Funds Transfer Pricing Example: Practical Illustration

22 March, 2025

Understanding the Fundamentals of Funds Transfer Pricing

Funds Transfer Pricing (FTP) constitutes a critical internal accounting mechanism employed by financial institutions to allocate interest income and expenses among different business units. This sophisticated pricing methodology assigns values to funds transferred between divisions within a banking organization, thereby facilitating accurate profitability measurement across various departments and products. At its core, FTP represents the notional price at which funds are "sold" from one division to another, forming the cornerstone of a bank’s internal economic framework. The establishment of an effective FTP system requires meticulous attention to detail and comprehensive understanding of both regulatory requirements and financial market dynamics. According to a PWC global banking study, over 85% of international banks have undertaken significant revisions to their FTP frameworks following the 2008 financial crisis, underscoring its paramount importance in the contemporary banking landscape. For organizations with international presence, proper FTP implementation demands consideration of cross-border implications and UK company taxation requirements.

The Strategic Significance of FTP in International Banking Operations

The implementation of robust Funds Transfer Pricing carries profound strategic implications for multinational financial institutions. Beyond mere compliance with regulatory standards, FTP serves as a decisive factor in resource allocation, capital deployment, and performance evaluation. By establishing transparent internal pricing mechanisms, banks can objectively assess the profitability of individual products, customer relationships, and business segments. This granular visibility enables executive leadership to make informed decisions regarding business expansion, contraction, or modification based on risk-adjusted returns. Financial institutions operating across multiple jurisdictions must align their FTP methodologies with their overarching strategic objectives while navigating the complexities of varying tax regimes. For companies incorporating in the UK online, understanding these mechanisms becomes particularly relevant when establishing treasury operations or banking relationships. Research published in the Journal of Banking & Finance indicates that banks with sophisticated FTP systems demonstrate superior risk management capabilities and enhanced profitability metrics compared to their counterparts employing rudimentary approaches.

Key Components of a Comprehensive FTP Framework

A robust Funds Transfer Pricing framework encompasses several integral components that collectively ensure its effectiveness and compliance with regulatory expectations. The base reference rate serves as the foundational element, typically derived from market benchmarks such as LIBOR, EURIBOR, or their successors like SONIA or SOFR. This baseline represents the "risk-free" component of the transfer price. Supplementing this foundation are various premium adjustments including liquidity premiums that reflect the cost of maintaining adequate funding stability, term premiums accounting for the duration risk of assets and liabilities, and option cost premiums capturing the implicit optionality in certain financial products. Additionally, credit risk premiums compensate for potential counterparty default, while capital charges account for regulatory capital requirements. The Basel Committee on Banking Supervision has published extensive guidance on FTP methodologies, emphasizing the importance of these components in creating a risk-aware pricing environment. Entities considering offshore company registration in the UK must understand how these FTP components interact with international tax considerations and banking relationships.

Practical Example: Basic FTP Calculation for a Retail Banking Division

To illustrate a straightforward application of Funds Transfer Pricing, consider a retail banking division within a multinational financial institution. This division accepts customer deposits and issues residential mortgages. For this example, the retail division has accepted a one-year time deposit of £1,000,000 at an interest rate of 3.25% per annum, while simultaneously issuing a five-year fixed-rate mortgage of £500,000 at 4.75% per annum. Under the bank’s FTP framework, the treasury department sets internal transfer rates based on market yield curves plus appropriate risk premiums. For the one-year deposit, the applicable FTP rate is 3.50% (reflecting the cost at which treasury could raise comparable funds in the market). For the five-year mortgage, the FTP rate is determined to be 4.25%. Consequently, the retail division pays the customer 3.25% on their deposit while receiving 3.50% from treasury, generating a positive margin of 0.25% or £2,500 annually on this transaction. Similarly, the division charges the mortgage customer 4.75% while paying treasury 4.25%, yielding a margin of 0.50% or £2,500 annually. This granular profitability analysis enables precise performance measurement and resource allocation decisions. Businesses engaged in UK company formation for non-residents with banking operations would benefit from understanding these fundamental FTP calculations.

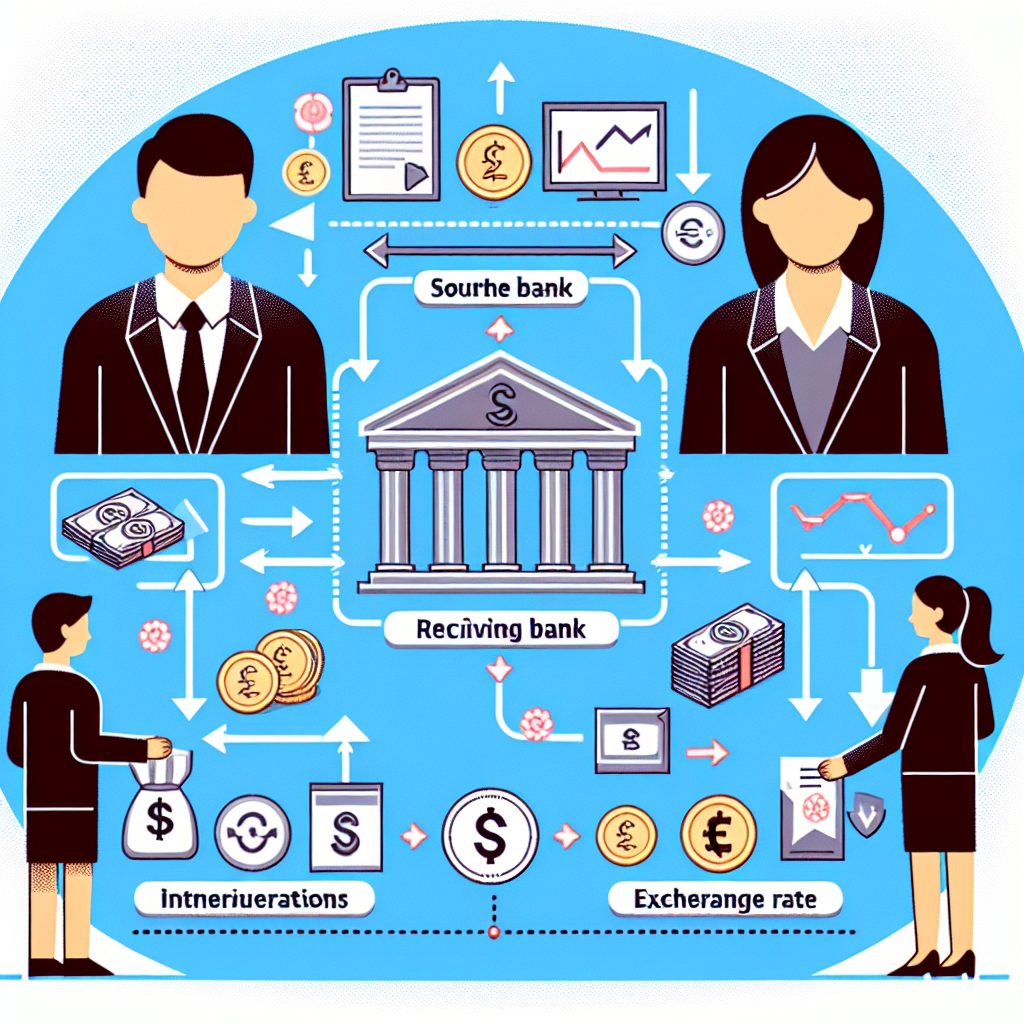

Advanced Example: Multi-Currency FTP Implementation across Jurisdictions

A more sophisticated application of Funds Transfer Pricing emerges when examining a multinational bank operating across multiple currency zones. Consider a banking group with headquarters in London and significant operations in both the Eurozone and the United States. This institution must develop an FTP framework that accommodates currency-specific risk factors while ensuring consistent application of pricing principles. A practical illustration involves a corporate banking division in France extending a €10 million term loan to a multinational client, funded partially by Euro-denominated deposits and partially through internal USD funding from the US division, subsequently converted to Euros. The FTP calculation in this scenario must incorporate not only the baseline interest rate components for each currency but also cross-currency basis spreads, liquidity premiums that vary by jurisdiction, and country-specific credit risk factors. Additionally, the bank must account for regulatory capital requirements that differ between the UK, EU, and US regimes. Using a matched-maturity approach, the treasury function assigns an FTP rate of EURIBOR + 95 basis points to the loan, reflecting both the funding cost and various risk premiums. This complex example demonstrates how multinational financial institutions must navigate the intricacies of cross-border funds transfer pricing while maintaining alignment with both local and group-level financial objectives. For companies considering setting up a limited company in the UK with international operations, understanding these multi-currency considerations becomes essential for treasury management.

Regulatory Perspectives on FTP: Compliance and Governance

Regulatory authorities worldwide have increased their scrutiny of Funds Transfer Pricing methodologies following the 2008 financial crisis, recognizing their pivotal role in risk management and financial stability. The Financial Conduct Authority (FCA) in the UK, the European Banking Authority (EBA), and the Federal Reserve in the US have all issued guidance emphasizing the necessity for documented, transparent, and defensible FTP frameworks. A particularly instructive example emerges from the EBA’s Guidelines on IRRBB Management, which explicitly addresses FTP as a component of interest rate risk management. These guidelines stipulate that banking institutions must ensure their FTP methodologies appropriately reflect the liquidity characteristics of financial instruments, incorporate all relevant risk components, and operate under robust governance structures. Non-compliance with these expectations may trigger regulatory interventions, including additional capital requirements under Pillar 2 assessments. Financial institutions must therefore establish clear lines of responsibility for FTP development, implementation, and oversight, typically involving senior treasury, risk management, and finance executives, with ultimate accountability residing with the board of directors. Organizations involved with UK companies registration and formation must consider these regulatory expectations when establishing banking subsidiaries or financial services operations.

FTP for Loan Products: Detailed Example Analysis

The application of Funds Transfer Pricing to loan products requires particular attention to maturity profiles, embedded options, and credit risk considerations. To illustrate this complexity, consider a commercial bank’s corporate lending division extending a £5 million, 7-year term loan with a quarterly repricing structure based on 3-month SONIA plus a margin of 250 basis points. Under the bank’s FTP framework, the treasury function constructs a corresponding FTP rate using several components: the base reference rate (3-month SONIA forward curve), a liquidity premium reflecting the 7-year commitment (65 basis points), a term premium capturing interest rate risk (15 basis points), and a capital charge for regulatory requirements (45 basis points). The resultant all-in FTP rate assigned to this loan equals the 3-month SONIA forward rate plus 125 basis points. With the customer paying SONIA plus 250 basis points, the corporate lending division realizes a net margin of 125 basis points or approximately £62,500 annually. This granular decomposition of pricing elements facilitates precise profitability analysis and strategic decision-making. Should the division consistently generate returns below the risk-adjusted hurdle rate, management might reconsider its strategic focus or repricing strategies. The Journal of Financial Intermediation has published multiple studies confirming that banks employing such detailed FTP methodologies demonstrate superior risk-adjusted performance in their lending portfolios. Companies engaged in international business requiring significant financing might benefit from understanding these principles when setting up a limited company UK.

FTP for Deposit Products: Case Study with Tax Implications

Deposit products present unique challenges for Funds Transfer Pricing due to their indeterminate maturity profiles and embedded optionality. A practical example involves a UK-based international bank’s retail division offering a savings account with the following characteristics: instant access with no withdrawal penalties, an advertised interest rate of 2.75%, and an average balance of £50 million across all accounts. Historical analysis indicates these deposits exhibit a relatively stable core component, with approximately 80% remaining with the institution for longer than two years despite their contractual overnight maturity. The bank’s treasury department employs a replicating portfolio approach for FTP purposes, modeling these deposits as a combination of overnight funding (20%) and a laddered portfolio of term instruments extending to five years (80%). This behavioral modeling results in an assigned FTP credit rate of 3.10% to the retail division, generating a positive margin of 0.35% or £175,000 annually on this product. From a taxation perspective, this internal transfer pricing must be documented to satisfy both UK regulatory requirements and international tax principles when the banking group operates across multiple jurisdictions. The OECD Transfer Pricing Guidelines require that such internal transactions reflect arm’s length pricing principles, particularly relevant for financial institutions with offshore company registration UK structures or international operations spanning multiple tax regimes.

FTP in the Context of Mergers and Acquisitions: Practical Considerations

When financial institutions engage in mergers or acquisitions, the harmonization of disparate Funds Transfer Pricing methodologies presents significant challenges and opportunities. Consider the recent acquisition of a medium-sized regional UK bank by a larger international banking group. The acquirer employs a sophisticated, multi-component FTP framework with extensive behavioral modeling and risk adjustments, while the target institution utilizes a simpler matched-maturity approach with limited risk premiums. The integration process requires careful analysis of both methodologies to develop a unified approach that maintains the strategic objectives of the combined entity. A practical example emerges in the treatment of the acquired bank’s mortgage portfolio: a £2 billion book with various fixed and variable rate products. The acquirer’s treasury team conducts a comprehensive revaluation of this portfolio using their more sophisticated FTP methodology, incorporating liquidity premiums, option costs for prepayment risk, and credit spread adjustments. This revaluation reveals that certain segments of the mortgage book were significantly underpriced from a risk-adjusted perspective, with some fixed-rate products generating returns below the appropriate hurdle rate when assessed against the acquirer’s capital allocation framework. This analysis directly influences post-acquisition strategic decisions, including potential portfolio adjustments, repricing initiatives, and product modifications. For businesses engaged in UK company formation with VAT planning to enter the financial services sector, understanding these integration challenges proves invaluable when formulating growth strategies that might include acquisitions.

Tax Implications of Funds Transfer Pricing for International Banking Groups

The tax implications of Funds Transfer Pricing extend beyond internal performance measurement, particularly for banking groups operating across multiple tax jurisdictions. FTP methodologies must align with transfer pricing regulations to avoid potential challenges from tax authorities regarding profit allocation between entities. A practical illustration involves a multinational banking group with its treasury hub in London and significant banking operations in Germany, France, and Spain. The group’s centralized treasury function in the UK provides funding to its European subsidiaries, with internal pricing determined through the group’s FTP framework. Under OECD transfer pricing principles and local tax regulations, these internal transactions must reflect arm’s length terms that would prevail between independent entities. To ensure compliance, the banking group maintains comprehensive documentation demonstrating how its FTP rates incorporate market-based reference rates, appropriate risk premiums, and entity-specific adjustments reflecting varying regulatory environments. During a recent tax audit by German authorities, the bank successfully defended its FTP methodology by evidencing that the assigned rates to the German subsidiary appropriately reflected market conditions, liquidity considerations, and regulatory constraints applicable to the German banking market. This example underscores the critical intersection between FTP and international tax compliance. Financial institutions with offshore company structures must be particularly vigilant in ensuring their internal pricing mechanisms withstand scrutiny from multiple tax authorities while optimizing their global tax position within legal parameters.

FTP and Liquidity Coverage Ratio: A Practical Implementation Example

The introduction of the Liquidity Coverage Ratio (LCR) under Basel III regulations has significantly influenced Funds Transfer Pricing methodologies within banking institutions. A practical implementation example involves a global bank headquartered in London with substantial retail and commercial operations across Europe. Following the LCR requirements, this bank revised its FTP framework to explicitly account for the differential liquidity value of various assets and liabilities. For instance, retail deposits classified as "stable" under LCR criteria receive a favorable FTP credit rate compared to wholesale funding sources with similar tenors, reflecting their preferential treatment in liquidity calculations. Conversely, committed credit facilities, which require liquidity buffer allocation under LCR rules, incur an additional FTP charge representing the cost of maintaining eligible high-quality liquid assets (HQLA). To illustrate with specific figures: a €100 million commercial loan with a 5-year maturity might carry a base FTP charge of EURIBOR + 85 basis points, with an additional liquidity premium of 35 basis points specifically attributable to LCR requirements. Simultaneously, a €50 million portfolio of stable retail deposits might receive an FTP credit of EURIBOR – 15 basis points, reflecting their favorable treatment under the LCR framework. This example demonstrates how regulatory liquidity requirements directly translate into tangible FTP adjustments, influencing product pricing decisions and resource allocation. Financial institutions engaging in UK company incorporation and bookkeeping services must consider these regulatory impacts when establishing treasury operations or banking subsidiaries.

Net Stable Funding Ratio and Its Impact on FTP: Case Analysis

Building upon the liquidity theme, the Net Stable Funding Ratio (NSFR) has introduced another dimension to Funds Transfer Pricing frameworks by emphasizing longer-term funding stability. A practical case analysis involves a mid-sized UK bank specializing in commercial real estate lending. This institution’s NSFR-adjusted FTP methodology assigns differentiated charges based on the Required Stable Funding (RSF) factors of various assets. For example, a £10 million, 10-year commercial mortgage receives an NSFR-related FTP charge of 25 basis points, reflecting its 100% RSF factor, while a £5 million, 6-month trade finance facility incurs only a 5 basis point NSFR-related charge due to its lower 50% RSF factor. On the liability side, the bank’s treasury function assigns preferential FTP credit rates to funding sources with higher Available Stable Funding (ASF) values. A £20 million corporate deposit with a contractual 3-year term receives an FTP credit enhancement of 18 basis points compared to a similar deposit with a 6-month term, directly reflecting the NSFR benefit of longer-term funding. This granular approach to incorporating NSFR considerations into FTP creates powerful incentives for business units to optimize their balance sheet structures from both liquidity and funding stability perspectives. The bank’s implementation of this refined methodology resulted in a strategic rebalancing of its lending portfolio toward assets with more favorable NSFR treatment and an extension of its liability profile, improving its overall regulatory position. Companies engaged in formation agent services in the UK with clients in the financial sector should be aware of these regulatory influences on banking operations and pricing structures.

Interest Rate Risk Management through FTP: Practical Application

Funds Transfer Pricing serves as a critical tool for managing interest rate risk in the banking book (IRRBB), with particular relevance to institutions operating in volatile interest rate environments. A compelling practical application involves a UK-based international bank with a significant fixed-rate mortgage portfolio funded primarily through variable-rate deposits. This structural mismatch creates substantial interest rate risk exposure, as rising rates would compress net interest margins. The bank’s treasury implements an advanced FTP framework that explicitly transfers this interest rate risk from business units to a centralized Asset and Liability Management (ALM) desk. For example, a £500 million portfolio of 5-year fixed-rate mortgages at 3.75% receives an FTP credit rate that matches this fixed rate minus an appropriate margin, effectively immunizing the mortgage division from interest rate movements. Similarly, the retail division accepting variable-rate deposits receives an FTP debit rate that floats with market rates, shielding it from interest rate risk. The ALM desk, having consolidated these offsetting positions, employs various hedging strategies including interest rate swaps, caps, and floors to manage the residual exposure at the enterprise level. According to a Bank of England Working Paper, institutions employing such sophisticated interest rate risk transfer mechanisms through FTP demonstrate significantly reduced earnings volatility during periods of interest rate turbulence. Companies considering how to register a business name UK for financial services operations should understand these risk management dimensions when establishing their corporate structures.

FTP and Capital Allocation: An Integrated Approach Example

The integration of capital allocation methodologies with Funds Transfer Pricing represents a sophisticated approach to comprehensive performance measurement in banking institutions. An illustrative example involves a diversified financial services group with banking operations across multiple European countries. This organization implements an integrated FTP and capital allocation framework that assigns risk-adjusted capital charges to various business activities based on their risk profiles. For instance, the corporate banking division extends a 7-year, £8 million term loan to a BBB-rated manufacturing company. The FTP framework assigns a funding cost based on the matched-maturity market rate plus appropriate liquidity and term premiums, totaling SONIA + 115 basis points. Additionally, the framework incorporates a capital charge of 60 basis points, representing the cost of regulatory capital required for this exposure multiplied by the bank’s target return on equity of 12%. With the customer paying SONIA + 240 basis points, the division realizes a risk-adjusted margin of 65 basis points after accounting for both funding costs and capital consumption. This integrated approach enables the bank to evaluate business performance on a fully risk-adjusted basis, identifying activities that genuinely create shareholder value after all costs are appropriately allocated. The implementation of this methodology resulted in a strategic reallocation of resources toward higher-return segments and informed several divestiture decisions for capital-intensive, low-return business lines. Organizations engaged in UK company formation with intentions to establish or acquire financial services operations would benefit from understanding these integrated performance measurement approaches.

FTP in Times of Financial Stress: Lessons from Historical Crises

Financial crises provide illuminating insights into the resilience and adaptability of Funds Transfer Pricing methodologies under extreme market conditions. The 2008 global financial crisis and the more recent COVID-19 market disruption offer particularly instructive examples. During the 2008 crisis, many banking institutions discovered fundamental weaknesses in their FTP frameworks, specifically their inability to appropriately capture dramatically widening liquidity premiums and credit spreads. A prominent UK bank with significant international operations saw its internal liquidity premiums for 5-year funding increase from 25 basis points pre-crisis to over 200 basis points during the market turmoil. The bank’s legacy FTP system, which updated rates only monthly, failed to reflect this rapid deterioration, leading to continued origination of new loans at inadequate spreads. Following this experience, the bank implemented a more responsive FTP framework with daily updates for volatile components and stress-testing capabilities. This enhanced system proved invaluable during the COVID-19 market disruption in March 2020, when similar liquidity pressures emerged. The bank’s treasury function rapidly adjusted FTP rates to reflect deteriorating market conditions, sending appropriate pricing signals to business units and curtailing unprofitable lending activities. According to the Financial Stability Board’s report on COVID-19 financial market impacts, institutions with dynamic, market-sensitive FTP frameworks demonstrated superior financial resilience compared to peers with less sophisticated systems. Companies engaged in online company formation in the UK should consider these crisis management aspects when establishing financial services operations with significant market exposures.

FTP for Non-Maturing Deposits: Behavioral Modeling Example

The treatment of non-maturing deposits (NMDs) represents one of the most challenging aspects of Funds Transfer Pricing due to their indeterminate contractual maturity yet typically stable behavioral characteristics. A sophisticated practical example involves a UK retail bank with a £15 billion portfolio of current accounts (checking accounts) paying minimal or no interest. The bank’s treasury function employs advanced statistical modeling to analyze the stability characteristics of these deposits, incorporating factors such as customer segment, account balance size, relationship tenure, and historical balance volatility. This analysis reveals that approximately 70% of the current account balances exhibit "core" characteristics, with an estimated average duration exceeding 5 years despite their contractual overnight maturity. Based on this behavioral assessment, the treasury assigns a blended FTP credit rate to the retail division that substantially exceeds overnight rates, reflecting the long-term stable funding value these deposits provide to the institution. Specifically, the retail division receives an FTP credit of 2.45% on these balances, composed of a weighted average of rates across the implied behavioral maturity spectrum. With the division paying customers an average rate of 0.15% on these accounts, it realizes a substantial margin contribution of 2.30% or approximately £345 million annually. This example demonstrates how sophisticated behavioral modeling directly translates into material financial outcomes through the FTP mechanism. According to research published in the Journal of Banking Regulation, institutions employing advanced behavioral modeling in their FTP frameworks demonstrate superior interest margin stability during interest rate cycles compared to banks using simpler methodologies. For organizations considering how to issue new shares in a UK limited company, understanding these banking valuation principles may provide relevant insights for capital raising activities.

Cross-Border and Multi-Currency FTP: Practical Framework for International Banks

International banking groups face additional complexity in implementing Funds Transfer Pricing across multiple currencies and jurisdictions. A practical framework example involves a global financial institution with significant operations in the UK, Eurozone, and United States. This organization implements a coordinated yet locally sensitive FTP approach that accounts for currency-specific factors while maintaining methodological consistency. The bank’s central treasury function establishes currency-specific yield curves for each major operating currency (GBP, EUR, USD), incorporating the appropriate reference rates (SONIA, €STR, SOFR) and market-based risk premiums. These base curves are then augmented with jurisdiction-specific factors including local regulatory requirements, country risk premiums, and market liquidity considerations. For cross-currency transactions, the framework incorporates the cost of cross-currency basis swaps to ensure accurate pricing of funds transferred between different currency zones. For example, a EUR-denominated loan booked in the bank’s UK entity but funded through USD resources incurs an additional FTP charge reflecting the cross-currency basis spread between EUR and USD for the corresponding tenor. This sophisticated approach enables the bank to make informed decisions regarding multi-currency asset-liability composition and cross-border capital allocation. The implementation of this comprehensive framework revealed previously obscured profitability distortions in certain cross-border business lines, leading to strategic portfolio adjustments. Organizations engaged in international banking with nominee director service UK arrangements should be particularly attentive to these cross-border financial mechanisms and their implications for governance and oversight.

Funds Transfer Pricing and Environmental, Social, Governance (ESG) Considerations

The integration of Environmental, Social, and Governance (ESG) considerations into Funds Transfer Pricing frameworks represents an emerging frontier for forward-thinking financial institutions. A pioneering example involves a UK-headquartered international banking group that has modified its FTP methodology to incorporate ESG factors. This institution implements preferential FTP pricing for lending activities that meet specific sustainability criteria or contribute to the bank’s climate commitments under the Net-Zero Banking Alliance. For instance, the bank’s treasury assigns a 10-15 basis point FTP discount to qualifying green loans, renewable energy project financing, and sustainability-linked lending facilities. This adjustment effectively subsidizes these activities by lowering their internal funding cost. Conversely, certain carbon-intensive financing activities incur an FTP surcharge of 5-20 basis points, reflecting the bank’s assessment of transition risks and potential future carbon pricing impacts. On the liability side, funds raised through green bond issuances receive preferential treatment in the FTP framework, with the benefit partially passed through to qualifying green assets. This innovative approach creates tangible economic incentives for business units to shift their portfolios toward more sustainable activities while maintaining overall financial discipline. According to the Network for Greening the Financial System, financial institutions incorporating climate considerations into their internal pricing mechanisms demonstrate accelerated progress toward portfolio decarbonization targets. Companies engaged in setting up an online business in UK with sustainability objectives may benefit from understanding these emerging financial mechanisms when establishing banking relationships.

Technology and Data Requirements for Effective FTP Implementation

The successful implementation of a sophisticated Funds Transfer Pricing framework demands robust technological infrastructure and comprehensive data management capabilities. A practical example involves a mid-sized UK bank that recently modernized its FTP system as part of a broader finance transformation initiative. The bank’s legacy approach relied on spreadsheet-based calculations, manual data transfers, and monthly updates, resulting in pricing latency and analytical limitations. The modernized system integrates directly with core banking platforms, market data providers, and risk systems to enable daily FTP rate calculations based on current market conditions and updated behavioral models. This technology foundation supports granular analysis at the individual account level rather than broader product averages, revealing previously obscured profitability patterns. For instance, when examining its mortgage portfolio through this enhanced system, the bank identified specific vintage years and customer segments with materially different prepayment behaviors, leading to refined FTP adjustments for prepayment risk. The implementation required significant investment in data architecture, establishing a unified data model for product characteristics, contractual terms, behavioral parameters, and market indicators. The resulting capabilities enable sophisticated simulation analyses, allowing treasury and business units to assess the profitability impact of various interest rate scenarios, liquidity conditions, and business strategies. According to the Banking Technology Journal, institutions that invest in advanced analytical capabilities for FTP demonstrate superior pricing responsiveness during market disruptions and more effective balance sheet optimization. Organizations engaged in UK ready-made companies acquisition for financial services operations should carefully evaluate the technology infrastructure required to support sophisticated financial management systems.

Governance and Controls for FTP: Best Practices Framework

The governance structure surrounding Funds Transfer Pricing constitutes a critical component of its effective implementation, particularly for international banking groups subject to multiple regulatory regimes. A comprehensive best practices framework emerges from examining a major UK-based international banking group’s approach. This institution established a dedicated FTP Committee with representation from treasury, finance, risk management, and business divisions, reporting directly to the Asset and Liability Committee (ALCO). The FTP Committee maintains oversight responsibility for methodology development, parameter calibration, exception handling, and periodic validation. Key control elements include mandatory independent validation of all FTP models by the bank’s Model Risk Management function, with particular focus on behavioral assumptions and option cost calculations. The framework requires quarterly back-testing of key FTP components against actual market conditions and annual comprehensive review by internal audit. Documentation standards mandate detailed methodological documentation, including the rationale for all premium components, data sources, and calculation procedures. Formal appeal procedures allow business units to challenge specific FTP determinations through a structured process, requiring substantive justification rather than merely seeking more favorable terms. This governance framework ensures that FTP fulfills its role as an objective mechanism for internal value attribution while maintaining alignment with the bank’s overall risk appetite and strategic objectives. According to regulatory guidance from the Prudential Regulation Authority, robust governance of internal pricing mechanisms represents an essential element of effective risk management for financial institutions. Organizations considering being appointed director of a UK limited company in the financial services sector should understand these governance requirements and associated fiduciary responsibilities.

Future Directions in Funds Transfer Pricing: Emerging Trends and Innovations

The evolution of Funds Transfer Pricing continues unabated, with several emerging trends reshaping its implementation across the banking industry. Machine learning techniques are increasingly being deployed to enhance behavioral modeling capabilities, particularly for complex products with embedded optionality. A leading UK banking group has implemented neural network models to predict prepayment behavior in its mortgage portfolio, capturing non-linear relationships between prepayment rates and variables including interest rate differentials, housing price movements, and customer demographics. This advanced modeling has refined option cost calculations within their FTP framework, improving pricing accuracy for fixed-rate lending products. Real-time FTP represents another frontier, with several institutions developing capabilities to calculate transaction-specific FTP rates at the point of origination rather than relying on product averages or periodic updates. This granularity enables precise risk-based pricing at the individual customer level. Climate risk integration continues to advance, with methodological refinements to quantify transition and physical risks within FTP frameworks. Several European banks have implemented sophisticated approaches to incorporate carbon pricing scenarios into their long-term FTP curves for carbon-intensive sectors. Additionally, quantum computing applications for complex FTP simulations are being explored by technology-forward institutions, particularly for scenarios requiring massive computation across multiple risk factors and time horizons. According to the Bank for International Settlements, these technological advancements will continue to enhance the precision and responsiveness of internal capital allocation mechanisms within financial institutions. Organizations engaged in directors’ remuneration structures for financial services companies should consider how these emerging capabilities may influence performance evaluation frameworks and incentive alignment.

Expert Guidance for International Banking and Tax Optimization

Navigating the intricate intersection of Funds Transfer Pricing, international taxation, and banking regulation requires specialized expertise and a comprehensive understanding of cross-border financial mechanisms. The implementation of an effective FTP framework carries significant implications not only for internal performance measurement but also for tax optimization, regulatory compliance, and strategic decision-making. For multinational financial institutions, particular attention must be paid to ensuring FTP methodologies align with transfer pricing regulations across all operating jurisdictions while supporting business objectives. Financial institutions must regularly review and update their FTP frameworks to reflect evolving market conditions, regulatory requirements, and strategic priorities. The failure to maintain robust FTP mechanisms can result in misallocated resources, mispriced products, and potential regulatory or tax challenges. The increasing scrutiny from tax authorities regarding profit allocation within financial groups makes this an especially critical consideration for internationally active banks. Through meticulous design, implementation, and governance of FTP systems, financial institutions can create a solid foundation for sustainable profitability, efficient capital allocation, and regulatory compliance in an increasingly complex global environment.

Comprehensive FTP Consulting Services at LTD24

If you’re seeking expert guidance to navigate the complexities of Funds Transfer Pricing and international banking taxation, we invite you to schedule a personalized consultation with our specialized team.

We are a boutique international tax consulting firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating on a global scale.

Our advisory team includes specialists with extensive experience in banking treasury operations, financial regulation, and cross-border taxation who can assist your organization in developing or refining FTP frameworks that align with both business objectives and regulatory requirements.

Schedule a session with one of our experts now for $199 USD/hour and receive concrete answers to your corporate taxation and financial questions. Book your consultation today.

Marcello is a Certified Accountant at Ltd24, specialising in e-commerce businesses and small to medium-sized enterprises. He is dedicated to transforming complex financial data into actionable strategies that drive growth and efficiency. With a degree in Economics and hands-on expertise in accounting and bookkeeping, Marcello brings clarity and structure to every financial challenge. Outside of work, he enjoys playing football and padel.

Comments are closed.