower tax bands. However, these reliefs typically have strict eligibility criteria and proper documentation requirements, necessitating careful planning with tax advisors specializing in international property.

Foreign Currency Considerations in Capital Gains Calculations

Foreign currency fluctuations introduce substantial complexity to capital gains calculations on overseas property. Tax authorities typically require gains to be calculated in the local currency where the property is situated before conversion to the taxpayer’s domestic currency at applicable exchange rates. This dual-currency approach can significantly impact the taxable gain amount, potentially creating "paper gains" solely from currency movements rather than actual property appreciation. Most tax systems mandate using official exchange rates on the transaction dates (both acquisition and disposal), though some jurisdictions offer alternative calculation methods. Exchange rate documentation becomes critical evidence for tax filings, requiring meticulous record-keeping throughout the property ownership period. Currency hedging strategies may be employed by sophisticated investors to mitigate foreign exchange risk, though the tax treatment of such instruments varies by jurisdiction. In scenarios involving mortgages in foreign currencies, loan repayments can generate separate foreign exchange gains or losses that may receive different tax treatment than the property gain itself. Given these complexities, specialized advice from international tax professionals with experience in multi-currency transactions is essential for accurate compliance and optimized tax outcomes.

Recent Regulatory Changes Affecting Foreign Property Taxation

The regulatory landscape governing foreign property taxation has undergone significant transformation in recent years, driven by international initiatives to combat tax evasion and enhance fiscal transparency. The OECD’s Common Reporting Standard (CRS) has facilitated automatic exchange of financial information between tax authorities, dramatically improving visibility of offshore assets including property holdings. In the UK, non-resident CGT (NRCGT) was extended to commercial property in 2019, and the 30-day reporting window for property disposals (later extended to 60 days) was introduced in 2020. The EU’s DAC6 directive implemented mandatory disclosure rules for potentially aggressive tax planning arrangements, including those involving real estate. Many jurisdictions have also introduced or enhanced beneficial ownership registers for property, reducing anonymity for holdings through corporate structures. Digital reporting requirements have been progressively implemented across major tax authorities, streamlining compliance but requiring enhanced data management. These regulatory developments highlight the increasing importance of proactive tax planning and timely compliance for foreign property investors. Staying informed of these changes requires ongoing engagement with specialized tax compliance services focused on international real estate.

Practical Strategies for Minimizing CGT on Foreign Property

Strategic planning can legitimately minimize capital gains tax exposure on foreign property investments. Timing property disposals to coincide with tax years when other losses can offset gains represents a fundamental approach to tax efficiency. Phased disposals may spread gains across multiple tax years, potentially utilizing annual exempt amounts and lower tax bands in each period. For married couples and civil partners, transferring property interests between spouses prior to disposal can effectively utilize both partners’ tax allowances and lower rate bands. Proper expense documentation is essential, as eligible enhancement expenditure can significantly reduce taxable gains—comprehensive records of capital improvements, extension costs, and qualifying professional fees should be maintained throughout ownership. Principal private residence elections in jurisdictions offering residence relief should be carefully considered and formally documented. For commercial properties, exploring available business asset reliefs may provide substantial tax advantages. Investment through appropriate corporate structures may offer advantages in certain scenarios, though substance requirements and anti-avoidance provisions must be carefully navigated. Consultation with specialized international tax advisors before acquisition, during ownership, and prior to disposal ensures these strategies align with current regulations across relevant jurisdictions.

Inheritance Considerations for Foreign Property with Unrealized Gains

The intersection of capital gains and inheritance tax regimes creates unique planning considerations for foreign property owners. In many jurisdictions, death triggers a deemed disposal for CGT purposes, potentially crystallizing gains during estate administration. However, some tax systems offer a "stepped-up" basis for inherited assets, effectively eliminating unrealized gains accrued during the deceased’s ownership. The UK, for instance, provides a CGT-free uplift to market value at death, though inheritance tax may still apply. This contrasts with countries like Canada, where deemed disposition rules apply upon death, requiring tax payment on unrealized gains unless specific spousal rollovers apply. Cross-border scenarios add further complexity, as inheritance tax treaties may not align perfectly with income tax agreements, potentially creating double taxation risks. Strategic lifetime gifting of appreciating foreign properties can, in some circumstances, freeze gain values and utilize available exemptions, though anti-avoidance provisions must be carefully navigated. The interaction between foreign property tax regimes and domestic inheritance systems requires specialized knowledge of both jurisdictions’ rules. Property owners should consider integrating inheritance tax planning with capital gains strategies, particularly for high-value international real estate portfolios.

Using Corporate Structures for Foreign Property Ownership

Corporate structures can offer significant tax advantages for foreign property ownership, though their benefits must be weighed against compliance costs and substance requirements. Holding foreign real estate through companies may provide inheritance tax protection, liability limitation, and privacy benefits depending on the jurisdictions involved. In some territories, corporate ownership can access preferential CGT rates or exemptions unavailable to individual investors. Certain corporate structures, such as Luxembourg Sociétés de Participation Financière (SOPARFI), Spanish SOCIMI, or UK Real Estate Investment Trusts (REITs) offer specific tax advantages for property investment. However, anti-avoidance legislation has increasingly targeted artificial arrangements, with many jurisdictions implementing "look-through" provisions that attribute gains directly to shareholders. Additional compliance considerations include annual filing requirements, transfer pricing regulations, substance requirements, and beneficial ownership reporting. The cost-benefit analysis must consider ongoing administrative expenses against potential tax savings. Corporate restructuring prior to property disposal requires careful planning to avoid triggering immediate tax liabilities. For substantial property portfolios, tiered holding structures may optimize tax efficiency across multiple jurisdictions, though these require careful implementation with guidance from international corporate service providers.

Impact of Brexit on UK Residents’ Foreign Property Taxation

Brexit has introduced significant changes to the taxation landscape for UK residents owning property within the European Union. The UK’s withdrawal from the EU has altered the application of certain EU directives that previously facilitated cross-border tax administration. UK residents may now face less favorable treatment regarding withholding taxes on rental income in some EU countries where preferential rates previously applied to EU/EEA residents. Additionally, access to certain tax exemptions or reliefs available only to EU residents has been restricted. For example, some EU countries offer reduced property transfer taxes or inheritance tax advantages to EU residents that no longer apply to UK owners. Post-Brexit compliance requirements have increased, with additional paperwork and potential fiscal representative appointments now mandatory in countries like France, Spain, and Portugal. While Double Taxation Treaties remain in force independently of Brexit, the practical application of relief mechanisms has become more administratively complex. UK residents with EU property interests should review their holdings in light of these changes and consider seeking updated advice from tax advisors specializing in post-Brexit scenarios to ensure continued compliance and tax efficiency.

Property Investment Through Pension Schemes and Tax Implications

Investing in foreign property through pension schemes presents unique tax considerations and potential advantages. Self-Invested Personal Pensions (SIPPs) in the UK and Individual Retirement Accounts (IRAs) in the US offer tax-efficient investment vehicles, though direct foreign property holding is restricted within most regulated pension structures. Instead, indirect investment through property funds, REITs, or property company shares may provide exposure to international real estate markets while maintaining tax advantages. These structures can offer significant benefits including tax-free growth within the pension wrapper, no immediate capital gains tax on property disposals within the fund, and potential tax relief on contributions used for investment. However, complexities arise regarding pension lifetime allowances, annual contribution limits, and eventual benefit crystallization. Commercial property investments may have different treatment than residential holdings in certain pension structures. For expatriates or those with international pension arrangements, additional considerations include Qualifying Recognised Overseas Pension Schemes (QROPS) and the tax treatment of pension transfers between jurisdictions. The interaction between domestic pension tax rules and foreign property tax regimes requires specialized knowledge, particularly when considering eventual pension drawdown strategies and retirement planning.

Record-Keeping Requirements for Foreign Property Ownership

Comprehensive record-keeping is fundamental to managing capital gains tax liabilities on foreign property. Tax authorities increasingly require detailed documentation spanning the entire ownership period, often for many years after disposal. Essential records include the original purchase contract, ownership registration documents, proof of funding sources, and all transaction costs including legal fees, stamp duties, and agent commissions. Throughout the ownership period, documentation of capital improvements must be meticulously maintained, including planning permissions, construction contracts, invoices, and payment evidence. Property valuation reports at key dates may prove invaluable, particularly for inherited properties or those held long-term. For rental properties, complete income and expense records are essential, as these may affect the CGT calculation in some jurisdictions. Records should be maintained in both the property’s local currency and the owner’s home currency, with supporting exchange rate documentation. Digital record management systems can facilitate organization of these documents, but consideration must be given to storage security and accessibility. The burden of proof typically falls on the taxpayer in tax inquiries, making robust record-keeping a critical risk management strategy. Professional support from accounting services specialized in international property can establish appropriate record-keeping systems aligned with relevant jurisdictional requirements.

Navigating Tax Inquiries and Investigations on Foreign Property

Tax inquiries concerning foreign property disposals have increased dramatically with enhanced international information exchange mechanisms. When facing such inquiries, proper preparation and professional representation are essential. Tax authorities typically have extended inquiry windows for international transactions—in the UK, HMRC can investigate for up to 20 years where offshore assets are concerned, compared to the standard four or six-year limitation periods. Initial responses to inquiries should be measured and accurate, avoiding hasty or incomplete disclosures that could expand the investigation scope. Voluntary disclosure facilities may offer reduced penalties for previously unreported disposals if utilized proactively before an investigation commences. During inquiries, taxpayers should maintain control over information flow, providing only what is specifically requested while ensuring accuracy. Understanding the distinction between formal and informal requests is crucial, as different legal obligations may apply. For complex scenarios, engaging specialized tax representation services with experience in cross-border investigations can significantly improve outcomes. Alternative dispute resolution mechanisms may be available in certain jurisdictions, potentially offering more efficient resolution paths than formal litigation. Throughout any investigation, maintaining professional communication and cooperation while protecting legitimate taxpayer rights represents the optimal approach for achieving favorable resolution.

Professional Assistance: When and Why to Seek Expert Help

The complexity of capital gains taxation on foreign property often necessitates professional guidance at various stages of ownership. Pre-acquisition tax planning represents an ideal entry point for expert consultation, as structure and ownership decisions made before purchase can significantly impact eventual tax outcomes. Professional advisors can conduct jurisdiction-specific analyses of potential tax liabilities, available exemptions, and optimal ownership structures before capital is committed. During ownership, tax professionals can guide enhancement expenditure documentation and recommend strategic timing for improvements to maximize tax efficiency. Pre-disposal planning is particularly valuable, as experts can forecast tax liabilities under various scenarios and recommend timing or structuring approaches to minimize exposure. Cross-border expertise is essential, as advisors must understand the interaction between multiple tax systems and applicable treaties. When selecting professional assistance, credentials, experience with specific jurisdictions, and international network access should be prioritized. While professional services represent an additional cost, their value typically exceeds their expense through identified tax savings, risk mitigation, and compliance assurance. For substantial property investments or complex cross-border scenarios, a coordinated advisory team including tax specialists, legal advisors, and financial planners provides comprehensive protection against the considerable risks of international property taxation.

Your International Property Tax Strategy: Next Steps

Developing a coherent international property tax strategy requires a methodical approach incorporating both immediate compliance needs and long-term planning objectives. Begin by conducting a comprehensive inventory of all foreign property holdings, including acquisition dates, purchase prices in original currencies, improvement expenditures, and current market valuations. This baseline assessment establishes the foundation for effective planning. Next, evaluate your current and anticipated future tax residency status, as this fundamentally impacts your global tax position. Consider implementing a proactive compliance calendar addressing reporting deadlines across all relevant jurisdictions to eliminate penalty risks. For properties approaching potential disposal, request preliminary CGT calculations under various timing scenarios to identify optimal disposal windows. Succession planning considerations should be integrated into your property strategy, particularly for aging property owners with significant unrealized gains. Regular reviews of your property portfolio’s tax efficiency should be scheduled, ideally annually and whenever significant tax law changes occur in relevant jurisdictions. Document retention protocols should be established to ensure all necessary records remain accessible for potential future inquiries. Professional advisors should be engaged based on specific jurisdictional expertise rather than general tax knowledge, creating an advisory network aligned with your unique property portfolio.

International Tax Expertise at Your Service

Navigating the complex world of capital gains taxation on foreign property requires specialized knowledge and strategic planning. The multifaceted nature of international property transactions creates both challenges and opportunities for investors seeking tax efficiency while maintaining full compliance. At LTD24, we understand these complexities intimately, having guided numerous clients through successful foreign property transactions across multiple jurisdictions.

Our international tax team possesses the technical expertise and practical experience to provide tailored solutions for your specific foreign property portfolio. From pre-acquisition structuring to disposal planning and compliance management, we deliver comprehensive support throughout the property ownership lifecycle. With deep knowledge of double taxation agreements, exemption provisions, and jurisdiction-specific reporting requirements, we help you navigate this complex landscape with confidence.

If you’re seeking expert guidance on capital gains tax matters for your international property investments, we invite you to book a personalized consultation with our specialized team. We are a boutique international tax consulting firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer customized solutions for entrepreneurs, professionals, and corporate groups operating globally.

Book a session with one of our experts now at $199 USD/hour and get concrete answers to your tax and corporate questions (link: https://ltd24.co.uk/consulting).

Marcello is a Certified Accountant at Ltd24, specialising in e-commerce businesses and small to medium-sized enterprises. He is dedicated to transforming complex financial data into actionable strategies that drive growth and efficiency. With a degree in Economics and hands-on expertise in accounting and bookkeeping, Marcello brings clarity and structure to every financial challenge. Outside of work, he enjoys playing football and padel.

Comments are closed.