Series Llc Vs Holding Company

22 April, 2025

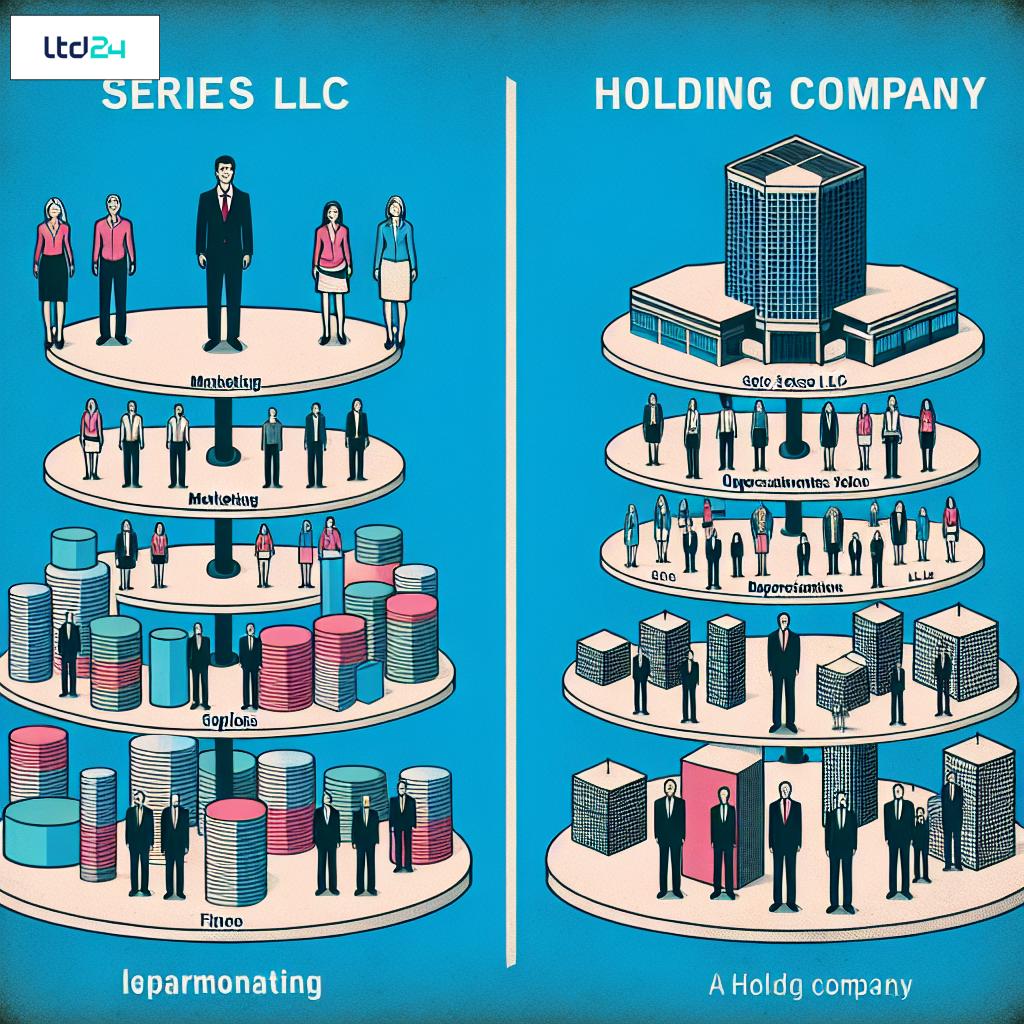

Understanding Business Entity Fundamentals: The Choice Between Series LLCs and Holding Companies

When structuring a business operation with multiple assets or ventures, entrepreneurs and investors face a critical decision: whether to utilize a Series Limited Liability Company (Series LLC) or a traditional Holding Company structure. This choice can significantly impact asset protection, taxation, compliance requirements, and operational flexibility. The Series LLC, a relatively newer innovation in business law, allows for multiple segregated "cells" or series within a single legal entity, while a Holding Company represents the conventional approach of establishing parent-subsidiary relationships through separate legal entities. Each structure offers distinct advantages depending on your specific business objectives, risk profile, and jurisdiction of operation. At ltd24.co.uk, our international tax specialists regularly guide clients through these nuanced decisions to optimize their corporate structuring.

The Series LLC: Legal Innovation for Asset Compartmentalization

The Series LLC represents a significant legal innovation in business structuring, particularly popular in the United States. This entity format enables entrepreneurs to create multiple segregated "series" within a single LLC, with each series functioning as a separate liability compartment. Pioneered in Delaware and subsequently adopted by approximately 20 U.S. states including Texas, Illinois, and Nevada, the Series LLC provides internal asset segregation without necessitating the formation of multiple separate legal entities. Each series can maintain its own assets, members, managers, and operating agreements, while benefiting from liability insulation between series. This structure is particularly advantageous for real estate portfolios, investment funds, and multi-brand businesses seeking simplified administration with robust internal asset protection. The statutory framework for Series LLCs varies significantly between jurisdictions, with certain states offering stronger asset segregation provisions than others. For businesses considering international operations, understanding how Series LLCs interact with foreign legal systems becomes critical for effective cross-border tax planning.

Traditional Holding Company Structures: The Time-Tested Approach

Holding Companies represent the traditional approach to organizational structuring and asset protection, with centuries of established legal precedent across global jurisdictions. A holding company, sometimes called a parent company, is formed specifically to own controlling interests in other companies (subsidiaries), rather than conducting operational business activities directly. This time-tested model creates distinct legal entities, each with its own corporate veil, thereby establishing well-recognized barriers against liability migration between business units. The holding company structure enjoys universal recognition across international borders and benefits from established case law and legal precedents. This structure is particularly popular for multinational corporations, family offices, and businesses with significant international operations. Holding companies can be established in various jurisdictions, including the UK, USA, or offshore financial centers, to capitalize on specific regulatory advantages, tax treaties, and business-friendly legal environments.

Comparative Legal Analysis: Asset Protection Capabilities

From a liability protection standpoint, both structures offer significant benefits, but through different mechanisms. Series LLCs provide internal liability compartmentalization, with statutory provisions designed to prevent creditors of one series from reaching assets held by other series within the same LLC. This "internal shield" works effectively provided that proper accounting, documentation, and operational separation are maintained between series. Holding companies, conversely, employ an "external shield" approach through the creation of separate legal entities, each with its own corporate veil and limited liability protection. The holding company model generally provides more established protection against veil-piercing claims due to its longer legal history and wider judicial recognition. For high-risk ventures or valuable assets requiring maximum protection, many legal experts recommend the holding company approach, particularly when operations span multiple jurisdictions or face significant regulatory scrutiny. Businesses involved in emerging sectors like cryptocurrency, cannabis, or innovative financial services should carefully evaluate the relative strength of asset segregation under each model within their specific jurisdictions of operation. For UK-oriented structures, our experts at ltd24.co.uk can provide jurisdiction-specific guidance on optimal entity selection.

Tax Implications: Comparative Analysis of Series LLC vs Holding Company

The tax treatment of Series LLCs and holding companies represents a critical differentiator that often drives entity selection decisions. Series LLCs typically benefit from pass-through taxation by default (similar to standard LLCs), with income, deductions, credits, and losses flowing through to individual members’ tax returns. This structure avoids the double taxation issue that sometimes affects corporate entities. However, the tax treatment of Series LLCs varies internationally, with many foreign tax authorities lacking clear guidance on their classification. Holding companies, particularly when structured as corporations, may face potential double taxation (at both corporate and shareholder levels) if dividends are distributed, though this can often be mitigated through careful tax planning. Corporate holding structures can access various tax incentives, including participation exemptions, foreign tax credits, and beneficial treatment under tax treaties. The holding company approach often provides clearer pathways for international tax planning, transfer pricing arrangements, and withholding tax optimization. For complex multinational structures, professional guidance from international tax specialists is essential to navigate the interplay between domestic and foreign tax regimes. At ltd24.co.uk/uk-company-taxation/, our experts specialize in developing tax-efficient corporate structures tailored to client-specific objectives and jurisdictional requirements.

Formation and Maintenance Requirements: Administrative Complexity Comparison

The administrative requirements associated with each structure represent important practical considerations. Series LLCs generally offer streamlined formation processes with a single filing fee, single registered agent, and consolidated annual state filings—representing potential cost savings compared to establishing multiple separate entities. However, maintaining proper separation between series requires rigorous internal record-keeping and documentation to preserve liability protection. Holding company structures involve forming and maintaining multiple separate legal entities, each with its own formation fees, registered agent requirements, and ongoing compliance obligations. While administratively more demanding, this approach benefits from clearer legal precedents and established compliance frameworks. For businesses operating internationally, the holding company model often provides greater clarity in foreign jurisdictions where Series LLCs may not be recognized or understood. The costs of formation and maintenance should be weighed against the specific objectives and operational requirements of each business. Entrepreneurs should consider both initial setup expenses and ongoing compliance costs when selecting between these structural alternatives. For comprehensive company incorporation services across multiple jurisdictions, our international formation specialists can provide tailored guidance based on specific business requirements.

Cross-Border Considerations: International Recognition and Functionality

The international recognition and functionality of business structures becomes particularly significant for companies operating across multiple jurisdictions. Series LLCs face considerable challenges in this regard, as most countries outside the United States have no equivalent legal concept and may not recognize the internal liability segregation that defines this entity type. This uncertainty potentially exposes series assets to foreign creditor claims or unfavorable tax treatment. Conversely, holding companies enjoy nearly universal recognition in global business law, with established precedents for cross-border operations, taxation, and asset protection. This international familiarity makes holding companies the preferred structure for businesses with significant foreign operations or international expansion plans. When structuring cross-border business activities, considerations such as bilateral tax treaties, withholding tax provisions, and permanent establishment risks become paramount in the decision-making process. For businesses considering international operations, our specialists at ltd24.co.uk provide expert guidance on navigating these complex cross-jurisdictional challenges while ensuring optimal tax treatment and legal protection.

Industry-Specific Applications: Where Each Structure Excels

Different business sectors benefit differently from these alternative structures based on their specific operational characteristics and risk profiles. The Series LLC structure has gained particular popularity in the real estate investment sector, where it allows property owners to segregate different properties within a single entity, protecting each from liabilities associated with the others. Similarly, investment fund managers often utilize Series LLCs to separate different investment strategies or asset classes while maintaining streamlined administration. The structure also appeals to franchise operations and businesses with multiple brands seeking internal liability segregation. Holding companies, meanwhile, excel in scenarios involving international operations, joint ventures, intellectual property management, and highly regulated industries where established legal precedent carries significant value. They are particularly well-suited for businesses planning public offerings or seeking outside capital investment, as their structure is more readily understood by institutional investors and capital markets. Industry regulation also plays a crucial role in this decision, with regulated sectors often having specific entity requirements or restrictions that may favor one structure over the other. Our specialists at ltd24.co.uk provide industry-specific guidance on optimal entity selection based on operational requirements and regulatory considerations.

Governance and Management Flexibility: Operational Control Considerations

The governance structures available under each model offer different approaches to operational management and control. Series LLCs provide significant flexibility in internal governance, allowing different management structures for each series while maintaining a single overarching entity. This can be advantageous for businesses with varying ownership interests across different assets or operations, as it allows customized governance for each series without creating separate legal entities. This structure can facilitate bringing in investors for specific projects or assets without giving them rights in unrelated operations. Holding company structures typically implement more standardized corporate governance across subsidiaries, though subsidiaries can be structured with different entity types (corporations, LLCs, partnerships) to accommodate specific operational or tax objectives. The holding company approach often provides clearer lines of authority and established governance precedents, which can be particularly valuable when dealing with institutional investors, lenders, or regulatory agencies. For businesses considering future capital raises, acquisitions, or public offerings, the governance structure becomes an important consideration in entity selection. The choice between centralized and decentralized management should align with the company’s long-term strategic objectives and operational requirements. Our corporate governance specialists at ltd24.co.uk can provide tailored guidance on implementing effective governance structures across complex corporate organizations.

Case Study Analysis: Real-World Applications in Business Structuring

Examining real-world applications provides valuable insight into how these structures function in practice. Consider the case of a real estate investment enterprise with multiple properties in different states. By utilizing a Series LLC, the investor maintained separate series for each property, achieving liability segregation while filing a single tax return and maintaining streamlined administration. This structure proved particularly effective for a portfolio consisting entirely of U.S. properties in states recognizing the Series LLC concept. Contrast this with a technology company managing intellectual property across global markets. This business opted for a holding company structure, establishing separate subsidiaries in strategic jurisdictions to optimize tax treatment of royalty income while ensuring robust asset protection through separate legal entities. The holding company approach provided clear recognition in foreign courts and greater certainty in cross-border transactions. Another illustrative example involves a family business with diversified operations spanning manufacturing, real estate, and retail. This enterprise implemented a hybrid approach, utilizing a holding company for its major divisions while deploying Series LLCs within certain U.S. operations to optimize internal asset protection. These case studies demonstrate that the optimal structure depends heavily on specific business activities, jurisdictional considerations, and long-term strategic objectives. Our consultants at ltd24.co.uk regularly develop customized structuring solutions based on client-specific requirements and objectives.

Regulatory Evolution: Emerging Trends in Business Entity Law

The legal landscape governing business entities continues to evolve, with notable developments affecting both Series LLCs and holding company structures. The Uniform Protected Series Act (UPSA), drafted by the Uniform Law Commission, aims to standardize Series LLC provisions across adopting states, potentially increasing interstate recognition and operational certainty for these entities. This development may eventually strengthen the position of Series LLCs, though widespread adoption remains incomplete. Simultaneously, holding company regulations continue to evolve in response to international initiatives targeting base erosion and profit shifting (BEPS), with increasing substance requirements in many jurisdictions. Recent developments in beneficial ownership reporting, such as the Corporate Transparency Act in the U.S. and similar initiatives globally, are impacting disclosure requirements for both entity types. These changes reflect the growing regulatory focus on transparency in business ownership and operations. Additionally, digital asset businesses face emerging regulatory frameworks that may influence entity structure decisions, particularly regarding jurisdictional selection and compliance requirements. Staying abreast of these regulatory developments is crucial for businesses implementing either structure, as compliance requirements and legal protections continue to evolve in response to changing economic and political priorities. Our regulatory specialists at ltd24.co.uk continuously monitor evolving legal requirements to ensure client structures remain optimally positioned within the changing regulatory landscape.

Privacy Considerations: Information Disclosure Requirements

Privacy considerations represent an increasingly important factor in entity selection decisions, particularly for businesses operating in sensitive industries or with high-profile ownership. Series LLCs potentially offer certain privacy advantages through consolidated filings, as the internal structure and specific assets held within individual series may not require public disclosure in all jurisdictions. This can provide a layer of privacy protection for assets segregated within the structure. Holding companies, depending on jurisdiction, may require more extensive public filings for each subsidiary, though privacy-oriented jurisdictions like Wyoming offer enhanced confidentiality provisions that can mitigate these concerns. The global trend toward beneficial ownership registries and increased transparency requirements—driven by anti-money laundering initiatives and tax compliance efforts—is gradually reducing the privacy advantages previously associated with certain entity structures. For businesses prioritizing legitimate privacy concerns, careful jurisdictional selection and professional guidance become increasingly important to balance privacy objectives with compliance requirements. Our specialists at ltd24.co.uk can provide current guidance on available privacy provisions within compliant corporate structures across various jurisdictions.

Conversion Considerations: Transitioning Between Entity Structures

Businesses frequently need to reevaluate their organizational structure as they grow or as their operational focus evolves. Converting between Series LLC and holding company structures presents varying degrees of complexity depending on the specific circumstances and jurisdictions involved. Transitioning from a Series LLC to a holding company structure typically involves forming new legal entities and transferring assets from individual series to these newly-formed subsidiaries. This process may trigger transfer taxes, due diligence requirements, and potential consent requirements from lenders or contractual counterparties. Converting from a holding company structure to a Series LLC generally proves more challenging, particularly for international operations, due to the limited recognition of Series LLCs outside the United States. Any structural conversion should be undertaken with careful consideration of potential tax consequences, including property transfer taxes, income recognition, and potential loss of tax attributes or treaty benefits. Additionally, existing contracts, licenses, permits, and financing arrangements may contain change of control provisions or assignment restrictions that complicate the conversion process. Developing a comprehensive conversion strategy with professional guidance helps minimize disruption and optimize post-conversion outcomes. Our corporate restructuring specialists at ltd24.co.uk provide comprehensive guidance for businesses contemplating structural reorganizations, ensuring compliance with applicable regulations while minimizing adverse tax consequences.

Financing Implications: Capital Raising and Banking Considerations

Access to capital and banking services represents a practical consideration when selecting between Series LLCs and holding company structures. Series LLCs may face challenges in obtaining financing, as many lenders remain unfamiliar with their internal segregation mechanisms and may hesitate to extend credit without additional guarantees or collateral. Banking relationships can similarly prove challenging, with some financial institutions expressing reluctance to open accounts for Series LLCs due to compliance concerns and limited experience with these entities. Holding company structures typically face fewer obstacles in financial relationships due to their traditional format and widespread recognition. This traditional approach often facilitates smoother relationships with lenders, investors, and financial institutions accustomed to standard corporate structures. For businesses anticipating significant capital needs or planning future exit strategies through acquisition or public offering, the holding company structure generally provides clearer pathways and greater market acceptance. However, as Series LLCs gain wider recognition, these financing challenges may gradually diminish in some jurisdictions. Entrepreneurs should consider both immediate and long-term capital requirements when selecting between these alternative structures. Our financial structuring specialists at ltd24.co.uk can provide guidance on optimizing entity structures to facilitate access to capital while maintaining appropriate asset protection.

Succession Planning and Exit Strategy Considerations

Long-term planning for business succession or eventual exit becomes significantly influenced by initial entity structure decisions. Series LLCs offer certain advantages for internal succession planning, allowing ownership interests in specific series to be transferred independently from the master LLC. This can facilitate gradual transition of business components to successors or the sale of individual business segments without restructuring the entire entity. However, Series LLCs may complicate certain exit strategies, particularly those involving institutional investors or acquirers unfamiliar with this entity format. Holding company structures typically provide clearer pathways for various exit strategies, including selling individual subsidiaries, executing a comprehensive sale of the parent entity, or pursuing public listing options. The clear separation between entities often simplifies valuation processes and due diligence procedures during acquisition negotiations. For family businesses implementing generational transfer plans or entrepreneurs contemplating eventual business sale, these succession and exit considerations should factor prominently in initial structuring decisions. Developing a structure aligned with long-term succession objectives can significantly streamline future transitions while optimizing tax treatment for both transferors and successors. Our succession planning specialists at ltd24.co.uk provide comprehensive guidance on developing entity structures that facilitate smooth ownership transitions while minimizing associated tax burdens.

Professional Service Requirements: Expert Guidance Needs

Successfully implementing and maintaining either structure requires specialized professional guidance across multiple disciplines. Series LLCs, given their relatively recent development and jurisdictional variations, often require attorneys specifically experienced with these entities to properly establish internal firewalls and develop appropriate operating agreements for each series. Additionally, accountants familiar with Series LLC taxation must implement proper accounting systems to maintain the financial separation necessary for preserving liability protections. Holding company structures similarly benefit from specialized guidance, particularly regarding international tax planning, transfer pricing compliance, and cross-border operational considerations. These structures often require coordinated guidance from professionals across multiple jurisdictions to ensure compliance with varying local requirements and optimal utilization of available tax benefits. The investment in proper professional guidance should be viewed as essential risk management rather than discretionary expense, as improper implementation of either structure can compromise intended protections and benefits. At ltd24.co.uk, our integrated team of international tax specialists, corporate attorneys, and compliance experts provides comprehensive guidance on entity structure implementation, ensuring alignment with regulatory requirements while optimizing operational and tax efficiency.

Jurisdictional Selection: Strategic Location Considerations

The jurisdiction of formation represents a critical strategic decision that significantly impacts the effectiveness of either entity structure. For Series LLCs, jurisdictional selection is particularly important given the significant variations in statutory provisions between states that recognize this entity type. Delaware offers the most established Series LLC legislation with strong judicial precedent, while Wyoming provides enhanced privacy protections, and Texas offers favorable liability segregation provisions. For holding companies, jurisdictional options expand globally, with considerations extending beyond domestic alternatives to international financial centers offering specific tax or regulatory advantages. Commonly utilized holding company jurisdictions include the UK (for its extensive tax treaty network), Ireland (for its competitive corporate tax rate and EU membership), and various offshore jurisdictions offering specific regulatory or privacy advantages. The optimal jurisdiction depends on factors including operational locations, investor nationality, intended exit strategies, and specific tax planning objectives. Businesses should consider both formation jurisdiction and operational jurisdictions in developing comprehensive structural plans. Our jurisdictional specialists at ltd24.co.uk provide comparative analysis across potential formation locations, identifying optimal jurisdictional combinations based on specific client objectives and operational parameters.

Specialized Applications: Industry-Specific Structure Optimization

Beyond general considerations, certain specialized applications deserve particular attention when evaluating these alternative structures. In the cryptocurrency and digital asset space, entity structure decisions intersect with rapidly evolving regulatory frameworks, with Series LLCs offering potential advantages for segregating different token projects or technological applications while maintaining operational integration. Real estate developers often utilize Series LLCs for development projects, establishing separate series for land acquisition, development activities, and eventual property management to isolate project-specific risks. Investment fund managers may employ Series LLCs to separate different investment strategies or asset classes under a unified management structure, streamlining administration while maintaining appropriate separation between distinct investment pools. Intellectual property holding structures typically favor the traditional holding company approach, particularly for international IP portfolios, as this structure provides clearer recognition of ownership rights across global jurisdictions. Family offices managing diverse asset portfolios often employ hybrid approaches, utilizing holding company structures for core operations while implementing Series LLCs for specific U.S.-based investments with unique risk profiles. Our industry specialists at ltd24.co.uk provide sector-specific guidance on optimizing entity structures for particular operational requirements and risk management objectives.

Integration with Other Legal Strategies: Comprehensive Asset Protection

Maximizing the effectiveness of either structure requires integration with complementary legal strategies to create comprehensive asset protection frameworks. For Series LLCs, these complementary strategies often include appropriate insurance coverage for each series, carefully drafted operating agreements establishing clear separation between series, and rigorous operational protocols maintaining this separation in practice. For holding company structures, integration typically involves implementation of appropriate transfer pricing policies, intercompany agreements documenting arm’s-length relationships between entities, and jurisdiction-specific compliance measures addressing substance requirements and beneficial ownership reporting. Both structures benefit from integration with estate planning mechanisms for individual owners, including trusts, family limited partnerships, or other vehicles designed to facilitate efficient wealth transfer while maintaining appropriate asset protection. Neither structure should be viewed as a standalone solution, but rather as a foundational component within a comprehensive legal strategy addressing business, tax, and personal wealth protection objectives. Our integrated planning specialists at ltd24.co.uk develop holistic protection strategies incorporating complementary legal mechanisms tailored to client-specific risk profiles and wealth preservation objectives.

Decision Framework: Choosing the Optimal Structure for Your Specific Needs

Selecting between Series LLC and holding company structures requires systematic evaluation of multiple factors specific to each business situation. We recommend a structured decision framework considering: (1) asset types and associated risks; (2) jurisdictions of operation; (3) current and anticipated financing needs; (4) tax optimization objectives; (5) administrative capacity and compliance resources; (6) international expansion plans; (7) intended exit strategies; and (8) specific industry regulations affecting operations. Businesses with exclusively domestic U.S. operations in states recognizing Series LLCs, moderate administrative resources, and primary focus on internal liability segregation may find the Series LLC structure advantageous. Conversely, enterprises with significant international operations, complex financing requirements, or operations in highly regulated industries typically benefit from the established precedents and universal recognition associated with holding company structures. Many businesses ultimately implement hybrid approaches, utilizing different entity structures for different operational components based on their specific characteristics and requirements. Our advisors at ltd24.co.uk employ this systematic framework to develop customized structuring recommendations aligned with each client’s specific objectives, operational parameters, and risk management priorities.

Strategic Implementation: Beyond Formation to Operational Integration

Successful implementation of either structure extends beyond initial formation to encompass ongoing operational practices that maintain intended protections. For Series LLCs, these operational practices include maintaining separate accounting records for each series, avoiding commingling of assets between series, ensuring appropriate labeling of series assets, and conducting series-specific meetings with documented minutes. Documentation practices become particularly crucial, with contracts clearly identifying the specific series involved in each transaction and appropriate series designations on all formal documentation. For holding company structures, operational implementation focuses on maintaining appropriate corporate formalities for each entity, documenting arm’s-length transactions between related entities, and ensuring each subsidiary maintains adequate capitalization for its operations. Both structures require ongoing regulatory monitoring to ensure compliance with evolving requirements across all relevant jurisdictions. Developing comprehensive operational protocols aligned with the selected structure helps maintain intended protections while optimizing administrative efficiency. Our implementation specialists at ltd24.co.uk provide comprehensive guidance on operational best practices for complex corporate structures, ensuring maintenance of liability segregation while streamlining administrative processes.

Expert Guidance for International Business Structuring

Selecting the optimal business structure represents a consequential decision with significant implications for asset protection, tax treatment, and operational flexibility. Both Series LLCs and holding company structures offer distinct advantages depending on your specific business circumstances, asset profile, and jurisdictional considerations. For businesses operating across international borders, the complexity of this decision increases substantially, requiring specialized expertise in cross-border taxation, multi-jurisdictional compliance, and international corporate law.

At Ltd24, our international tax consultants specialize in developing customized structuring solutions that align with your specific business objectives while navigating the complexities of global tax regulations. We provide comprehensive guidance on entity selection, jurisdictional optimization, and implementation strategies tailored to your unique circumstances.

If you’re seeking expert guidance on international business structuring, we invite you to book a personalized consultation with our specialist team. As a boutique international tax consultancy with advanced expertise in corporate law, tax risk management, asset protection, and international audits, we offer tailored solutions for entrepreneurs, professionals, and corporate groups operating on a global scale.

Schedule a session with one of our experts now at $199 USD/hour and receive concrete answers to your tax and corporate questions. Book your consultation today.

Alessandro is a Tax Consultant and Managing Director at 24 Tax and Consulting, specialising in international taxation and corporate compliance. He is a registered member of the Association of Accounting Technicians (AAT) in the UK. Alessandro is passionate about helping businesses navigate cross-border tax regulations efficiently and transparently. Outside of work, he enjoys playing tennis and padel and is committed to maintaining a healthy and active lifestyle.

Leave a Reply