Transfer Property Stamp Duty: How It Applies

28 November, 2025

Understanding Stamp Duty on Property Transfers: Foundations and Principles

Stamp Duty Land Tax (SDLT) represents a critical fiscal mechanism within the UK property taxation framework. This governmental levy applies to property acquisitions and land transfers exceeding specified financial thresholds. The fundamental rationale behind SDLT is to generate public revenue from property market transactions while simultaneously functioning as a regulatory instrument for real estate market dynamics. The tax operates on a progressive structure, with rates incrementally increasing alongside property values. For international investors and domestic purchasers alike, comprehending the nuances of SDLT constitutes an essential element of transaction planning, as failure to accurately calculate and remit this duty may result in substantial penalties, interest charges, and potential transaction complications. Property transfer stamp duty encompasses residential dwellings, commercial properties, and mixed-use assets, with distinct rate schedules applicable to each category. The legal foundation for this taxation regime derives from the Finance Act 2003, with subsequent amendments refining its application and scope through various legislative instruments and government directives.

Historical Context and Legislative Evolution of Property Transfer Taxation

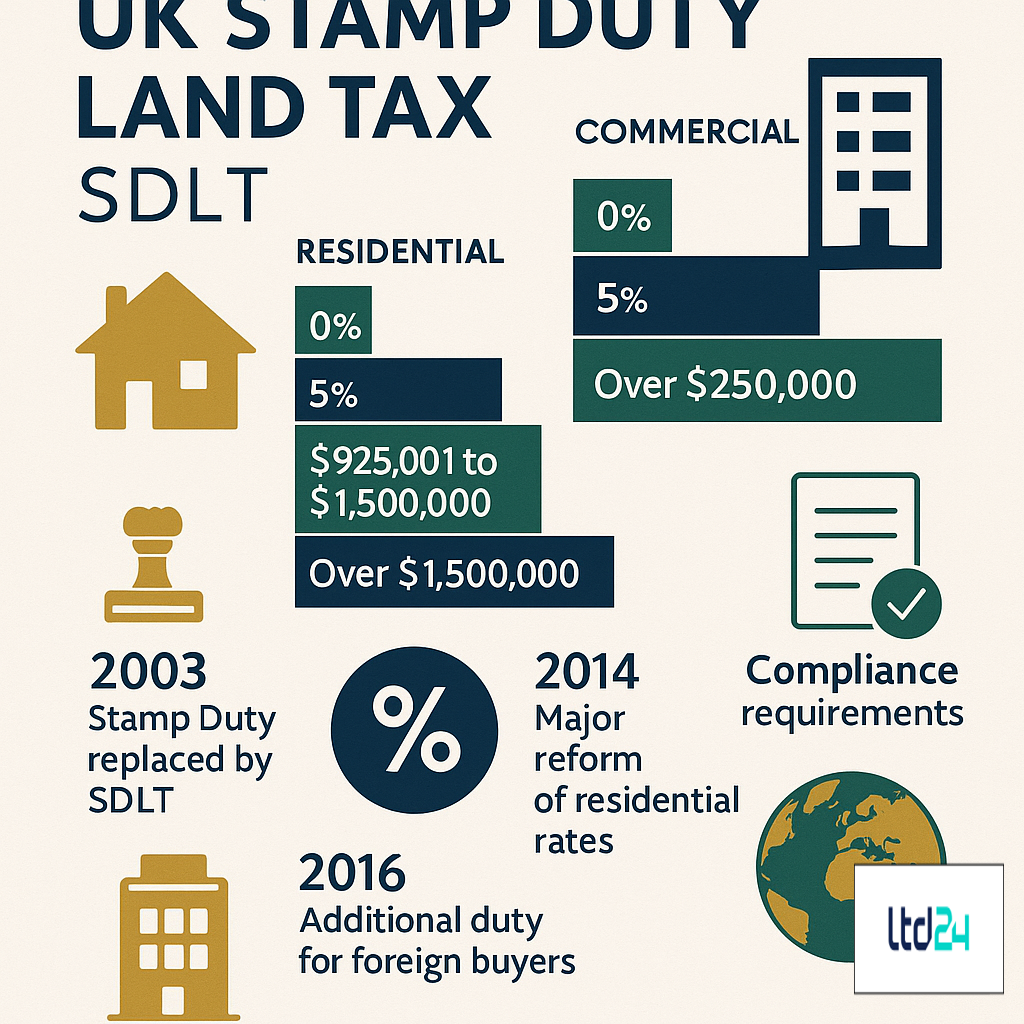

The contemporary SDLT framework emerged from centuries of fiscal development, originating in 1694 when stamp duty was first introduced in England to fund war efforts against France. This initial iteration required legal documents to bear official stamps as evidence of tax payment. The system underwent substantial transformation in 2003 when Stamp Duty Land Tax replaced traditional stamp duty on land transactions, establishing a more structured and comprehensive property taxation regime. Subsequent legislative modifications have repeatedly altered rate structures, thresholds, and exemption criteria in response to shifting economic conditions and housing market considerations. Notably, the 2014 reforms eliminated the previous "slab" system in favor of a progressive marginal rate calculation methodology, fundamentally altering the taxation mechanics for property transfers. Further significant amendments occurred in 2016 with the introduction of higher rates for additional residential properties, and in 2017 with first-time buyer relief provisions. These historical developments have shaped a complex fiscal landscape that requires specialized expertise in UK company taxation for optimal navigation and compliance.

Current SDLT Rate Structure for Residential Properties

The prevailing residential property transfer stamp duty framework operates on a tiered structure, with distinct rate brackets applying to progressive portions of a property’s purchase price. For standard residential transactions by existing homeowners, as of April 2021, no SDLT is payable on the first £125,000 of consideration. Subsequently, a 2% rate applies to the portion between £125,001 and £250,000, followed by 5% on the segment from £250,001 to £925,000, rising to 10% for the slice between £925,001 and £1.5 million, and culminating in a 12% rate for any remaining amount exceeding £1.5 million. First-time buyers benefit from an elevated threshold, with SDLT exemption on the initial £300,000 for properties valued up to £500,000. Conversely, purchasers of additional residential properties face a 3% surcharge applied to all standard rate bands, significantly increasing the fiscal burden for property investors and second-home acquisitions. These rate configurations function as crucial determinants in transaction structuring and investment strategy formulation, particularly for foreign investors exploring UK company formation for non-residents. The precise application of these rates demands meticulous calculation, as misconceptions regarding rate application to purchase price can lead to substantial financial miscalculations.

Commercial Property SDLT Considerations and Differential Treatment

Commercial property transfers operate under a distinct SDLT regime with different thresholds and rate structures compared to residential transactions. Currently, commercial properties benefit from a zero-rate band on the first £150,000 of consideration, followed by a 2% rate applicable to the portion between £150,001 and £250,000, and a 5% rate imposed on any value exceeding £250,000. This differentiated treatment reflects policy objectives to support business investment and commercial development. Mixed-use properties—those combining residential and commercial elements—qualify for commercial rates, potentially yielding substantial tax efficiency for strategically structured acquisitions. The classification determination between commercial, residential, and mixed-use categories frequently presents interpretive challenges, with significant tax implications hinging on correct categorization. Recent judicial decisions, including the landmark Prudential Assurance case, have clarified classification criteria while simultaneously introducing nuanced considerations regarding predominant use assessment. For international businesses considering UK company incorporation, these differential treatments warrant careful evaluation within broader investment strategies, particularly when commercial property holdings constitute integral components of corporate structures.

SDLT Exemptions, Reliefs, and Special Provisions

The SDLT framework incorporates numerous exemptions and reliefs designed to address specific policy objectives and transaction scenarios. Multiple Dwellings Relief (MDR) offers potential tax efficiency for transactions involving multiple residential properties by calculating duty based on average property value rather than aggregate purchase price. Group relief provisions enable property transfers between qualifying corporate group members without triggering SDLT liability, subject to stringent conditions regarding shared ownership percentages and commercial justification. Charities benefit from complete SDLT exemption when acquiring property for charitable purposes, while registered social housing providers may qualify for reduced rates. Specific industry sectors enjoy targeted relief mechanisms, including substantial concessions for alternative finance arrangements compliant with Sharia principles. First-time buyer relief provides meaningful tax reduction for market entrants, while strategic corporate reconstructions may qualify for specialized reliefs under specific statutory provisions. Transaction structuring to legitimately optimize SDLT liability through available exemptions represents a cornerstone of tax-efficient property investment strategy, particularly relevant for businesses considering online company formation in the UK as part of international expansion initiatives.

International Dimensions: Non-UK Residents and Additional Rate Implications

From April 2021, non-UK resident purchasers of residential property face an additional 2% SDLT surcharge beyond standard rates and the 3% higher rate for additional dwellings where applicable. This international surcharge applies to non-resident individuals, companies, partnerships, and trusts, potentially resulting in effective maximum rates of 17% for affected transactions. The residency determination follows specific statutory tests distinct from broader tax residency frameworks, creating potential complexity for international investors with multijurisdictional presence. Corporate entities face non-resident classification unless incorporated in the UK or centrally managed and controlled within UK territory. The interaction between this surcharge and existing higher rates for additional dwellings creates substantial tax implications for international investment portfolios. Comprehensive tax planning increasingly necessitates consideration of alternative acquisition structures, including potential benefits of UK company incorporation for holding property assets. Furthermore, the territorial application of SDLT extends exclusively to property situated in England and Northern Ireland, with Scotland and Wales implementing their own distinct transaction tax regimes—Land and Buildings Transaction Tax (LBTT) and Land Transaction Tax (LTT), respectively—creating additional jurisdictional considerations for investors with geographically diverse UK property portfolios.

Corporate Structure Implications for SDLT

The selection and implementation of appropriate corporate structures substantially influence SDLT outcomes in property transactions. Share acquisitions of property-holding companies potentially circumvent SDLT entirely, as the tax applies to direct land transfers rather than share transfers, though anti-avoidance provisions increasingly target artificial arrangements. Partnership structures introduce distinct SDLT treatment with specialized calculation methodologies and potential relief opportunities, particularly regarding transactions between connected persons. Corporate reorganizations involving property transfers may qualify for specific relief provisions, subject to stringent conditions regarding commercial purpose and ownership continuity. The 2016 introduction of higher rates for corporate purchasers significantly altered the commercial calculus for entity-based acquisition structures. Companies considering UK company registration should carefully evaluate these implications within comprehensive tax planning frameworks. Additionally, specific anti-avoidance rules target transactions involving linked companies and connected parties, with substance requirements increasingly scrutinized by tax authorities. The intricate interplay between corporate law, property law, and taxation necessitates specialized advisory support to navigate these complexities effectively while maintaining compliance with evolving regulatory standards.

SDLT Return Filing Requirements and Administrative Compliance

Property transfer stamp duty imposes rigorous compliance obligations regarding return submission, payment deadlines, and information disclosure. Standard SDLT returns must be filed electronically via HMRC’s online platform within 14 calendar days following the "effective date" of the transaction—typically completion date but occasionally earlier based on substantial performance criteria. This compressed timeline represents a reduction from the previous 30-day window, creating intensified pressure for transaction participants to gather, verify, and submit accurate information within strictly limited timeframes. Late filing triggers automatic financial penalties escalating with delay duration, commencing at £100 for submissions delayed by up to three months and potentially reaching £1,000 for returns filed over 12 months late. Payment must accompany the return filing, with interest accruing on late payments at rates specified by HMRC. The return requires comprehensive disclosure of transaction parameters, including consideration allocation, linked transactions, and relief claims. The completion of these administrative procedures often necessitates professional support, particularly for complex transactions involving multiple properties or unusual structural elements. For businesses establishing presence through UK company formation, integrating SDLT compliance within broader corporate governance frameworks represents an essential operational consideration.

Strategic Planning to Mitigate SDLT Liability

Legitimate SDLT mitigation represents a cornerstone of tax-efficient property transaction planning. Property value allocation between residential and commercial elements in mixed-use acquisitions may generate substantial savings through application of commercial rates to appropriately structured transactions. Consideration allocation between fixtures, fittings, and chattels—which fall outside SDLT scope—and chargeable real property elements creates opportunities for appropriate tax reduction when substantiated by proper valuation evidence. Strategic phasing of multi-property portfolio acquisitions potentially mitigates liability through multiple transactions below higher threshold triggers. Corporate reorganization relief provisions offer opportunities for intra-group property transfers without triggering full SDLT liability when properly structured. Additionally, judicious application of available statutory reliefs, including Multiple Dwellings Relief for apartment block purchases or social housing provisions, frequently yields substantial tax efficiency. For international investors, comparative analysis between direct property acquisition and corporate vehicle utilization through setting up a limited company in the UK increasingly forms an essential component of investment structuring. Critically, effective planning must maintain commercial substance and purpose beyond tax considerations to withstand potential scrutiny under General Anti-Abuse Rule (GAAR) provisions.

Recent Developments and Temporary Measures

The property transfer stamp duty landscape has experienced significant fluctuation in recent years, with multiple temporary measures implemented in response to economic conditions and housing market dynamics. The 2020-2021 "SDLT holiday" temporarily raised residential thresholds to stimulate market activity during pandemic-related economic challenges, generating unprecedented transaction volumes before phased withdrawal. The 2022 mini-budget introduced further threshold adjustments aimed at supporting market liquidity, though many provisions were subsequently rescinded following fiscal policy revisions. These interventions illustrate the increasingly active utilization of SDLT as both fiscal and economic policy instruments. Simultaneously, recent judicial decisions have refined interpretative approaches to mixed-use property classification, multiple dwellings relief application, and consideration allocation methodologies. Regulatory focus has intensified regarding artificial avoidance structures, with targeted anti-avoidance provisions addressing specific planning techniques previously utilized. For businesses engaged in online business setup in the UK, maintaining currency with these developments represents an essential element of effective tax governance. The fluid nature of this regulatory landscape necessitates continuous monitoring and adaptive strategy refinement to maintain compliance while optimizing legitimate planning opportunities.

Comparative Analysis: SDLT vs. International Property Transfer Taxes

Property transfer taxation varies substantially across major international jurisdictions, creating significant implications for cross-border investment strategies. While the UK’s SDLT system imposes progressive rates reaching 12% for high-value residential properties (plus potential 3% and 2% surcharges for certain purchasers), comparable European regimes exhibit substantial variation. France applies registration duties (droits d’enregistrement) at approximately 5.8% for existing properties, while Germany’s real estate transfer tax (Grunderwerbsteuer) ranges between 3.5% and 6.5% depending on federal state location. Spain imposes Transfer Tax (Impuesto sobre Transmisiones Patrimoniales) typically between 6% and 10%, subject to regional variation. The United States presents particularly complex jurisdictional diversity, with transfer taxes varying dramatically between states and municipalities—ranging from zero in states like Texas to combined rates exceeding 4% in certain New York City transactions. Hong Kong stands as notably aggressive with Stamp Duty reaching 15% for residential properties, plus additional duties for foreign purchasers. These international variations create strategic opportunities for sophisticated investors to structure multinational portfolios with sensitivity to jurisdictional tax efficiency. For businesses establishing international presence, consultation with experts in UK company formation for non-residents can provide valuable insights into comparative tax implications.

SDLT Anti-Avoidance Provisions and Compliance Risks

The SDLT regulatory framework incorporates increasingly sophisticated anti-avoidance measures targeting artificial arrangements designed primarily to circumvent tax liability. The General Anti-Abuse Rule (GAAR) establishes broad authority to challenge arrangements deemed abusive based on reasonableness standards and evidenced tax avoidance purpose. Specific anti-avoidance provisions address linked transactions, connected party transfers, and corporate envelope arrangements with targeted rules. The higher rates for additional dwellings incorporate detailed anti-avoidance language preventing artificial transaction structuring to evade surcharge application. Non-compliance penalties extend beyond financial sanctions to potential criminal prosecution for deliberate submission of false information or fraudulent return preparation. HMRC’s compliance investigation powers include extensive information-gathering authority, property inspection rights, and extended assessment timeframes for suspected avoidance. Recent years have witnessed intensified enforcement activity targeting both sophisticated planning structures and basic non-disclosure compliance failures. The disclosure of tax avoidance schemes (DOTAS) regime imposes mandatory reporting requirements for arrangements meeting specified hallmarks, with severe penalties for non-compliance. For businesses establishing UK presence through nominee director services, ensuring thorough understanding of these provisions represents an essential governance priority to prevent inadvertent triggering of anti-avoidance measures through inappropriately structured transactions.

Professional Guidance and Expert Support for SDLT Optimization

The intricate nature of property transfer stamp duty necessitates specialized professional guidance to navigate compliance requirements while identifying legitimate planning opportunities. Qualified tax advisors with SDLT specialization provide crucial support regarding rate determination, relief eligibility assessment, and filing obligation management. Legal practitioners with property taxation expertise offer essential guidance on transaction structuring, particularly regarding corporate reorganizations, partnership considerations, and mixed-use property classifications. Valuation specialists contribute critical input regarding consideration allocation between chargeable and non-chargeable elements, particularly important for mixed-use properties and transactions involving substantial fixture components. For international investors, advisors with cross-border expertise, including those specializing in offshore company registration in the UK, provide valuable guidance regarding residency determination and international surcharge application. The integration of SDLT planning within comprehensive tax strategy requires collaborative approaches between these professional disciplines to develop coherent solutions addressing multiple taxation dimensions. The costs associated with professional guidance frequently represent modest investments relative to potential tax savings and compliance risk mitigation. Additionally, formal tax opinions from qualified practitioners potentially provide penalty protection in contested scenarios by demonstrating reasonable care and diligence in addressing complex interpretive questions.

Future Trends and Anticipated Developments in Property Transfer Taxation

The property transfer stamp duty landscape continues evolving in response to economic conditions, housing policy objectives, and revenue requirements. Several discernible trends suggest likely future developments warranting attention from stakeholders. Environmental considerations increasingly influence property taxation policy, with potential future SDLT incentives for energy-efficient buildings or surcharges for properties failing minimum environmental standards. Digitalization of tax administration continues advancing, with electronic verification systems and enhanced data-sharing potentially streamlining compliance while simultaneously intensifying enforcement capabilities. Recent governmental emphasis on housing affordability suggests potential future relief expansions for first-time buyers alongside possible additional charges for non-resident investors in residential markets. Corporate taxation harmonization initiatives may impact current differentials between share acquisitions and direct property transfers. Wealth taxation debates periodically highlight property transfer occasions as potential collection points for broader asset value taxation. For businesses considering company registration with VAT and EORI numbers, these evolving dynamics warrant careful monitoring. The intersection of property taxation with broader international tax reform initiatives, including OECD-led minimum taxation frameworks, creates additional complexity for multinational investment structures. These anticipated developments underscore the importance of maintaining flexible and adaptable property investment strategies capable of responding to evolving policy landscapes.

SDLT Implications for Estate Planning and Intergenerational Transfers

Property transfer stamp duty considerations substantially influence estate planning strategies involving real estate assets. Lifetime gifts of property generally trigger SDLT liability calculated on market value rather than consideration, potentially creating substantial tax inefficiency without proper planning. However, specific relief provisions apply to property transfers resulting from divorce or dissolution of civil partnerships under court orders. Similarly, transfers upon death typically avoid SDLT, though subsequent distributions from estates to beneficiaries may create liability depending on structural arrangements. The interaction between SDLT and inheritance tax creates complex planning considerations, particularly regarding timing optimizations and vehicle utilization. Trust arrangements introduce additional complexity, with specific rules governing entry, exit, and interest variations. These considerations increasingly necessitate integrated planning approaches addressing multiple tax dimensions simultaneously. For family businesses utilizing UK companies registration, corporate reorganization relief potentially facilitates property transfers within qualifying group structures without triggering SDLT, subject to strict conditions regarding commercial purpose and continuity of ownership. The preservation of business property relief for inheritance tax purposes while minimizing SDLT on property restructuring represents a particularly challenging planning objective requiring specialized advisory input to navigate effectively.

Practical Implementation: Case Studies and Real-World Applications

Concrete case scenarios illustrate practical SDLT implications across diverse transaction profiles. Consider a residential property investor acquiring a £750,000 apartment building containing six individual units. Without strategic planning, standard rates would apply to the aggregate purchase price. However, Multiple Dwellings Relief application recalculates liability based on average unit value (£125,000), potentially reducing SDLT from approximately £27,500 to £7,500, representing substantial tax efficiency. Alternatively, examine a manufacturing business expanding operations through acquisition of combined industrial and office premises for £2.5 million, with careful valuation allocating 70% to commercial production areas and 30% to residential caretaker accommodation. Proper classification as mixed-use property applies commercial rates to the entire transaction rather than residential rates plus surcharge to the accommodation portion, potentially reducing SDLT from approximately £213,750 to £114,500. For international businesses utilizing company incorporation in the UK, compare direct acquisition of £10 million commercial property triggering immediate SDLT of approximately £489,500 against share acquisition of UK property-holding company potentially eliminating SDLT entirely, subject to anti-avoidance considerations and comparative analysis with potential future capital gains implications.

Expert Support for Your Property Tax Challenges

Navigating the complexities of property transfer stamp duty requires specialized expertise and strategic planning. At LTD24, our international tax consulting team provides comprehensive support for property investors and businesses facing SDLT challenges.

We combine deep technical knowledge with practical implementation strategies to optimize your property transactions while maintaining full compliance with regulatory requirements. Our services include transaction structuring advice, relief eligibility assessment, cross-border investment planning, and comprehensive SDLT return preparation.

For businesses expanding internationally or restructuring existing property holdings, we offer integrated solutions incorporating corporate formation, tax planning, and ongoing compliance support. Our expertise spans residential, commercial, and mixed-use property transactions across multiple jurisdictions.

We are a boutique international tax consulting firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating globally.

Book a session with one of our experts now at $199 USD/hour and get concrete answers to your tax and corporate inquiries by visiting our consulting page.

Bruno is a sales specialist at Ltd24 and a key collaborator in lead generation. He focuses on identifying potential clients, initiating first contact, and providing the initial support needed to help them move forward with their business projects. With a degree in Economics and Commercial Sales, Bruno stands out for his analytical mindset, customer-oriented approach, and strong communication skills. His proactive attitude and commercial awareness allow him to build solid relationships from the very first interaction. Outside of work, he enjoys competing in padel tournaments.

Comments are closed.