Introduction to UK Capital Gains Tax on Second Properties

The taxation of property investments in the United Kingdom has been subject to significant legislative changes over recent years, particularly regarding the treatment of second homes. When disposing of residential property that is not your primary residence, UK Capital Gains Tax (CGT) becomes an immediate consideration for taxpayers. This tax liability can substantially affect the profitability of property investments and necessitates careful financial planning. For individuals who own multiple properties, understanding the nuances of CGT is paramount to making informed decisions about property acquisition, management, and disposal. The tax implications can vary considerably based on numerous factors, including the duration of ownership, the property’s usage patterns, and the taxpayer’s residency status. Property investors, whether domestic or foreign, must navigate these complex tax provisions to optimize their investment strategies and ensure compliance with HM Revenue & Customs (HMRC) regulations.

Legal Definition and Scope of Second Homes

In tax legislation, the term "second home" encompasses any residential property that is not classified as the taxpayer’s principal private residence (PPR). The legal determination of a dwelling’s status as a second home is primarily governed by the Taxation of Chargeable Gains Act 1992, which provides the statutory framework for CGT assessment. Properties that may fall within this classification include holiday homes, buy-to-let investments, inherited properties, and dwellings purchased specifically for capital appreciation. The distinction between a principal residence and secondary properties is crucial for tax purposes, as primary residences generally benefit from Private Residence Relief (PRR), which exempts them from CGT. The determination of a property’s status is not merely based on ownership documentation but requires substantive evidence of habitation patterns, utility usage, and community integration. Taxpayers with international property portfolios should also consider how UK company taxation might interact with their personal tax liabilities when structuring their investments across multiple jurisdictions.

Current CGT Rates Applicable to Second Home Disposals

The tax burden on second home disposals is determined by the prevailing CGT rates, which currently stand at 18% for basic rate taxpayers and 28% for higher or additional rate taxpayers when selling residential property. These rates are significantly higher than those applied to other asset classes (10% and 20% respectively), reflecting the government’s policy approach to property investment. The applicable rate is contingent upon the individual’s income tax band after adding the taxable gain to their annual income. For instance, a taxpayer with annual earnings of £40,000 who realizes a gain of £50,000 on their second home would pay CGT at different rates for portions of the gain that fall within different tax bands. This progressive taxation structure necessitates comprehensive income forecasting to accurately predict CGT liabilities. International investors should be particularly attentive to these rates, as they may differ substantially from property taxation regimes in other jurisdictions. For detailed analysis of how these rates might affect your specific situation, consulting with specialists in international tax planning is advisable.

Calculation Methodology for Capital Gains on Property

The computational process for determining CGT on second homes follows a systematic methodology prescribed by HMRC. The calculation begins with establishing the property’s disposal value, typically the sale price or market value if disposed of by means other than sale. From this figure, the acquisition cost is deducted, which includes the original purchase price plus eligible acquisition expenses such as legal fees, stamp duty, and survey costs. Subsequently, enhancement expenditure is subtracted, encompassing capital improvements that have added value to the property, provided they are still reflected in the property’s state at disposal. Inflation adjustments, previously allowed through indexation allowance, have been eliminated for individuals since April 1998 but may still apply to pre-1998 acquisitions. The resulting figure constitutes the chargeable gain upon which tax is levied, subject to any available reliefs or annual exempt amount. For properties acquired before April 2015, special rules may apply for non-UK residents seeking to establish their tax liability, as detailed in guidance for non-resident property owners.

The Annual Tax-Free Allowance and Its Application

Every UK taxpayer is entitled to an Annual Exempt Amount (AEA), which represents a tax-free threshold for capital gains. For the 2023/24 tax year, this allowance has been reduced to £6,000 (down from £12,300 in previous years), with further reductions planned. This allowance operates as a deduction from total taxable gains arising in the fiscal year, effectively creating a nil-rate band for CGT. It’s important to note that the AEA applies to an individual’s cumulative gains across all asset classes, not just property. Therefore, if a taxpayer has already utilized their allowance through other disposals, such as shares or business assets, no further exemption would be available for property gains. The AEA is non-transferable between spouses, though strategic timing of disposals can enable both partners to utilize their respective allowances. Foreign investors should be aware that the AEA is fully available to non-residents disposing of UK property, providing a small but meaningful reduction in tax liability. Further information on utilizing this allowance effectively can be found in resources for UK company formation for non-residents.

Principal Private Residence Relief and Its Limitations

Principal Private Residence (PPR) Relief represents the most significant tax exemption for residential property gains, completely eliminating CGT liability for qualifying properties. However, its application to second homes is strictly limited and subject to detailed statutory conditions. A property can only qualify as a principal residence if it constitutes the taxpayer’s main home, characterized by factors such as where they spend the majority of their time, where they are registered to vote, and where they maintain their primary family connections. In scenarios where a taxpayer has occupied a second home as their main residence for part of the ownership period, partial PPR Relief may be available, proportionate to the qualifying period of occupation plus the final nine months of ownership (reduced from 18 months in April 2020). The nomination option allows individuals with multiple residences to designate which property should be treated as their principal residence for tax purposes, requiring formal notification to HMRC within two years of acquiring an additional property. This election can have profound tax implications and warrants careful consideration, often necessitating professional advice from specialists in UK company incorporation and bookkeeping.

Lettings Relief: Historical Changes and Current Position

Lettings Relief has undergone substantial reform in recent years, significantly restricting its availability for second home disposals. Prior to April 2020, this relief provided valuable tax mitigation for property owners who had let out a former principal residence, offering up to £40,000 reduction in chargeable gain. However, following the Finance Act 2020, Lettings Relief has been dramatically curtailed and now applies exclusively to situations where the property owner shares occupancy with the tenant (known as "shared occupation"). This legislative amendment effectively eliminated the relief for the vast majority of second home scenarios, where the owner typically does not reside in the property simultaneously with tenants. The historical justification for this change was to refocus property tax relief on owner-occupiers rather than property investors. For those who previously benefited from this relief, the restriction represents a significant increase in potential tax liability upon disposal. Property investors seeking to optimize their tax position might instead consider alternative investment structures, such as offshore company registration, though these carry their own complex tax implications that require specialist advice.

Business Asset Disposal Relief for Furnished Holiday Lettings

Second homes operated as Furnished Holiday Lettings (FHLs) occupy a distinctive position within the UK tax framework, potentially qualifying for Business Asset Disposal Relief (formerly known as Entrepreneurs’ Relief). This preferential treatment can reduce the effective CGT rate to 10% on qualifying disposals, subject to a lifetime limit of £1 million of gains. To access this advantageous relief, the property must satisfy stringent criteria: it must be furnished, commercially let with the intention of profit-making, available for commercial letting for at least 210 days annually, and actually let for at least 105 days annually. Additionally, longer-term occupancies (exceeding 31 consecutive days) must not exceed 155 days in the tax year. The qualification assessment typically examines compliance over a rolling period of 12 months, with special provisions for properties newly entered into or ceasing FHL business. This classification effectively recognizes certain holiday letting operations as business activities rather than passive investments, reflecting their contribution to local tourism economies. Investors considering this route should review comprehensive guidance on setting up a business in the UK to ensure all regulatory requirements are addressed.

Timing Considerations for Property Disposals

The timing of second home disposals can dramatically impact the resulting tax liability, making strategic planning essential. From a CGT perspective, the date of disposal is typically the date of contract exchange rather than completion, which creates opportunities for tactical year-end transactions to utilize annual exemptions effectively. Phased disposals, whereby a property is sold in segments across multiple tax years, can maximize the utilization of annual exempt amounts and potentially keep gains within lower tax bands. Furthermore, the government has periodically introduced CGT rate changes, often announced in advance, creating windows of opportunity for accelerated or delayed disposals. Since April 2020, taxpayers have been subject to a 30-day reporting and payment window for residential property disposals (extended to 60 days from October 2021), replacing the previous system whereby gains could be reported on the annual Self-Assessment return. This compressed timeline necessitates advanced preparation of disposal calculations and funding for tax payments. Property investors with international portfolios should be particularly attentive to these timing considerations, as outlined in resources for those looking to be appointed director of a UK limited company with property investments.

CGT Deferral Through Reinvestment Strategies

While direct exemptions from CGT on second homes are limited, various deferral mechanisms exist that can postpone tax liabilities, enhancing investment cash flow. Rollover Relief permits the deferral of gains when proceeds are reinvested in qualifying replacement business assets, though residential properties rarely qualify unless they form part of a qualifying business operation such as FHLs. Enterprise Investment Scheme (EIS) reinvestment offers another avenue for deferral, whereby gains from any asset (including residential property) can be deferred if the proceeds are invested in qualifying EIS companies within a specified timeframe. For entrepreneurs with portfolio investments, incorporating a UK limited company to hold property assets can transform the tax treatment from income tax and CGT to corporation tax, potentially at lower rates, though this approach introduces additional complexities including Stamp Duty Land Tax on property transfers and potential double taxation on extracted profits. Each deferral mechanism carries specific qualifying conditions and administrative requirements that necessitate careful navigation, often with professional guidance as suggested in resources on how to issue new shares in a UK limited company for property investment purposes.

International Dimensions: Non-Resident CGT Considerations

The territorial scope of UK CGT on second homes expanded significantly in April 2015 with the introduction of Non-Resident Capital Gains Tax (NRCGT), which brought disposals of UK residential property by non-UK residents within the tax net. This legislation was further extended in April 2019 to encompass commercial property and indirect disposals of UK property-rich entities. Non-resident taxpayers are entitled to market value rebasing as of April 2015 (or 2019 for commercial properties), effectively excluding pre-reform appreciation from taxation. The reporting and payment requirements for non-residents are particularly stringent, with a mandatory NRCGT return due within 60 days of completion, regardless of whether a gain arises or tax is payable. Double taxation considerations are paramount for international investors, who may face concurrent tax claims from their jurisdiction of residence and the UK, mitigated only through applicable double taxation agreements. The interaction of NRCGT with broader international tax planning structures, such as offshore holding companies or trusts, has become increasingly complex following successive anti-avoidance measures. Non-residents contemplating UK property investment should consult specialized resources on UK companies registration and formation to navigate these multijurisdictional implications effectively.

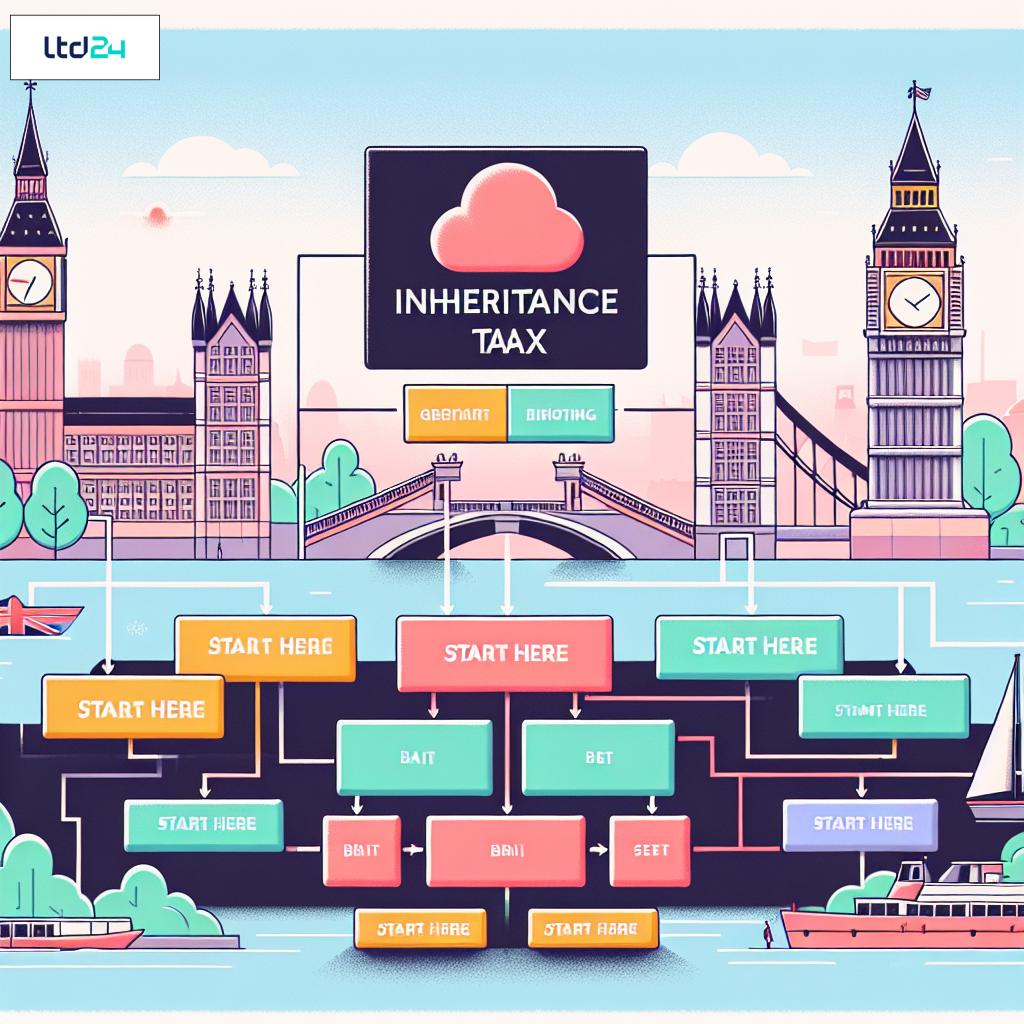

Inheritance Tax Implications for Second Homes

While CGT applies upon disposal during a taxpayer’s lifetime, Inheritance Tax (IHT) considerations for second homes become paramount in estate planning contexts. UK residential properties are generally included in an individual’s taxable estate at their market value upon death, potentially attracting IHT at 40% above the available nil-rate bands. Unlike primary residences, which may benefit from the Residence Nil Rate Band under certain circumstances, second homes are fully exposed to IHT without specific reliefs. Previously popular structures involving offshore companies to hold UK residential property ("enveloping") have been largely neutralized by extensions to the IHT regime implemented in April 2017, which look through such structures to tax the underlying UK property. Certain agricultural or business properties may qualify for Agricultural Relief or Business Relief, reducing or eliminating their IHT exposure, though standard second homes rarely meet these qualification criteria. The interaction between CGT and IHT creates complex considerations upon death, as beneficiaries receive a market value acquisition cost for CGT purposes, effectively wiping out latent gains, but potentially at the cost of an IHT charge. Comprehensive estate planning often necessitates balancing these competing tax considerations, as outlined in guidance on setting up a limited company in the UK for property holding purposes.

CGT Implications of Gifting Second Properties

The transfer of second homes by way of gift rather than sale carries distinctive CGT implications that warrant careful consideration. Contrary to common misconception, gifting does not circumvent CGT; instead, such transfers are deemed to occur at market value regardless of whether consideration changes hands. This deemed disposal rule creates potential "dry tax charges" where tax becomes payable without corresponding proceeds to fund the liability. Limited relief is available through holdover relief for gifts of business assets, though standard second homes typically don’t qualify unless operated as FHLs meeting stringent criteria. Transfers between spouses and civil partners occur at "no gain, no loss" basis, effectively deferring rather than eliminating the eventual CGT liability. Strategic partial transfers to spouses can optimize utilization of dual annual exemptions and basic rate bands upon eventual disposal. Gifts with reservation of benefit, where the donor continues to derive benefit from the property post-gift, encounter anti-avoidance provisions that may effectively disregard the transfer for IHT purposes while still triggering an immediate CGT charge. The interaction of these gift-related provisions with broader family wealth planning necessitates holistic tax consideration, particularly for families with international connections who might benefit from formation agent services in the UK.

Recent and Anticipated Legislative Changes

The taxation landscape for second homes has experienced persistent legislative flux, with numerous policy changes implemented in recent years and further modifications anticipated. The 30-day CGT reporting window introduced in April 2020 (subsequently extended to 60 days) represented a significant acceleration of tax payment timelines for property disposals. The reduction of the final period exemption for PPR Relief from 36 months to 18 months (2014) and then to 9 months (2020) has progressively limited tax relief for properties that were once primary residences. The dramatic curtailment of Lettings Relief in April 2020 eliminated a valuable CGT mitigation tool for many second homeowners. Looking forward, the government’s consultation on a potential alignment of CGT rates with income tax rates could substantially increase the tax burden on property gains. The progressive reduction of the Annual Exempt Amount from £12,300 to £6,000 in 2023/24 and £3,000 in 2024/25 will expose more modest gains to taxation. Property investors must remain vigilant to these evolving provisions, which reflect the government’s ongoing policy orientation toward favoring owner-occupation over investment property ownership. Keeping abreast of these changes is essential for effective long-term property investment planning, as emphasized in resources for online company formation in the UK for property holding purposes.

CGT Mitigation Strategies for Second Homeowners

While tax avoidance constitutes legitimate planning within legal parameters, taxpayers must distinguish this from illegal tax evasion. Several legitimate strategies can minimize CGT exposure on second homes. Maximizing deductible expenditure through comprehensive record-keeping of enhancement costs can substantially reduce chargeable gains. Timing disposals to utilize annual exemptions effectively, potentially spreading large disposals across tax years, can create substantial tax savings. For married couples or civil partners, transferring ownership interests between spouses prior to sale can double available exemptions and potentially utilize lower tax bands. Principal residence elections can optimize PPR Relief for those with genuine multi-home living arrangements. For properties with development potential, selling with planning permission versus developing and then selling requires careful analysis, as the latter may attract higher tax rates through potential classification as trading rather than investment activity. For larger property portfolios, incorporation relief might permit tax-neutral transfer into a corporate structure, though the long-term benefits must be weighed against increased complexity and potential double taxation. Each strategy must be evaluated within the specific circumstances of the taxpayer, often warranting consultation with specialists as referenced in guidance on how to register a business name in the UK for property investment activities.

Interaction with Stamp Duty Land Tax on Second Homes

The acquisition of second homes attracts enhanced Stamp Duty Land Tax (SDLT) rates, imposing an additional 3% surcharge above standard rates across all price bands. This surcharge applies to purchases of additional residential properties worth over £40,000 by individuals who already own a residential property anywhere in the world. The interrelationship between CGT and SDLT creates important planning considerations, particularly regarding the timing of property acquisitions and disposals. In scenarios where a new primary residence is purchased before the previous one is sold, the SDLT surcharge applies initially but may be reclaimed if the previous main residence is sold within 36 months. This temporary additional outlay affects acquisition financing requirements and potentially influences disposal timing decisions. For international investors, the interaction between SDLT, CGT, and equivalent taxes in their home jurisdictions adds further complexity to property investment decisions. Property portfolio restructuring, such as transfers between individual and corporate ownership, triggers both SDLT and potential CGT charges, necessitating comprehensive cost-benefit analysis before implementation. These multiple tax considerations underscore the importance of holistic property tax planning, particularly for investors utilizing structures outlined in resources on setting up a limited company in the UK for property investment.

Record-Keeping Requirements for CGT Compliance

Maintaining comprehensive documentation is fundamental to accurate CGT calculation and effective compliance with HMRC requirements. Essential records include acquisition documents (purchase contracts, conveyancing statements, stamp duty payments), enhancement expenditure evidence (planning permissions, building invoices, architectural fees), and disposal documentation (sales contracts, agent’s fees, legal costs). For properties acquired before March 1982, establishing the market value at that date may be necessary, requiring historical valuation evidence. Where PPR Relief is claimed, documentation supporting periods of occupation becomes crucial, including utility bills, council tax statements, and electoral register entries. The statutory retention period for CGT-related records extends to at least five years after the 31 January following the tax year of disposal (six years for companies). In practice, longer retention is advisable given the potential for delayed HMRC enquiries and the difficulty of reconstructing historical property expenditure retrospectively. Digital record-keeping systems can facilitate this long-term documentation management, particularly for taxpayers with extensive property portfolios or those utilizing corporate structures as described in resources on how to register a company in the UK for property holding purposes.

Case Study: CGT Calculation for a Typical Second Home

To illustrate the practical application of CGT principles to second home disposals, consider the following representative scenario. Mr. Johnson purchased a holiday apartment in Cornwall in July 2010 for £200,000, incurring £3,000 in acquisition costs. He subsequently spent £25,000 on qualifying property improvements in 2015. In June 2023, he sells the property for £350,000, with selling costs of £4,000. The CGT calculation proceeds as follows: The disposal proceeds (£350,000) less selling costs (£4,000) establishes a net disposal value of £346,000. The acquisition base cost combines the purchase price (£200,000), acquisition costs (£3,000), and enhancement expenditure (£25,000), totaling £228,000. The chargeable gain is therefore £118,000 (£346,000 – £228,000). Mr. Johnson can deduct his Annual Exempt Amount of £6,000 (2023/24), resulting in a taxable gain of £112,000. Assuming Mr. Johnson is a higher rate taxpayer, CGT at 28% on £112,000 produces a tax liability of £31,360. This example demonstrates the substantial tax implications of second home ownership, particularly for properties held long-term in appreciating markets. The calculation would be further complicated by any periods of principal residence occupation or letting that might qualify for partial reliefs. For complex scenarios involving overseas elements, resources on business address services in the UK may provide additional context for international property investors.

CGT Reporting and Payment Procedures

The procedural requirements for reporting and paying CGT on second home disposals have been significantly reformed in recent years. Since April 2020 (with modifications from October 2021), UK residents disposing of residential property with chargeable gains must submit a UK Property Account to HMRC within 60 days of completion, with corresponding tax payment due within the same timeframe. This represents a dramatic acceleration from the previous system, whereby gains could be reported up to 22 months after disposal via Self Assessment. The property return requires detailed information including acquisition and disposal dates, property address, consideration amounts, and calculation of the chargeable gain. Provisional calculations may be necessary where complete information is unavailable within the reporting window, with subsequent amendments through Self Assessment. Non-UK residents face even more stringent requirements, being obligated to submit returns within 60 days regardless of whether a gain arises or tax is payable. Penalties for late filing begin at £100 for reports up to three months late, escalating for extended delays, with separate interest charges on delayed tax payments. The compressed reporting timeline necessitates advance planning for property disposals, particularly regarding funding arrangements for tax payments, as emphasized in guidance on ready-made companies for streamlined property investment operations.

Professional Guidance and HMRC Clearances

The complexity of CGT legislation as applied to second homes often necessitates professional guidance to achieve both compliance and tax efficiency. Chartered tax advisors specializing in property taxation can provide tailored advice reflecting individual circumstances and the latest legislative provisions. For transactions with uncertain tax treatment, HMRC offers limited formal clearance procedures, though these are typically restricted to specific statutory provisions rather than general tax position confirmations. Where formal clearance is unavailable, taxpayers may seek a non-statutory clearance for significant transactions, though HMRC is not obligated to respond. For historical transactions with uncertainty, the Disclosure of Tax Avoidance Schemes (DOTAS) and Advanced Disclosure Facility may provide mechanisms to regularize positions with minimized penalties. Professional representation during HMRC enquiries can substantially improve outcomes, particularly in scenarios involving technical interpretations of residence, property usage patterns, or enhancement expenditure qualification. The cost of professional advice should be evaluated against potential tax savings and risk mitigation, particularly for high-value disposals or international scenarios as outlined in resources on cross-border taxation.

Navigating the International Property Investment Environment

The global dimension of property investment presents distinctive challenges and opportunities regarding UK CGT on second homes. Investors must navigate the interaction between UK tax provisions and corresponding regulations in their countries of residence or citizenship. Double Taxation Agreements (DTAs) typically allocate primary taxing rights for immovable property to the jurisdiction where the property is situated (the UK for British properties), with residence countries providing tax credits to prevent double taxation. The Common Reporting Standard (CRS) has significantly enhanced international tax transparency, with automatic exchange of financial information between participating jurisdictions making cross-border non-compliance increasingly difficult. For structured international property investments, the UK’s Corporate Criminal Offence legislation creates potential liability for facilitating tax evasion, necessitating robust compliance procedures. The post-Brexit environment has introduced new considerations for European investors, particularly regarding withholding taxes and recognition of corporate structures. These multijurisdictional complications underscore the importance of integrated international tax planning, as emphasized in resources on nominee director services for international property structures.

Seeking Expert Support for Your International Property Taxation

In navigating the intricate landscape of UK Capital Gains Tax on second homes, professional advice tailored to your specific circumstances is invaluable. The constant evolution of tax legislation, reporting requirements, and international transparency measures makes staying current with obligations increasingly challenging for individual investors. Whether you’re contemplating a property acquisition, planning a disposal, restructuring a property portfolio, or addressing historical compliance issues, specialized guidance can provide significant value through both tax optimization and risk mitigation.

If you’re seeking a guide through these complex waters, we invite you to book a personalized consultation with our team. We are an international tax consulting boutique with advanced expertise in corporate law, tax risk management, asset protection, and international audits. We offer tailored solutions for entrepreneurs, professionals, and corporate groups operating on a global scale.

Schedule a session with one of our experts today for $199 USD/hour and receive concrete answers to your tax and corporate inquiries. Book your consultation now and ensure your property investment decisions are fully informed by current tax implications and opportunities.