Capital Gains Tax Allowance UK: How Much You Can Claim

28 November, 2025

Introduction to Capital Gains Tax Allowance

Capital Gains Tax (CGT) represents a significant consideration for investors, property owners, and business stakeholders in the United Kingdom. This tax is levied on the profit or ‘gain’ realized when disposing of an asset that has increased in value. Understanding the Capital Gains Tax allowance – the tax-free threshold below which no CGT becomes payable – is crucial for effective tax planning. The UK tax framework provides taxpayers with an annual exempt amount, colloquially known as the CGT allowance, which has undergone substantial modifications in recent fiscal periods. This allowance serves as a cornerstone of tax efficiency strategies, particularly for individuals with investment portfolios, property holdings, or business interests. The strategic utilization of this allowance can significantly reduce tax liabilities and enhance overall investment returns, making it an essential component of comprehensive financial planning for UK taxpayers and international investors with UK assets.

Historical Context and Recent Changes

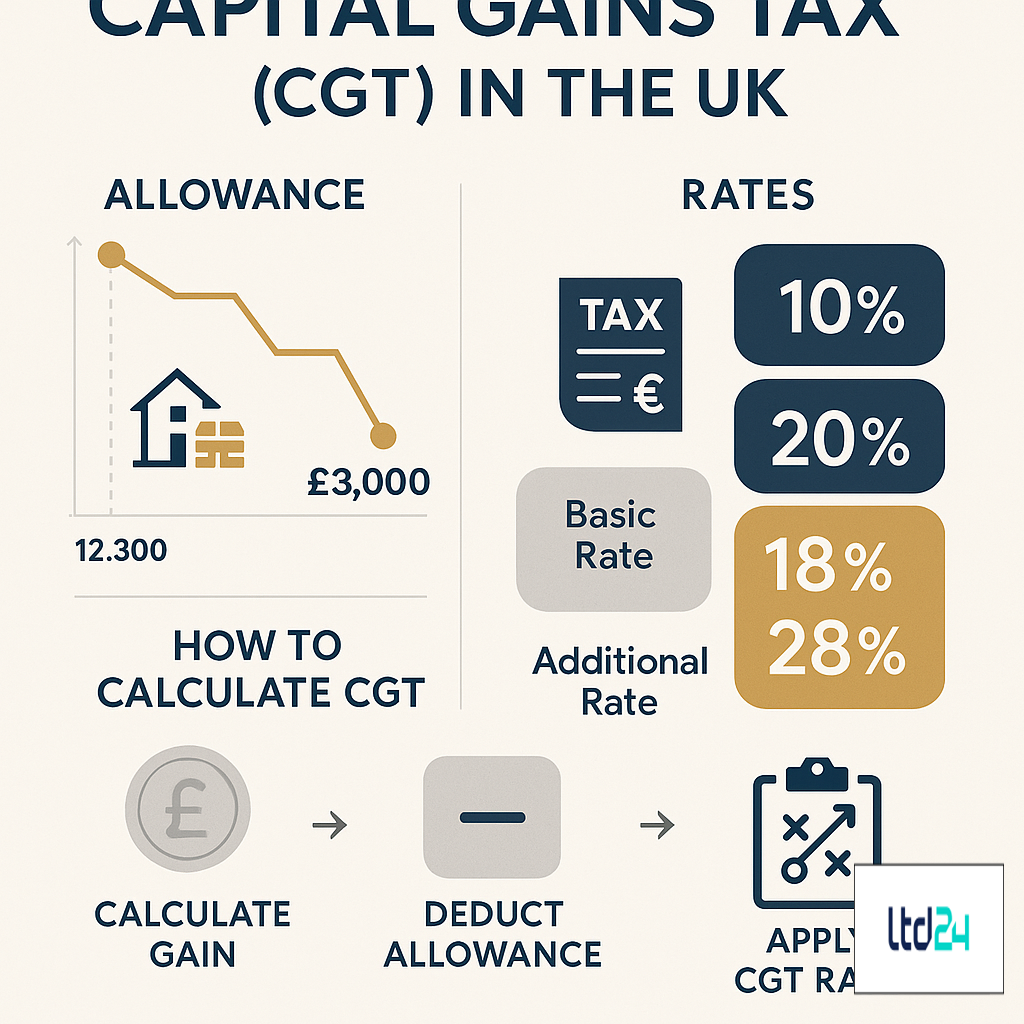

The Capital Gains Tax allowance has experienced considerable fluctuation throughout its legislative history. Historically, the allowance was designed to exclude small, incidental gains from taxation while focusing on more substantial capital appreciations. In the 2022/23 tax year, the individual CGT allowance stood at £12,300, providing taxpayers with a generous tax-free threshold. However, the fiscal landscape underwent a dramatic transformation when Chancellor Jeremy Hunt announced significant reductions to this allowance. For the 2023/24 tax year, the allowance was reduced to £6,000, representing a near 50% decrease. More notably, from April 2024, the allowance has been further diminished to £3,000 – a reduction that has profound implications for investors and property owners. This progressive contraction of the tax-free threshold reflects broader governmental efforts to increase tax revenue without directly raising headline tax rates. The historical trajectory and recent legislative amendments to the CGT allowance underscore the dynamic nature of the UK tax framework and necessitate regular reassessment of tax planning strategies for UK company formation and investment decisions.

Current CGT Rates and Thresholds

The current Capital Gains Tax framework in the UK operates on a tiered structure with rates contingent upon both the nature of the asset disposed and the taxpayer’s income tax band. For basic rate taxpayers (those with taxable income not exceeding £37,700 for 2023/24), the CGT rate stands at 10% for most assets. However, this rate increases to 18% for residential property disposals that do not qualify for Principal Private Residence Relief. Higher and additional rate taxpayers face more substantial CGT liabilities, with rates of 20% applicable to most assets and 28% for residential property. Business assets may qualify for Business Asset Disposal Relief (formerly Entrepreneurs’ Relief), potentially reducing the applicable CGT rate to 10% on qualifying disposals up to a lifetime limit of £1 million. Crucially, the annual exempt amount – currently £3,000 from April 2024 – applies before these rates are calculated, offering a modest buffer against tax liability. This intricate rate structure necessitates careful consideration of both income levels and asset types when formulating tax-efficient disposal strategies, particularly for those considering UK company incorporation or investment planning.

Calculating Your Capital Gains Tax Liability

Determining your Capital Gains Tax liability involves a methodical assessment of several financial elements. The calculation commences with establishing the ‘disposal proceeds’ – the total amount received when selling or transferring the asset. From this figure, you must deduct the ‘allowable costs’, which typically include the original acquisition cost, enhancement expenditure that has increased the asset’s value, and transaction costs such as legal fees or stamp duty. This calculation yields the ‘chargeable gain’. Subsequently, you may apply loss relief if applicable, deducting allowable losses from the current or previous tax years. The annual exempt amount (£3,000 from April 2024) is then subtracted from the remaining gain to determine the taxable amount. The appropriate CGT rate – dependent on your income tax band and the asset type – is applied to this taxable amount to compute the final tax liability. For instance, if a higher-rate taxpayer realizes a gain of £20,000 on share disposals, after deducting the £3,000 allowance, the CGT payable would be £3,400 (£17,000 × 20%). This computational process underscores the importance of maintaining comprehensive records of asset acquisitions, improvements, and disposals to ensure accurate tax reporting and UK company taxation compliance.

Strategies for Utilizing the Annual Exemption

Despite the significant reduction in the CGT allowance, strategic utilization remains vital for tax efficiency. One fundamental approach involves ‘bed and breakfasting’ – selling assets to realize gains up to the annual exemption limit and subsequently repurchasing similar investments. However, the 30-day rule prevents immediate repurchase of identical securities without tax consequences; alternatives include utilizing spouse transfers or ‘bed and ISA’ arrangements to circumvent these restrictions. Timing disposals across tax years represents another effective strategy, potentially allowing utilization of multiple annual exemptions. For married couples or civil partners, transferring assets between spouses (which occurs on a no-gain/no-loss basis) before disposal can effectively double the available allowance. Portfolio diversification not only mitigates investment risk but also creates multiple distinct assets whose disposal can be strategically staggered across tax years. For business owners, particularly those with UK limited companies, judicious timing of share disposals in conjunction with other income planning can optimize the utilization of available exemptions and potentially qualify for Business Asset Disposal Relief. These strategies demonstrate how thoughtful planning can maximize the benefit derived from even the reduced CGT allowance.

CGT for Property Investors and Second Homeowners

Property investors and second homeowners face particularly significant CGT implications following the reduction in the annual exemption. Unlike one’s principal residence, which typically qualifies for Principal Private Residence Relief (PPR), additional properties are fully subject to CGT upon disposal. With rates at 18% for basic-rate taxpayers and 28% for higher and additional-rate taxpayers specifically for residential property, the tax burden can be substantial. For instance, a higher-rate taxpayer selling a rental property with a gain of £50,000 would, after applying the £3,000 allowance, face a CGT liability of £13,160 (£47,000 × 28%). Strategic considerations for property investors include evaluating the timing of disposals, potentially spreading them across multiple tax years to utilize multiple annual exemptions. Transferring partial ownership to a spouse or civil partner before disposal can also prove advantageous. Additionally, investors should meticulously document all allowable expenses, including acquisition costs, improvement expenditures, and selling expenses, as these reduce the chargeable gain. For international investors considering UK property investments through company structures, understanding the interplay between CGT, corporate tax regimes, and potential double taxation agreements becomes paramount to effective tax planning.

Business Assets and Entrepreneurs’ Relief (Now BADR)

Business Asset Disposal Relief (BADR), formerly known as Entrepreneurs’ Relief, presents a valuable tax advantage for business owners and shareholders when disposing of qualifying business assets. This relief reduces the applicable CGT rate to a flat 10% on qualifying disposals, substantially below the standard rates of 20% for higher-rate taxpayers. However, BADR is subject to a lifetime limit of £1 million in gains, significantly reduced from the previous £10 million threshold. To qualify for BADR, specific conditions must be satisfied: for business disposals, the individual must have been a sole trader or business partner for at least two years; for company shares, the individual must be both an officer or employee and hold at least 5% of ordinary shares with voting rights for the same duration. The qualifying business must be a trading entity rather than an investment vehicle. Strategic considerations for maximizing BADR benefits include ensuring compliance with the qualifying criteria well before planned disposals and potentially restructuring shareholdings to optimize eligibility. For entrepreneurs establishing UK limited companies, early consideration of future exit strategies and corresponding BADR implications can yield significant tax advantages. Given the complexity of qualification criteria, seeking specialized tax advice prior to business disposals or share transfers is highly advisable.

International Aspects of UK Capital Gains Tax

The international dimensions of UK Capital Gains Tax introduce additional complexities for non-UK residents, expatriates, and those with cross-border investments. Non-UK residents are generally exempt from UK CGT on most asset disposals except for UK residential property and assets used in a UK trade. Since April 2019, non-UK residents disposing of UK commercial property and land have also been brought within the scope of UK CGT. For UK residents with overseas assets, global gains are typically subject to UK CGT, though relief may be available under double taxation agreements to prevent taxation of the same gain in multiple jurisdictions. The ‘temporary non-residence’ rules warrant particular attention – individuals who become non-UK resident but return within five tax years may find gains realized during their absence retrospectively subject to UK taxation. For those considering UK company formation for non-residents, the interaction between corporate structures, personal tax status, and CGT liability requires careful analysis. The UK’s extensive network of tax treaties, while designed to prevent double taxation, varies significantly in its provisions regarding capital gains, necessitating country-specific assessment when structuring international investments. These international aspects underscore the importance of jurisdiction-specific tax planning for globally mobile individuals and investors with cross-border holdings.

Reporting and Payment Requirements

The reporting and payment framework for Capital Gains Tax has undergone significant transformation in recent years, introducing more stringent timelines particularly for property disposals. For UK residential property disposals made on or after 6 April 2020, a specific UK Property Account submission to HMRC is required within 60 days of completion, accompanied by payment of the estimated CGT. This accelerated reporting requirement represents a substantial departure from the previous system where all gains were reported through the Self Assessment tax return after the tax year’s conclusion. For non-property assets, gains must still be reported through the annual Self Assessment tax return, due by 31 January following the tax year of disposal. Digital reporting through the HMRC online services portal has become the standard method for CGT declarations, requiring comprehensive documentation of acquisition costs, improvement expenditures, and disposal proceeds. Failure to comply with these reporting deadlines can result in substantial penalties – an initial £100 penalty for late submission, with escalating penalties for prolonged non-compliance. For businesses and UK company directors, these reporting requirements add an additional layer of compliance consideration when planning asset disposals or corporate restructuring. The accelerated payment timeline for property transactions also has significant cash flow implications, requiring advance planning for tax liabilities.

CGT Deferral and Reliefs

Despite the narrowing scope of Capital Gains Tax allowances, various deferral mechanisms and reliefs remain available to mitigate or postpone tax liabilities. Rollover Relief provides for deferral of gains on business assets when the proceeds are reinvested in qualifying replacement business assets within a specified timeframe. Similarly, Holdover Relief allows for the deferral of CGT on the gift of business assets or shares in certain circumstances. Enterprise Investment Scheme (EIS) investments offer another deferral opportunity – gains reinvested into qualifying EIS companies within a specified period can defer the original CGT liability until the EIS shares are subsequently disposed of. Gift Relief permits the postponement of CGT when assets are gifted, with the recipient essentially inheriting the transferor’s acquisition cost. For residential property, Principal Private Residence Relief exempts gains on one’s main home, while Lettings Relief may provide partial exemption for properties that have been both a main residence and let as residential accommodation. For business owners conducting UK company incorporation, understanding how these reliefs interact with corporate structures and shareholder transactions can yield significant tax advantages. These various reliefs and deferral mechanisms, while increasingly restricted, continue to offer valuable planning opportunities for those with comprehensive understanding of their application.

Impact of the Reduced Allowance on Investment Strategies

The dramatic reduction in the Capital Gains Tax allowance from £12,300 to just £3,000 necessitates a fundamental reassessment of investment strategies for UK taxpayers. This contraction effectively increases the tax burden on investment gains, potentially altering the relative attractiveness of different asset classes and holding structures. Tax-advantaged accounts such as Individual Savings Accounts (ISAs) and pension wrappers have become increasingly valuable, as gains within these vehicles remain entirely exempt from CGT regardless of size. The reduced allowance has also enhanced the comparative appeal of investment assets generating returns primarily through income rather than capital appreciation, particularly for higher-rate taxpayers where the differential between income tax and CGT rates has narrowed. For active investors, more frequent realization of smaller gains to utilize the annual allowance may prove optimal, contrasting with previous strategies that might have favored allowing larger gains to accumulate. The diminished allowance particularly impacts property investors, potentially influencing decisions between direct property ownership and investment via Real Estate Investment Trusts (REITs) or property funds. For business owners considering UK company formation versus direct asset ownership, the corporate tax regime may now present more favorable treatment for capital gains in certain scenarios. This shifting landscape underscores the need for regular review and potential restructuring of investment portfolios in response to tax framework changes.

Comparing CGT Rates Internationally

The UK’s Capital Gains Tax regime exhibits distinctive characteristics when positioned within an international context. With basic rates of 10% and 18% for residential property, escalating to 20% and 28% for higher-rate taxpayers, the UK’s CGT rates occupy a moderate position among developed economies. The United States, by comparison, employs a more complex structure with rates ranging from 0% to 20% based on income brackets, plus an additional 3.8% Net Investment Income Tax for high-income taxpayers, but significantly, offers preferential treatment for long-term capital gains (assets held over one year). Germany imposes a flat 25% rate plus solidarity surcharge on investment assets but exempts property held for over ten years. Notable outliers include Switzerland, where most cantons exempt capital gains on movable private assets entirely, and New Zealand, which generally does not impose CGT except in specific circumstances. The progressive reduction of the UK’s annual exempt amount has diminished one of the previously generous aspects of its CGT regime. For international investors considering setting up businesses in the UK, these comparative tax considerations may influence jurisdiction selection and investment structuring. This international perspective highlights how tax competition between nations creates diverse approaches to capital gains taxation, with varying emphases on factors such as holding periods, asset types, and taxpayer characteristics.

Planning for Inheritance Tax and CGT Interaction

The intricate relationship between Capital Gains Tax and Inheritance Tax (IHT) presents both challenges and planning opportunities. While CGT is triggered by disposal during lifetime, IHT applies to the value of estates upon death. Crucially, death is not considered a CGT disposal event; instead, assets receive a ‘tax-free uplift’ to their market value at death, effectively wiping out any latent capital gain. This interaction creates a fundamental tension in estate planning: lifetime gifts may trigger immediate CGT liability but potentially reduce future IHT, whereas retention until death eliminates CGT but exposes the full asset value to potential IHT at 40%. Strategic approaches include considering the relative size of potential CGT versus IHT liabilities, utilization of annual gift exemptions for IHT purposes, and exploration of holdover relief for certain business assets. For family businesses, Business Property Relief for IHT may provide up to 100% relief on qualifying business assets, creating powerful incentives for retention until death rather than lifetime disposal. The incorporation of family investment companies or trusts may also offer opportunities to balance CGT and IHT considerations, particularly when combined with UK company structures for asset holding. Given the potentially significant tax implications of the CGT-IHT interaction, comprehensive estate planning that addresses both tax regimes simultaneously is essential for high-net-worth individuals and business owners.

CGT and Share Disposals in Limited Companies

The disposal of shares in limited companies presents distinct CGT considerations that merit specialized attention. For individuals holding shares directly, the standard CGT rates apply – 10% for basic-rate taxpayers and 20% for higher-rate taxpayers (subject to available allowances). Business Asset Disposal Relief may reduce this to 10% on qualifying shareholdings up to the lifetime limit of £1 million. Share-for-share exchanges, where shares in one company are exchanged for those in another as part of a corporate reorganization, can potentially qualify for CGT deferral under specific conditions. For shareholders in UK limited companies, the distribution of capital upon winding up may be treated as a capital distribution rather than income, potentially benefiting from CGT treatment rather than income tax. However, targeted anti-avoidance rules aim to prevent exploitation of this treatment where businesses are wound up and then similar activities are resumed shortly thereafter. Employee share schemes present another dimension, with specific tax treatments applying to various approved schemes such as Enterprise Management Incentives (EMI), Share Incentive Plans (SIPs), and Company Share Option Plans (CSOPs). For entrepreneurs establishing business structures in the UK, early consideration of share structures and potential exit strategies can yield significant tax advantages. Given the technical complexity of share disposals, particularly in corporate reorganization contexts, specialist tax advice is strongly recommended before proceeding with significant share transactions.

Digital Record Keeping for CGT Compliance

Effective digital record-keeping has become increasingly essential for Capital Gains Tax compliance, particularly given the reduced allowance that brings more disposals within the taxable threshold. Comprehensive documentation must be maintained for asset acquisitions, including purchase price, acquisition costs such as legal fees or stamp duty, and the precise acquisition date. Throughout the ownership period, records of enhancement expenditures that have increased the asset’s value should be preserved, as these constitute allowable deductions when calculating the chargeable gain. Upon disposal, evidence of the disposal proceeds and associated costs is similarly required. For property transactions, this documentation burden is especially significant, encompassing purchase contracts, improvement invoices, and sale agreements. Various digital platforms and applications now facilitate this record-keeping process, offering secure storage of documentation and automatic calculation of potential tax liabilities. HMRC’s own Making Tax Digital initiative, while not yet fully implemented for CGT, signals the direction of travel toward digital submission requirements. For businesses and company directors in the UK, integration of personal and business record-keeping systems can enhance compliance efficiency. Establishing robust digital record-keeping practices not only ensures regulatory compliance but also facilitates strategic tax planning by providing immediate visibility of potential tax implications prior to asset disposals.

Future Trends and Potential CGT Reforms

The trajectory of Capital Gains Tax policy in the UK suggests continued evolution in this complex area of taxation. Tax policy experts and fiscal commentators have identified several potential directions for future reform. The alignment of CGT rates with income tax rates represents one frequently discussed possibility, which would eliminate the current differential that sees capital gains taxed at lower rates than equivalent income. The Office of Tax Simplification has previously recommended such an approach, though political considerations may impede implementation. Further restriction of reliefs, particularly Business Asset Disposal Relief, remains a possibility given the trend toward narrowing tax advantages for entrepreneurs. The annual exempt amount, having already been substantially reduced, may face further contraction or potentially complete elimination in favor of a de minimis threshold for administrative simplicity. International developments, particularly the OECD’s global minimum tax initiatives, may influence domestic CGT policy as jurisdictions seek to maintain competitive tax environments while ensuring appropriate revenue collection. For investors and business owners engaged in UK company formation, this evolving landscape necessitates regular review of structures and strategies. While specific reforms remain speculative, the general direction of travel appears to be toward more comprehensive taxation of capital gains, suggesting that proactive planning and flexibility in investment approaches will remain essential for tax efficiency in the coming years.

Case Study: Practical Application of CGT Allowances

To illustrate the practical application of CGT principles and allowances, consider the case of Sarah, a higher-rate taxpayer with diversified investments. During the 2023/24 tax year, Sarah disposed of shares acquired five years previously for £20,000, realizing proceeds of £35,000. She also sold a buy-to-let property purchased in 2010 for £150,000 (plus £3,000 in acquisition costs) for £250,000, incurring £4,000 in selling expenses. For the share disposal, Sarah’s chargeable gain is calculated as £15,000 (£35,000 – £20,000). For the property, the gain amounts to £93,000 (£250,000 – [£150,000 + £3,000 + £4,000]). Sarah’s total gains for the year therefore total £108,000. After applying her annual exemption of £6,000 (for 2023/24), Sarah allocates this preferentially against the share gain, resulting in a taxable share gain of £9,000 and unaffected property gain of £93,000. The CGT liability is calculated as £9,000 × 20% = £1,800 for the shares, and £93,000 × 28% = £26,040 for the property, yielding a total CGT liability of £27,840. Had Sarah staggered her disposals across two tax years, she could have potentially utilized two annual exemptions, reducing her overall tax burden. This case study demonstrates the significant tax implications of disposal timing, allowance utilization, and the differential treatment of various asset types under the UK CGT regime, reinforcing the importance of strategic planning for UK tax optimization.

Expert Tax Guidance: When and How to Seek Professional Advice

The complexity of Capital Gains Tax regulations, combined with the significant financial implications of disposal decisions, frequently necessitates professional tax guidance. Circumstances warranting expert consultation include high-value asset disposals, business sales or restructuring, property portfolio management, and scenarios involving international elements or multiple reliefs. When selecting a tax advisor, credentials such as chartered tax adviser status, relevant specialization in capital gains, and experience with situations similar to your own should be prioritized. The engagement process typically involves an initial consultation to assess needs, followed by a formal engagement letter outlining scope, fees, and expectations. Cost structures vary from fixed-fee arrangements for discrete projects to hourly rates for ongoing advice, with fees generally reflecting the complexity of the case and the advisor’s expertise level. The advisor-client relationship benefits from clear communication, comprehensive disclosure of relevant facts, and realistic expectations regarding outcomes. For businesses undergoing UK company incorporation or considering exit strategies, engaging tax expertise at the planning stage rather than retrospectively can yield substantial benefits. While professional advice represents an additional cost, the potential tax savings and risk mitigation frequently outweigh this investment, particularly for complex or high-value transactions. The reduced CGT allowance has amplified the importance of expert guidance, as smaller gains now exceed the exempt threshold and enter the taxable range.

Strategic Tax Planning for Your Financial Future

In light of the significant reduction in the Capital Gains Tax allowance, proactive and comprehensive tax planning has become increasingly critical for preserving and growing wealth. Strategic approaches encompass both short and long-term perspectives, combining immediate tactical decisions with broader structural planning. Regular portfolio rebalancing within tax-efficient wrappers such as ISAs and pensions maximizes the utility of these CGT-exempt vehicles. For unwrapped investments, harvesting gains up to the annual allowance prevents the accumulation of large taxable gains in future years. Family tax planning, including interspousal transfers and consideration of children’s tax positions, can effectively multiply available allowances. The integration of CGT planning with broader considerations including income tax, inheritance tax, and potential future liability for care costs ensures holistic optimization rather than siloed decision-making. For business owners, structuring decisions regarding UK company formation versus direct ownership should incorporate CGT implications of eventual exit alongside operational and commercial factors. Regular review and adaptation of tax strategies in response to both personal circumstances and legislative changes maintains optimization despite the evolving fiscal landscape. While tax efficiency represents an important consideration, it should complement rather than override fundamental investment principles including risk management, diversification, and alignment with financial goals. By adopting this balanced approach to tax planning, investors can navigate the increasingly restricted CGT environment while maintaining focus on long-term financial wellbeing.

Expert International Tax Support for Your Business Needs

If you’re navigating the complexities of Capital Gains Tax in the UK or managing international tax considerations, professional guidance can make a substantial difference to your financial outcomes. At Ltd24, we specialize in providing sophisticated tax planning strategies for businesses, investors, and high-net-worth individuals operating across multiple jurisdictions.

Our international tax consultants offer expertise in CGT optimization, business structuring, and cross-border investment planning. With the recent significant reductions to the UK Capital Gains Tax allowance, strategic tax planning has become more crucial than ever for preserving wealth and maximizing investment returns.

We provide tailored solutions that address your specific circumstances, whether you’re considering UK company formation, managing property investments, or planning business succession. Our comprehensive approach integrates CGT considerations with broader tax and business planning to ensure optimal outcomes.

Book a personalized consultation with one of our international tax experts at a rate of 199 USD/hour and receive actionable insights into managing your tax liabilities effectively. Our team will help you navigate the evolving tax landscape while maintaining full compliance with relevant regulations.

Contact us today at Ltd24.co.uk/consulting to secure your financial future with expert guidance on Capital Gains Tax and international taxation.

Marcello is a Certified Accountant at Ltd24, specialising in e-commerce businesses and small to medium-sized enterprises. He is dedicated to transforming complex financial data into actionable strategies that drive growth and efficiency. With a degree in Economics and hands-on expertise in accounting and bookkeeping, Marcello brings clarity and structure to every financial challenge. Outside of work, he enjoys playing football and padel.

Comments are closed.