Corporate Tax UK Rates: Complete Breakdown

28 November, 2025

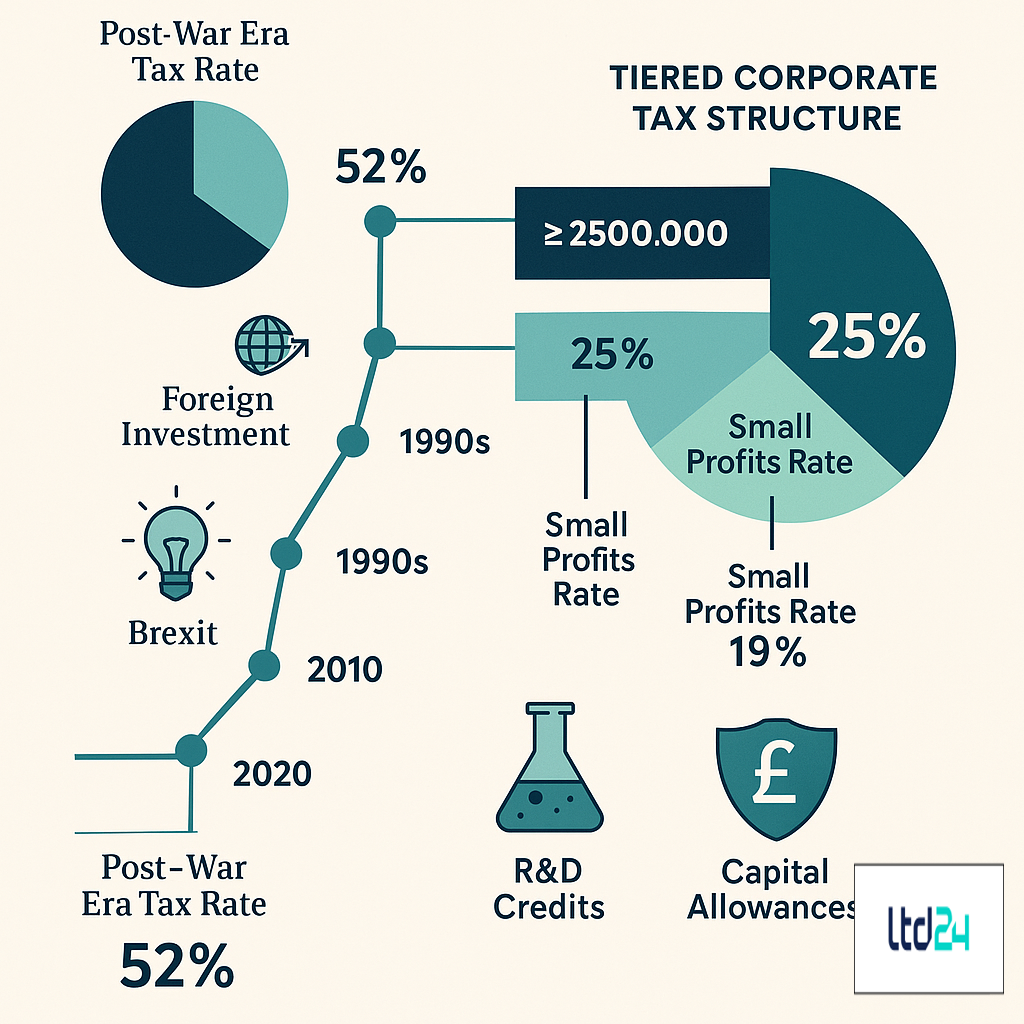

Historical Evolution of Corporate Taxation in the United Kingdom

The corporate tax framework in the United Kingdom has undergone significant transformations over the past decades, reflecting broader economic policy objectives and international taxation trends. Initially established in the post-war era, the corporate tax system has witnessed a gradual reduction in headline rates from the highs of 52% in the 1970s to the current competitive levels. This downward trajectory represents a deliberate fiscal strategy to enhance the UK’s business environment and attract foreign direct investment. The Finance Act of 2010 marked a pivotal shift, initiating a series of rate reductions that positioned the UK advantageously within the global tax landscape. The taxation history demonstrates the delicate balance successive governments have maintained between revenue generation and economic stimulation, particularly evident in the aftermath of financial crises and during Brexit preparations. For businesses considering company incorporation in the UK, understanding this historical context provides valuable insights into the stability and predictability of the UK’s fiscal approach.

Current Corporate Tax Rate Structure

As of fiscal year 2023/24, the main rate of corporation tax in the United Kingdom stands at 25% for companies with profits exceeding £250,000. However, the UK employs a graduated system with a Small Profits Rate of 19% applicable to businesses with profits below £50,000. Companies with profits between these thresholds face a marginal relief calculation that effectively creates a tapered rate. This tiered structure represents a significant departure from the previous flat rate system and aims to provide proportional tax burdens aligned with business scale and profitability. The marginal relief formula employs a complex calculation: (main rate – small profits rate) × (upper limit – profits) ÷ (upper limit – lower limit) × profits ÷ main rate. Notable exemptions exist for certain investment companies, charitable organizations, and some specialized business structures. For international entrepreneurs considering a UK company formation for non-residents, these differentiated rates offer potential advantages compared to flat-rate jurisdictions, particularly for early-stage ventures operating below the higher threshold.

The Marginal Relief System: Practical Applications

The marginal relief system introduced in April 2023 creates a progressive taxation framework that warrants detailed examination for businesses with profits falling between £50,000 and £250,000. This system functions as a mathematical sliding scale designed to smooth the transition between the 19% Small Profits Rate and the 25% Main Rate. To illustrate with a practical example: a company with taxable profits of £100,000 would initially face a headline tax liability of £25,000 (at 25%), but the marginal relief calculation would reduce this burden substantially. The formula [(25% – 19%) × (£250,000 – £100,000) ÷ (£250,000 – £50,000) × £100,000 ÷ 25%] would yield a relief of approximately £3,000, resulting in an effective tax rate of 22%. This mechanism is particularly beneficial for growing businesses navigating the threshold boundaries. Financial planning strategies might include accelerating capital allowance claims or deferring revenue recognition across accounting periods to optimize positioning within these bands. Companies considering setting up a limited company in the UK should incorporate marginal relief calculations into their financial projections to accurately assess tax implications.

International Comparison and Competitiveness Analysis

The UK’s corporate tax framework must be evaluated within the broader international context to understand its competitive position. At 25% for larger businesses, the UK main rate positions slightly above the OECD average of approximately 23.5%, though the Small Profits Rate of 19% remains relatively competitive. Neighboring Ireland maintains a notably lower 12.5% rate for trading income, while France applies a 25% standard rate similar to the UK. The United States employs a 21% federal corporate tax plus varying state taxes, creating effective rates between 21-28%. Within the G7 nations, the UK positions in the middle tier of corporate tax jurisdictions. Despite recent increases, the UK retains competitive advantages through its extensive double taxation treaty network covering over 130 countries, the substantial shareholdings exemption, and the Patent Box regime offering a reduced 10% rate on qualifying intellectual property income. These supplementary features enhance the holistic competitiveness of the UK tax environment beyond headline rates alone. For multinational enterprises, these considerations are often more determinative than base rates when evaluating offshore company registration options.

Strategic Corporate Tax Planning for UK Entities

Effective corporate tax planning within the UK framework necessitates a comprehensive approach that extends beyond rate considerations. A fundamental strategy involves precise profit threshold management, particularly for businesses operating near the £50,000 or £250,000 boundaries. Strategic timing of revenue recognition, expense allocation, and investment decisions can yield substantial tax efficiencies within these margins. Capital allowance optimization presents another critical avenue, with the Annual Investment Allowance (currently £1 million until March 2026) permitting immediate tax relief on qualifying expenditures. The Research and Development (R&D) tax credit scheme offers enhanced deductions of up to 230% of qualifying expenditure for SMEs or a 13% expenditure credit for larger companies. Group relief provisions facilitate the transfer of losses between qualifying group entities, enabling consolidated tax optimization. Furthermore, the Patent Box regime’s 10% rate on qualifying intellectual property-derived income presents compelling opportunities for innovation-focused businesses. Companies engaging with UK company taxation should conduct regular strategic reviews to align corporate structure, operational decisions, and growth plans with tax efficiency objectives.

Research and Development Tax Relief: Opportunities and Limitations

The UK’s Research and Development (R&D) tax relief schemes represent one of the most significant corporate tax incentives within the system, designed to stimulate innovation and technological advancement. Small and medium-sized enterprises can access an enhanced deduction of 186% (reduced from 230% from April 2023) on qualifying R&D expenditure, effectively reducing taxable profits by an additional 86% beyond standard expense deductions. For loss-making SMEs, this can convert into a valuable tax credit payment worth up to 10% of the qualifying expenditure. Larger companies operate under the Research and Development Expenditure Credit (RDEC) scheme, providing a 20% (increased from 13% from April 2023) above-the-line credit. Qualifying expenditures encompass staff costs, subcontractor expenses, consumable materials, software licenses, and certain capital expenditures when used directly for R&D activities. Recent reforms have refined the territorial scope, requiring R&D activities to be conducted within the UK to qualify, with limited exceptions for unavoidable overseas work. For technology-focused businesses establishing through online company formation in the UK, these incentives can substantially reduce effective tax rates during developmental phases.

Tax Treatment of Dividends for Corporate Shareholders

The UK corporate tax system applies distinctive treatment to dividend income received by corporate entities, creating important considerations for holding structures and investment strategies. Generally, dividends received by UK companies from both domestic and foreign sources benefit from the dividend exemption, effectively excluding such income from corporation tax. This exemption typically applies automatically to dividends from UK companies and controlled foreign companies, while dividends from non-UK sources may qualify under various conditions, including participation exemptions. The exemption system replaces the previous tax credit mechanism and aligns with the territorial approach to corporate taxation. However, complex anti-avoidance provisions exist, particularly regarding artificial dividend arrangements, non-commercial purposes, and certain hybrid instrument scenarios. For holding companies, this regime creates significant advantages when structured appropriately, allowing efficient profit repatriation without multiple layers of taxation. Companies considering how to issue new shares in a UK limited company should carefully evaluate the dividend implications within their broader corporate structure to maximize tax efficiency throughout the ownership chain.

Capital Allowances and Investment Incentives

The UK corporate tax framework incorporates a comprehensive capital allowances system that provides tax relief for capital expenditure, effectively functioning as the tax equivalent of accounting depreciation. The Annual Investment Allowance (AIA) remains the cornerstone of this system, permitting immediate 100% tax relief on qualifying plant and machinery expenditure up to £1 million annually through March 2026. Beyond the AIA threshold, the main rate writing down allowance of 18% applies to general plant and machinery on a reducing balance basis, while special rate assets (such as integral building features and long-life assets) qualify for a 6% allowance. The temporary super-deduction scheme, which offered 130% relief, concluded in March 2023, but was succeeded by Full Expensing, offering 100% first-year allowances for qualifying expenditure on main rate assets acquired new and unused. Enhanced capital allowances for energy-efficient and environmentally beneficial technologies continue under specific schemes. For property investments, structures and buildings allowances provide a 3% straight-line relief over 33.33 years. These provisions offer significant opportunities for tax-efficient investment planning, particularly for capital-intensive businesses seeking UK company incorporation and bookkeeping services.

Loss Relief Provisions and Carry-Forward Rules

The UK corporate tax system provides flexible loss relief mechanisms that have undergone significant reforms in recent years to enhance business resilience. Under current provisions, trading losses can be carried forward indefinitely against future profits from the same trade, with companies able to offset up to 100% of profits up to £5 million. Beyond this threshold, a 50% restriction applies to the remaining profits. Crucially, the post-April 2017 reforms permit greater flexibility in utilizing carried-forward losses against profits from different income streams within the same company, removing previous trade-specific limitations. For group structures, losses can be surrendered between qualifying group companies within the same accounting period, providing immediate relief opportunities. Terminal loss relief allows losses incurred in a company’s final 12 months of trading to be carried back against profits of the preceding three years. Additionally, the temporary extended loss carry-back rule introduced during the pandemic permitted losses to be carried back for up to three years (with a £2 million cap), though this measure has now concluded. For businesses experiencing cyclical performance or in early growth stages, these provisions represent a valuable cash flow management tool when implementing UK company registration and formation strategies.

Value Added Tax Interaction with Corporate Taxation

While Value Added Tax (VAT) operates as a separate tax regime from corporation tax, the interplay between these systems creates important strategic considerations for UK companies. The standard VAT rate of 20% applies to most goods and services, with reduced rates of 5% and 0% for specific categories. The mandatory VAT registration threshold of £90,000 (increased from £85,000 in April 2024) requires businesses exceeding this turnover to register, though voluntary registration below this threshold often proves advantageous. From a corporate tax perspective, VAT-registered businesses benefit from claiming input VAT on business expenses, reducing overall costs. However, the timing differences between VAT accounting periods and corporation tax accounting periods can create cash flow implications that require careful management. Partial exemption scenarios, where businesses conduct both taxable and exempt activities, introduce complex recovery calculations that directly impact profitability and therefore corporate tax liabilities. For international businesses, the VAT treatment of cross-border transactions presents additional considerations following Brexit changes. Companies combining company incorporation in UK online with appropriate VAT planning can achieve significant operational efficiencies and competitive advantages.

Corporate Tax Implications for Groups and Holding Structures

The UK corporate tax framework provides specialized provisions for group structures that can deliver substantial efficiencies when properly implemented. The group relief system permits the surrender of current-year trading losses, excess capital allowances, and certain other deductible amounts between UK group companies (typically requiring 75% ownership). This mechanism effectively allows consolidated tax treatment while maintaining separate legal entities. For holding structures, the Substantial Shareholdings Exemption (SSE) provides a valuable capital gains tax exemption on disposals of qualifying shareholdings (generally requiring at least 10% ownership in trading companies held for at least 12 months). The dividend exemption regime typically eliminates tax on inter-company dividends, facilitating efficient profit repatriation. Controlled Foreign Company (CFC) rules apply complex tests to overseas subsidiaries to prevent artificial profit shifting, though various exemptions exist for genuinely commercial arrangements. Transfer pricing regulations require arm’s length pricing for intra-group transactions, with documentation requirements scaled according to business size. These provisions create opportunities for international businesses to establish efficient UK-centered holding structures, particularly when combined with directorship services that ensure proper governance and compliance.

Tax Residence and Permanent Establishment Considerations

Determining corporate tax residence status represents a fundamental consideration within the UK taxation framework. A company incorporated in the UK is automatically UK tax resident, while foreign-incorporated entities become UK resident if central management and control is exercised within the UK. This dual test creates important planning considerations for international structures. The UK’s extensive treaty network (covering over 130 countries) provides tie-breaker provisions where dual residence occurs, typically based on effective management location. Permanent establishment (PE) concepts determine when a non-UK company creates a taxable presence in the UK, generally requiring a fixed place of business or dependent agent with authority to conclude contracts. Recent digital economy expansions have broadened these traditional PE definitions. The Finance Act 2019 introduced a Diverted Profits Tax charging 25% on arrangements designed to avoid UK PE status artificially. For foreign businesses, determining the optimal balance between UK presence and tax exposure requires careful structuring decisions. Entrepreneurs considering setting up an online business in UK should evaluate these residence factors alongside commercial considerations to determine the most appropriate corporate structure.

Recent Reforms and Future Taxation Trends

The UK corporate tax landscape continues to evolve through ongoing reforms and anticipated future developments. The April 2023 increase to the main rate (from 19% to 25%) represented the most significant recent change, reversing a decade-long downward trajectory. This shift reflects broader international trends toward establishing minimum effective tax rates, particularly influenced by the OECD’s Pillar Two initiative implementing a global minimum 15% rate for large multinational enterprises from 2024. The UK has enacted domestic implementation of these rules through the Multinational Top-up Tax, ensuring alignment with international standards. Recent technical adjustments have also reformed loss relief utilization, research and development qualification criteria, and anti-avoidance provisions. Looking forward, the tax system appears likely to maintain the dual-rate approach while potentially introducing targeted reliefs aligned with the government’s industrial strategy objectives, particularly in green technology, advanced manufacturing, and digital services sectors. For businesses engaging in long-term planning, monitoring these developments through tax advisory services remains essential to anticipate compliance requirements and identify emerging opportunities.

Digital Services Tax and International Digital Taxation

The Digital Services Tax (DST) introduced in April 2020 represents the UK’s interim response to the taxation challenges presented by digitalized business models. This 2% revenue-based tax applies to specific digital service revenues derived from UK users where businesses exceed global revenue thresholds of £500 million and UK digital services revenues of £25 million. The tax targets search engines, social media platforms, and online marketplaces, applying to revenues deemed attributable to UK users irrespective of the business’s physical presence. Importantly, this tax operates outside the standard corporate tax framework, functioning as a distinct revenue-based levy rather than a profits-based assessment. The DST was designed as a temporary measure pending broader international consensus on digital economy taxation through the OECD’s two-pillar approach. Under these international agreements, the DST is expected to be phased out once Pillar One implementation occurs, creating a more coordinated approach to market jurisdiction taxation rights. For digital businesses establishing through formation agent services in the UK, understanding these specialized provisions and their likely evolution remains essential for accurate financial forecasting and compliance planning.

Brexit Impact on UK Corporate Taxation

The UK’s departure from the European Union has generated significant implications for the corporate tax landscape, though many fundamental domestic taxation principles remain unchanged. The most substantial impacts manifest in cross-border transaction treatments, where previously applicable EU Directives no longer provide automatic benefits. The Parent-Subsidiary Directive and Interest and Royalties Directive previously eliminated withholding taxes on qualifying intra-group payments, requiring businesses to now rely on bilateral tax treaties for relief. While the UK’s extensive treaty network mitigates many potential adverse effects, certain scenarios may face increased withholding tax costs. The UK has gained greater autonomy in setting corporate tax policy post-Brexit, though international commitments through the OECD and G20 continue to influence policy direction. VAT rules for cross-border trade have undergone substantial revisions, with Northern Ireland maintaining special provisions under the Protocol. State aid restrictions on tax incentives have been replaced by domestic subsidy control regulations that potentially permit greater flexibility in targeted relief programs. For businesses involved in cross-border European activities, these changes may necessitate structural reconsideration, potentially utilizing cross-border royalties guidance to navigate the modified landscape efficiently.

Anti-Avoidance Framework and Corporate Compliance Obligations

The UK maintains a robust anti-avoidance framework that businesses must navigate alongside standard corporate tax compliance requirements. The General Anti-Abuse Rule (GAAR) empowers tax authorities to counteract tax advantages arising from abusive arrangements, applying a "double reasonableness" test to determine whether arrangements constitute a reasonable course of action. Targeted anti-avoidance rules address specific planning techniques, including loss buying, dividend stripping, and hybrid mismatches. The Corporate Criminal Offence provisions create potential criminal liability for failing to prevent tax evasion facilitation, requiring businesses to implement reasonable prevention procedures. Mandatory disclosure rules under DAC6 (now modified post-Brexit) and the OECD’s MDR require reporting of certain cross-border arrangements. Large businesses face additional obligations under the Senior Accounting Officer regime, requiring certification of appropriate tax accounting arrangements. The uncertain tax treatment notification regime requires reporting positions where the tax treatment is uncertain and exceeds materiality thresholds. These provisions create substantial compliance obligations beyond mere calculation and payment responsibilities, necessitating robust governance frameworks. For larger organizations, working with nominee director services requires careful consideration of these compliance obligations within governance structures.

Banking and Financial Services Sector Taxation

Financial services businesses face specialized corporate tax provisions reflecting the sector’s economic significance and distinctive operational characteristics. The Bank Levy, introduced following the 2008 financial crisis, applies an additional charge based on chargeable equity and liabilities for banks with relevant aggregated liabilities exceeding £20 billion. The current rate stands at 0.10% (or 0.05% for long-term liabilities). The Bank Corporation Tax Surcharge imposes an additional 3% (reduced from 8% in April 2023) on banking company profits exceeding £100 million, creating an effective rate of 28% for larger banking entities. Specific rules govern the tax treatment of financial instruments, securities lending arrangements, and derivative contracts, with complex provisions addressing timing, characterization, and computational matters. Insurance companies operate under tailored taxation provisions accounting for technical provisions and long-term business structures. Recent reforms have addressed regulatory capital instruments and banking loss restriction rules. The financial sector also faces heightened substance requirements and transfer pricing scrutiny due to the mobility of certain activities. Financial institutions establishing a UK presence should consider specialized fund accounting services to navigate these sector-specific provisions effectively.

Corporate Tax Filing and Payment Procedures

UK corporation tax administration follows a self-assessment system requiring businesses to calculate, report, and pay their tax liabilities within specific timeframes. Companies must file an annual Corporation Tax Return (Form CT600) with HM Revenue & Customs within 12 months following the end of the accounting period, though payment deadlines operate independently from filing dates. For larger companies (with annual profits exceeding £1.5 million, adjusted for group membership), quarterly installment payments apply, with payments due in months 3, 6, 9, and 12 of the accounting period. From April 2023, very large companies (with annual profits exceeding £50 million) face accelerated payments in months 3, 6, 9, and 14 of the preceding period. Smaller companies benefit from a simpler schedule, with payment due nine months and one day after the accounting period end. Filing occurs electronically through the government gateway, requiring accounts and computations in Inline XBRL (iXBRL) format. Late filing penalties begin at £100 and escalate based on the duration and persistence of non-compliance, while interest charges apply to late payments. Companies utilizing UK business address services must ensure these facilitate timely receipt of HMRC correspondence to maintain compliance with these procedural requirements.

Expert Tax Planning: Navigating UK Corporate Taxation

Navigating the complex landscape of UK corporate taxation demands specialized expertise and strategic foresight. At LTD24, our international tax consultants provide comprehensive guidance on optimizing your corporate structure while maintaining full compliance with UK tax regulations. We understand that effective tax planning extends beyond rate calculations to encompass entity structuring, international considerations, and long-term business objectives.

Our team specializes in creating tailored solutions for businesses at every stage—from startups exploring company incorporation in the UK to established multinational enterprises seeking to optimize their global tax position. We provide ongoing support through changing regulatory landscapes, ensuring your business remains adaptable while maximizing available incentives and reliefs.

If you’re seeking expert guidance on UK corporate taxation matters, we invite you to book a personalized consultation with our specialized team. We are a boutique international tax consulting firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating globally.

Schedule a session with one of our experts now at $199 USD/hour and receive concrete answers to your tax and corporate queries: Book a Consultation.

Bruno is a sales specialist at Ltd24 and a key collaborator in lead generation. He focuses on identifying potential clients, initiating first contact, and providing the initial support needed to help them move forward with their business projects. With a degree in Economics and Commercial Sales, Bruno stands out for his analytical mindset, customer-oriented approach, and strong communication skills. His proactive attitude and commercial awareness allow him to build solid relationships from the very first interaction. Outside of work, he enjoys competing in padel tournaments.

Comments are closed.