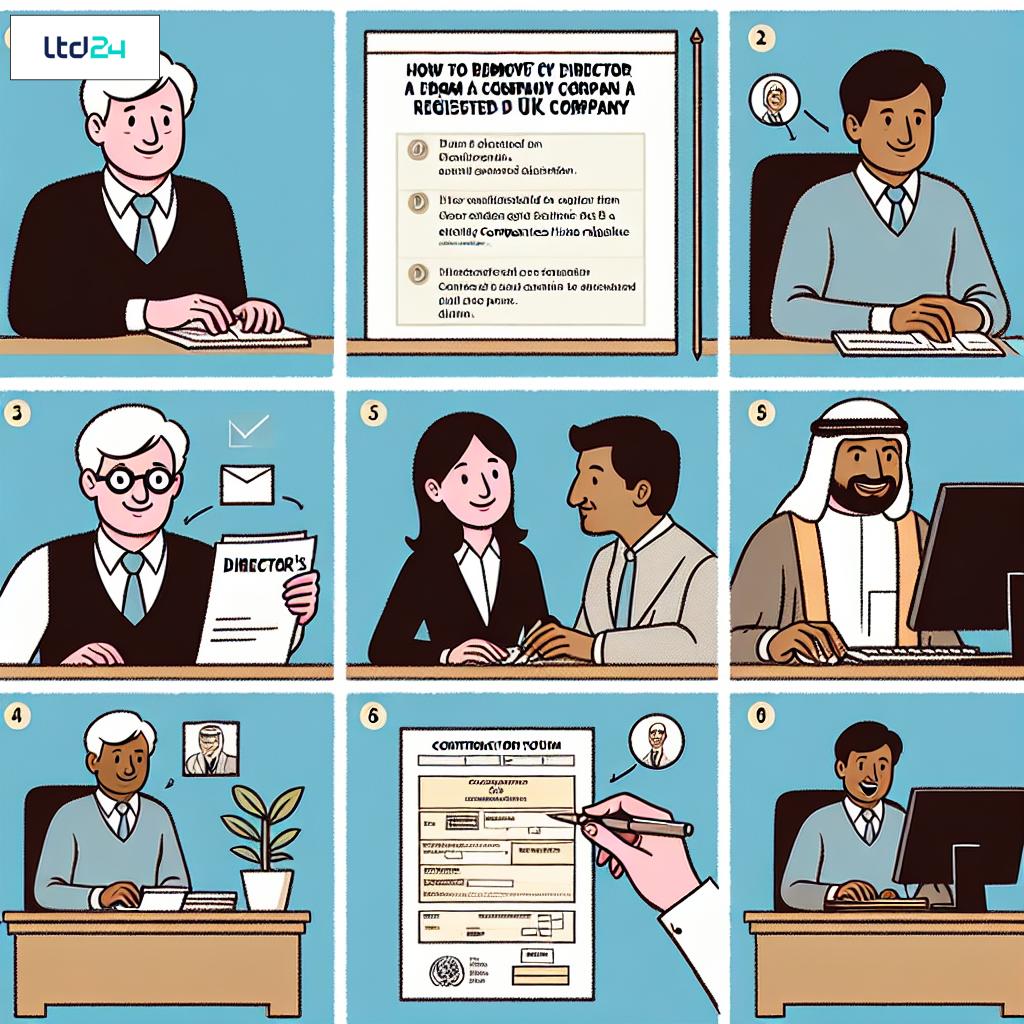

Understanding the Legal Framework for Company Name Changes

When a business decides to alter its identity in the United Kingdom, understanding the legal framework surrounding company name changes is paramount. The Companies Act 2006 establishes the foundational legislation governing corporate name modifications. This statutory regime stipulates explicit procedures that must be meticulously adhered to when initiating a name change application with Companies House, the official registrar of companies in the UK. The legislative provisions encompass not only the procedural aspects but also substantive requirements regarding permissible designations and prohibited denominations. Companies must navigate these regulatory parameters with precision, as non-compliance may result in application rejection or subsequent legal complications. The registrar possesses discretionary authority to refuse names that contravene established naming conventions or potentially mislead the public regarding the nature of business operations. Business proprietors contemplating identity rebranding must therefore familiarize themselves with the regulatory framework to ensure procedural validity and substantive compliance.

Preliminary Considerations Before Changing Your Company Name

Prior to initiating the formal process of amending your corporate designation, several critical considerations warrant thorough examination. Foremost among these is the availability verification of your prospective name. Companies House maintains a comprehensive register of existing corporate entities, which must be consulted to confirm that your intended designation does not replicate or closely resemble an existing registered name. Beyond mere availability, prudent business practice necessitates trademark verification through the Intellectual Property Office to mitigate potential infringement risks. Commercial implications also merit careful assessment—brand recognition, customer loyalty, and market positioning may be substantially impacted by nomenclature modification. Strategic alignment between your proposed designation and future business trajectory is essential. Additionally, financial obligations associated with rebranding, including documentation updates, marketing materials, and digital asset modifications, require budgetary allocation. For enterprises engaged in international commerce, jurisdictional considerations regarding name recognition and cultural appropriateness across diverse markets must inform decision-making. Companies contemplating UK company incorporation and bookkeeping services should be particularly attentive to these preliminary considerations.

Legal Restrictions on Company Names: What You Need to Know

The Companies Act 2006 imposes stringent limitations on permissible corporate nomenclature within the United Kingdom’s business registry framework. These restrictions serve to maintain nomenclatural integrity and prevent public confusion. Specifically, designations suggesting affiliation with governmental or regulatory bodies are prohibited without explicit authorization. Terms such as "Royal," "Queen," or "King" require approval from the Cabinet Office. Additionally, names containing sensitive words—including "Bank," "Insurance," "Trust," "International," or "Federation"—necessitate supplementary documentation evidencing regulatory compliance or substantiating the accuracy of such descriptors. The legislature further prohibits offensive appellations or denominations that may constitute a criminal offense. Companies must also avoid designations identical or excessively similar to existing registrations, with permissible differentiation typically requiring more substantive variance than mere punctuation modifications or legally mandated suffixes. The registrar possesses discretionary authority to reject names deemed misleading regarding business activities or implying pre-eminence without justification. For businesses contemplating UK company registration and formation, comprehension of these nomenclatural constraints is imperative to ensure application approval and regulatory compliance.

The Essential Documentation Required for Company Name Change

The procedural requirements for effectuating a corporate designation modification necessitate submission of specific documentation to Companies House. Central to this process is the NM01 form (or NM04 for Limited Liability Partnerships), which constitutes the official notification instrument for company name alterations. This form must be accompanied by a certified copy of the special resolution authorizing the nomenclature change, passed by shareholders with a minimum 75% majority in accordance with Section 21 of the Companies Act 2006. The resolution document must bear contemporary dating and contain explicit wording regarding the approved new designation. For companies with articles of association containing specific provisions regarding name modifications, additional documentation demonstrating compliance with these internal governance requirements may be necessary. Entities operating under specialized regulatory frameworks, such as financial services firms under Financial Conduct Authority oversight, must provide evidence of regulatory notification or approval. Companies utilizing sensitive words in their new designation must submit supporting documentation justifying such usage. When utilizing formation agent services in the UK, professional guidance can streamline the compilation and submission of these essential documents, ensuring procedural adherence and minimizing processing delays.

Step-by-Step Process for Filing a Company Name Change

The procedural sequence for effectuating a corporate designation modification entails several methodical steps. Initially, board members must convene to approve the proposed nomenclature alteration, documenting this decision in formal minutes. Subsequently, a special resolution must be drafted and circulated to shareholders for consideration, accompanied by a notice period of minimally 14 days (or shorter with 90% shareholder consent). The resolution requires approval by a 75% shareholder majority during a general meeting or through written resolution. Following approval, the NM01 form must be completed with precision, incorporating the company’s registration number, current designation, and proposed new name. This form, accompanied by the certified special resolution, must be submitted to Companies House, either electronically via the Web Filing service or through postal submission. The filing fee, currently £10 for electronic submissions and £30 for paper applications, must be remitted concurrently. Companies House typically processes applications within 24-48 hours for electronic filings and approximately five business days for paper submissions. Upon approval, the registrar issues a Certificate of Incorporation on Change of Name, legally effectuating the nomenclature modification. For businesses seeking to set up a limited company in the UK, understanding this procedural sequence is essential for subsequent identity modifications.

Understanding the Costs and Timeframes Involved

The fiscal implications and temporal considerations associated with corporate nomenclature modification warrant careful budgetary planning. The direct administrative fee payable to Companies House currently stands at £10 for electronic submissions and £30 for paper applications. However, the comprehensive financial assessment must encompass ancillary expenses including legal consultation fees, which typically range from £150 to £500 depending on complexity and advisorial scope. Companies utilizing specialized formation agents may incur service fees between £50 and £250, contingent upon service comprehensiveness. The temporal framework for processing typically spans 24-48 hours for electronic submissions, while paper applications generally require five business days for completion. Expedited processing options, available for an additional premium of approximately £100, can reduce processing time to same-day service. Post-approval, businesses must allocate resources for extensive rebranding initiatives, including stationary updates, signage modifications, marketing material revisions, and digital asset amendments, which collectively represent significant expenditure components. For enterprises maintaining international operations, jurisdictional registration updates in foreign territories introduce additional time and cost variables. Companies seeking to register a business name in the UK should incorporate these financial and temporal considerations into their strategic planning to ensure seamless transition management.

Post-Application: What Happens After Submission

Following application submission to Companies House, the registrar conducts a comprehensive review to verify compliance with statutory regulations and naming conventions. Upon approval, Companies House issues the Certificate of Incorporation on Change of Name, constituting the official legal documentation authenticating the nomenclature modification. This certificate bears the new designation, company registration number, and effective date of alteration. Concurrently, the Companies House register undergoes updating to reflect the revised corporate identity, ensuring public accessibility to current information. It is imperative to note that while Companies House automatically notifies HMRC of the designation change, the onus remains on the company to update additional governmental entities, including VAT registration authorities if applicable. Post-certification, companies must systematically implement comprehensive notification protocols to inform stakeholders of the identity alteration. This includes communication with banking institutions to update account details, notification to insurers for policy revisions, information provision to suppliers and customers, and updates to contractual counterparties. For businesses that have utilized online company formation in the UK, similar electronic channels can often facilitate efficient post-application updates across various stakeholder categories.

Common Reasons for Application Rejection

Applications for corporate nomenclature modifications encounter rejection for various statutory and procedural deficiencies. Predominant among these is name duplication or excessive similarity to existing registrations, which contravenes Section 66 of the Companies Act 2006. The registrar employs sophisticated comparison methodologies that identify not only identical designations but also those deemed "too like" existing entities, with assessment extending beyond superficial orthographic differences. Submissions containing prohibited words or sensitive terms without requisite supporting documentation or governmental authorization similarly face rejection. Procedural inadequacies, including improperly executed special resolutions lacking the requisite 75% shareholder approval or bearing incorrect dating, constitute frequent grounds for application dismissal. Documentation deficiencies, such as illegible submissions, incomplete forms, or missing supporting materials, impede processing advancement. Applications proposing offensive or potentially misleading designations encounter categorical rejection under regulatory provisions. Companies filing name changes shortly after incorporation may face heightened scrutiny, as frequent modifications within brief temporal intervals raise regulatory concerns regarding potential misrepresentation or fraudulent intent. For businesses that have completed UK company formation for non-residents, particular attention to these potential rejection factors is essential due to potential complexities in rectification processes for overseas directors.

Managing Your Digital Presence During a Name Change

The digital ecosystem transformation necessitates systematic modification of online assets following corporate nomenclature alteration. Website domain reconfiguration represents a primary consideration, with strategic options including immediate redirection implementation from the legacy domain to the new URL, maintaining dual domains throughout a transitional period, or complete migration with appropriate SEO preservation strategies. Email infrastructure requires reconfiguration to reflect the updated corporate identity, with forwarding protocols established to capture communications directed to legacy addresses. Social media platform management demands coordinated profile updates across all relevant networks, with consistent naming conventions and visual identity implementation. Online business registry listings, including Google My Business, Bing Places, and industry-specific directories, require systematic updating to ensure informational consistency across digital touchpoints. E-commerce enterprises must give particular attention to payment gateway configurations and customer account management systems to ensure transactional continuity. Strategic planning for search engine optimization implications is crucial, with implementation of appropriate redirects, metadata updates, and strategic content modifications to preserve established search engine positioning. For businesses that set up an online business in UK, these digital transition considerations are particularly pertinent to maintaining operational continuity and preserving customer experience quality throughout the rebranding process.

Notifying Stakeholders: Legal Requirements and Best Practices

Following official nomenclature modification registration, companies bear statutory and practical obligations to disseminate this information across their stakeholder ecosystem. From a legal perspective, businesses must update their company name on all official documentation, including letterheads, invoices, purchase orders, and contracts. Section 82 of the Companies Act 2006 mandates display of the new designation on the company website, with concurrent updating of website legal notices, terms of conditions, and privacy policies. Banking institutions require formal notification accompanied by the Certificate of Incorporation on Change of Name to update account details. Similarly, insurance providers, leasing companies, and utility services necessitate official information provision. A comprehensive stakeholder communication strategy encompasses tiered notification protocols, prioritizing critical business partners, followed by suppliers, customers, and broader network connections. Communication methodologies should be calibrated to stakeholder significance—personal outreach for key relationships, formal correspondence for institutional entities, and mass communication for broader audiences. Internal communication strategies ensuring employee awareness and providing guidance on external communications regarding the nomenclature change are equally essential. For businesses utilizing nominee director services in the UK, particular attention should be directed to ensuring these representatives possess accurate and updated information for regulatory and business interactions.

Updating Business Stationery and Marketing Materials

The logistical dimensions of corporate rebranding extend to comprehensive physical and digital collateral modification. Business stationery reconfiguration encompasses letterheads, compliment slips, business cards, envelopes, and internal documentation templates. Marketing material revisions involve brochures, catalogs, promotional literature, exhibition displays, and advertising assets. Packaging alterations may include product labels, shipping materials, and warranty documentation. Signage updates extend to office entrances, building fascia, directional indicators, and vehicle livery. The implementation strategy typically adopts a phased approach, commencing with high-visibility and frequent-usage materials, progressing to less frequently utilized assets. Cost-optimization strategies include exhausting existing stock where possible, particularly for non-client-facing materials, while implementing immediate changes for customer-visible assets. Digital template repositories require comprehensive updating to ensure all newly generated documentation reflects the revised corporate identity. Quality control mechanisms should be established to verify consistent application of the new designation across all materials. For businesses with minimal operational history or recent establishment through company incorporation in UK online, the material update process may present reduced complexity due to limited existing collateral, potentially offering cost advantages in the rebranding implementation.

Legal Implications for Contracts and Agreements

Corporate nomenclature modification introduces juridical considerations regarding existing contractual arrangements that warrant careful legal assessment. The fundamental legal principle holds that a company’s identity persists notwithstanding designation changes—the corporate entity remains the same legal person, maintaining all rights and obligations under existing agreements. Consequently, contracts generally remain enforceable without formal amendment requirements. Nevertheless, prudential business practice dictates notification to contractual counterparties, particularly for high-value or strategically significant arrangements. For contracts containing explicit provisions regarding corporate identity changes, adherence to specified notification protocols is mandatory to avoid technical breaches. In specialized sectors such as financial services, telecommunications, or government contracting, regulatory frameworks may impose specific notification requirements regarding identity modifications. International contracts operating under diverse jurisdictional frameworks may necessitate additional procedural steps to ensure continued enforceability. Companies should undertake comprehensive contract reviews, categorizing agreements by significance and notification requirements. Formal communication with counterparties, incorporating the Certificate of Incorporation on Change of Name as evidentiary documentation, provides clarity and mitigates potential disputes. For businesses contemplating how to issue new shares in a UK limited company, attention to any shareholder agreements is particularly important during the name change process to ensure compliance with any notification provisions therein.

Banking and Financial Considerations During a Name Change

The financial ecosystem modifications necessitated by corporate nomenclature alteration require methodical implementation to maintain operational continuity. Banking relationship management constitutes a primary consideration, with institutions typically requiring the Certificate of Incorporation on Change of Name, updated mandate forms, and potentially revised signatory documentation. Account transition strategies vary by institution—some maintain the original account with updated details, while others establish new accounts necessitating systematic transfer of standing orders and direct debits. Payment processing systems, including merchant accounts and payment gateways, require reconfiguration to reflect the updated entity designation. Credit arrangements, loan agreements, and leasing contracts generally persist unchanged but warrant formal notification to avoid potential complications. Investment accounts and securities registrations necessitate formal notification procedures, particularly for publicly traded entities. Tax administration considerations include updated VAT registration details, corporation tax references, and PAYE scheme information, though Companies House automatically notifies HMRC of nomenclature modifications. Financial reporting systems require reconfiguration to generate documentation under the new designation. For companies utilizing UK company taxation advisory services, coordination with tax professionals ensures comprehensive updating across all fiscal reporting frameworks and maintenance of compliance throughout the transition period.

International Considerations for Multinational Companies

For multinational enterprises, corporate nomenclature modification introduces multijurisdictional complexities transcending United Kingdom regulatory parameters. Entities maintaining international operations must navigate diverse registration requirements across multiple territories, with each jurisdiction imposing distinct procedural frameworks for corporate identity updates. Trademark and intellectual property protections necessitate reassessment and potential reregistration in each operational jurisdiction to maintain proprietary safeguards. Regulatory notifications extend to securities commissions for publicly traded entities, necessitating compliance with disclosure obligations across relevant exchanges. Banking relationships in international territories typically require individualized updating procedures adhering to local regulatory frameworks. Contractual reviews must extend to international agreements, with particular attention to governing law provisions that may influence notification requirements. Tax implications warrant careful consideration, especially regarding transfer pricing arrangements and permanent establishment documentation, which may reference the corporate designation. Strategic implementation planning should incorporate jurisdictional prioritization based on operational significance, regulatory complexity, and temporal requirements. Translation considerations for non-English speaking territories introduce additional dimensions regarding nomenclatural appropriateness and cultural connotations. Companies engaged in offshore company registration UK should be particularly attentive to these international dimensions, as the interface between UK and offshore jurisdictions may introduce additional procedural layers requiring specialized expertise for effective navigation.

Tax Implications of Changing Your Company Name

While corporate nomenclature modification does not fundamentally alter tax obligations, several administrative dimensions require careful attention to maintain fiscal compliance. Companies House automatically communicates designation changes to HM Revenue & Customs, updating corporation tax records accordingly. However, businesses hold individual responsibility for VAT registration updates, necessitating formal notification to the VAT Central Unit through the VAT 484 form, accessible via the HMRC website. PAYE and National Insurance administration similarly requires explicit notification to ensure accurate employment tax records. International tax considerations include updates to tax residency certificates, permanent establishment documentation, and treaty benefit claim forms, which typically reference the corporate designation. For groups utilizing transfer pricing arrangements, intercompany agreements may require updating to reflect the revised nomenclature. Tax authority correspondence addresses require systematic updating to avoid processing delays or potential non-compliance penalties due to communication failures. Digital tax accounts, including Government Gateway credentials, necessitate profile updates to reflect the current designation. For businesses contemplating setting up a limited company UK, understanding these tax administrative requirements provides preparation for potential future name change implications and ensures comprehensive compliance planning from inception.

Case Studies: Successful Company Name Changes in the UK

Empirical examination of successful corporate rebranding initiatives yields valuable implementation insights. In 2018, RBS Group executed a strategic transition to NatWest Group, representing more than mere nomenclatural modification—it signaled deliberate realignment with its primary consumer-facing brand following reputational challenges. The implementation strategy encompassed phased stakeholder communication, commencing with regulatory and investor notifications, followed by comprehensive customer outreach. Digital transformation prioritized user experience continuity through sophisticated redirection protocols. Norwich Union’s transformation to Aviva in 2009 exemplifies international harmonization objectives, creating global brand consistency across previously disparate entities. The implementation encompassed extensive market research regarding nomenclatural reception across diverse cultural contexts, with tailored communication strategies for distinct stakeholder segments. Recently established technology enterprise Elastic Supply initially registered under a placeholder designation, subsequently implementing designation modification after trademark verification, exemplifying the strategic utility of name changes for early-stage businesses. Common success factors across case studies include: comprehensive stakeholder mapping; prioritized communication protocols; rigorous documentation updates; digital continuity strategies; and coordinated internal communication ensuring consistent external messaging. For businesses considering how to register a company in the UK, these case studies illustrate the potential strategic value of establishing with an interim name before finalizing branding strategy, providing flexibility through the early business development phase.

Changing Your Business Structure Alongside Your Name

Corporate nomenclature modification occasionally coincides with structural reorganization, introducing additional procedural dimensions beyond standard designation update requirements. Transitioning from sole tradership to limited company status necessitates comprehensive entity establishment rather than mere name alteration, requiring new incorporation through Companies House with subsequent asset and operation transfer. Conversion from private limited company (Ltd) to public limited company (PLC) status involves not only nomenclatural adjustment but also compliance with enhanced capital requirements, governance structures, and regulatory obligations under Companies Act provisions. Structural modifications from standard limited company to Community Interest Company (CIC) introduce social purpose tests and asset lock requirements alongside designation changes. For entities considering conversion between limited company and Limited Liability Partnership (LLP) structures, the process extends beyond nomenclature modification to fundamental entity dissolution and reformation, with accompanying tax and operational implications. Partnership transitions to incorporated status similarly involve new entity establishment rather than simple name updating. When structural and nomenclatural changes coincide, strategic implementation sequencing becomes critical—determining whether to implement structural modification prior to or concurrent with designation change impacts procedural efficiency and transitional complexity. For businesses utilizing business address services in the UK, coordinate with service providers to ensure documentation reflects both structural and nomenclatural modifications appropriately, maintaining compliance across all official communications throughout the transition period.

How Professional Advisors Can Facilitate the Process

Engaging specialized practitioners provides significant procedural advantages throughout the corporate nomenclature modification journey. Formation agents offer comprehensive service packages encompassing availability verification, application preparation, submission management, and post-approval implementation guidance. Their expertise in Companies House procedural requirements and common rejection factors enhances first-time approval probability. Legal advisors contribute specialized insight regarding naming convention compliance, potential trademark conflicts, and contractual obligation management during transition. For complex international operations, their jurisdictional knowledge facilitates coordinated global implementation. Accountancy professionals ensure comprehensive financial system updates, tax authority notifications, and banking relationship transitions. Their involvement mitigates risks of financial discontinuity or compliance oversights during the transition period. Brand consultants provide strategic guidance regarding market perception, customer recognition factors, and communication strategy development. Their contribution extends beyond procedural compliance to maximizing commercial opportunity through the rebranding process. Digital specialists facilitate website transitions, email infrastructure reconfiguration, and search engine optimization preservation. For businesses seeking comprehensive support, formation agents in the UK offer end-to-end service packages, consolidating these advisory functions through experienced practitioners familiar with Companies House procedural requirements, significantly reducing administrative burden while enhancing implementation efficiency.

Common Misconceptions About Company Name Changes

Several persistent misconceptions surround corporate nomenclature modification processes, potentially leading to procedural confusion or unrealistic expectations. A prevalent misunderstanding holds that name change implementation occurs immediately upon director decision, overlooking the mandatory shareholder approval and formal Companies House registration requirements. Another common fallacy suggests that name availability confirmation through the Companies House WebCheck service guarantees application approval, disregarding the comprehensive review process that examines additional factors beyond mere duplication. Some business proprietors incorrectly believe that nomenclature modification automatically protects the new designation as a trademark, failing to recognize the distinct registration processes for company names versus intellectual property protections. A technical misconception involves the belief that minor orthographic variations or punctuation differences constitute sufficient differentiation from existing registrations, when regulatory standards typically require more substantive distinction. Some entities incorrectly assume that special resolutions can be retroactively dated to accelerate implementation timelines, contravening procedural requirements for contemporaneous documentation. Finally, a persistent misconception holds that corporate identity changes necessitate new company registration numbers, whereas the fundamental corporate identity and registration number remain consistent throughout nomenclatural transitions. For businesses seeking to register a company with VAT and EORI numbers, understanding that these identifiers remain unchanged during name modifications is particularly important for maintaining regulatory and customs compliance.

Future-Proofing Your Company Name Choice

Strategic nomenclature selection incorporates forward-looking considerations to minimize subsequent modification necessity. Longevity-oriented designation selection avoids excessively trendy terminology or temporal references that may rapidly become anachronistic. Scalability considerations ensure the chosen appellation accommodates business expansion across product categories, geographical territories, or service diversification. Jurisdictional validation extends beyond United Kingdom availability to assess registration viability in potential future operational territories, particularly for enterprises with international expansion aspirations. Trademark research should similarly transcend domestic boundaries to evaluate international registrability, identifying potential expansion impediments before significant brand investment. Digital compatibility assessment examines domain availability across relevant extensions, social media handle accessibility, and search engine optimization implications. Nomenclatural breadth versus specificity requires careful calibration—overly specific designations may constrain future diversification, while excessively generic appellations may present trademark protection challenges. Cultural and linguistic evaluation across potential market territories identifies unintended connotations or pronunciative difficulties. For enterprises contemplating potential acquisition or investment attraction, nomenclatural selection should consider investor perception and acquisition compatibility factors. Engagement with branding specialists or trademark attorneys during initial selection processes represents prudent investment to mitigate future modification requirements. For businesses considering opening an LTD in UK, adopting these future-proofing strategies during initial registration can significantly reduce the likelihood of subsequent name change requirements as the business develops and expands.

The Impact of Name Change on Company Reputation and Brand Identity

Corporate nomenclature modification introduces multidimensional implications for market positioning and stakeholder perception. Reputational transfer management requires strategic communication emphasizing continuity despite designation alteration. Brand equity preservation necessitates deliberate association between established goodwill and the updated corporate identity through consistent visual elements, messaging continuity, and explicit transition acknowledgment. Customer relationship management during transition extends beyond mere notification to include reassurance regarding service continuity and quality maintenance. Stakeholder perception research before implementation provides valuable insight regarding potential reception, enabling preemptive addressing of concerns or misconceptions. Media engagement strategies typically include press release distribution, journalist briefings, and prepared statements addressing the strategic rationale underlying the nomenclatural modification. Social media management throughout the transition period requires heightened monitoring and responsive engagement to address queries and maintain brand consistency. Internal culture implications warrant consideration, particularly when the designation change accompanies broader strategic reorientation or follows significant organizational developments such as mergers or acquisitions. Measurement metrics should be established to evaluate transition effectiveness, including brand recognition assessments, customer retention analytics, and media sentiment analysis. For businesses that have utilized company search UK services to identify their original company name, similar competitive intelligence approaches can be valuable during rebranding to ensure the new name establishes appropriate market differentiation while maintaining relevant industry associations.

Expert Assistance for Your Company Name Change and Registration Needs

Navigating the intricate procedure of corporate nomenclature modification demands meticulous attention to regulatory requirements and procedural nuances. At LTD24, our specialized expertise in UK company registration and compliance enables us to facilitate seamless designation transitions through comprehensive service provision. Our consultative approach encompasses strategic nomenclatural selection guidance, availability verification, potential conflict assessment, and trademark compatibility evaluation. Our procedural management services include special resolution drafting, Companies House submission processing, and post-approval implementation support. For international enterprises, our cross-jurisdictional expertise addresses multiterritorial implications of identity modifications, ensuring global compliance and brand protection.

If you’re seeking expert guidance for navigating the complexities of changing your company name at Companies House, we invite you to book a personalized consultation with our team.

We are a boutique international tax consulting firm with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating globally.

Book a session with one of our experts now for just 199 USD/hour and get concrete answers to your corporate and tax questions. Book your consultation today.